Discover how joint ventures can help you enter the world of real estate investing, even if you don’t have the resources to do it alone. Read on to learn more.

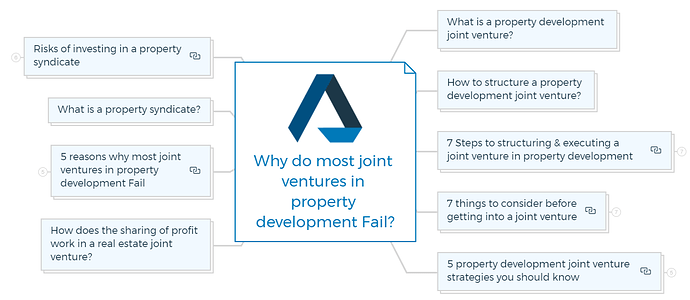

What is a property development joint venture?

A property development joint venture is a business partnership between two or more parties to develop a real estate project.

The parties involved can be developers, investors, landowners, or other relevant parties.

In a joint venture, each partner contributes expertise, resources, and capital to the project in exchange for a share of the profits.

The joint venture agreement outlines the partnership’s terms and conditions, including each partner’s roles and responsibilities, the project timeline, the funding structure, and the distribution of profits.

Joint ventures are often used for large and complex real estate projects, such as commercial or residential developments, that require significant financial resources and expertise.

Joint ventures can offer several benefits for property developers.

Joint ventures can provide access to new markets and opportunities that may not be available to individual developers.

Joint-venture working example

Understand the basic principle behind the real estate joint venture through this example.

Company A owns a plot of land in Queensland, based out of Victoria. They need to gain the expertise of Queensland. There is a person named John, born and grew up in Queensland and lives next to the plot of land company A purchased.

Company A plans to use the plot of land by building an office block there. The company gets into a property development joint venture with John, where Company A takes care of funding while John undertakes the expertise part.

How to structure a property development joint venture?

The structure of modern joint ventures usually has one party with ideas, opportunities and or experience and another party with funds and resources. Simply put, joint ventures are usually between two parties, one with the expertise and the other with no TIME. In the perfect world, it’s a match made in heaven.

In a rising market, Joint Venture partners with cash are lured in by offering a larger portion of the upside. While in a declining market, they will want to minimise or cap their risk and maximise their profits at their partner’s or lender’s cost.

The developer on the other hand wants to give up as little profit share as possible, which increases their risk profile.

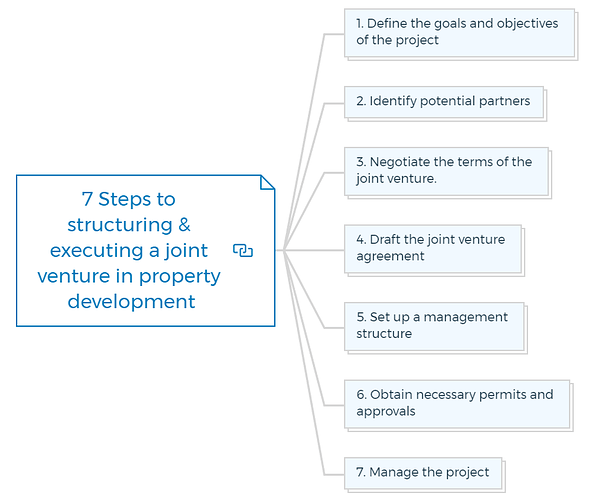

7 Steps to structuring & executing a joint venture in property development

1. Define the goals and objectives of the project

Before you start structuring the joint venture, it is crucial to define the goals and objectives of the project. This should include details such as the type of property to be developed, the location, the project size, and the expected return on investment.

2. Identify potential partners

Once you have defined the project’s goals, you can identify potential joint venture partners. They can be property developers, investors, construction companies, and other relevant parties.

3. Negotiate the terms of the joint venture

The next step is to negotiate the terms of the joint venture. This includes vital details such as the financial contributions of each partner, the profit-sharing structure, the decision-making process, and the timeline for the project.

