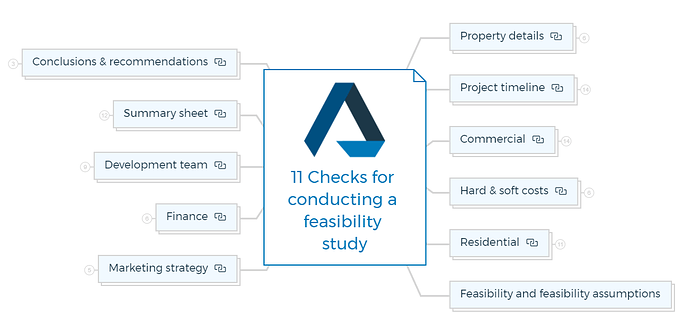

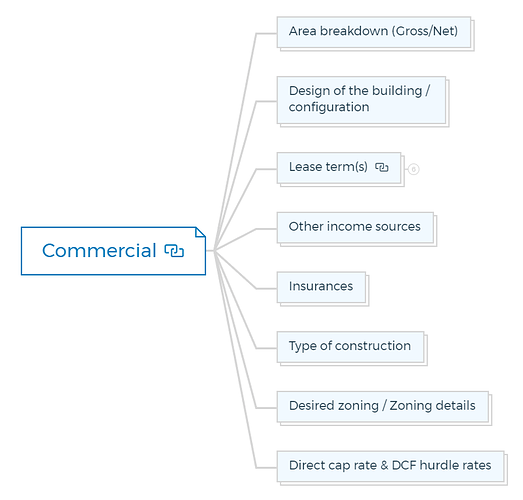

1. Property details

1.1. Identification of the property

Clearly identify the property’s location, address, and unique identifiers.

1.2. Legal description (Title & lot details)

Provide the legal description of the property, including title details, lot numbers, and any relevant legal documents.

1.3. Neighborhood boundaries

Define the boundaries of the neighbourhood in which the property is located, indicating its proximity to essential amenities, schools, transportation, etc.

1.4. Current zoning & overlays

Determine the property’s current zoning classification and any additional zoning overlays that might affect its use or development potential.

1.5. Topography & contours

Assess the property’s topography and contours to understand any grading challenges or advantages for development.

1.6. Maps / Local Government Area:

Clearly indicate the property’s location within the broader geographical context, including the suburb, state, city, county, and neighbourhood it falls under.

You are missing out if you haven’t yet subscribed to our YouTube channel.

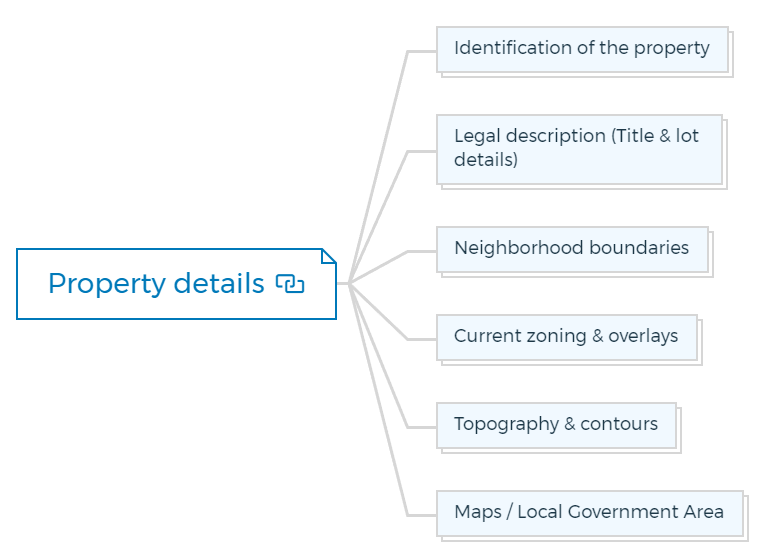

2. Project timeline

2.1. Project start

Note the anticipated start date of the project, indicating when the development process will commence.

2.2. Land acquisition period

Specify the duration during which the property will be acquired.

Learn more - Site acquisition

2.3. Land acquisition loan

Detail the loan period for the land acquisition and its associated terms.

2.4. Interim income

Identify any potential sources of income during the development phase, such as temporarily leasing out parts of the property.

2.5. Development costs

Estimate the costs associated with developing the property, including construction, permits, and other expenses.

2.6. Construction period

Define the timeframe for the construction phase.

2.7. Developers equity | GP

Clarify the equity investment from the developer or general partners.

2.8. Investors equity | LP

Specify the equity investment from investors or limited partners.

2.9. Mezzanine loan

If applicable, provide details about any mezzanine loans secured for the project.

2.10. Construction loan

Describe the terms and duration of the construction loan used to finance the development.

2.11. Develop & sell period

Indicate the projected period for developing and selling residential or commercial units.

2.12. Expected stabilisation period

Determine the estimated time it will take for the property to reach full occupancy or revenue potential.

2.13. Develop & hold

If applicable, note the period during which the residential or commercial units will be held before a potential sale.

2.14. Permanent loan - Construction takeout loan

Detail the terms and purpose of the permanent loan to replace the construction loan upon project completion.

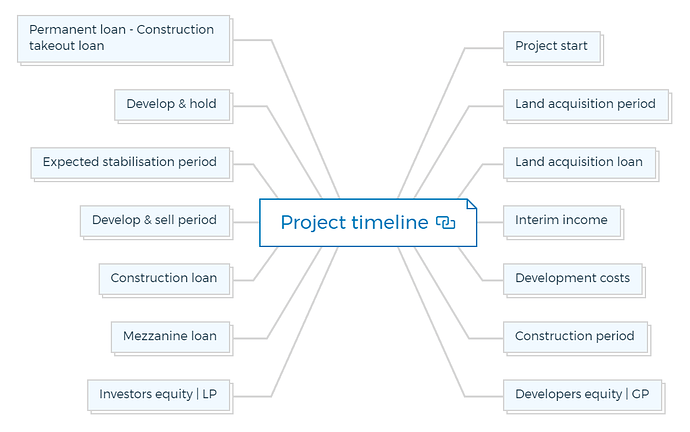

3. Commercial

3.1. Area breakdown (Gross/Net):

- Lot Size / Site Area: State the total area of the property’s land.

- Total Built Area: Indicate the total area covered by all buildings on the property.

- Total Saleable Area: Specify the area available for sale to buyers.

- Total Leaseable / Rentable Area: Indicate the area available for lease to tenants.

- Floor Space Ratio (FSR): Define the ratio of built-up area to land area, influencing the density of development.

- Gross & Net Area / Floor or Level: Distinguish between gross and net area per floor or level.

- Number Of Floors / Levels: Specify the total number of floors or levels in the building.

3.2. Design of the building / configuration:

- No. Of Office, Retail, Common Areas with Details: Enumerate the number of office and retail spaces, along with details of common areas.

- Parking Requirements / Parking Lots: Outline the parking requirements for the property and the number of parking spaces available.

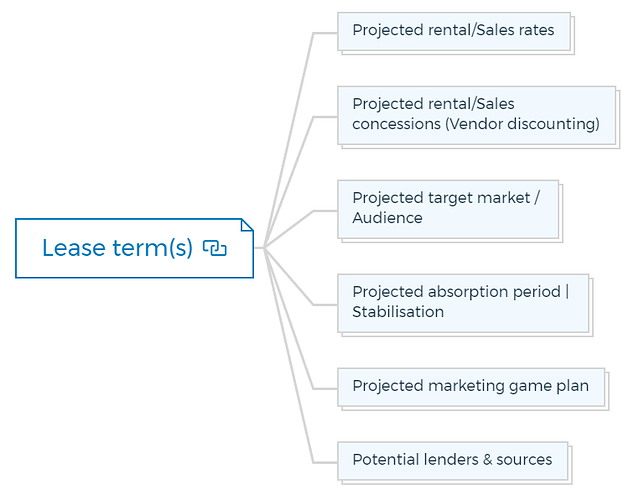

3.3. Lease term(s):

Projected rental/Sales rates

Estimate the rental or sales rates for the property’s units.

Projected rental/Sales concessions (Vendor discounting)

Consider any discounts or concessions offered to tenants or buyers.

- General vacancy & credit allowance: Account for potential vacancies and credit losses in revenue projections.

- Real estate commission policy & rates: Outline the policy and rates for real estate commissions.

- Leasing costs / Agents commission: Include costs associated with leasing activities and agent commissions.

- Tenant interior finish allowances: Note allowances provided to tenants for interior finishes.

- Property amenities: List any amenities offered to tenants or buyers.

- Escalation rates for operating expenses & rent: Specify the annual escalation rates for operating expenses and rent.

Projected target market / Audience

Define the intended customer base for the property, such as businesses, residents, etc.

Projected absorption period | Stabilisation

Estimate the time it will take to achieve full occupancy and Stabilisation of the property.

Projected marketing game plan

Outline the strategies and methods for marketing the property to potential tenants or buyers.

Potential lenders & sources

Identify potential lenders and sources of financing for the project.

3.4. Other income sources

- Vending machines: Include income from vending machines on the property.

- Utilities (Phone, internet): Consider income from utility service providers.

- Parking lots (If leased separately): If applicable, consider income from separately leased parking lots.

3.5. Insurances

Determine the types of insurance coverage required for the property, such as property insurance, liability insurance, etc.

3.6. Type of construction

Clarify the chosen method and materials for constructing the property. This includes specifying whether the building will be constructed using steel frames, concrete, wood, or any other materials.

Additionally, it outlines the structural approach and design considerations that will influence the building’s durability, safety, and overall aesthetic. The type of construction selected will impact costs, timeline, and the property’s long-term value, making it a crucial decision in the feasibility study.

3.7. Desired zoning / Zoning details

Define the desired zoning classification for the property and any relevant zoning details.

3.8. Direct cap rate & DCF hurdle rates

State the project’s desired direct capitalisation rate and discounted cash flow (DCF) hurdle rates.

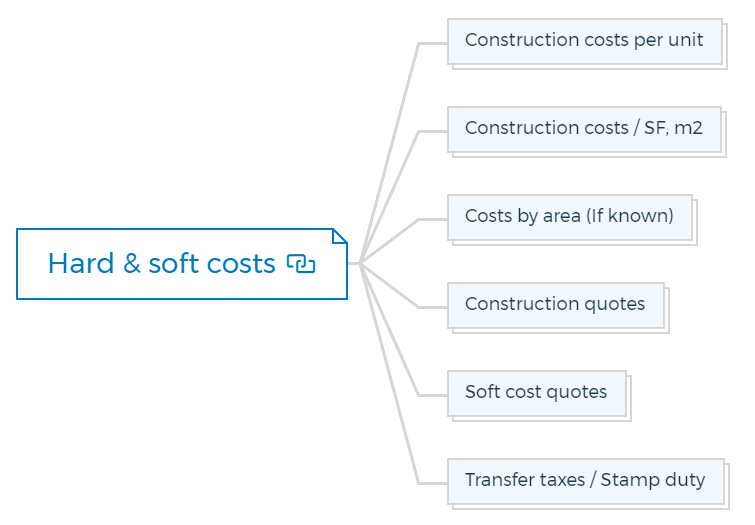

4. Hard & soft costs

4.1. Construction costs per unit

Calculate the construction costs associated with each unit.

4.2. Construction costs / SF, m2

Determine the construction costs per square foot or square meter.

4.3. Costs by area (If known)

If available, break down costs by specific areas of the property.

4.4. Construction quotes

Gather quotes from contractors to estimate construction expenses accurately.

4.5. Soft cost quotes

Obtain quotes for soft costs such as architectural design, permits, legal fees, etc.

4.6. Transfer taxes / Stamp duty

Account for transfer taxes or stamp duty applicable to property transactions.

Learn more - A-Z of tax.

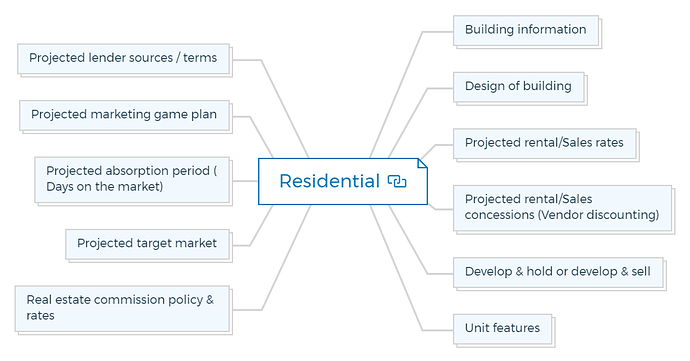

5. Residential

5.1. Building information

- Total number of units: Indicate the total number of residential units planned.

- Unit mix: Specify the distribution of unit types (e.g., studio, one-bedroom, two-bedroom, etc.).

- Unit type: Detail the characteristics of each unit type.

5.2. Design of building

- Type construction: Define the type of construction material to be used.

- Desired zoning / Zoning details: Reiterate the desired zoning classification and any relevant zoning details.

- Parking requirements: Note the parking requirements for residential units.

5.3. Projected rental/Sales rates

Estimate the expected rental or sales rates for the residential units.

5.4. Projected rental/Sales concessions (Vendor discounting)

Consider any discounts or concessions offered to renters or buyers.

5.5. Develop & hold or develop & sell

Decide whether the residential units will be sold or held for leasing.

5.6. Unit features

Highlight unique features and amenities offered in each residential unit.

5.7. Real estate commission policy & rates

Define policies and rates for real estate commissions related to residential sales or leasing.

5.8. Projected target market

Specify the target audience for the residential units.

5.9. Projected absorption period (Days on the market)

Estimate the average time units will spend on the market before being rented or sold.

5.10. Projected marketing game plan

Outline strategies for marketing the residential units to potential tenants or buyers.

5.11. Projected lender sources / terms

Identify potential lenders and their terms for financing residential development.

6. Feasibility and feasibility assumptions

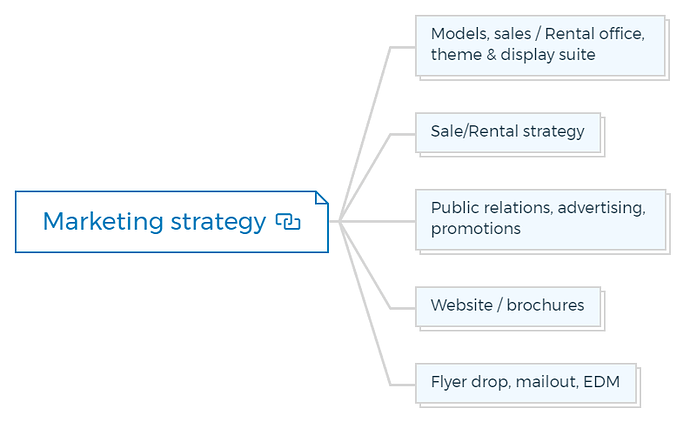

7. Marketing strategy

7.1. Models, sales / Rental office, theme & display suite

Explain the use of models, sales or rental offices, and thematic display suites for marketing purposes.

7.2. Sale/Rental strategy

Detail the strategy for selling or renting out the property’s units.

7.3. Public relations, advertising, promotions

Describe PR, advertising, and promotional activities planned for the property.

7.4. Website / brochures

Explain the role of a property website and brochures in marketing efforts.

7.5. Flyer drop, mailout, EDM

Clarify the methods for distributing flyers, mailouts, and electronic direct mail (EDM) to reach potential customers.

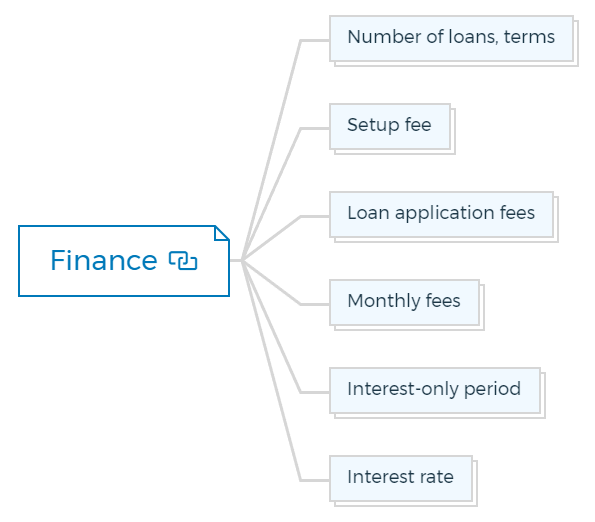

8. Finance

8.1. Number of loans, terms

Indicate the number of loans required and the terms associated with them.

8.2. Setup fee

Specify setup and exit fees expressed as percentages of the loan amount.

8.3. Loan application fees

Detail any fees associated with applying for loans.

8.4. Monthly fees

List any recurring monthly fees linked to the loans.

8.5. Interest-only period

Mention the period during which only interest payments are required.

8.6. Interest rate

State the interest rate associated with the loans.

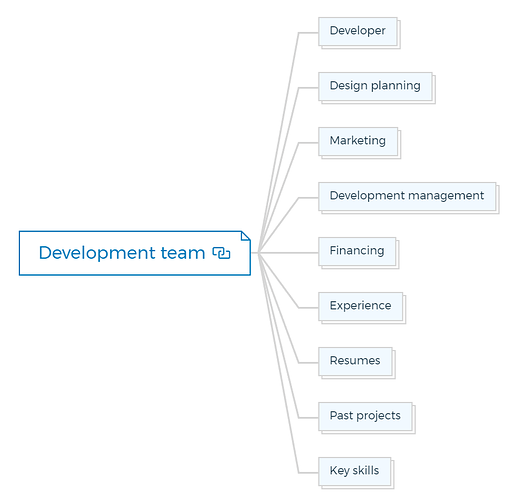

9. Development team

9.1. Developer

Provide a brief introduction to the developer or development company, including their experience, background, and track record in property development. Highlight any notable projects they have completed.

9.2. Design planning

Describe the design planning team responsible for conceptualising and creating the architectural and layout plans for the property. Discuss their expertise in creating functional and aesthetically pleasing spaces.

9.3. Marketing

Introduce the marketing team that will position the property in the market, identify the target audience, and create effective marketing strategies to attract buyers or tenants.

9.4. Development management

Explain the role of the development management team in overseeing and coordinating the various aspects of the project, including budget management, timeline adherence, and quality control.

9.5. Financing

Outline the individuals or team members responsible for securing financing for the project, detailing their experience in negotiating loan terms and securing investment.

9.6. Experience

Provide a comprehensive overview of the development team’s collective experience in the real estate and property development industry. Highlight their strengths in handling various stages of development.

9.7. Resumes

Include resumes or profiles of key development team members, showcasing their educational background, professional achievements, and roles within the project.

9.8. Past projects

Highlight notable past projects completed by the team, emphasising their relevance to the current property’s scope and market positioning.

9.9. Key skills

Enumerate the critical skills each team member possesses that are essential for the successful execution of the project. This might include skills in negotiation, project management, market analysis, architectural design, financing, and more.

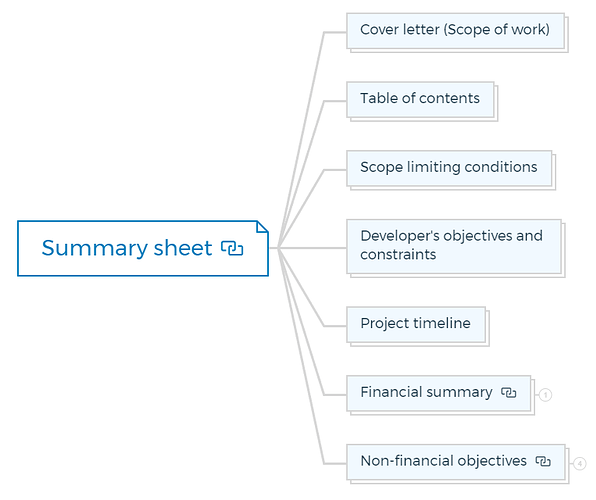

10. Summary sheet

10.1. Cover letter (Scope of work)

Include a cover letter detailing the scope of work for the feasibility study.

10.2. Table of contents

Provide an organised table of contents for easy navigation.

10.3. Scope limiting conditions

Specify any conditions or limitations that might impact the study’s scope.

10.4. Developer’s objectives and constraints

Outline the developer’s objectives and any constraints they must work within.

10.5. Project timeline

Summarise the key milestones and timeline for the project.

10.6. Financial summary

Provide a brief overview of leverage, liquidity, yield, and risk associated with the project.

10.7. Non-financial objectives:

Mention available resources for the project.

Describe the capabilities of the development team.

Highlight any limitations or constraints affecting the project.

Summarise the chosen development strategy.

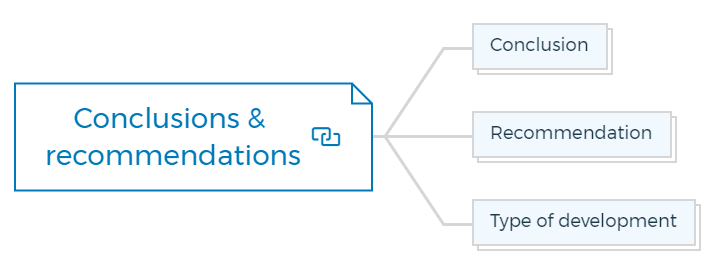

11. Conclusions & recommendations

11.1. Conclusion

Summarise the findings of the feasibility study and the project’s viability.

11.2. Recommendation

Provide a recommendation based on the study’s assessment, suggesting whether to proceed with the project.

11.3. Type of development

Specify the type of development proposed based on the study’s outcomes.

This comprehensive checklist with explanations covers various aspects of conducting a feasibility study for a property, ensuring that all critical considerations are addressed before embarking on a development project.