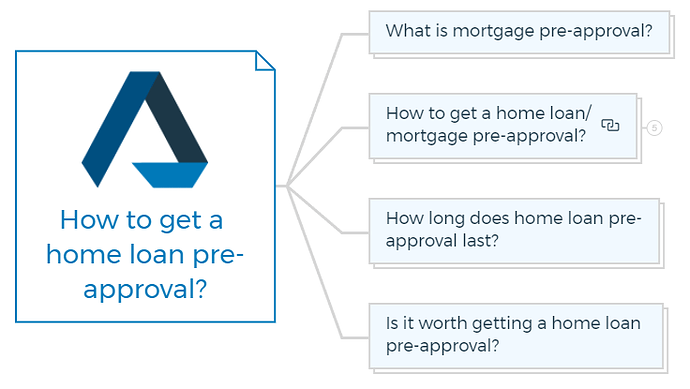

How to get a home loan pre-approval?

Ready to take the plunge into homeownership? Apply for mortgage pre-approval and get ahead of the competition with a better understanding of your borrowing power.

Make offers on properties confidently, knowing that you have the edge over other buyers!

What is mortgage pre-approval?

A mortgage pre-approval is a process in which a lender evaluates your financial situation and creditworthiness to determine how much they are willing to lend you for a home loan.

A home loan pre-approval is also called conditional approval or approval in principle.

A pre-approval of a mortgage can help you determine how much you can afford and make you a more attractive candidate to sellers when you’re ready to make an offer on a home.

You are missing out if you haven’t yet subscribed to our YouTube channel.

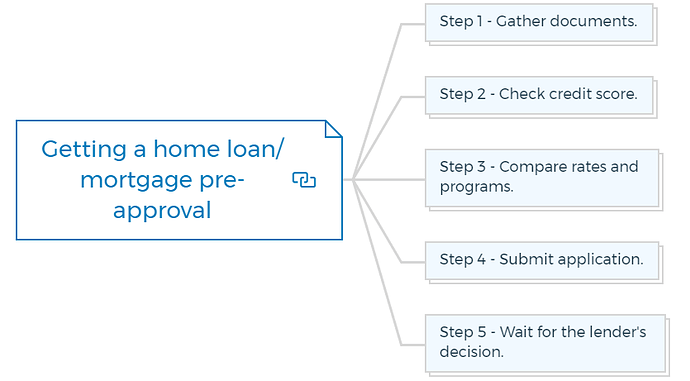

How to get a home loan/mortgage pre-approval?

When you apply for pre-approval for any other loan product, a lender will want to know about your finances.

Each lender may have slightly different requirements, but in general, here are the steps you will follow for a mortgage, aka home loan pre-approval process:

Step 1 - Gather documents.

You must provide documentation of your income, employment, assets, and debts.

This may include payslips / pay stubs, tax returns, bank statements, and proof of any other income or assets you have.

Step 2 - Check credit score.

Your credit score will be a significant factor in determining whether or not you can get pre-approved for a mortgage.

Review your credit score and credit report to ensure no errors or issues need to be addressed.

You can access credit reports for free using applications available online.

Step 3 - Compare rates and programs.

Shop around to compare rates and programs from different lenders. Make sure to compare the APR (Annual Percentage Rate), which includes the interest rate and any fees associated with the loan.

Step 4 - Submit application.

Once you have found a lender you are comfortable with, submit a loan pre-approval application.

The lender will review your application and credit history and let you know how much they will lend you.

Step 5 - Wait for the lender’s decision.

Once your application is reviewed, the lender will let you know whether or not you’ve been pre-approved for a mortgage.

If you are pre-approved, the lender will provide you with a letter stating your approved amount.

Property Development “How To’s” & Frequently Asked Questions

Includes 5 x detailed eBooks [142 pages]

✓ How To Become A Property Developer? In 10 Easy Steps (51 Pages)

✓ How To Overcome Fear In Property Development? (15 Pages)

✓ How To Become A Real Estate Developer? Without Experience (37 Pages)

✓ Property Developer FAQs – Who, What, When, How? (20 Pages)

✓ How To Become A Real Estate Millionaire In 10 Steps? (19 Pages)

How long does home loan pre-approval last?

Pre-approval for a mortgage from a bank or other lending institution often lasts 60 to 90 days.

In some cases, the process may take longer than usual. It might be because of the following reasons -

- You are borrowing more amount such as more than $2 million.

- You’re borrowing over 80% of the property’s value. Lenders Mortgage Insurance (LMI) takes longer to process for loans over 80%.

- You are taking support from a guarantor.

- Your income is irregular.

- You reside abroad or work in Australia temporarily.

Is it worth getting a home loan pre-approval?

Yes, a home loan pre-approval can be incredibly beneficial when purchasing a home.

- It gives you an understanding of the amount you may be able to borrow and what kind of repayment plan you will have.

- A pre-approval also allows real estate agents and sellers to take your offer more seriously, showing them that you are serious about making a purchase.

- A pre-approval also puts you in a better position to negotiate the price of your home, as you know that you have financing already secured.

- Additionally, it could speed up the buying process since much of the paperwork has already been taken care of.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber