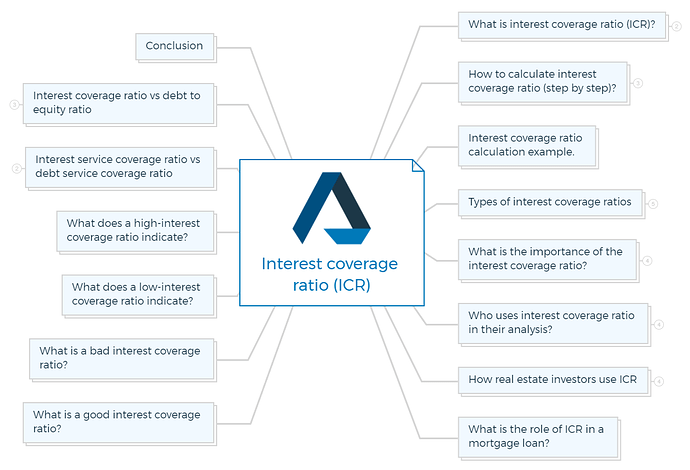

Calculating interest coverage ratio a comprehensive overview

Real estate investors use the Interest Coverage Ratio (ICR) to evaluate a property’s cash flow and interest expenditures. The ICR calculates how many times a property’s cash flow can cover its interest payments.

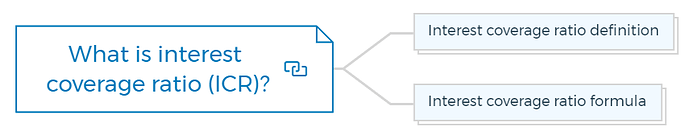

What is interest coverage ratio (ICR)?

Interest coverage ratio definition

Interest Coverage Ratio (ICR) is a financial ratio that measures a real estate property’s ability to cover its interest expenses with its operating income. ICR is a useful tool for real estate investors as it shows whether the property’s cash flow is sufficient to meet its interest obligations.

The interest coverage ratio is also known as the “times interest earned (TIE)” ratio.

A property’s interest coverage ratio compares income to interest expense. The ratio is calculated by dividing a property’s net operating income by its annual interest expense.

Interest coverage ratio formula

Interest Coverage Ratio = Net Operating Income/ Annual Interest Expense

You are missing out if you haven’t yet subscribed to our YouTube channel.

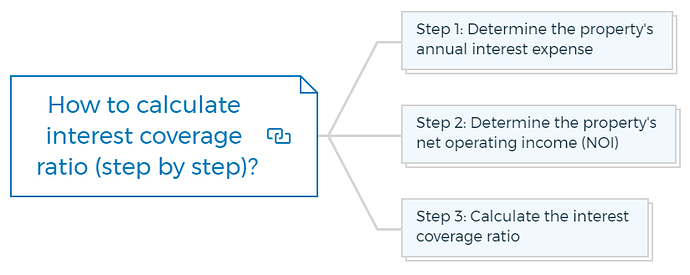

How to calculate interest coverage ratio (step by step)?

Applying a simple formula to a property’s financial information calculates the interest coverage ratio (ICR). Interest coverage ratio calculation:

Step 1: Determine the property’s annual interest expense

Property loan interest is the Interest Expense. This is typically a fixed cost that is paid each year. The mortgage statement or income statement will show interest expense.

Step 2: Determine the property’s net operating income (NOI)

The next step is to determine the property’s net operating income (NOI). You can get this figure by subtracting operating expenses from the property’s gross income.

NOI = Gross rental income - operating expenses

For example, if a property generates $100,000 in rental income and has operating expenses of $40,000, the NOI would be:

NOI = $100,000 - $40,000 = $60,000

Step 3: Calculate the interest coverage ratio

Calculate the interest coverage ratio using the annual interest expense and NOI figures:

Interest Coverage Ratio = NOI / Annual Interest Expense

Using the figures from our example, the interest coverage ratio would be:

Interest Coverage ratio = $60,000 / $20,000 (assume)

Interest Coverage Ratio = 3

The property generates three times the cash flow needed to service interest with a ratio of 3. Higher ICRs indicate financial stability and lower risk.

Interest coverage ratio calculation example.

As a real estate investor, you’re considering a commercial property that generates $10,000 per month. The monthly principal and interest mortgage payment is $5,000. The monthly mortgage interest is $2,000.

Divide the property’s NOI by its annual interest expense to calculate its ICR. The property’s NOI is its total income, less operating expenses like upkeep, taxes, and insurance.

In this example, assume the property’s annual operating expenses are $30,000. The property’s NOI is $90,000 ($10,000 monthly rental income x 12 months - $30,000 annual operating expenses).

Interest costs $24,000 annually ($2,000 monthly x 12 months).

The property’s ICR is 3.75 ($90,000 NOI/$ 24,000 interest expense). This means that the property’s cash flow is sufficient to cover its interest payments 3.75 times over.

Real estate investors like high ICRs because they signal strong cash flow that can support debt. However, a low ICR may indicate that the property is unable to generate enough cash flow to pay its debts.

