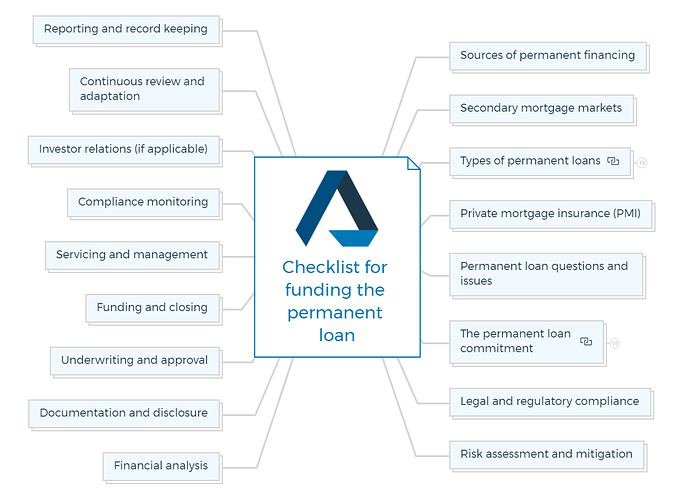

1. Sources of permanent financing

Research potential sources for permanent financing, including:

- Credit companies

- Mortgage limited partnerships

- Charitable foundations

- Religious and fraternal associations

- Individual investors

- Securities sold by Wall Street brokerage firms

2. Secondary mortgage markets

Understand the role of secondary mortgage markets in facilitating the sale of mortgages and mortgage-backed securities.

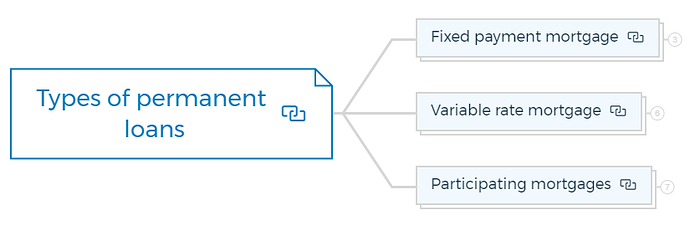

3. Types of permanent loans

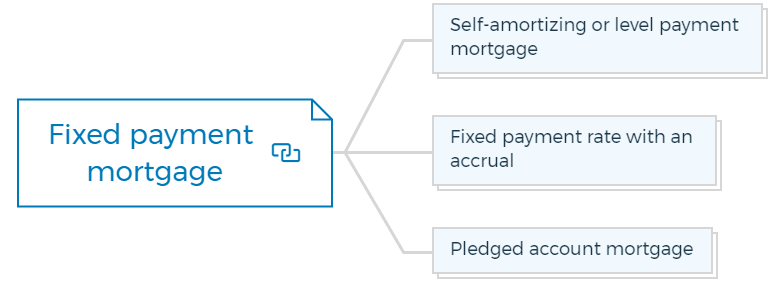

3.1. Fixed payment mortgage

Familiarize yourself with various types of fixed payment mortgages, such as:

3.1.1. Self-amortizing or level payment mortgage

This type of mortgage involves equal monthly payments over the loan term, with each payment covering both principal and interest. The ratio shifts toward principal repayment as time passes, leading to eventual full repayment.

3.1.2. Fixed payment rate with an accrual

Similar to a standard fixed payment mortgage, but includes an accrual feature that allows interest to accumulate before it’s added to the principal, usually annually.

3.1.3. Pledged account mortgage

In this arrangement, the borrower maintains an account that acts as a cushion against default risk. If the borrower defaults, funds from this account can cover payments.

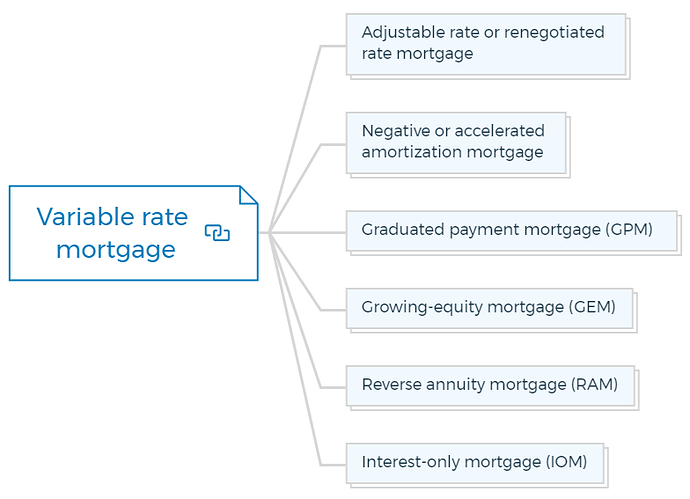

3.2. Variable rate mortgage

Understand different types of variable rate mortgages, including:

3.2.1. Adjustable rate or renegotiated rate mortgage

The interest rate of this mortgage adjusts periodically based on a specific financial index. Monthly payments can increase or decrease over time, often subject to a cap or floor.

