In the world of business, companies are often faced with the need to take on debt obligations to finance their operations, make capital expenditures, or pursue growth opportunities. While taking on debt can be a strategic move, it also comes with risks.

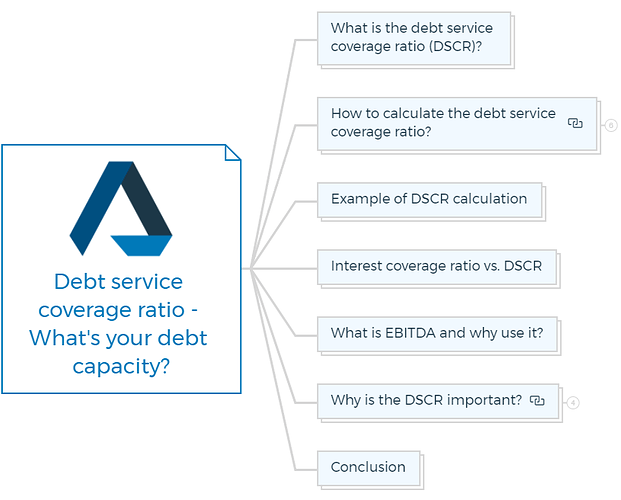

One important metric that can help companies assess their debt capacity and manage their debt risk is the debt service coverage ratio (DSCR). In this post, we will explain what the DSCR is, how it is calculated, and what it can tell us about a company’s ability to service its debt.

What is the debt service coverage ratio (DSCR)?

The debt service coverage ratio (DSCR) is a financial metric that measures a company’s ability to service its debt obligations. It compares the company’s net operating income (NOI) to its total debt service (TDS), which includes principal and interest payments on its debt.

The company’s NOI and TDS make up the DSCR ratio. A DSCR of 1 or above implies that the firm earns enough money to meet its debt obligations, whereas a DSCR of less than 1 suggests the opposite.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How to calculate the debt service coverage ratio?

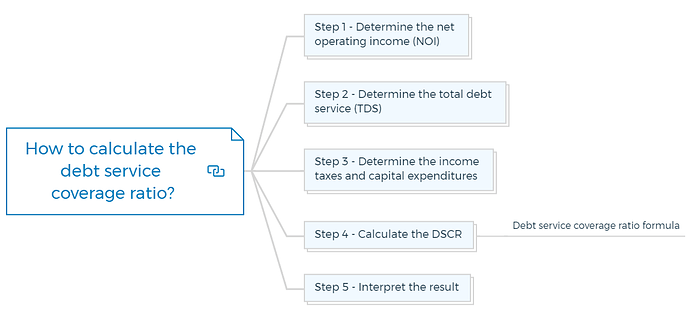

Here are the steps to calculate DSCR:

Step 1 - Determine the net operating income (NOI)

Start the DSCR calculation by determining the Net Operating Income. The company’s income statement displays revenue minus operational expenditures.

NOI Formula

NOI = Total Revenue - Operating Expenses

Step 2 - Determine the total debt service (TDS)

The next step is to calculate the Total Debt Service. This comprises principle, interest, and other debt-related charges.

TDS Formula

TDS = Total Annual Debt Payments + Other Debt-Related Expenses

Step 3 - Determine the income taxes and capital expenditures

Determining income taxes and capital expenditures for the period is the third phase. You can find these on the company’s income statement. Income tax and capital expenditure formulas:

Income Taxes = Total Tax Expense

Capital Expenditures = Total Capital Investments

Step 4 - Calculate the DSCR

Once you have all the required details, you can calculate the DSCR by using the following formula

Debt service coverage ratio formula

DSCR = (NOI + Depreciation + Amortization) / (TDS + Income Taxes + Capital Expenditures + Annual Debt Payments)

Depreciation and amortisation are added back to NOI to reflect the company’s debt service capabilities better.

Step 5 - Interpret the result

Interpret the DSCR after calculation. A DSCR of less than 1 means the firm is not making enough money to pay its debts, while a DSCR of 1 or more means it is. DSCR increases the company’s debt buffer.

Example of DSCR calculation

Let’s say that a company has the following financial information for the year:

- Net Operating Income (NOI) = $200,000

- Total Debt Service (TDS) = $100,000

- Income Taxes = $20,000

- Capital Expenditures = $30,000

- Annual Debt Payments = $80,000

To calculate the DSCR for this company, we would use the following formula:

DSCR = (NOI + Depreciation + Amortization) / (TDS + Income Taxes + Capital Expenditures + Annual Debt Payments)

Since there is no information about depreciation or amortisation, we will assume they are both zero. Therefore, the DSCR for this company would be:

DSCR = ($200,000 + $0 + $0) / ($100,000 + $20,000 + $30,000 + $80,000) = 1.48

This means that the company is generating 1.48 times the amount of income needed to cover its service debt obligations. In general, a 1.25 DSCR is considered a good DSCR, so it shows that this company has a healthy DSCR.

However, a high DSCR does not always suggest a firm is financially stable. Other financial measures should also be evaluated.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Interest coverage ratio vs. DSCR

A company’s debt service ability is assessed by its interest coverage ratio (ICR) and debt service coverage ratio (DSCR). Both ratios reveal a company’s debt capacity, although they differ.

The interest coverage ratio evaluates a company’s ability to pay interest expenses with EBIT. It shows how many times a company’s earnings can pay its interest.

Interest coverage ratio formula

ICR = EBIT / Interest Expenses

However, the debt service coverage ratio evaluates a company’s capacity to pay its total debt service (principal and interest payments) with its net operating income.

Formula to calculate DSCR

DSCR = Net Operating Income / Total Debt Service

Unlike the DSCR, the interest coverage ratio solely analyses interest payments. Therefore, the DSCR gives a more complete picture of a company’s debt capacity.

The DSCR employs net operating income (NOI) as the numerator, while the interest coverage ratio uses earnings before interest and taxes (EBIT).

NOI is computed by removing operating expenditures (except interest) from revenue, while EBIT is calculated by subtracting all expenses (including interest) from revenue. Thus, while the DSCR focuses on operating income, the interest coverage ratio considers a broader variety of expenses.

What is EBITDA and why use it?

EBITDA is Earnings Before Interest, Taxes, Depreciation, and Amortisation. It measures a company’s operating performance and finances.

EBITDA formula

EBITDA = EBIT + Depreciation + Amortization

Where EBIT (Earnings Before Interest and Taxes) is the company’s operating income before interest and taxes are deducted.

Using EBITDA has several benefits. Because it excludes non-operating expenses like interest and taxes, it shows a company’s operating performance better.

This helps property investors and analysts evaluate companies with diverse capital structures and tax conditions.

EBITDA also measures a company’s cash flow for debt service. It is a better indicator of a company’s cash flow than measurements that don’t include depreciation and amortisation.

EBITDA is often used to calculate enterprise value (EV). Analysts can forecast a company’s future earnings and worth by using EBITDA as a proxy for cash flow.

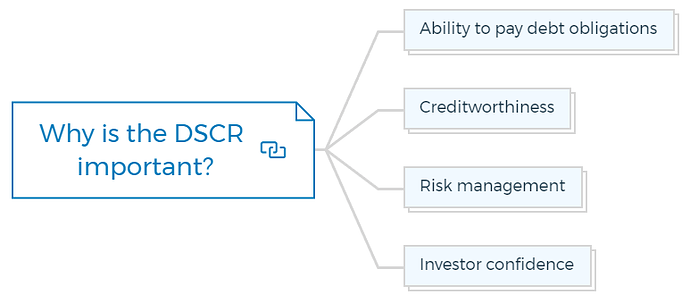

Why is the DSCR important?

A company’s debt service coverage ratio (DSCR) is a key financial indicator. It indicates a company’s financial health and debt management.

The DSCR is important for various reasons:

Ability to pay debt obligations

The DSCR shows if a company generates enough cash flow to cover principal and interest payments. A corporation with a high DSCR has enough cash flow to pay its debts, while a low one may struggle.

Creditworthiness

Lenders evaluate companies’ creditworthiness using the debt service coverage ratio. A high DSCR implies that a corporation can repay its loans, making it simpler to get financing at good rates. A low DSCR may make financing difficult or increase interest rates.

Learn More

Risk management

The DSCR helps organisations manage debt and minimise overspending. By monitoring the debt service coverage ratio, companies can identify potential financial risks and take steps to mitigate them, such as reducing debt or improving cash flow.

Investor confidence

A steady, low-risk company with a high debt service coverage ratio can attract investors and boost shareholder confidence.

Conclusion

In conclusion, the Debt servicing Coverage Ratio (DSCR) is a significant financial indicator that assesses a company’s debt servicing ability. A DSCR of 1 or greater means the company makes enough money to pay its debts, whereas a DSCR of less than 1 means it may default.

To calculate the DSCR, deduct the company’s operational expenses (excluding interest) from its revenue to get the Net operating Income (NOI) and compare it to the Total Debt Service (TDS), which includes principal and interest payments on the debt.

The DSCR also helps companies assess debt capacity and manage debt risk, making it a vital financial instrument. DSCR can be supplemented by interest coverage ratio and EBITDA to assess a company’s financial health.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber