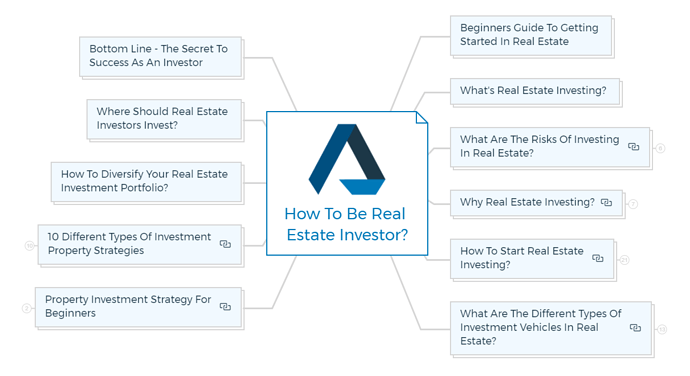

How To Be Real Estate Investor? (A Comprehensive Guide)

How to be a successful real estate investor?

No doubt, real estate investing is one of the best ways to create wealth and build your financial future. But what does it take to be a successful real estate investor? Explore here some of the key things you need to know in order to achieve success in this exciting and lucrative field. So read on – learning these tips could make all the difference for your future!

Take your first step -

The first step to getting started in real estate is researching and understanding the basics of real estate investment. Learn about the different types of real estate investments available and the risks and rewards associated with each.

Once you understand what’s out there, you can start narrowing down your options for becoming a real estate investor. Keep in mind that there is no one “right” way for real estate investments.

Different property investing strategies can be successful, so it’s important to find the one that best suits your goals and interests.

Let’s begin with understating real estate investing.

What’s real estate investing?

Real estate investing is acquiring, owning, managing, and selling real estate properties for profit. You can do this through various methods, such as buying a property outright, taking out loans to purchase property, or leasing a property from landlords.

Real estate investing aims to make money by generating income from rental properties, flipping properties for a profit, or cashing out on appreciated property values.

Real estate investors have many different ways to achieve these objectives, so it’s important to find the property investment strategy that best suits your skills and interests.

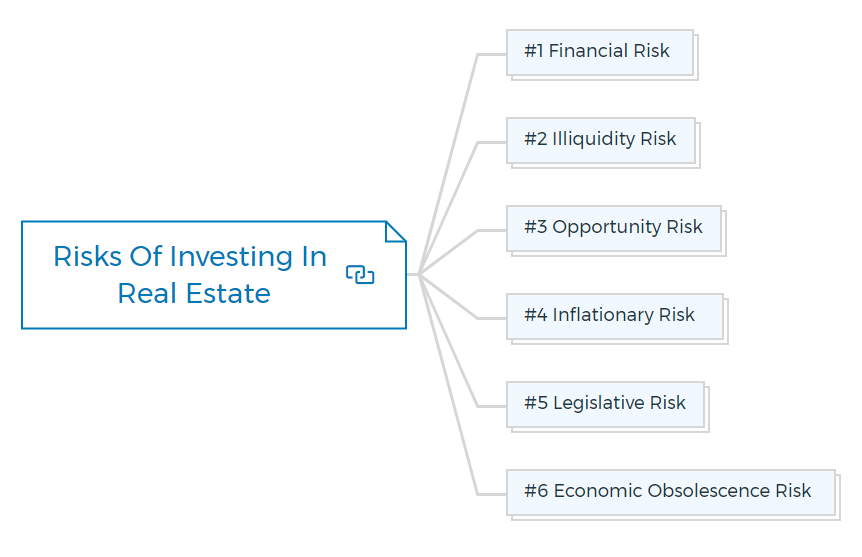

Risks in real estate investment

Before starting real estate investing, it’s important to understand the risks involved. All investments come with some level of risk, but real estate is particularly risky due to its volatility and the potential for financial losses.

Some of the risks of real estate investing include:

#1 Financial risk

The first and most obvious risk in real estate investment is financial. When you invest in real estate, you’re using your money to purchase the property.

If the property doesn’t increase in value or if it takes a long time to sell, you could end up losing money.

Suppose the property has a negative cash flow and is subsequently sold to the mortgage lender. The investor may lose both the initial and ongoing equity investment and any tax recoupment from the IRS.

#2 Illiquidity risk

Another real estate investment risk to consider is illiquidity. It can be not easy to sell a good investment property quickly.

It’s not like stocks where you can sell them almost immediately. It can take weeks or even months to find a buyer for your property, and in the meantime, you’ll still have to pay the mortgage payments, taxes, and other forms of expenses.

#3 Opportunity risk

An investor who does not get the predicted returns from the current investment may miss out on another investment opportunity because they do not have enough saved money to invest in it.

#4 Inflationary risk

Inflation is the gradual increase in the price of goods and services. Inflation can have a significant impact on the property market.

As inflation rises, the purchase price of buying or renting property also goes up. This rise can eat into your profits or lead to losses if you’re not careful.

For example, if you purchase one property for $100,000 in an inflationary market and the property value goes up to $120,000, you’ve still made a good return on your investment. However, if the property value only rises to $105,000, you’ve lost money in real terms.

It’s important to be aware of the inflation risk when investing in real estate and factor it into your investment properties strategy.

#5 Legislative risk

It is the risk when new legislation or regulation could negatively impact the property market and your real estate investments.

For example, if the government changes property taxes laws that make it more difficult to own investment property, you could lose money. Be sure to stay up-to-date on any changes in legislation that could affect your real estate investments so that you can make the necessary adjustments to your investment strategy.

#6 Economic obsolescence risk

Another risk of investing in real estate is Economic Obsolescence risk. It is a risk when a property becomes outdated or no longer meets the market’s needs, and as a result, its value declines.

If you’re not careful, you could end up with an investment property worth much less than you paid. When choosing your real estate investments, be sure to factor in economic obsolescence risk, and be prepared to sell quickly if necessary.

Learn More

Why real estate investing?

Real estate investing offers several advantages that make it appealing to investors.

Some of the benefits of investing in real estate include:

Cash flow

One of the most appealing aspects of real estate investing is the potential for cash flow. With a well-chosen property, you can generate rental income in payments and other sources, such as parking or storage fees. It’s important to remember that cash flow is not the same as profit.

Cash flow is the money that comes in from tenants while profit is the excess amount after accounting for all of your expenses.

However, cash flow can be a good indicator of whether or not a property is making money, and it can help you decide whether to hold on to a property or sell it.

Benefits on property taxes

When it comes to real estate investing, one of the most important factors is the tax benefits.

Real estate investments offer several tax breaks that can save you a lot of money in the long run.

Some of the benefits include:

- Deducting mortgage interest from your taxes

- Tax-free exchange of investment property

- Tax-deductible depreciation

- 1031 exchange

Be sure to speak with a tax advisor to ensure you are taking advantage of all the tax benefits available to you as a real estate investor.

Equity build-up

Another key benefit of real estate investing is the potential for equity build-up. Over time, the value of your property will likely increase, giving you a valuable asset that you can use to secure loans or investments later on.

You can use this equity to cover costs such as repairs and renovations, which can help you keep your property in good condition and generate even more income.

Appreciation

Appreciation in real estate is when the value of a property rises above the price paid for it. The property’s increased value is realised by selling it to another investor who is willing to pay more for it than the initial investor did.

Tax-free refinancing proceeds

One of the benefits of investing in real estate is using the proceeds from refinancing to reinvest in other properties.

For example, if you own a property worth $200,000 and refinance it for $250,000, you can use the $50,000 difference to invest in another property.

It is a great way to grow your investment portfolio quickly without using your own money.

Leverage

Another advantage of real estate investing is using leverage to finance your investments.

Leverage is the use of debt to finance an investment, and it allows you to control a larger property than you could otherwise afford.

For example, if you have $50,000 to invest in a property, you could use leverage to purchase a $100,000 property. It would give you a 50% down payment on the property, and you would be responsible for the remaining $50,000.

While leverage can help you grow your portfolio quickly, it increases your risk. Be sure to weigh the pros and cons carefully before using leverage to finance your investments.