3.2.2. Negative or accelerated amortization mortgage

With this mortgage, the borrower’s monthly payments may be set below the interest due. The unpaid interest is added to the principal, potentially leading to negative amortization.

3.2.3. Graduated payment mortgage (GPM)

This mortgage starts with lower initial payments that gradually increase over a defined period, typically three to five years, before leveling off.

3.2.4. Growing-equity mortgage (GEM)

Monthly payments for this mortgage increase at a fixed rate, which allows for accelerated repayment of the principal and builds equity faster.

3.2.5. Reverse annuity mortgage (RAM)

Primarily used by seniors, this mortgage allows homeowners to receive monthly payments from the lender, converting home equity into cash. Repayment typically occurs when the homeowner sells the property.

3.2.6. Interest-only mortgage (IOM)

Borrowers pay only the interest for a specified period, after which they repay both principal and interest. This option offers lower initial payments but can lead to higher payments later.

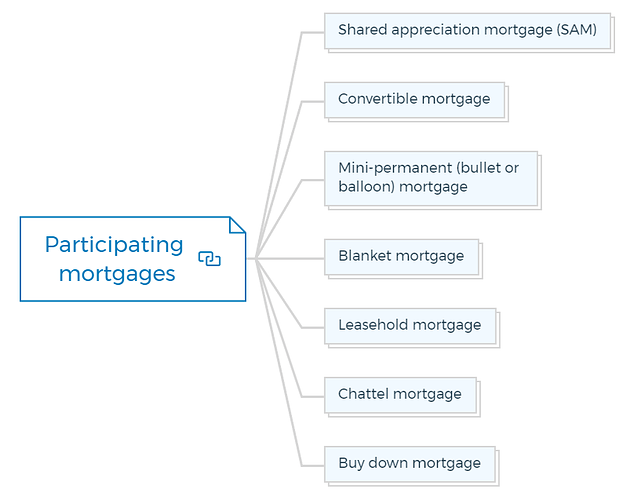

3.3. Participating mortgages

Participating mortgages, including:

3.3.1. Shared appreciation mortgage (SAM)

In this arrangement, the lender shares in the property’s appreciation. When the property is sold, the lender receives a percentage of the sale price.

3.3.2. Convertible mortgage

This mortgage allows the borrower to convert from an adjustable rate to a fixed rate at specific intervals, offering flexibility if market conditions change.

3.3.3. Mini-permanent (bullet or balloon) mortgage

A short-term loan with lower monthly payments, often followed by a large “balloon” payment due at the end of the term. It’s typically refinanced or paid off with the balloon payment.

3.3.4. Blanket mortgage

Used in commercial real estate, this mortgage covers multiple properties under a single loan, allowing for flexibility in managing a real estate portfolio.

3.3.5. Leasehold mortgage

Used for properties where the borrower doesn’t own the land but leases it, this mortgage secures the lender’s interest in the leasehold.

3.3.6. Chattel mortgage

This mortgage involves movable property, such as vehicles or equipment, as collateral. It’s common for financing personal property or assets.

3.3.7. Buy down mortgage

The borrower or a third party pays additional funds upfront to lower the interest rate temporarily, resulting in reduced initial payments.

You are missing out if you haven’t yet subscribed to our YouTube channel.

4. Private mortgage insurance (PMI)

Understand the concept of PMI and its implications for borrowers and lenders.

5. Permanent loan questions and issues

Compile a list of questions and considerations related to permanent loans, such as:

- Will the lender finance this type of property?

- Will the lender finance this type of property in this location?

- Will the lender finance the amount needed?

- Will the lender’s interest rate work within your projected economics?

- Will the lender lend on a percentage of the appraised value or on a certain debt service coverage ratio?

- Debt coverage ratio to be used

- Will the lender project out the rent?

- Loan rate to be charged

- Can accrual loans with lower pay rates be used?

- Rates to be used (fixed or tied to an index)

- Are interest-only loans available?

- Loan term

- Loan amortization period

- Loan extensions

- Loan extension terms

- Points charged at commitment

- Points charged at closing

- Who pays closing costs?

- What are the closing costs?

- Whose attorney will close the loan?

- Appraisals required?

- Approved appraisers

- Loan funding date

- Prepayment of loan

- Can the loan be funded with an earn-out based on a higher net operating income?