4. Draft the joint venture agreement

Once you have agreed on the key terms of the joint venture, you should draft a formal joint venture agreement. This agreement should cover all the project’s essential details, including each partner’s responsibilities, the management structure, the distribution of profits, and the termination of the joint venture.

5. Set up a management structure

It is crucial to set up a management structure for the joint venture. This includes identifying the key decision-makers and establishing a process for making decisions.

Establishing reporting and communication protocols is also essential to keep all partners informed about the project’s progress.

6. Obtain necessary permits and approvals

Depending on the location and project type, obtaining permits and approvals from local authorities may be necessary.

Identifying these requirements early in the process and ensuring that all necessary permits and approvals are obtained before the project starts is crucial.

Learn More

7. Manage the project

Once the joint venture is established and the project is underway, it is vital to manage it effectively. This includes overseeing the construction process, managing budgets and timelines, and ensuring the project meets all legal and regulatory requirements.

Structuring a property development joint venture requires careful planning, negotiation, and management to ensure all partners are aligned and the project succeeds.

You are missing out if you haven’t yet subscribed to our YouTube channel.

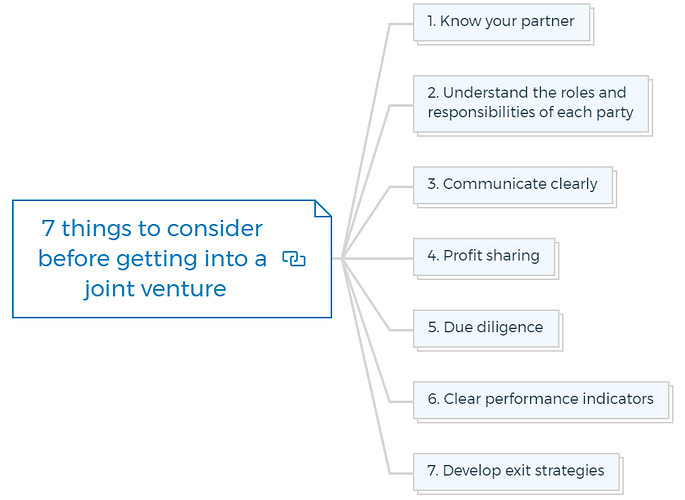

7 things to consider before getting into a joint venture

Two or more companies collaborate to accomplish a goal in a joint venture. Apart from having an explicit agreement, there are some other considerations:

1. Know your partner

Research your joint venture partner, and know about their corporate culture. Find out if the organisation has done joint ventures before. Ask about their results.

There is always a risk associated while partnering with joint ventures in property development. Any act of your partner can adversely affect your reputation.

2. Understand the roles and responsibilities of each party

List all development tasks to define each party’s responsibilities throughout the entire real estate development process. Assigning a lead and “peer review” position is also becoming popular.

The simplest way to divide this up is to write a simplified list of things that need to be done between the start and finish of the project and determine the skill sets of the stakeholder’s strengths and weaknesses.

You can also use a top-down approach by which the senior lead is responsible for allocating/delegating the appropriate sub-tasks, with peer reviews by the secondary party to ensure a logical approach and share ownership of its success or failure.

Learn More

3. Communicate clearly

Communication is crucial in building a relationship. Ensure everyone knows the joint venture agreement’s aims, financial contributions, human resources, and projected duration.

The joint venture’s major players should often meet in person. You may be required to notify and consult workers.

4. Profit sharing

The distribution of profits and risks should also reflect each party’s efforts, abilities, and financial input. It’s crucial to have flexible ways to adjust profit distributions when these contributions vary during a JV’s lifespan.

This happens when more equity contributions are needed, especially when not all parties can or want to participate. The agreement should consider this and alter entitlements to reflect contributions and risk weightings.

Poorly constructed agreements lead to disputes. If a partner is under-incentivised, their performance and the project’s status may suffer.

5. Due diligence

As a single real estate development project managed independently, you must do your due diligence when considering joint venture property development funding.

Consider how your opponent’s reputation will affect yours. The wrong partner may ruin your company or personal reputation and goodwill.

Check your partner’s qualifications and dismiss anybody who disagrees. Police checks, credit ratings, and financial and accounting reviews are possible. They can also help.

If you see red markings or flags, decide whether the risk is worth it.

Learn More

6. Clear performance indicators

There should be clear performance indicators for each party in the real estate joint ventures. What if business plan estimates fail?

The two parties often have different expectations about what the joint venture can accomplish at various periods and how failing to meet those expectations would influence their contributions.

For example, if one party finances while the other provides knowledge, would the former believe its financial obligations should be decreased if profit objectives are missed?

Performance indicators will help both parties understand what to expect from each other and raise critical issues about adapting if performance indicators fall short.

7. Develop exit strategies

Joint venture partners must have an exit strategy.

Exit strategies are crucial for several reasons.

- It improves collaboration efficiency.

- It may prevent commercial disputes.

- It may safeguard firms if the partnership fails.

There are many exit strategies. The most common one is a buy-sell agreement. This agreement governs how the company will sell if one partner leaves. This agreement may reduce disputes and guarantee fairness.

Another exit strategy is a put option. One partner may sell their company stake to the other at a fixed price. This may prevent one partner from taking advantage of the other when they leave.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

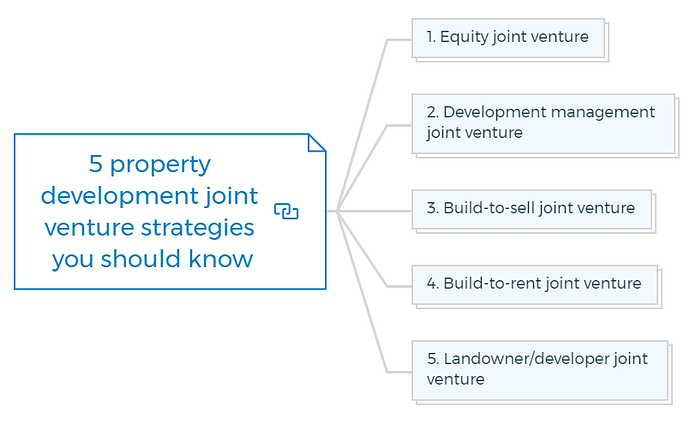

5 property development joint venture strategies you should know

Here are five common property development joint venture strategies:

1. Equity joint venture

An equity joint venture involves two or more parties contributing equity to a project in proportion to their ownership interest. This means that each party shares in the profits and losses of the project in proportion to their contribution.

2. Development management joint venture

In a development management joint venture, one partner manages the development process while the other contributes the necessary capital. The development partner may receive a management fee or a percentage of the profits.

3. Build-to-sell joint venture

A build-to-sell joint venture involves partners developing a property to sell once completed. This strategy can be used for residential or commercial properties and can involve multiple partners contributing capital and expertise.

4. Build-to-rent joint venture

In a build-to-rent joint venture, partners develop a property to rent out to tenants.

5. Landowner/developer joint venture

A landowner/developer joint venture involves a landowner and a property developer working together to develop a property on the landowner’s property.

The landowner may contribute the land, while the developer contributes the capital and expertise to develop the property.

How does the sharing of profit work in a real estate joint venture?

Generally, profit is divided as per the agreed-upon rate or as per share/unit holing in the development entity. If any party or group funding the project has incurred upfront costs, they will get their money back.

Similar to profit, risks are also shared among joint venture partners per the conditions mentioned in the joint venture agreement.

5 reasons why most joint ventures in property development Fail

There are several reasons why joint ventures in property development may fail. Here are some of the common ones:

1. Misaligned goals and expectations

Property development joint ventures require all parties to have similar goals and expectations. If these are not aligned, it can lead to misunderstandings and disagreements.

For example, one partner may want to focus on maximising profits, while another may be more concerned about creating sustainable development that benefits the community.

2. Poor communication

Effective communication is critical for any joint venture to succeed. If partners do not communicate regularly and openly, misunderstandings can occur, leading to delays, increased costs, and other problems.

3. Financial issues

One of the most common reasons why joint ventures in property development fail is financial problems.

For example, partners may have different ideas about how much money should be invested in the project. One partner may need help contributing their promised investment, leading to delays or the project’s cancellation.

4. Legal issues

Joint ventures require the drafting of complex legal agreements. If these agreements are not well-written or if they do not cover all potential issues, disputes can arise that may fail the project.

5. Market changes

The real estate market can be unpredictable, and market conditions changes can impact a joint venture’s viability. For example, a sudden drop in property prices can make it difficult to sell units, leading to financial difficulties for joint venture partners.

Overall, joint ventures in property development can be successful if all parties clearly understand the risks and benefits of the project and if they work together to mitigate the risks and manage the project effectively.

What is a property syndicate?

A property syndicate is a joint venture between a group of investors who pool their resources to invest in real estate. This joint venture could develop the property or invest in an already established property with stabilised rent.

Learn More

In a property syndicate, each investor contributes a certain amount of capital to the investment, and the group collectively owns the property or properties. The syndicate members or a professional property management company may manage the property.

The structure of a property syndicate can vary, but typically it is set up as a unit trust or a company.

The syndicate is managed by a trustee or board of directors, who are responsible for making decisions about the investment, such as buying and selling properties, setting rental rates, and managing maintenance and repairs.

Investing in a property syndicate can offer several advantages over investing in real estate individually. For example, property syndicates allow investors to pool their resources and share the investment risk. This can provide access to more significant, complex properties that may only be feasible for some investors.

IMPORTANT

Property syndicates can also allow investors to diversify their real estate portfolio across multiple properties or locations.

Another advantage of property syndicates is that they can provide passive income for investors, as rental income from the properties is distributed among the syndicate members.

Additionally, property syndicates may offer tax advantages, such as depreciation deductions and the ability to defer capital gains taxes.

However, investing in a property syndicate also carries risks. For example, the value of the properties and the rental income may fluctuate, and there may be costs associated with managing the properties.

It is essential to carefully research the syndicate and its investment strategy and understand the associated fees and risks before investing in a property syndicate.

Risks of investing in a property syndicate

Investing in a property syndicate can offer many benefits, such as access to larger and more complex properties, diversification of real estate investments, and potential tax advantages.

However, as with any investment, risks are associated with investing in a property syndicate. Here are some of the common risks to consider:

1. Lack of control

Investors in a property syndicate have limited control over investment management. The syndicate’s trustee or board of directors makes decisions about the purchase, management, and sale of the properties, and investors do not have direct control over these decisions.

2. Property market fluctuations

The value of the properties in a syndicate can be impacted by changes in the real estate market, such as fluctuations in property values or rental demand.

These changes can affect the income and capital growth potential of the investment.

3. Liquidity risk

Investments in property syndicates are typically illiquid, meaning that investors may not be able to sell their shares or withdraw their investments easily. This can make it challenging to access capital in the short term, particularly in financial hardship.

4. Fees and costs

Property syndicates often charge fees and costs associated with purchasing, managing, and selling properties. These fees can include management, legal, valuation, and other costs. These fees can impact the returns of the investment.

5. Concentration risk

Investing in a property syndicate can result in concentration risk, as the investment is focused on a particular property or group of properties.

If the investment performs poorly or the properties experience unexpected issues, the entire investment may be at risk.

6. Counterparty risk

The trust or company structure of the syndicate may expose investors to counterparty risk, as the syndicate relies on the trust or company being financially stable and operating effectively.

Investors should carefully research the syndicate, its investment strategy, and the associated risks and fees before investing in a property syndicate. It is also recommended to seek independent financial and legal advice to understand the risks and benefits of the investment fully.

FAQs

Who owns property in a joint venture?

In a joint venture, the ownership of the property is typically shared between the partners involved in the partnership. The ownership structure and percentage of ownership will be outlined in the joint venture agreement.

What are the three types of joint venture?

The three types of joint ventures are equity joint ventures, contractual joint ventures, and cooperative joint ventures.

Equity joint ventures involve the creation of a new entity with shared ownership, contractual joint ventures involve a contractual agreement between the partners, and cooperative joint ventures involve collaboration without the creation of a new entity.

Is a joint venture Always 50-50?

No, a joint venture is not always 50-50. The percentage of ownership and distribution of profits in a joint venture depends on the terms of the joint venture agreement.

The agreement can be tailored to meet the needs of the partners involved, and ownership percentages can be structured in any way that the partners agree upon.