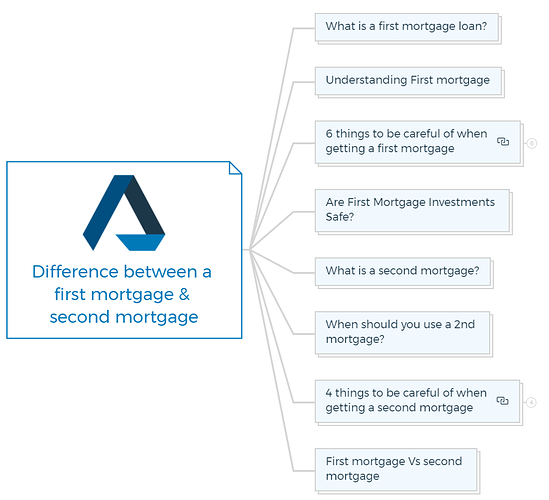

First Mortgage Vs a Second Mortgage

The first mortgage and second mortgage are the two primary elements of the lending market. The first mortgage refers to a loan to buy a property, while the second mortgage is usually understood as a home equity loan.

What is a first mortgage loan?

A first mortgage is a loan that uses real estate as collateral for the loan. It is typically the largest loan taken out by borrowers and has priority over other forms of lending, such as second mortgages or home equity loans.

First mortgages are secured by the lender, meaning an asset backs them up — usually the house — as collateral. In the event of a default, the lender will have the first right to claim the property to recoup their losses.

First mortgages are usually taken out by homebuyers when they purchase a property, but homeowners looking to refinance or take out additional loans using their existing home equity can also use them.

Understanding First mortgage

The first mortgage is also known as the first lien. It is a fixed-term investment, meaning once you put money into a specific mortgage, the interest rate is set for the time you agreed to.

The lender can enjoy higher returns through monthly installments paid by the borrower. The returns depend on the loan rates and include a portion of principal and interest payments.

You are missing out if you haven’t yet subscribed to our YouTube channel.

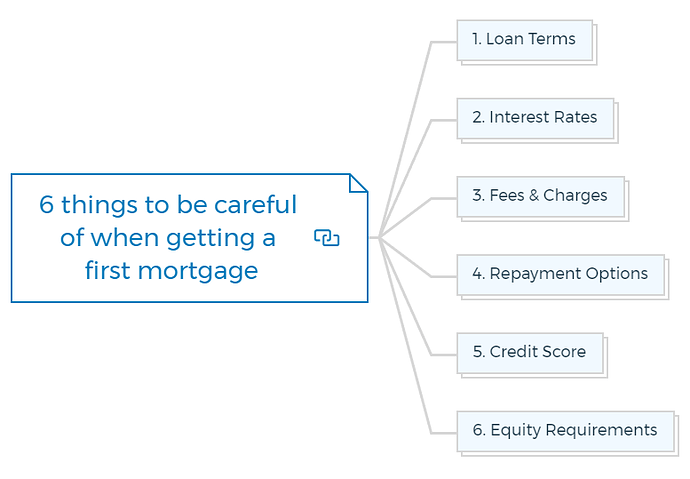

6 things to be careful of when getting a first mortgage

1. Loan Terms

When taking out the first mortgage, it is essential to understand all of the loan terms and conditions associated with the loan before signing any paperwork.

Be sure to read the fine print so you are fully aware of what the loan will cost you over time and what happens if you default.

2. Interest Rates

Another thing to pay attention to when getting a first mortgage is its associated interest rate.

Understanding current market rates and shopping around for the best deal can help you save money over time by securing an affordable rate.

3. Fees & Charges

There are typically fees and other charges associated with getting a first mortgage.

Be sure to ask your lender about any upfront costs or additional charges you might have to pay before taking out the loan.

4. Repayment Options

Different lenders offer different repayment options for first mortgages, so make sure you understand the terms and conditions of those options before signing up for one.

5. Credit Score

Your credit score plays a vital role in determining the terms and conditions of the loan, so it is essential to ensure your score is in good standing before applying for a first mortgage.

6. Equity Requirements

Depending on the lender, you may need to provide proof of equity to qualify for a first mortgage.

Be sure to ask about this before signing any paperwork, as it can affect the terms and conditions of the loan.

Are First Mortgage Investments Safe?

Despite the higher returns, first mortgage loan investments carry certain risks but are relatively safe.

- Registered first mortgages on the underlying property secure all loans.

- The loan amount will typically be at most 60-70 percent of the mortgaged property’s value.

- Most of the time, lenders can choose who gets their money.

Registered first mortgage investors can get their money back if a borrower stops paying. The investors can sell the property and use that money to pay back the rest of the loan.

It makes first mortgage funds a relatively safe and less risky way to invest.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

What is a second mortgage?

A second mortgage is a loan secured by the home’s equity. It sits “second” behind any first mortgages on the property, meaning it will take second priority if the borrower defaults on their payments.

Second mortgages are typically taken out to finance more significant expenses such as home improvements, paying off debt, or gaining access to cash when necessary.

It is important to remember that a second mortgage adds a loan on your property that could affect your credit score if not paid back in full and on time.

Since the second mortgage receives repayments only after the first mortgage is paid off, the interest rate is higher, and the amount borrowed is lesser.

When should you use a 2nd mortgage?

There are three situations when getting a second mortgage loan is beneficial-

-

If your first mortgage was a fixed-rate loan, you could be subject to substantial exit costs or may not want to refinance because your fixed rate is far lower than the market’s current variable rates. Using a second mortgage, you can borrow more.

-

You can use a 2nd mortgage to get money for business purposes and work on key business areas.

-

Many private lenders who can give you money within 48 hours will take a second mortgage behind a big bank as security for their loan.

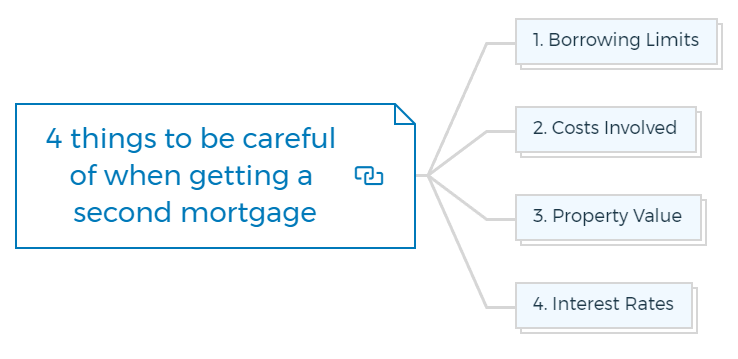

4 things to be careful of when getting a second mortgage

1. Borrowing Limits

With a second mortgage loan, you can borrow up to 80% of your property’s value, and some lenders can let you borrow even more. Borrow enough money to pay off both your first and second mortgages.

2. Costs Involved

Like any other mortgage, some fees are included in the second mortgage. Check with the lender about any extra costs before signing the deal.

3. Property Value

Before taking out a second mortgage, you must assess the property’s value. This will help determine how much you can borrow and set realistic repayment expectations.

4. Interest Rates

Interest rates on second mortgages are usually higher than those associated with first mortgages because they involve a higher risk for the lender. Shopping around and comparing the interest rates provided by different lenders is vital.

First mortgage Vs second mortgage

To summarise quickly, here is a short comparison -

- A first mortgage may contain fixed and variable rates, while second mortgages are similar to home equity loans having fixed rates.

- Lienholders get paid first with 1st mortgage, and with 2nd mortgage, they are paid after the primary lienholders.

- The loan limits are approved according to the borrower’s capacity and loan type. In a Secondary mortgage, you can get a loan amount equal to 80% of your home’s value.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber