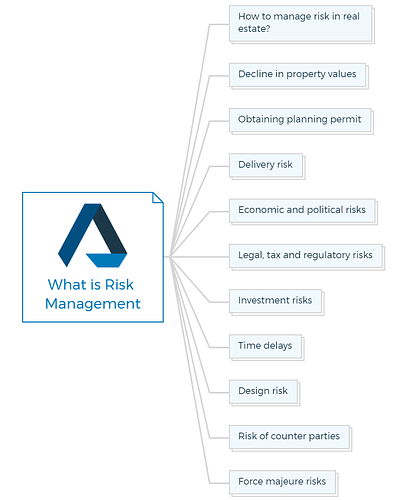

Risk Management

Risk management in property development is the process of identifying, assessing, and mitigating potential risks that may arise during the development of a real estate project.

These risks can include financial risks, such as cost overruns or delays in obtaining financing; market risks, such as changes in demand for the property or shifts in the real estate market; and physical risks, such as natural disasters or construction accidents.

How to manage risk in real estate?

To manage these risks in property development, developers may employ a variety of strategies, such as:

- Conducting market research to better understand the demand for the property and potential risks related to the local real estate market

- Establishing contingency plans to address potential delays or cost overruns

- Securing insurance to protect against physical risks such as natural disasters

- Implementing safety protocols to minimize the risk of construction accidents

- Building in flexibility to adapt to changing market conditions.

Overall, effective risk management in property development is crucial to the success of a project as it helps to minimize potential losses and maximize returns for the developer and stakeholders.

If you are in property development, it is simply unavoidable to have no risk at all. Let me put it this way, there are inherent risks when driving on the road. However, we all take those risks everyday, to the point we don’t even think about the bad stuff that can happen on the road when leaving our house.

We do that because we follow a system, we do that because we are going to follow rules. Property Development is no different.

There are rules and systems to follow at each step to manage risks. In fact, everything that I have discussed in this article is to manage risk, avoid it, minimize it or contain it.

But above all, you must always have an exit strategy from your project at hand. Following is a list of various types of risks that everyone should be aware of when getting started in property development.

Not all of them apply to all developments and it is your responsibility as a property developer to identify them and mitigate them for each project. Read more about managing risks in property development.

Decline in property values

- Market could take a downturn and the end value of your development may not be the same as in feasibility.

Obtaining planning permit

- There is a possibility that the council may decline the planning permit application.

- Add conditions to the planning permit, which may add costs that may not be included in the feasibility study.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Delivery risk

- There is a risk that cost overruns may exceed the contingency amount or that the builder is bankrupt during the course of construction.

Economic and political risks

- In the course of the development, the property developer could be exposed to the direct and indirect consequences of political, economic and social changes in the investment environment.

Legal, tax and regulatory risks

- Legal, tax and regulatory changes in the Australian investment environment, or otherwise, may occur during the investment term which could have adverse effects on the return of the development.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

Investment risks

- Time delays, building disputes, unforeseen litigation, planning and environment controls, loss of sales, competition for similar developments, adverse market conditions are just some of the problems which may confront the project.

Time delays

- Development approvals, slow decision making by counterparties, complex construction specifications, changes to design briefs, legal issues and other documentation changes may give rise to delays in construction completion, loss of revenue and cost overruns.

- Other time delays that may arise in relation to construction and development include supply of labour, scarcity of construction materials, lower than expected productivity levels, inclement weather conditions, land contamination and unforeseen environmental issues and industrial action that may arise from Occupational Health and Safety issues, which may give rise to difficult site access and industrial relations issues.

- Objections raised by community interest groups, environmental groups and neighbours may also delay the granting of planning approvals or the overall progress of a project.

Design risk

- There is a risk that design problems or defects may result in rectification or other costs or liabilities which cannot be recovered.

Risk of counter parties

- There is always a risk that, notwithstanding appropriate safeguards, parties with whom you as a developer have dealings with, may experience financial or other difficulties with consequential adverse effects for the relevant project or asset.

Force majeure risks

- Acts of terrorism and events of force majeure may affect projects and insurance may not fully cover these risks.

So before you get started in property development, make sure that you understand the Due Diligence process in its entirety. Watch the video above to understand these concepts in detail.

If you would like to learn more and get a better understanding of the complete Due Diligence process, I would highly recommend that you checkout one of my property development courses that can help you get started in property development.

So to conclude this post, here is what is important to get into property development and become a property developer:

- Location Analysis – make sure you understand the suburb that you are planning to invest into thoroughly.

- Site Analysis – a thorough analysis on the actual site to make sure that you are not buying a lemon is essential.

- Understanding zoning and overlays is essential to determine the highest best possible use of the site. i.e. determining if you can accommodate the maximum number of units that make you profit on a site is the basis for any financial feasibility.

- Data Collection and Spatial analysis go hand in hand. Gathering and organising data visually that speaks to you about the past sales, rental information and currently on sale properties will help you determine the end value of the units you are planning to develop.

- Risk Mitigation – always have an exit strategy and make sure that you have identified all risks and have a plan for each one of them.