8 Important considerations for property ownership

Any property investment has three ownership stages. It involves buying an investment, enjoying gains, dividends, interest, or other ownership benefits over time, and then selling, inheriting, maturing (in the case of a bond), or otherwise disposing of it.

Property ownership cycle:

- Buy (which can also be an inheritance or some other nonpurchase event)

- Management

- Reversion, a sale, disposal, or change in nature or use

This broad paradigm covers practically every real estate ownership and gives a way to figure out how much a property is worth at each stage. If you own real estate, you’d need a basic understanding of marketing, finance, development, building, and maintenance.

This is all you are going to explore here.

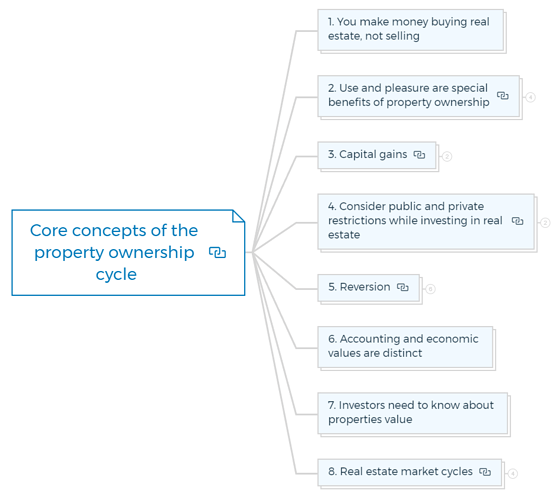

Core concepts of the property ownership cycle

1. You make money buying real estate, not selling

If you buy a real estate property at the right price, you can easily sustain the unstable real estate markets, peculiar property issues, and regular industry interruptions. While, if you are overpaying, no amount of inflation will ever get you up to where you should have been.

When you purchase a piece of real estate, the value of that property increases over time - based on factors like inflation and increased demand - resulting in a higher resale price when you go to sell it.

This is why savvy investors buy low and hold onto the property for as long as possible, allowing them to reap maximum profits when they finally decide to put it back on the market.

In simple words, the concept is that an investment property may have a specific market value, but a different investment value. Investors’ strategic objectives base the investment value of a property.

For example, one investor may be seeking a short-term return on the property and will flip it for a profit shortly after purchase. Meanwhile, another investor may view the same property as an ideal rental property to generate passive income over long-term ownership.

Real estate investments can have far greater returns than many other types of investments when done properly. By understanding these core concepts of real estate ownership, investors can make wise decisions on their purchases, increasing their chances of success in the future.

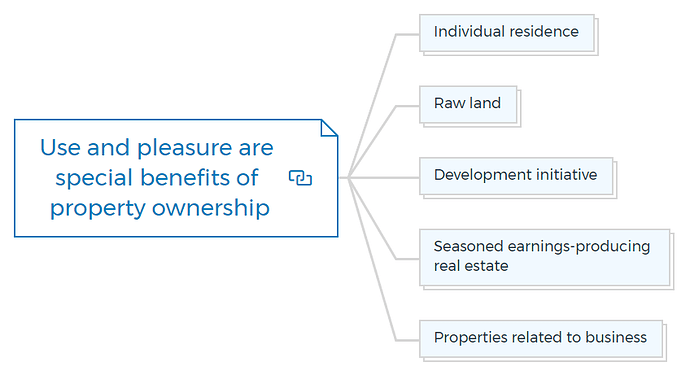

2. Use and pleasure are special benefits of property ownership

During the time that a person owns real estate, certain benefits are available. When you invest in stocks or bonds, you can anticipate capital growth over time and, in some situations, a stream of income.

There are numerous potential advantages for investors in real estate. Some are simple to value, such as rental incomes. Others may be more difficult to quantify, such as the intangible advantages of a private dwelling or recreational property.

Some types of real estate, such as owner-occupied commercial real estate, offer both the possibility for subjective business synergies and present income (or at least implicit income from forgone rental expenses).

The following are some examples of use benefits -

Individual residence

The occupancy benefit is part of the use and enjoyment. It is frequently overestimated by merely considering the lost rent.

Studies reveal that the benefits received by owner-occupant homeowners outweigh the lost rent by a large margin, and the quantitative estimates of these benefits vary greatly.

By residential value, there is the most frequent fluctuation. Unsurprisingly, upscale homes have use and enjoyment benefits that far outweigh their rental worth.

Raw land

Many investors view carefully selected undeveloped land as an advantageous location to store cash. When appraised and managed correctly, land typically increases in value over time. Over time, the usage and enjoyment gained might be that appreciation.

Investors may also gain substantial intangible benefits from their land investments. You can rent land for farming, hunting, or recreational purposes.

Despite the relatively modest yearly agricultural rental rates, some investors may find this a good property investment due to the current income and potential future capital gains.

Development initiative

It can apply to various real estate projects, including developing a commercial structure or a residential property subdivision.

The development project should be approached similarly to any other commercial venture, with startup costs, small cash flows in the early going, and significant cash flows in the latter.

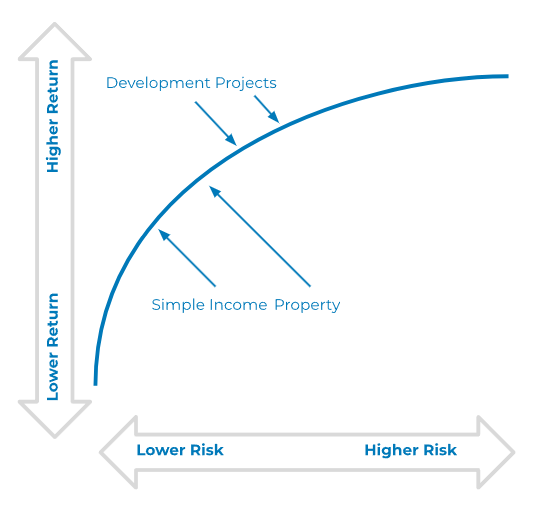

Investors with greater risk tolerance may experience greater rewards.

Seasoned earnings-producing real estate

For the majority of investors, this is a typical scenario. Such investments typically have reduced risk and lower revenue levels.

Relationship between Risk and Return

Even when adjusted for risk, this income frequently exceeds bond income and is frequently uncorrelated with other income investments like bonds.

Properties related to business

The lost rents alone show why it’s good for an investor’s business to own real estate. Commercial renters often experience rent increases over time; landlords benefit from built-in escalation provisions in the contracts.

The landlord benefits from income and capital gains rise over the lease term since well-selected and well-maintained commercial real estate frequently improves in value over time.

On the other hand, the firm owner who owns the investment property keeps these benefits for themselves. Additionally, business owners who own real estate may modify the space more precisely to meet the company’s unique demands over time and reap additional benefits.

Lastly, the owner of the business can split ownership and pay themself rent. There are big tax and estate planning benefits to these kinds of deals.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Capital gains over time

In some circumstances, investors have the freedom to balance the advantages of immediate cash versus future capital gains.

While some investments, like development projects, may have distinct return structures for capital gains vs current income, when options are available, this is frequently a consequence of the tax implications.

For a particular project, the capital gains may have a higher overall rate of return than the current income. It is sometimes done to persuade the investor to keep the money in the project, thereby extending the project’s time with development liquidity.

Quick Tip

Capital gains could result from -

- The developers’ entrepreneurial efforts.

- An increase over time influenced by typical real estate market cycles.

- Short-term market cycles, purchasing at an upswing.

- Property enhancement over time, such as renovating an outdated structure in a prime location to command higher rents.

- Using low early-period rentals and escalation clauses to strategically structure higher rents with long-term tenants in “out” years to give the investor a built-in financial gain over a predictable time.

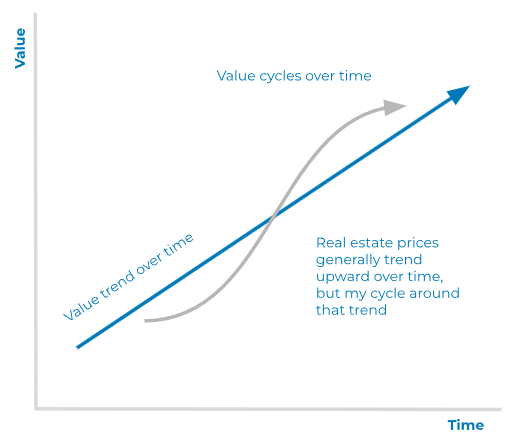

Real estate values rise over time, but these tendencies are rarely constant. In the intermediate term, prices tend to oscillate around these tendencies for most properties and markets.

Real estate value cycles

These cycles are somewhat predictable, and while it is advised that investors avoid trying to “catch a falling knife,” the astute investor can recognise market cycles and profit from them for short- and intermediate-term capital gains.

Rents and occupancy typically drive real estate cycles. Savvy property investors will look for properties with soon-expiring leases when the market is at its bottom.

In the medium run, those properties will rent up with rising escalations, and their values will increase at the cycle’s peak. On the opposite end of the investing spectrum, some unsophisticated landlords will try to fill vacant properties by giving long-term, fixed-rate leases at the bottom of the real estate cycle.

As the market exits the cycle, those landlords will see other properties appreciate while the value of their property investment stagnates because of below-market lease rates.

Successful real estate investors know the importance of keeping up with market trends and developments. If you’re serious about getting into real estate, then you need this - Free Quick-start property development course.

If you take this course, not only will you gain a better grasp of the market, but you’ll also be able to own more properties even if the market is flat.

Buy low and sell high.

Monitoring local market cycles can be pretty rewarding long-term, but it takes perseverance to avoid what is known in the business world as the “winner’s curse.” It can be risky to precisely time up and down cycles.

Buying on the cycle’s downside and holding or even selling on the upside is a tried-and-true technique if the cycle is natural and can be monitored with some assurance. Of course, using that tactic calls for the investor to maintain a sizable cash reserve.

A property may significantly enhance over time. In reality, property investors can find possibilities for buying and renovating homes by keeping an eye on local market cycles and taking advantage of them.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

4. Consider public and private restrictions while investing in real estate

Numerous limitations apply to real estate valuation, some imposed by a jurisdiction, others by consent among parties, and others by the weight of economic reality.

It is good to know that the first stage of a highest and best use analysis entails identifying the property’s legally authorised uses by looking at the public, private, and economic constraints.

Public restrictions

Zoning is the most typical type of public restriction. Most jurisdictions set up use limitations or exceptions for specific locations to ensure widespread use.

A trash dump being abruptly built close by would negatively affect a small community of single-family homes. Similarly, industrial buildings may be hit with unforeseen obligations if single-family homes are on the same block.

These zoning regulations offer commonality of use and lessen economic depreciation.

The adoption of building codes is a second typical constraint. The majority of jurisdictions have enacted a standard construction code with regional modifications.

Beyond zoning laws, many governments will impose size restrictions on development. For commercial properties, these are typically restrictions on height as well as what is known as a floor area ratio (FAR), which is the ratio of the building size to lot size.

Public restrictions frequently consider parking, ingress/egress, and services. These restrictions may be intricate, and a commercial structure will need the services of a licensed architect, a professional land planner, and some wrangling with the local government.

Many towns will have environmental restrictions to safeguard wetlands, natural spaces, ecosystems, streams, and tree canopies.

No-growth protection zones, wetlands buffers, and view easements may be present in places with significant natural habitats. Elaborate and complicated development management rules govern numerous locations.

Private restrictions

Private limitations typically consist of:

- Concessions

- Use limitations (typically through covenants)

- Lease constraints (typically contractual)

- Overcrowding

The most typical type of restriction is an easement, which imposes particular limitations on a specified area of a piece of property. The most typical is given to a utility, like an easement for buried or overhead power or telephone lines.

The construction by the property owner is prohibited from obstructing the utility’s ability to access and maintain its power lines.

Many properties include use restrictions described in covenants connected to the deed; however, some of these restrictions might be a matter of public or even private record apart from the deed itself.

Real estate users and buyers are advised to review public records for any private limitations carefully. Although they often restrict or grant rights to the entire land, such restrictions may be comparable to easements.

Real estate investments have the potential to be highly lucrative, and adaptive reuse of real estate—through development, rehabilitation, or conversion to another use—can be a substantial opportunity to benefit from tax-advantaged profits during the holding term.

The best adaptive use techniques should be considered when valuing real estate, whether at the acquisition stage or later in the ownership phase. Restrictions in public and private spheres might evolve.

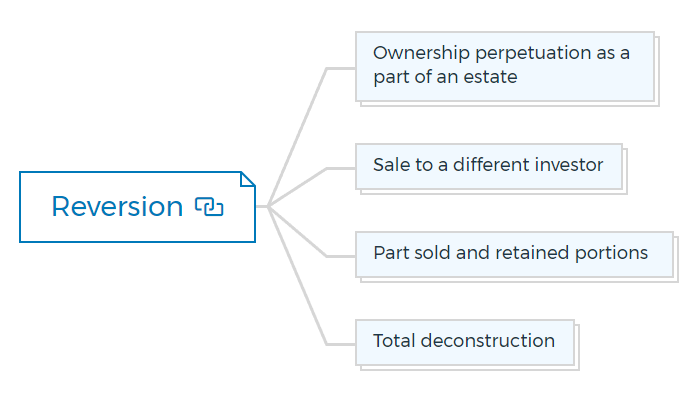

5. Reversion

Reversion is a general phrase that refers to numerous situations for property valuation towards the conclusion of its life cycle.

Reversion might seem in a variety of ways from the standpoint of an investor, including:

Ownership perpetuation as a part of an estate

This one is the most popular estate planning tool for affluent families. A location to keep riches is real estate.

It has anti-inflationary value trends if carefully acquired and managed and typically survives downturns unharmed. Residential market value appraisal methods presuppose perpetual ownership of a home.

Like preferred stock is valued, net operating income for commercial properties is capitalized using a perpetuity metric.

Sale to a different investor

The appropriate valuation methodologies include some form of discounted cash flow, with an estimate of the reversion cash flows if the property is intended to be owned for a short or intermediate duration (the net cash from the sale or conversion).

The estimation and timing of reversion cash flows may be a changing target, even in conditions with a high degree of assurance. You should manage the endgame cash flows to optimise the investing strategy.

Part sold and retained portions

Physical subdivision - A shopping mall or shopping centre is a common example of a physical subdivision. The leading investor keeps some common areas, parking, “out-parcels,” and smaller units while renting out the anchor tenant units to specific merchants.

While the principal investor keeps the rights to the marginally more lucrative smaller units and benefits from the permanent anchor’s halo effect, the larger stores hold their spaces and guarantee unrestricted parking.

Although not all shopping complexes are set out in this manner, it is becoming more and more frequent.

A legal subdivision - Primary investors may offer tenant-in-common shares or rights, such as shared parking rights, to smaller investors. To promote job growth, a city constructed a parking garage and sold a guarantee of a specific number of parking spaces to a significant downtown office tenant.

Parking privileges are, in fact, frequently bought and traded. Air rights are yet another typical division of the law.

Total deconstruction

Conversion back to raw land may be necessary for value optimisation. Dedicating land to open space, view space, parking, or a long-term easement may be desirable. In many cases, tax incentives for open space and preservation are available.

Learn More

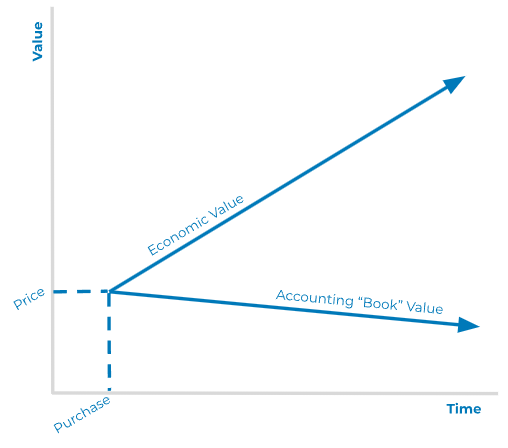

6. Accounting and economic values are distinct

Depreciation is computed by formula rather than according to economic reality in accounting, primarily focused on historic costs. Buildings can be written off over a specific period, but land cannot be depreciated (usually less than their actual economic life).

You may also use other formulas to deduct additional real estate improvements, such as fixtures. These depreciation estimates are only seldom linked to actual economic conditions.

It is anticipated that land will always be valued at its original purchase price. On the other hand, economic value is prospective and concentrated on cash flows.

Rarely, and only when there is an economic justification, are improvements and land divided for appraisal. Depreciation is based on economic realities and is split between components that can be repaired and those that can’t.

To increase returns, repairable parts can be updated or fixed.

The difference between the book value and the actual worth of the real estate owned may become extremely real over time.

Economic value versus book value

For income tax purposes, some estate decisions, or even for keeping track of the economic performance of the surviving real estate, the historic book value may be a helpful metric.

On the other hand, market value serves as the benchmark for investment management.

The investor seeks to maximise, or at least optimise, these factors so that real estate can serve as a value storer, a portfolio hedge that diversifies, and a successful investment.

7. Investors need to know about properties value

You must resolve two crucial issues to determine how much a property is worth: who is the most likely buyer and what is being bought and sold?

The market and the property are owned, managed and sold and must be considered at every stage of the real estate cycle. The market in which you may purchase, lease, renovate or sell the property and the specifics of the property and the rights associated with it determine the values.

8. Real estate market cycles

The four phases of a market’s cycles are expansion, hyper supply, recession, and recovery.

Expansion

Rents are rising quickly, which encourages new buildings. Since the building is lagging, there is rapid rent growth while vacancy rates are declining.

Hyper supply

The pace of new buildings keeps up with demand. Rents are rising, although at slower rates. As the market becomes saturated, property developers scale back on new projects. Slowly increasing vacancy rates.

Based on cost against rent, new development is economically viable during expansion and hyper-supply periods.