If rental income drops or operating expenses rise, the property may fail on its mortgage if the ICR is low. A property with a higher ICR is more likely to weather financial shocks.

Finally, ICR helps real estate investors evaluate property risk and profitability. Investors can assess a property’s feasibility and risk tolerance by knowing its ICR.

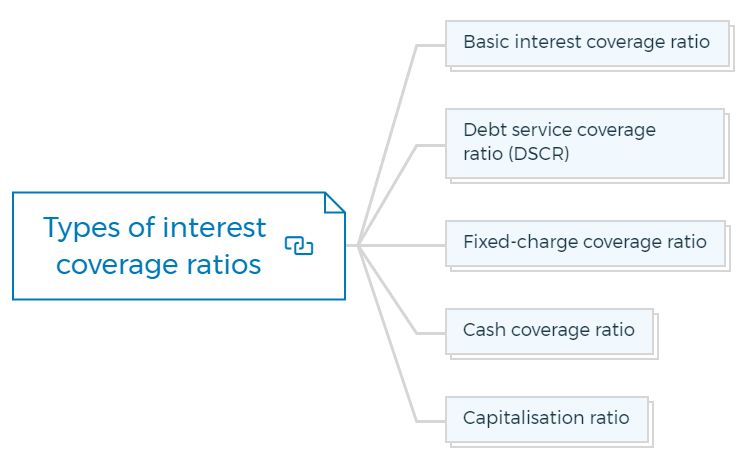

Types of interest coverage ratios

The financial analysis uses various interest coverage ratios. Some common types include:

Basic interest coverage ratio

When we divide EBIT by annual interest expense it yields the basic interest coverage ratio. This ratio shows how often EBIT covers interest expenditure.

Debt service coverage ratio (DSCR)

A property’s debt service coverage ratio is computed by dividing its net operating income (NOI) by its entire debt service, including principal and interest.

Real estate analysts use this ratio to assess a property’s capacity to generate enough income to pay its debts.

Fixed-charge coverage ratio

Fixed-charge coverage ratio is computed by dividing its EBITDA by its fixed charges, which include interest, leasing, and other constant expenses.

This ratio shows a real estate property’s ability to earn enough to meet its fixed obligations.

Cash coverage ratio

Cash coverage ratio is derived by dividing its operating cash flow by its total debt servicing (principal and interest).

Capitalisation ratio

Long-term debt is divided by total capitalisation to calculate the capitalisation ratio. This ratio shows a property’s debt-to-capital ratio.

Learn More

What is the importance of the interest coverage ratio?

Real estate professionals use the interest coverage ratio (ICR) to assess a property’s financial health and capacity to cover its interest costs. ICR’s real estate benefits include:

Evaluating property investment opportunities

Before investing in real estate, calculate its ICR to see if it can generate enough cash flow to pay its interest costs. This will aid investors’ property investment selections.

Assessing loan repayment ability

Lenders use the ICR to analyse borrowers’ loan repayment capabilities. The borrower is less risky if their ICR is high. However, a low ICR suggests a riskier borrower who may struggle to make loan payments.

Monitoring property performance

ICR tracks property performance for real estate investors. They can analyse their properties’ ICR trends to increase cash flow and profitability.

Negotiating loan terms

A high ICR gives investors negotiating power with lenders. They can negotiate cheaper interest rates, longer durations, and greater loan amounts due to their strong financial position.

ICR is a crucial real estate statistic that helps investors and lenders assess property financial health and make informed investment and lending decisions.

Who uses interest coverage ratio in their analysis?

In the real estate industry, several parties use the interest coverage ratio in their analysis.

Real estate investors

Interest coverage ratio helps investors decide if a property generates enough income to pay its interest costs. The ratio helps investors compare investment prospects and choose properties.

Lenders

Lenders assess borrower creditworthiness using the interest coverage ratio. A borrower with a high interest coverage ratio has enough cash flow to pay their interest, lowering their credit risk.

Appraisers

Property appraisers may use the interest coverage ratio. Appraisers evaluate income and value by analysing cash flow and interest payments.

Property managers

The interest coverage ratio helps property managers assess financial health. If the ratio declines, the property may not be generating enough money to pay its expenses and may need to be fixed.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How real estate investors use ICR

Real estate investors use ICR as a financial metric to evaluate the profitability and financial health of potential real estate investments.

Here are some ways real estate investors use ICR:

Determine borrowing capacity

The ICR helps real estate investors assess their borrowing capability. Real estate investors must meet their debt obligations and lenders’ minimum ICR requirements.

Property investors can compute the ICR for a property to assess how much debt they can take on while meeting interest payments.

Evaluate investment risk

The ICR helps real estate investors assess risk. Higher ICRs imply that a property generates enough income to repay its interest payments, reducing default risk.

However, a lower ICR suggests a property may struggle to pay its interest, increasing the chance of default.

Learn More

Compare investment opportunities

The ICR helps property investors evaluate investment prospects.

Real estate investors might find homes with more revenue than interest payments by comparing ICRs. This helps real estate investors maximise returns.

Assess income stability

The ICR helps investors evaluate a property’s income stability. High ICR properties are more likely to retain revenue stability and profitability over time than low ICR properties.

What is the role of ICR in a mortgage loan?

Lenders evaluate borrowers’ mortgage repayment ability using the interest coverage ratio (ICR). ICR is also known as DSCR in mortgage loans.

DSCR measures a borrower’s capacity to make mortgage payments on time and in full. It compares the borrower’s NOI to mortgage payments, including principal and interest.

The ratio is NOI/total debt service.

Mortgage lenders require a minimum DSCR before approving a mortgage loan. Lenders and loan types set minimal DSCRs, however 1.25 is typical. The borrower’s NOI must be 1.25 times the mortgage payment.

If a borrower’s DSCR is below the minimum, lenders may reject the loan application or request more collateral or a bigger down payment to reduce default risk.

Learn More

What is a good interest coverage ratio?

An ICR of above 2.0 is considered a good interest coverage ratio. A ratio above 2.0 means a corporation earns enough to pay off debt interest.

What is a bad interest coverage ratio?

Bad interest coverage ratios are often below 1.0. A ratio below 1.0 implies that a corporation is not earning enough to cover its interest payments and may have trouble servicing its debt obligations.

What does a low-interest coverage ratio indicate?

A low interest coverage ratio suggests the property’s cash flow may not meet interest expenditures. This may indicate that the property owner is having trouble paying interest.

Lenders and investors may be concerned if the interest coverage ratio is regularly low. They may see the property as a risky venture and refuse to finance or participate. If the property owner cannot pay the interest, a low-interest coverage ratio could lead to default or foreclosure.

Thus, real estate investors and lenders must monitor a property’s interest coverage ratio and address any concerns. Restructuring the financing or raising rents or lowering expenses may increase the property’s cash flow.

What does a high-interest coverage ratio indicate?

Real estate properties with high interest coverage ratios produce enough cash flow to pay their debts. This means the property is earning enough to meet its financing costs. Real estate investors prefer it because it means the property is safer and more likely to pay its debts.

A high interest coverage ratio shows that the property is financially strong, which can help it get better financing terms. Investors can get financing for properties with better interest coverage ratios because lenders see them as less risky.

High interest coverage ratios can also indicate property growth and profitability. The property has significant cash flow and can provide additional income for expansion or reinvestment.

Interest service coverage ratio vs debt service coverage ratio

ISCR and DSCR are financial ratios used to assess a property’s debt capacity.

Debt service coverage ratio

The DSCR assesses the property’s ability to pay principle and interest. Divide net operating income (NOI) by total debt service to calculate DSCR. Mortgage interest and principal make up the total debt service. The property’s debt coverage increases with DSCR.

Interest service coverage ratio

The ISCR, like the DSCR, only examines the property’s interest payments. Divide net operating income (NOI) by interest expense to calculate the ISCR. The property’s ability to pay interest increases with ISCR.

Both ratios estimate the property’s financial health, but the ISCR is more cautious because it solely analyses its capacity to cover interest payments. The DSCR covers principal and interest payments, giving a more complete picture of the property’s debt coverage.

Lenders use the DSCR to assess property loan eligibility and borrower ability to repay. Most lenders approve loans with DSCRs of 1.25 or higher. Both ratios can help investors evaluate the property’s finances.

Interest coverage ratio vs debt to equity ratio

Investors and lenders use the interest coverage ratio and debt-to-equity ratio to assess a property’s financial health. Both ratios assess distinct financial features of a property, yet they both indicate investment risk.

Interest coverage ratio

The interest coverage ratio (ICR) gauges a property’s ability to pay debt interest. Divide the property’s net operating income (NOI) by its interest expenses.

Debt-to-equity ratio

The debt-to-equity ratio (D/E ratio) quantifies how much debt a real estate investment project uses compared to equity. Divide the investment’s debt by its equity. A property with a high D/E ratio relies largely on debt financing, while a low D/E ratio indicates a reduced debt-to-equity ratio.

Comparison between ICR and D/E ratio

Both ratios evaluate a property’s financial health, although they measure distinct characteristics. The D/E ratio assesses a real estate investment project’s debt-to-equity ratio, while the ICR measures a property’s ability to pay its loan interest. A high D/E ratio does not guarantee a low ICR, and vice versa.

A property with a high ICR and low D/E ratio may easily satisfy its interest commitments and is less reliant on debt financing, reducing financial risk. A property with a low ICR and a high D/E ratio may struggle to pay its interest and be significantly reliant on debt financing.

Conclusion

Investors can assess investment potential, loan payback capabilities, and performance by calculating the ICR. Dividing the property’s net operating income by its annual interest expense yields the ICR.

Financial analysis might employ Basic Interest Coverage Ratio, Debt Service Coverage Ratio (DSCR), Fixed-Charge Coverage Ratio, Cash Coverage Ratio, and Capitalisation Ratio.

Overall, a higher ICR indicates financial stability and lower risk, while a lower ICR suggests the property may struggle to make loan payments, making it riskier for investors.