The amount of money real estate developers can make depends on 3 things:

1) What Real Estate Developers can charge the project as a development management fee?

Real estate developers, also known as General Partners or GP would normally charge a development management fee to the project for managing the project. The most common way to structure development management fees is by…

- Charging a monthly fee.

- Charging a fee based on project costs.

- Charging a fee based on project milestones.

- Charging a success fee based on project objectives and performance.

- Charging a fee based on the number of total units developed.

CAUTION

Always make sure that the development management fee is linked with project performance. Why?

Because if it is not, the developer has little incentive to make sure that the project is on track and within budget.

You are missing out if you haven’t yet subscribed to our YouTube channel.

2) Project Performance Based incentive

Often general partners, GP or real estate developers will also be paid based on the project performance based on IRR hurdles, minimum desired returns for investors, cash on cash return, equity multiple or a combination of both.

3) Property Development Profit

Depending upon the equity held by real estate developers, they will also be entitled to a share of the project based on the percentage of equity they hold. If they own the project 100%, then the entire project profit is for them to keep.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

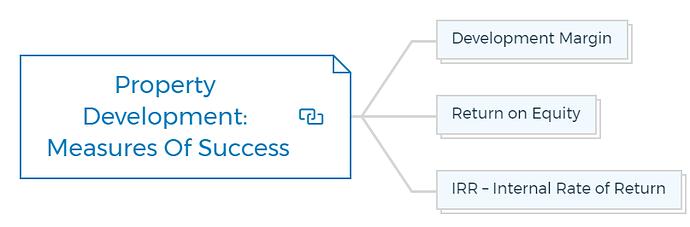

Property Development: Measures Of Success

There are three main measures of success.

Development Margin

The first one is Development Margin, and you should strive to make sure that your project makes a minimum of 10%-15% development margin on cost.

Return on Equity

The second measure is Return on Equity (ROE) or Cash on Cash Return (COC).

This is the profit you make from the money you invest from your pocket. This does not include the money that you borrow from the bank. As a thumb rule, I never take on projects with less than 30% ROE.

IRR – Internal Rate of Return

IRR is another measure of return for projects that span over 24 months. It is similar to any return measure; however, it considers when the money was injected into the project and when it was returned. In other words, it takes into account the time value of money.

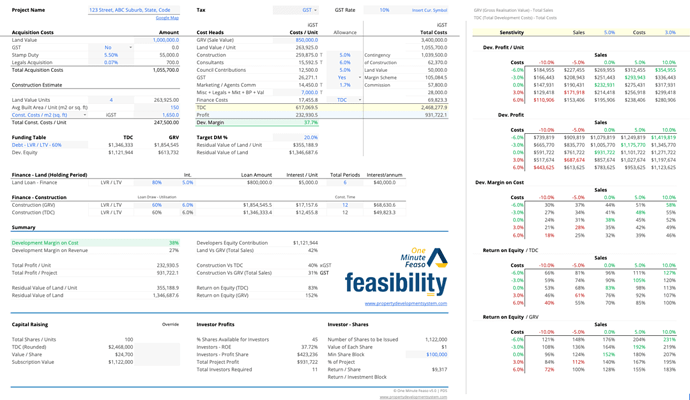

This is the reason, that in order to become a property developer, you need to understand the property development feasibility study as well as the sensitivity analysis.

Continuing with the example from the image above, below is the Sensitivity analysis that both my property development feasibility softwares and training courses include.

In the above example, if everything goes right the project makes $100,451 per unit as development profit, 18% as Development Margin and the Return on Equity will be 45% or 61% depending upon whether the LVR or LTV (Loan to Value Ratio) was against the Total Development Costs or Gross Realisation Value.

This means that if you managed to borrow more money and your maximum loan was determined against GRV your ROE will be 61% and if you were allowed a lower maximum loan, i.e. your LVR was determined against TDC, your ROE will be 45%.

You will make 61% return on your money if you borrow against GRV and 45% return on your money if you borrow against TDC.

The sensitivity table below shows how your profitability, development margin and return on equity will be impacted if your Sales and Costs were to fluctuate in 5% and 3% slabs.