Inflation hedge

One of the biggest benefits of investing in real estate is that it can act as a hedge against inflation. As prices rise, the value of your property will also increase, giving you a valuable asset that you can use to purchase goods and services in the future.

It is in contrast to investments in the stock market and bonds, which can lose value in the face of inflation.

You are missing out if you haven’t yet subscribed to our YouTube channel.

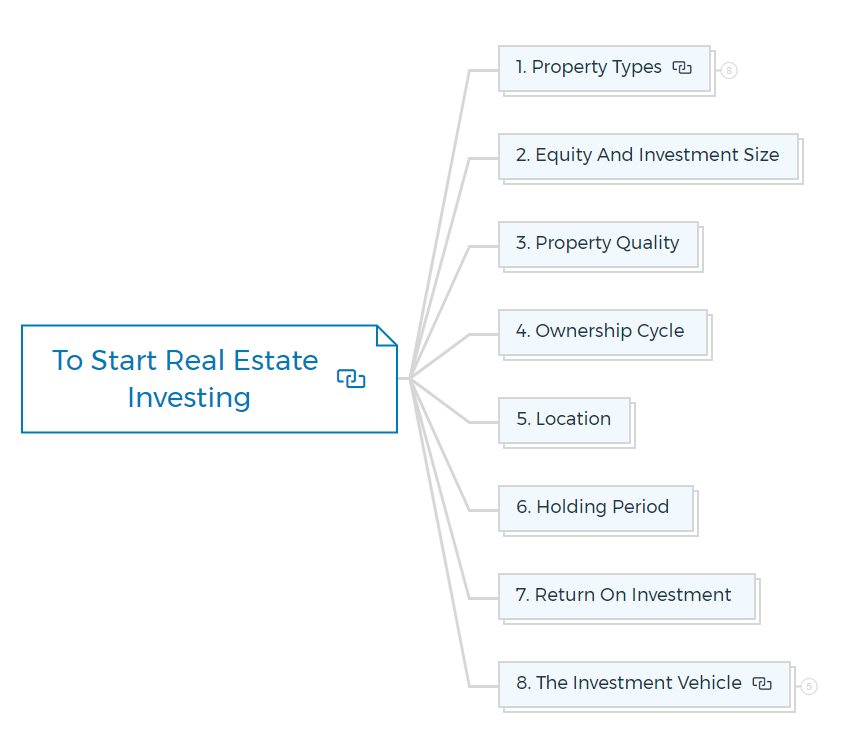

How to start real estate investing?

Now that you understand the basics of real estate investing, you’re probably wondering how to get started in real estate investing. Here are a few things (buying criteria) to consider as you start investing in real estate.

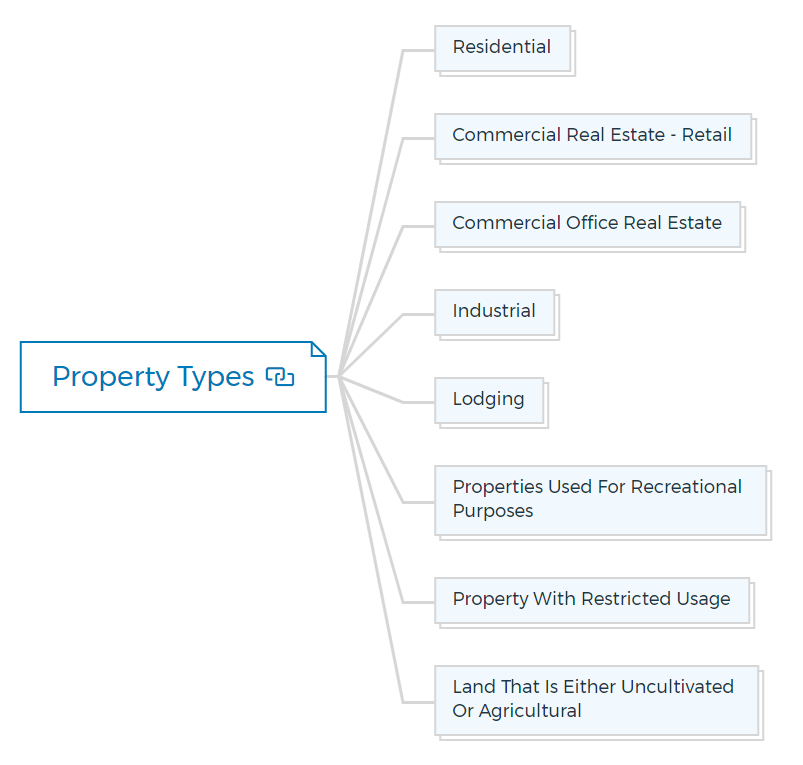

1. Property types

There are several different property types to choose from when it comes to investing in real estate. Here is a list of properties that real estate investors can choose to invest in.

