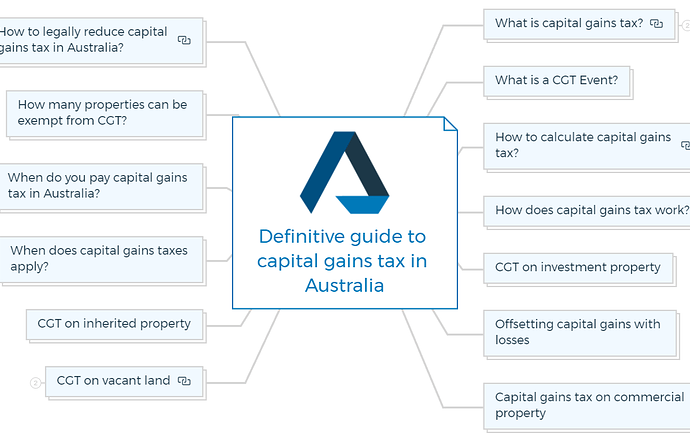

The Ultimate guide to capital gains tax in Australia

A capital gain or loss is the difference between the amount paid and the amount received on an asset’s purchase and sale.

So, if you made a profit while selling a property or an asset, that’s your capital gain. You will need to report your capital gains or losses in your income tax return.

What is capital gains tax?

Capital gains tax is taxation on capital gains, the profits realised from selling or trading an asset such as stocks, bonds, real estate, shares, or other investments.

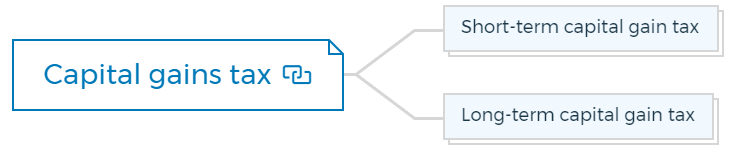

Capital gains taxes can be either short-term or long-term, depending on how long you have held the asset before selling it.

Short-term capital gain tax

Short-term capital gain tax is taxation on profit from selling assets or investment properties held for twelve months.

Long-term capital gain tax

Long-term capital gain tax is taxation on profit from selling an asset held for more than 12 months.

Short-term capital gain taxes are typically higher than long-term capital gain taxes.

For example,

If you bought a property for $100,000 and sold it for $150,000, your capital gain would be $50,000.

If you held the investment property for less than a year, the gain would be taxed as ordinary income at your marginal tax rate. If you held the property for more than 12 months, your gain would be taxed at a lower CGT rate.

What is a CGT Event?

A CGT event is a point when you make a profit or loss on your capital by selling an asset subject to capital gains tax.

There are other CGT events, including -

- Disposals

- Use and enjoyment before the title passes

- End of a CGT asset

- Bringing into existence a CGT asset

- Trusts

- Creating a trust over a CGT asset

- Transferring a CGT asset to a trust

- Converting a trust to a unit asset

- Capital payment for trust interest

- Beneficiary becoming entitled to a trust asset

- Leases

- Granting a long-term lease

- Lessor pays lessee to get lease changed

- Lessee receives payment for changing a lease

- Lessor receives payment for changing a lease

- Shares

- Capital payment for shares

- Liquidator or administrator declares shares or financial instrument worthless.

- Special capital receipts

- Australian residency ends

- CGT events relating to roll-overs

- Other CGT events

- Consolidated groups and MEC groups

You are missing out if you haven’t yet subscribed to our YouTube channel.

How to calculate capital gains tax?

How much capital gains tax you will pay on selling your property depends on your taxable income, the duration you owned the asset, and the marginal tax rate.

There are free CGT calculators that can help you to work out your capital gain or loss.

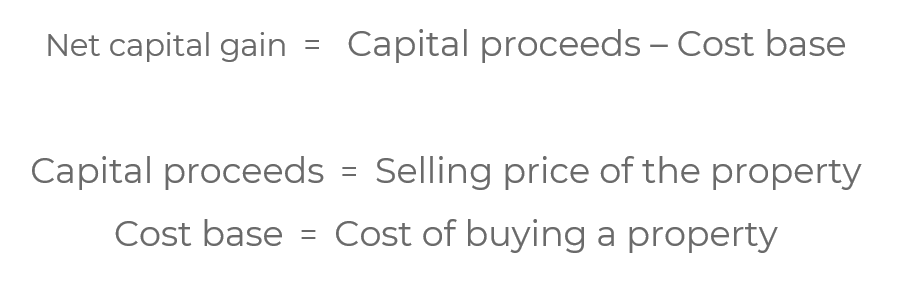

To calculate capital gains tax, find your net capital gain, which is generally the difference between your capital proceeds and the asset’s cost base. Then add this net capital gain to the taxable income of the relevant entity subject to tax.

According to ATO, the cost base of a CGT property includes several elements, such as the original cost of buying the property, stamp duty, legal costs, renovation costs, and other costs associated with acquiring, holding, and disposing of the property.

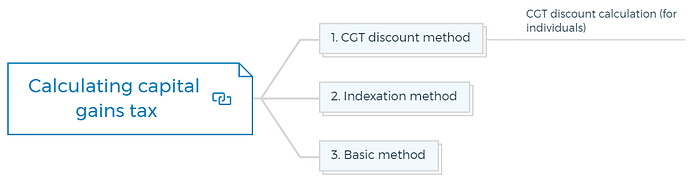

3 methods to calculate CGT (capital gains tax)

1. CGT discount method

The CGT discount method applies to long-term CGT calculation and allows a discount of -

- 50% for individuals

- 33.33% for complying with super funds and life insurance companies.

CGT calculation

CGT discount calculation (for individuals)

IMPORTANT

CGT discount method calculation example

John, an Australian resident, bought a property in June 2021 for $500,000 and sold it in August 2022 for $550,000. As he held the property for more than 12 months, he is eligible for a 50% discount.

He made a profit of $50,000 and has no capital losses. With the CGT discount method, he will declare a capital gain of $25,000.

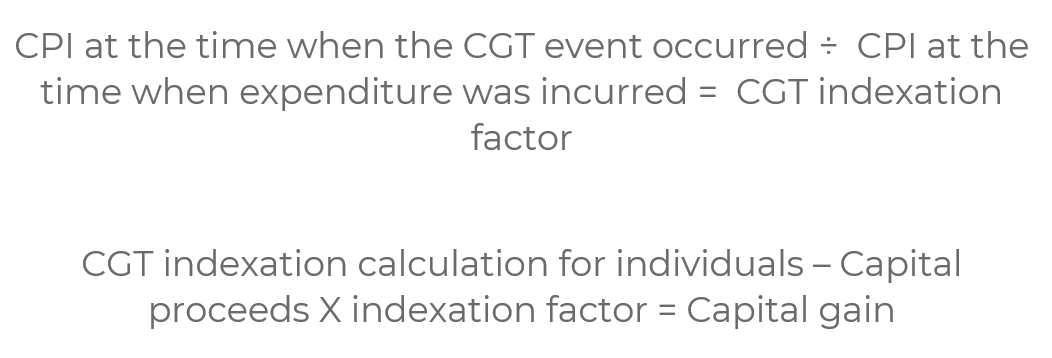

2. Indexation method

The indexation method applies to properties acquired before 11.45 am (ACT time) on 21 September 1999 and held for 12 months or more before the relevant CGT event.

As a result, inflation will significantly affect the cost base of the investment property.

To calculate CGT using the indexation method, you must apply an indexation factor to each cost base element.

The Consumer Price Index is used to find out the indexation factor.

Indexation factor calculation

You can get the CPI data here.

3. Basic method

The above two methods apply to assets held for more than 12 months. The basic method is for assets held less than 12 months before the CGT event.

CGT calculation with the basic method.

IMPORTANT

Example -

John purchased a house for $600,000 on 15 May 2021. He deposited $50,000 on the contract date and paid the remaining 550,000 on the settlement date, 10 August 2021.

He paid other costs of $20,000 related to acquiring the property on 10 August 2021.

John sold the property within 12 months for $740,000 and used the basic method to calculate his capital gain. During the process, he incurred other costs of $9,400.

Cost Base = $600,000 + $20,000 + $9,400

= $629,400

Sale price = $740,000

Capital gain using the basic method = $740,000 - $629,400 = $110,600

How does capital gains tax work?

CGT is basically the last tax that the income tax department may cut from your family’s wealth.

The more your capital gains, the more tax will be applied while selling an asset or property. After your death, if your beneficiaries sell your investment property, they will need to pay CGT.

When you sell an investment for more than you paid for it - a “capital gain” - your profit is subject to taxation. The tax you will pay depends on your tax bracket and how long you hold the asset before selling it.

Your capital gain is added to your assessable income in the year you sold the property. It is a part of income tax but is still referred to as CGT.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

CGT on investment property

For real estate investors, the CGT event for investment property is triggered when the seller enters into a contract of sale. At this point, they are no more the owner of the property. The tax on your capital gains also applied in the same year you sold the property.

To accurately calculate your capital gain or loss, you must keep records of this process for five years after the CGT event occurs. These records are crucial when you make a capital loss to carry forward the amount as unapplied net capital losses.

The capital loss will help the taxpayers to offset the loss against a capital gain in the upcoming financial years.

Learn More

Offsetting capital gains with losses

You can offset capital losses against capital gains, and in case you don’t have capital gains, you can carry over your net capital losses for future financial years.

Remember that you can not offset capital losses against your regular income.

You might be thinking about when to use your losses to reduce your capital gains tax.

You must use capital losses at the first opportunity. In case you have capital losses in the current financial year and some unused capital losses from previous years, it is recommended to use the earliest losses first.

Some non-allowable capital losses can’t be deducted, including losses from -

- Personal use assets like boats or furniture

- Assets that are exempt from CGT

- A leased property

- Remuneration for personal work through a business you set up for yourself.

Capital gains tax on commercial property

CGT on commercial property is similar to residential property. Some significant differences include the following -

- Unlike residential property, where the main residence is exempt from CGT, owner-occupied commercial properties are not exempt from CGT. But owners can take advantage of several discounts available for some ownership and usage criteria.

- Organisations do not receive the 50% discount on properties held for the long term(more than 12 months).

- The tax rules are different for home-based businesses and farms in Australia.

Along with CGT, commercial property owners also pay the Goods and Service Tax (GST).

CGT on vacant land

Like residential and commercial properties, vacant lands are considered capital assets subject to Capital Gains Tax.

Subdividing land

When subdividing vacant land into 2 or more parts, they become separate assets for CGT purposes.

The acquisition date for subdivided blocks is the same as the acquisition date for the original land. The cost base of the original land is divided into subdivided blocks on a reasonable basis.

Combining land titles

It is not a CGT event when you combine 2 or more land blocks and make it one separate land title. So there is no Capital gain or loss.

For Aussies, if you bought a piece of land before 20 September 1985 and merged it with another block of land acquired after that date, then the land still retains its Pre-CGT status.

CGT on inherited property

Generally, you do not need to pay CGT on the inherited property, but it may apply later when you sell or dispose of it. This is because an inheritance transaction is not considered a CGT event; thus no capital gain or loss.

The good news is you can get a CGT exemption for inherited property. Your inherited property must include a dwelling, and you should sell them together.

Whether CGT is applicable or not depends on the following -

- When the deceased acquired the property

- The date when the deceased died

- Citizenship of the deceased at the time of death

- Use of the property when the deceased owned it (was it a main residence)

- Whether you were an Australian citizen when you sold the property.

When does capital gains taxes apply?

Capital gains taxes are applied when you sell an asset at a higher price than its purchasing cost. Capital gains taxes are calculated differently depending on how long the asset has been owned.

When do you pay capital gains tax in Australia?

If you are buying property, assets, or even shares at one price and selling them at another, you will need to pay capital gains tax on your profit during the transaction.

It may include selling or exchanging the asset, giving it as a gift, or transferring ownership.

How many properties can be exempt from CGT?

Only your single home, your primary residence, is eligible for CGT exemption.

Suppose a couple owns two different residences and live in both. In that case, they can jointly declare one common property as their primary residence and receive a CGT exemption or declare two different homes as each of their main residences and get an exemption for both.

While declaring two different properties as the main residence, both partners may reduce their entitlement to the exemption based on their shares of ownership in the relevant property.

For example, William and Isla are a couple and nominate two properties as their main residences. William owns only 50% or less of the property; he will be eligible for a 100% exemption on his share of ownership.

While if William owns more than 50% ownership in his primary residence, he is eligible only for 50% of the exemption for the duration during which the couple has a different main residence.

How to legally reduce capital gains tax in Australia?

Here are some ways to reduce paying CGT -

1. Buying property with an SMSF

Buying an investment property with an SMSF is a long-term investment strategy that helps to balance your financial future by minimising the CGT.

If you sell a property once you retire, you won’t have to pay capital gains on that property. Also, you will be eligible for a 33% discount under the discount calculation method of CGT.

Borrowing property via SMSF comes with certain risks -

- SMSF property loans are more expensive than other property loans

- There is always a need to maintain sufficient liquidity or cash flow.

- You can’t offset your tax losses against your taxable income outside the fund.

- You can only alter property if the SMSF property loan is completely paid.

2. Avoid CGT by living on the property

If you have lived in a property for at least 12 months before selling it, or it is your primary residence, then you are exempt from CGT.

As I told you earlier, to get the exemption, your property or residence must have a dwelling on it, and you must have lived in it.

Property development and investment is an attractive business and requires sufficient time and knowledge to gain good returns. Take the leap from property investor to property developer with this FREE Quick-start property development course.

FAQs

What is the 6 year rule for capital gains tax?

The 6 year rule for capital gains tax is a provision designed to determine the period of time in which an asset must be held before it is eligible for long-term capital gain tax (LTCG) treatment. Generally, if you hold an asset for six years or more, it’s eligible for LTCG treatment, meaning you’ll get lower tax rates than on short-term investment gains.

Can capital gain be zero?

Yes, capital gain can be Zero. If you have a taxable income of $44,625 or less (single filers) and $89,250 (for joint filers) you are eligible for the 0% CGT tax rate.