- Loan lock-in period

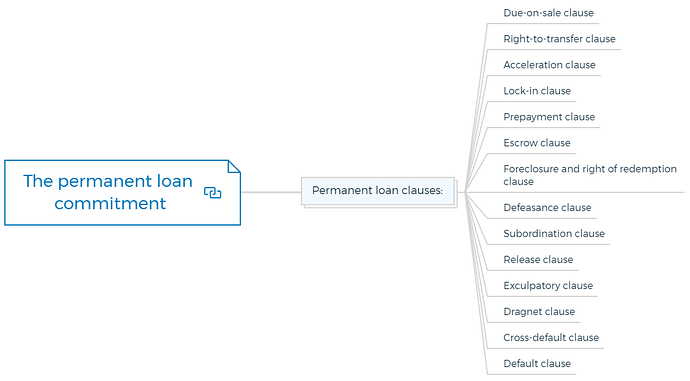

6. The permanent loan commitment

6.1. Permanent loan clauses:

Familiarise yourself with important clauses in a permanent loan commitment, including:

6.1.1. Due-on-sale clause

This clause states that if the property is sold or transferred, the full loan amount becomes due immediately. It safeguards the lender’s interests in case the borrower sells the property without repaying the loan.

6.1.2. Right-to-transfer clause

This clause outlines the borrower’s ability to transfer the property title without triggering the due-on-sale clause. It provides flexibility for the borrower to transfer the property within certain conditions.

6.1.3. Acceleration clause

This clause permits the lender to demand full loan repayment if the borrower breaches specific terms or defaults on payments. It accelerates the repayment schedule in case of default.

6.1.4. Lock-in clause

This clause ensures that the borrower and lender are committed to the agreed-upon interest rate for a specified period, protecting the borrower from rate fluctuations during that time.

6.1.5. Prepayment clause

This clause outlines the borrower’s ability to make extra payments or pay off the entire loan before the term’s end. It may include prepayment penalties to compensate for potential interest income loss.

6.1.6. Escrow clause

This clause mandates that the borrower contributes to an escrow account for property taxes, insurance, and other expenses. The lender manages these payments on behalf of the borrower.

6.1.7. Foreclosure and right of redemption clause

This clause details the lender’s rights to initiate foreclosure proceedings in case of default and may include a right of redemption for the borrower to reclaim the property after default.

6.1.8. Defeasance clause

This clause is common in commercial mortgages and allows the borrower to substitute other collateral, such as bonds, to release the property from the mortgage lien.

6.1.9. Subordination clause

This clause stipulates the priority of liens on the property. It determines which liens take precedence if multiple loans are involved, ensuring the lender’s position in case of foreclosure.

6.1.10. Release clause

This clause permits the release of a specific property from the mortgage lien after a partial repayment, providing flexibility to the borrower in managing their assets.

6.1.11. Exculpatory clause

This clause limits the lender’s ability to pursue personal assets of the borrower in case of default. It’s often found in commercial mortgages to protect individual borrowers.

6.1.12. Dragnet clause

This clause allows a lender to extend an existing mortgage to cover additional properties or transactions without creating a new mortgage document.

6.1.13. Cross-default clause

This clause specifies that a default on one loan can trigger default on other loans with the same lender. It ensures that the lender is protected across various loan agreements.

6.1.14. Default clause

This clause outlines the specific conditions that constitute default, such as missed payments or breach of terms. It triggers the lender’s right to enforce remedies.

7. Legal and regulatory compliance

Ensure that the loan structure and terms comply with applicable legal and regulatory requirements.

8. Risk assessment and mitigation

Evaluate potential risks associated with the loan and develop strategies to mitigate those risks.

9. Financial analysis

Conduct a thorough financial analysis of the borrower’s ability to repay the loan, including credit history, income, and assets.

10. Documentation and disclosure

Prepare all necessary loan documentation and ensure transparent disclosure of terms to borrowers.

11. Underwriting and approval:

Review and assess the loan application, including creditworthiness, collateral, and overall risk.

12. Funding and closing:

Coordinate the funding process, complete all necessary paperwork, and close the loan.

13. Servicing and management

Set up a system for loan servicing and ongoing management, including payment collection, escrow management, and customer support.

14. Compliance monitoring

Establish a process to monitor ongoing compliance with loan terms and regulatory requirements.

15. Investor relations (if applicable)

Communicate with property investors or stakeholders involved in financing the loan.

16. Continuous review and adaptation

Continuously review the loan portfolio’s performance and adapt strategies as needed.

17. Reporting and record keeping

Maintain accurate records and generate relevant reports for internal and regulatory purposes.