Residential

This category encompasses single-family residences (sale or rental properties), condominiums or townhomes, duplexes, triplexes, quadruplexes, and larger multifamily apartment buildings.

This type of investment property also contains multifamily properties typically designed as garden, mid-rise, or high-rise structures.

Commercial real estate - retail

This category covers strip shopping malls in residential neighbourhoods, community halls, regional centres, superregional hubs, and free-standing retail structures.

Retail Commercials are best suitable for experienced real estate investors.

Commercial office real estate

Office buildings are designed to accommodate tenants who require non-retail space. They are featured with garden, mid-rise, or high-rise configurations. Included in this category are office buildings and business parks.

Industrial

Industrial real estate house tenants who require bulk storage. This category encompasses both light and heavy industrial structures and mini-warehouses that cater to the storage needs of small businesses.

Lodging

Lodging properties cater to people who require living space temporarily.

There are motels, hotels, and all-suite combinations available.

Properties used for recreational purposes

There are waterfront developments, golf courses, and athletic clubs.

Property with restricted usage

Special-use properties, such as theatres and parking garages, are purpose-built for a specific use.

Uncultivated or agricultural land

Raw land, which may be zoned or un-zoned, contains zero development. Agricultural land is defined as land used for timber production or other agricultural purposes.

2. Equity and investment size

The amount of equity you have to invest in a property will depend on the type of investment, the loan-to-value ratio, and your financial situation.

For example, if you’re investing in single-family rental properties, you may be able to put down as little as 10% on each. But if you’re looking at a more expensive property, such as an office building, you may need to put down closer to 30%.

The size of your investment will also play a role in how much equity you’ll need to invest. For instance, if you’re looking at a smaller multifamily property priced at $1 million, you may only need to put down $200,000 to $300,000 in equity.

3. Property quality

There are two categories of property: class and type. The four types of property are as follows:

Class A

- These homes are prized possessions.

- They have the best tenants and the best sites.

- The greatest prices are paid for these types of houses.

Class B

- These properties aren’t quite as good as Class A.

- They are often older than Class A properties while being in outstanding locations.

- The majority of the time, they are leased to high-quality tenants.

Class C

- These are “fixer-upper” properties.

- They are still in good locations but neglected due to bad management or the former owners’ lack of financial decision.

Class D

- They can be in an inconvenient location, badly constructed, or both.

- Many of these structures should never have been constructed in the first place.

Determine the age range and the type of building you are comfortable with when choosing the type of property to invest in.

Many real estate developers and investors are looking for properties that are less than five years old, while others will focus on older houses. Furthermore, some real estate investors will prefer properties in urban regions, while others may prefer properties in the suburbs.

4. Ownership cycle

There are three phases in the property ownership cycle; property investors can select the one appropriate for them.

Step 1

The first step is building the product from scratch. The significant risks of property construction and first lease-up usually necessitate the most expertise.

Step 2

To buy an existing property that requires minimal remodelling. You should be able to review a property’s financial history. The property is then rehabilitated and renovated.

Step 3

A property in this stage may require a complete external and interior makeover to meet market standards. Investors or property owners may even convert an industrial loft to a primary residence.

5. Location

The location of your investment will have a significant impact on its value.

When considering where to invest in real estate, you’ll want to think about the following factors:

- The current and future state of the local economy

- The local job market

- The quality of the schools

- The crime rate

- The availability of public transportation

- The desirability of the neighbourhood

Each of these factors can impact the value of your investment, so it’s important to do your research before you choose a location. Some individual investors like to own property close to home, while others don’t mind owning property out of town.

Some property investors choose urban property while others prefer rural. Some prefer locations that are currently or will soon start to rebound.

Property Development “How To’s” & Frequently Asked Questions

Includes 5 x detailed eBooks [142 pages]

✓ How To Become A Property Developer? In 10 Easy Steps (51 Pages)

✓ How To Overcome Fear In Property Development? (15 Pages)

✓ How To Become A Real Estate Developer? Without Experience (37 Pages)

✓ Property Developer FAQs – Who, What, When, How? (20 Pages)

✓ How To Become A Real Estate Millionaire In 10 Steps? (19 Pages)

6. Holding period

How long do you intend to keep the property?

Many property investors prefer to own properties for a limited time, such as just long enough to repair the building, find a new tenant, and then sell, while others desire to own for the rest of their lives.

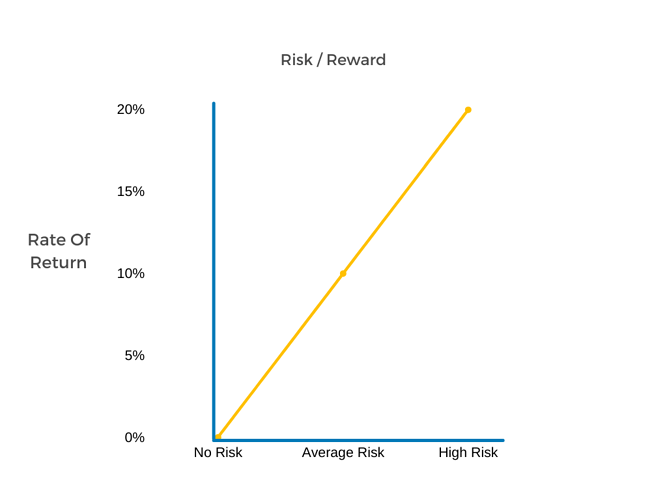

7. Return on investment

It is one of the most important factors to consider when investing in real estate. Your return on investment (ROI) is the percentage of your investment you expect to get back each year.

For example, if you made an initial investment of $100,000 in property and expect to make $5,000 in profit each year, your ROI would be 5%.

The higher the ROI, the better.

But remember, higher returns usually come with higher risks.

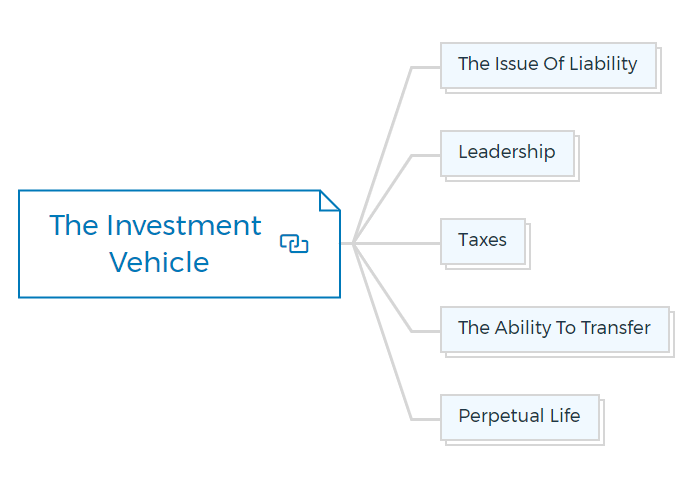

8. The investment vehicle

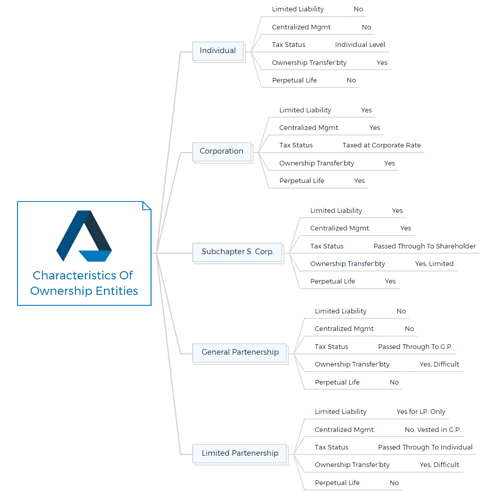

Sit down with an accountant before making any purchases to decide which sort of ownership vehicle best suits your investment style.

Consider the following factors while evaluating each type of ownership vehicle:

The issue of liability

Who bears the costs involved for the invoices and other losses?

Leadership

Who will be in charge of the company’s day-to-day operations?

Taxes

What method will be used to calculate the taxes?

The ability to transfer

Is it possible to transfer ownership?

Perpetual life

What is the expected lifespan of the ownership entity?

Investment Vehicle - An investment vehicle is a legal entity created to invest in real estate.

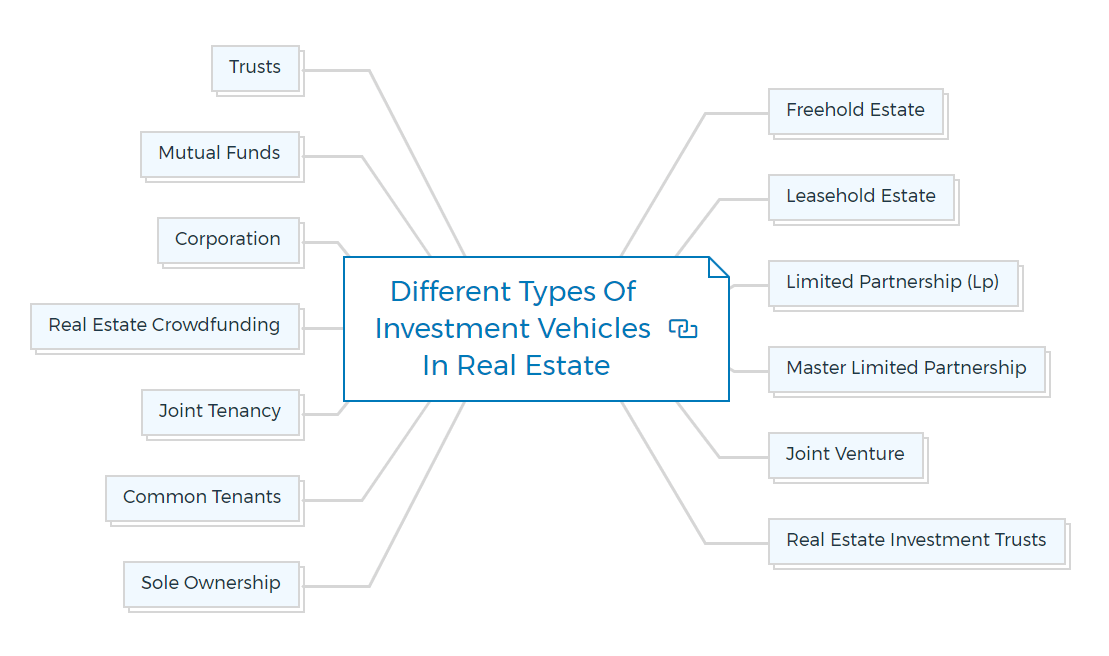

Types of investment vehicles in real estate

Below are several types of investment vehicles in real estate -

Freehold estate

The most common and simplest type of ownership is when an individual has full ownership of a piece of real property.

Leasehold estate

A leasehold estate is an agreement between a tenant and a landlord in which the landlord receives rental income from tenants who live on or use the rental property for a specific period.

Limited partnership (LP)

Limited partnerships are investment vehicles that cater to passive investors.

This investment vehicle allows investors to pool funds to purchase larger properties with other investors.

The partnership agreement outlines each partner’s responsibilities and financial stake in the project.

Master limited partnership

Master limited partnerships are merged limited partnerships.

Master limited partnerships increase the liquidity of an investment vehicle by providing a bigger market for reselling limited partnership shares.

Joint venture

Joint ventures are utilized instead of general partnerships and are restricted to specific property ownership. One contributes equity or financial muscle while the other contributes land, knowledge or labour.

Real estate investment trusts

A real estate investment trust (REIT) is a business that owns, manages, or funds income-producing real estate.

A REIT is a pass-through entity, meaning it passes its earnings through to shareholders. It avoids double taxation of profits.

Sole ownership

Sole ownership is the most basic investment type. This investment vehicle has no partners, and only the purchaser owns it.

Common tenants

When there are multiple property owners, you can choose common tenancy as your investment vehicle. Each property owner can choose their tax year, and all profits and losses go to them, regardless of the other investors.

If one real estate investor dies, the estate owns the interest, not the other investors. This investment instrument is ideal for investors who do not wish to be involved in daily property maintenance.

Joint tenancy

If ownership is held in joint tenancy with survivorship, the deceased’s investment stake reverts to the remaining investors.

Family members should only use this sort of ownership. If your experienced partner is not a family member, you should buy life insurance for everybody’s family.

Real estate crowdfunding

Real estate crowdfunding is a new way to invest in real estate that has only become possible in recent years due to the JOBS Act.

It allows non-accredited investors to pool their and other people’s money together and invest in larger real estate projects. The minimum investment is usually around $5,000, and the platforms take a small percentage of the profits.

Corporation

A corporation is a legal body created by a state or federal government distinct from the stockholders. Corporations can own property, borrow money, and enter into legal agreements.

Mutual funds

Companies that hold real estate can invest in mutual funds similar to stock market mutual funds. Like REITs, they offer investors liquidity and diversification but not tax advantages.

Trusts

You can use trusts to control real estate while providing economic benefits.

The grantor gives legal ownership of the property to a trustee for the beneficiary’s benefit.

Formulating your investment strategy

Property investment strategy for beginners

Once you’ve defined your buying criteria and investment motives, you’ll be ready to build an investment strategy.

If this is your first property investment, consider the time and money commitment you can make, the type of property you feel most comfortable investing in, the type of return you want, and whether you need partners to help with the purchase.

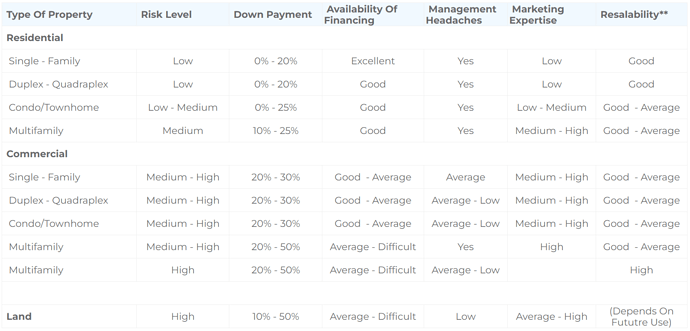

The figure below outlines the investment characteristics of several property types.

- If you are just looking for help to pay your housing expenditure, make your first property investment in a duplex.

- You could buy a few small houses every year and refinance them after five to seven years to take your tax-free profit.

- Maybe you want to start with little investments and work your way up to larger ones. If you’re feeling more daring, you can decide to take a more hands-on approach, first renovating, then developing homes.

Investment-Strategy-Matrix

Investors might be passive or active.

Passive investor

A passive investor may choose to participate with other more management-intensive partners or in a more liquid real estate investment vehicle such as a REITs or a real estate-focused mutual fund.

The above-listed investment vehicles provide hands-free investing, knowledgeable management, and liquidity.

An investor who wants to control the property but does not want to manage it can purchase triple-net-leased properties to AAA tenants.

In these cases, the investor simply collects rental income and pays the monthly mortgage and escrow required by the lender. The tenant will be responsible for all other monthly bills and repairs.

Active investor

On the other hand, an active investor will choose to do day-to-day investing and management.

It includes the investor’s management and marketing expertise, the amount of equity invested, the quantity of time invested, and whether or not to involve other partners.

Many active investors want to make money by quickly selling their property options or fixing them up to add value, while others wish to hold their properties eternally.

You must also determine if you will pay cash or on terms. A term buyer will pay more but negotiate terms to help offset the greater price. The seller may agree to a lesser or split down payment or rental guarantees.

The all-cash buyer usually has financing lined up for the cash on hand to make a speedy purchase. Cash buyers always negotiate for the best deal.

Continued at…

How to be real estate investor? [Part 2-2]