Recession

New buildings have surpassed demand, and vacancy rates are now higher than when new construction is practical. Rents drop. There is no new building.

Recovery

The market starts to absorb excess supplies naturally. Rent growth resumes, albeit at a slower pace than inflation. Up until occupancy exceeds long-term averages, new property development is still not practical.

After that, the cycle resumes and the recovery phase transitions into an expansion phase.

We categorize markets according to their physical location, such as the metro region, or their type of property, such as hotel, industrial, or retail. We can also examine subgroups of each property type, such as suburban offices, full-service hotels versus limited-service hotels, and local shops against shopping centres.

This kind informs the investment decision of information. Naturally, it is not the only or even the main instrument for an astute investor to make decisions.

The fundamental idea that you may use the vacancy rates, rentals, and supply/demand measures to track a local market and a particular type of property within a local market is a crucial tool for acquisition strategies, property management, and disposal choices.

Quick Tip

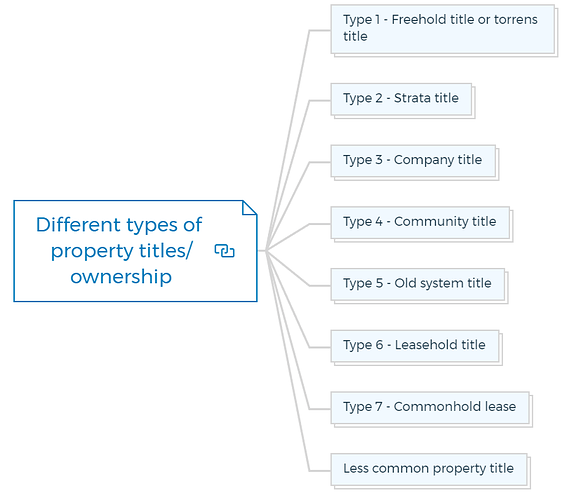

What is a property title?

A property title is a legal document that proves you are the owner of a piece of property. The title includes your name and the address of the property. It may also include other information, such as any restrictions on how you can use the property.

When it comes to property, there are a few different types of real estate ownership. You may own the property outright or have a leasehold estate or a freehold estate.

Different types of property titles/ownership

Type 1 - Freehold title or torrens title

Freehold title means you own the property outright and do not have to renew a lease. You will also not have to pay ground rent. This type of ownership gives you more control over what you can do with your property, as there are no restrictions from a landlord.

A freehold title or Torrens title will cover everything inside the property’s limits. Still, there may also be “easements”—rights of way for authorities like the water and electricity boards to pass through your property if necessary.

Type 2 - Strata title

Strata titles apply to properties such as serviced apartments, flats, villas, senior housing communities, and hotels. These were developed to acknowledge that some areas will be shared by everybody and require money for maintenance.

By law, every owner must be awarded membership in an owners’ company, also known as a corporate body. The corporate elected office bearers of the body typically consist of a Chair, a Secretary, and a Treasurer to maintain the balance of the books.

Every owner pays a tax for the upkeep of the communal spaces. This levy consists of two components: a sinking fund contribution and a strata levy, which cover the costs of maintaining the shared facilities daily and substantial improvements to things like roofs, walkways, and swimming pools, respectively.

Your contribution depends on your unit’s size, not its age. Check the sinking fund’s balance if you plan to purchase a property with a strata title to ensure it is in good shape.

Type 3 - Company title

Company title is when you own the property through a company. The company may be a private company, cooperative, or other type of organisation.

With company title ownership, you do not own the property outright. Instead, you own shares in the company that owns the property. You may have voting rights and other privileges as a shareholder, but you will not have the same rights as someone who owns the property outright.

Rarely is the original structure owned under a corporation name. You have no ownership interest in the property title under this arrangement. Instead, you are a shareholder in the business that is the property’s owner.

There is common property to maintain, so there will typically be a charge to pay. Although not very common, company titles do exist. Since there is no title to the property, banks often won’t lend to you for such a transaction because they can’t take out a mortgage on the property.

Type 4 - Community title

Community title is when you own a property with other people. With community title, you own your unit outright, but you also share ownership of common areas with the other owners in the community. This type of ownership is common in condominiums and townhouses.

Type 5 - Old system title

Old system title is the most common type of property ownership in Australia. With this type of title, you own the property outright, and there are no restrictions on how you can use it.

The property’s title deed will list any easements or encumbrances, like a neighbor’s right of way.

Only a small fraction of properties are still listed under the “old system” title. These property titles are challenging to track because there is no apparent ownership history.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

Continued at…

8 Keys to property ownership [Part 2-2]