How to calculate interest on loan?

Buying a property is the most significant financial decision you’ll ever make. Ensure success in your investment by understanding how to calculate interest on the loan and how it influences overall repayment costs.

What is the mortgage interest?

Mortgage interest or loan interest is the amount of money a lender charges to a borrower for borrowing funds to purchase a home.

Mortgage interest can be either fixed or variable and is typically charged as an annual percentage rate (APR) based on the amount borrowed, the loan term and the borrower’s creditworthiness.

The lender may charge additional fees to cover the loan’s closing costs and other charges.

Mortgage interest is typically paid monthly along with principal payments and will affect the loan’s total cost, including the mortgage amount and associated fees.

Other factors, such as the type of loan, loan term and down payment amount, can also affect the mortgage interest rate. Potential borrowers need to shop for the best interest rate available to get the most favourable terms on their loan.

Learn More

How is loan interest calculated?

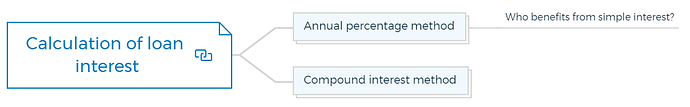

The following are two ways to calculate interest on loan -

Annual percentage method

You can use different methods to calculate loan interest, but the most common method is the annual percentage rate (APR) or the simple interest method.

This method calculates interest as a percentage of the principal amount of the loan.

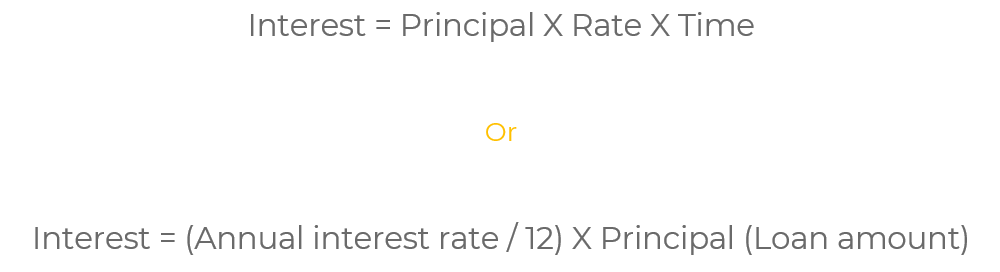

The formula to calculate simple interest on a loan is -

Where:

- The principal is the amount of the loan.

- Rate is the annual interest rate (expressed as a decimal)

- Time is the length of the loan term (expressed in years)

For example, if you take out a loan of $50,000 at an annual interest rate of 7% for a term of 7 years (or 60 months), the interest on the loan would be:

Interest = $50,000 x 0.07 x 7 = $24,500

That means the total repayment of the loan will be $50,000+ $24,500 = $74,500

Or

Interest = (0.07/ 12) x $50,000 = $291.66

This means that each month, you would need to pay $291.66 in interest in addition to any payments you make towards the principal of the loan.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Who benefits from simple interest?

Borrowers that make payments on time or early are rewarded with simple interest.

They can save money during the loan life compared to compound interest loans because interest is calculated based solely on the principal.

Compound interest method

The compound interest method is another popular loan interest calculation method.

Compound interest is calculated not just on the loan’s principal but also on the accumulated interest from the previous period, which means it is calculated more frequently (such as daily, monthly, and annually).

This can cause the total interest on a loan to be higher over time. It is always better to use an online loan interest calculator or consult the bank or the lender to get an accurate interest calculation, as the interest calculation can vary depending on the loan product, lender and the type of interest calculation.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

How to calculate loan repayments?

There are several ways to calculate loan repayments.

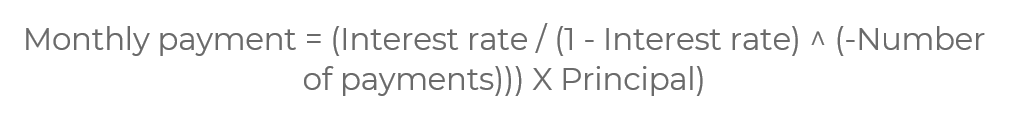

Still, one of the most common methods is to use the formula for the fixed monthly payment on a loan with a constant interest rate, also known as the annuity formula.

The formula for calculating the fixed monthly payment on a loan is as follows:

Where:

- Interest Rate is the annual interest rate on a loan, expressed as a decimal.

- The number of payments is the total number of payments required to pay off the loan.

- The principal is the total amount of the loan.

For example, if you take out a loan of $40,000 at an annual interest rate of 7% and you plan to pay it back over 10 years, the fixed monthly payment would be:

Monthly Payment = (0.07 / (1 - (1 + 0.07)^(-120))) x $40,000

This formula gives you a fixed monthly payment of $461.74

It is important to note that this formula assumes a fixed interest rate, fixed term, and fixed payments.

Some loans, however, have variable rates, adjustable rates or different types of payment schedules; the calculation will change accordingly.

Also, consider adding an extra amount to your repayment to pay off the loan faster or reduce the interest.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber