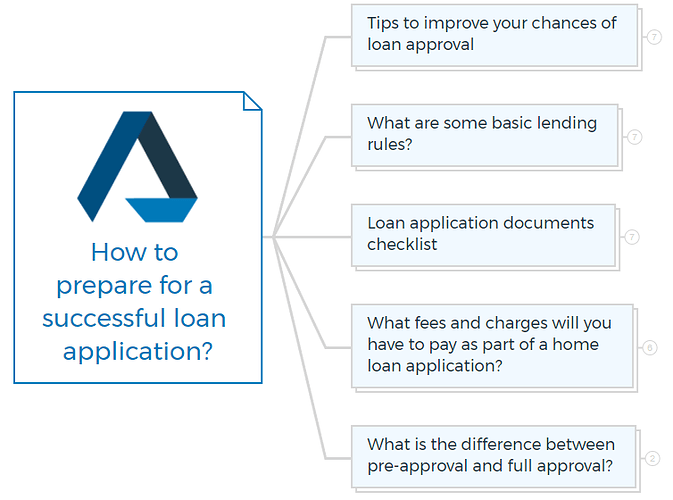

Loan application can be a daunting process, but with the right preparation, you can improve your chances of approval. Whether you’re applying for a personal loan, home loan, or business loan, here are some tips to help you prepare for a successful loan application.

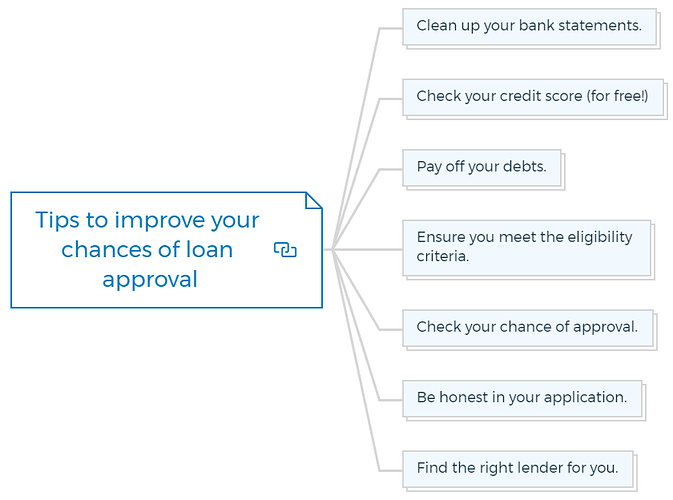

Tips to improve your chances of loan approval

If you want to apply for a loan, make sure you take steps to up your chances of getting approved. Here are some tips to help you improve your loan application so you can get the funds you need.

Clean up your bank statements.

Before you send in your loan application, check out your bank statements and make sure they look good.

So you need to ensure all your personal loans and money stuff is organised and there’s no bad stuff like bounced checks or overdrafts. Lenders usually check out your bank statements to see if you’re good for the home loan and can repay it.

Check your credit score (for free!)

Your credit score is super important when it comes to getting approved for a loan. Make sure you check it out before you apply!

You can check your score for free online, and if you need to, you can work on improving it. Having a solid credit score can not only up your chances of getting approved, but it can also score you a better interest rate.

Pay off your debts.

If you owe money already, it’s best to pay your debt off before trying to get a new loan. This not only helps your credit score but also shows lenders that you’re good with credit and can handle your money well.

Ensure you meet the eligibility criteria.

Make sure you’re eligible for the loan before you apply. Lenders and banks look at how much money you make if you have a job, your credit report, and how much debt you have compared to your income.

If you don’t meet the criteria, your loan application won’t get approved.

Check your chance of approval.

Many lenders have online tools that let you see if you’re likely to get approved before applying for a loan. These tools do a quick check to see if you’re likely to get approved and give you an idea of your credit status.

This can help you avoid applying for loans you probably won’t get approved for, which can mess up your good credit score anyway.

Learn More

Be honest in your application.

When filling out your loan application, ensure you’re being honest and accurate with the info you give.

If you mess up or lie, they might say no to your application, and you could get in trouble.

Find the right lender for you.

Lenders all have their lending criteria and requirements, so it’s essential to find the one that’s right for you.

Check out different lenders and loans, and pick the one that gives you the best deal and suits your needs.

You are missing out if you haven’t yet subscribed to our YouTube channel.

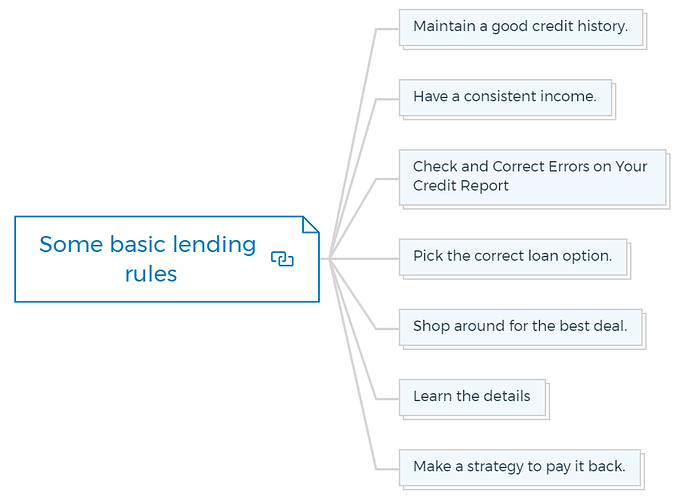

What are some basic lending rules?

Lending rules are the lending criteria that a borrower needs to meet to borrow money from Australian Banks or any other certified lenders. A good knowledge of lending rules can increase your chances of a successful loan application.

Maintain a good credit history.

A high rating makes you more attractive to lenders, giving you access to lower interest rates on loans. Keep your credit utilisation ratio low and your bill payments on schedule to keep your credit score high.

Have a consistent income.

Lenders prefer borrowers who can prove that they have a consistent source of income from which to repay their loans. The likelihood of obtaining a loan authorised rises if you have a regular source of income, such as a job.

Check and Correct Errors on Your Credit Report

Take a look at your credit report and fix any mistakes! If there are any mistakes or issues, it could mess up your credit score and make it harder to get a loan.

Pick the correct loan option.

There are various kinds of loans to pick from, including fixed-rate and variable-rate loans, short-term and long-term loans, and secured and unsecured loans.

Pick the loan term and sort of loan that meets your current demands and budget the best.

Shop around for the best deal.

Don’t take the first loan offer you get; instead, look around for the best rate. Find the finest loan terms, conditions and interest rates by shopping around at multiple lenders.

Learn the details

Make sure you know what you’re getting into before signing the loan agreement by reading it thoroughly and asking questions if you need to help understand something.

Make a strategy to pay it back.

Prepare a strategy for regular loan repayments. Make sure you can afford your loan payments without letting other obligations pile up by making a budget.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

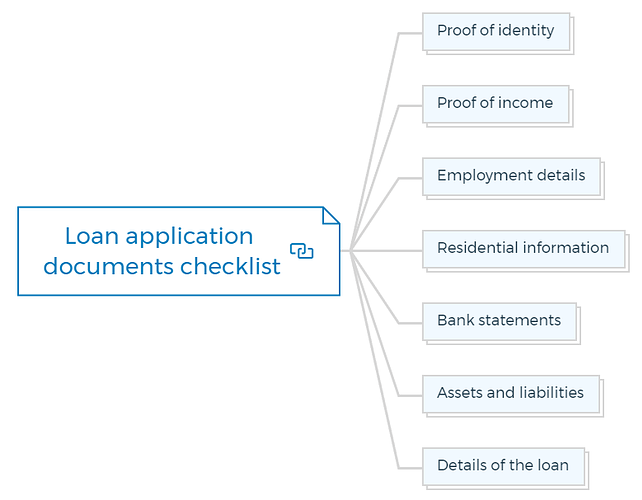

Loan application documents checklist

Australian loan applicants must submit the following documents when applying for a loan:

Proof of identity

To prove your identification, you’ll need a driver’s licence, passport, or birth certificate.

Proof of income

Submit documents that prove your income, such as pay stubs, tax returns, bank statements, and job contracts, are required.

Employment details

Your employer’s name, contact information, job title, and length of employment are required.

Residential information

Provide your current and past residences, including your landlord’s name and contact information.

Bank statements

Show your income and spending with 3-6 months bank statements.

Assets and liabilities

You’ll need to list your assets, such as property or cars, and liabilities, like credit card debt or loans.

Details of the loan

You’ll need to provide details about the loan you’re applying for, such as the loan amount, the purpose of the loan, and the repayment term.

Lenders and loan types may demand different paperwork than other loans. Check with your lender to see what documentation you’ll need to apply for a loan.

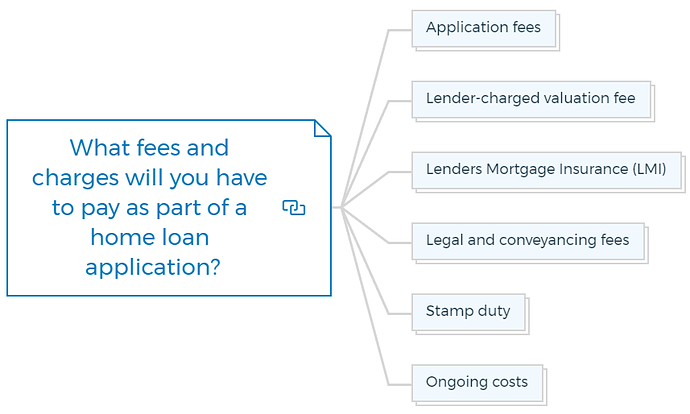

What fees and charges will you have to pay as part of a home loan application?

Australian house loan applicants may have to pay several fees and levies. Some of them include the following -

Application fees

The lender charges a one-time fee to complete your whole loan application process. It can cost hundreds to thousands of dollars.

Lender-charged valuation fee

A professional valuer values your property. Location and property size affect cost.

Learn More

Lenders Mortgage Insurance (LMI)

LMI covers the lender if you default on the loan if you borrow more than 80% of the property’s value. LMI costs depend on the loan amount and property value.

Legal and conveyancing fees

Your property’s title may need to be confirmed and transferred to your name. The transaction’s intricacy and legal expenses determine the cost.

Stamp duty

This state or territorial tax on property purchases varies by region and value. Some states exclude first-time home buyers from stamp duty.

Ongoing costs

After getting your home loan, you may have to pay yearly or monthly account-keeping, redraw, or early repayment fees.

To calculate the loan’s total cost, you must carefully evaluate and budget for home loan fees and charges. Before taking out a mortgage, review all charges with your lender and get independent financial advice.

What is the difference between pre-approval and full approval?

If you’re trying to get a loan, you might hear people talking about “pre-approval” and “full approval.” Here’s the deal on the diff between the two.

Pre-Approval

It’s like a first look at your loan application to see if your financial situation is good. Pre-approval usually involves a soft credit check and can give you an idea of how much you can borrow.

Just because you got pre-approved doesn’t mean you’re approved. They still have to check things out and make sure everything’s good.

Full approval

Full approval is when they’ve gone through all your stuff and given you the green light for your loan. Usually, getting full approval means they’ll do a deep dive into your finances and credit history with a hard credit check.

Once everything’s good to go, the loan gets paid out, and you and the lender are locked in.

In conclusion, preparing for a successful loan application involves checking your credit score, organizing your financial documents, reducing your debt-to-income ratio, saving for a deposit, and comparing lenders and loan options.

Understanding the difference between pre-approval and full approval can also help you navigate the loan application process with confidence. By following these tips and taking a proactive approach, you can increase your chances of approval and secure the loan you need.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber