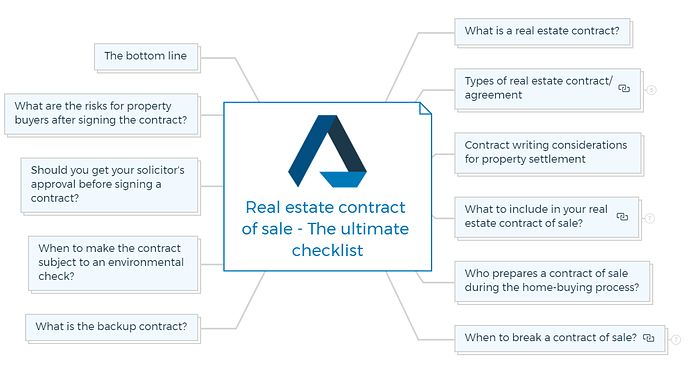

Real estate contract of sale

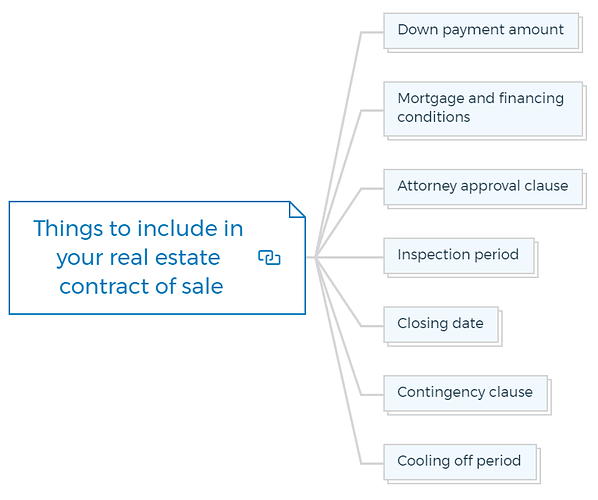

When you’re buying or selling real estate, it’s essential to have an air tight contract in place that protects your interests. A real estate contract must include the following:

- Specific information about the property being sold.

- The purchase price.

- The closing date.

- Any contingencies that need to be met.

- And finally any “subject-to” clauses

This guide walks you through the complete “Contract of Sale”.

Key Takeaways

- A real estate contract of sale is a legal agreement that guarantees the commitments of buyers and sellers.

- With a financing contingency, the buyer can back out of the deal if they cannot secure mortgage financing.

- To prepare a contract of sale, you will need a qualified conveyancer or solicitor.

What is a real estate contract?

Quick Tip

A real estate contract is a legally binding agreement between a buyer and a seller. It is a guarantee or a set of commitments that the law recognizes.

A real estate contract of sale protects both the parties by setting clear expectations for the transaction. Without a contract, either party could back out of the deal at any time without any penalty.

A property contract has to meet specific standards. The contract involves proper subject and consideration.

You, as a seller, must pay something to the buyer or vice-versa. Considerations include cash, land swap, ownership transfer, valuable item, or even a service.

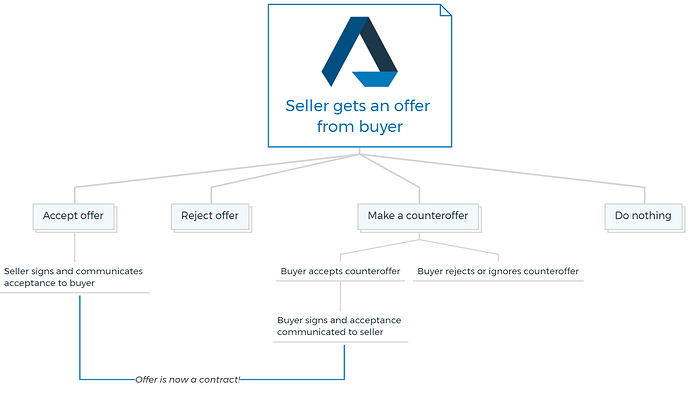

Each party signing a property contract agrees to its terms. There must be an exchange of commitment and acceptance.

You are missing out if you haven’t yet subscribed to our YouTube channel.

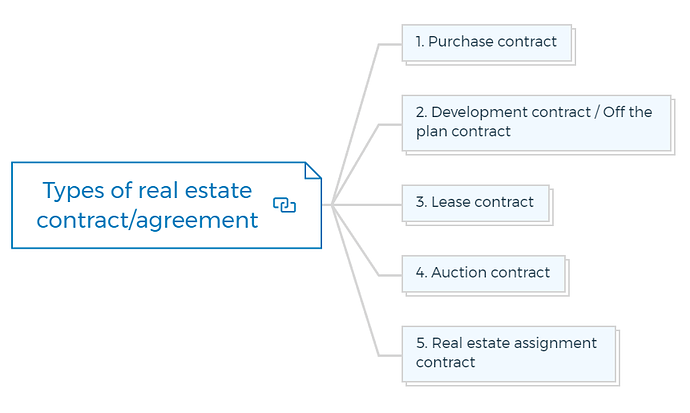

Types of real estate contract/agreement

Here are 5 major types of contracts in real estate -

1. Purchase contract / Contract of Sale

When buying or selling property, buyers and sellers can use a standard real estate contract, also known as a purchase agreement.

2. Development contract / Off the plan contract

You’ll likely sign a development contract aka an off-the-plan contract of sale if you buy a property off the plan from a development. This type of contract outlines the terms of the sale, including the purchase price, closing date, sunset clause and any contingencies that need to be met.

3. Lease contract / Lease agreement

If you’re leasing commercial property, you’ll sign a lease agreement. This type of contract outlines the lease’s terms, including the lease’s length, monthly rent amount, and any special conditions.

4. Auction contract / Contract of Sale with special conditions

You’ll sign an auction contract if you sell property through a real estate auction.

5. Real estate assignment contract / Assignment clause

It is a legal document that allows a buyer to assign their rights to purchase a property to another party. They are used when the original buyer cannot obtain financing or decides they no longer want to purchase the property.

Novation clause - By executing a novation clause, a party can transfer both its rights/benefits and obligations.

Quick Tip

Real estate Assignment contract is known by different names, such as selling contract, flipping contract and wholesaling.

Contract writing considerations for property settlement

- Do not write or execute your contracts unless you are a lawyer or have sufficient knowledge of contracts in real estate.

Quick Tip

Start with a rough draft, but have your lawyer make the final edits and writing. Just explain what conditions you have agreed to and let your lawyer draft in the correct terms & clauses.

- Standard fees like title insurance, escrow, transfer tax, stamp duty.-,Stamp%20duty,-Stamp%20duty%20is) and so forth should be stated clearly in the agreement.

- There should be essential clauses about financing, home inspections, closing costs, and the closing date, among other things.

Ultimate Getting-Started Guides To Property Development

Everything you need to get started in property development.

Includes 6 x detailed eBooks [159 pages]

✓ My Secret Property Development Process (42 Pages)

✓ Preparing For Your First Property Development Project (29 Pages)

✓ How To Choose Property Development Courses For Fast Results (24 Pages)

✓ What Does The Property Clock Say? (14 Pages)

✓ Property Market Cycle – Get In Or Get Out? (31 Pages)

✓ Bonus: Property Investment Strategies: Definitive Guide (19 Pages)

What’s included in a real estate contract of sale?

Here is a quick checklist for you

- Seller’s name and address

- Buyer’s name

- Complete property description

- Type of the deed

- The form of the title

- Initial deposit, loan terms, and requirements

- List of conditions and restrictions

- Purchase price

- Mortgage financing conditions

- Down payment amount

- Deadlines for finalizing the purchase

- Division of expenses such as taxes, rent, etc.

- Liquidation damage clause

- Contingency clause

- Dated signature of all involved in the transaction

- Agency disclosure statement

- Closing instructions

- Attorney approval clause

- Inspection period

- Offer Date

- Possession Date

- The cooling-off period

If any term confuses you, check the below explanation; else, jump to the next heading.

Down payment amount / Deposit

It can be an agreed-upon dollar amount or a part of the purchase price. Down payment is also called earnest money and is also known as a deposit. It can range from 5%-10% of the total purchase price.

Mortgage and financing conditions

Obtaining a 100% mortgage for buying property is tough. Often buyers obtain an 80% mortgage with a 20% down payment / deposit. All these agreed-upon mortgage and financing conditions are specified in the contract of sale. This section focuses on -

- The amount mortgaged

- The interest rate of the buyer

- Amortisation schedule

- Mortgage payback period

Attorney approval clause

An attorney approval clause in your contract of sale is required to protect you. This paragraph gives your attorney time to evaluate the contract and make any comments, changes, or revisions before signing.

Inspection period / Due diligence period

An inspection or a due diligence period is a provision in a real estate contract of sale that allows the buyer to have the property inspected by a qualified inspector.

The inspection period gives the buyer time to identify any potential problems with the property.

Learn More

If the buyer decides to break the deal because of problems found during the inspection, they can do so without penalty. The inspection period is usually 7-10 days long.

Closing date

It says when the buyer gives the seller the check for the property, and the seller gives the buyer the deed to the property. On this day or date, the person who bought it becomes the owner.

Contingency / Subject to clause

A contingency clause is a provision in a contract of sale that allows the buyer or seller to back out of the deal if certain conditions are not met. Typical contingencies include things like financing, inspections, and appraisals/ property valuations.

The buyer or seller can void the contract without penalty if these contingencies are not met.

Cooling off period

The cooling-off period is a short duration that allows a buyer to withdraw from the contract before it becomes unconditional. This period is usually three-five days, but can be negotiated.

Property buyers can use the cooling-off period to perform due diligence or feasibility analysis.

According to Australian Govt Laws

If the buyer terminates the contract during the cooling-off period, the seller may charge a penalty of 0.25% of the purchase price (if clarified in the contract), and the seller will need to refund the deposit within 14 days.

Every real estate contract is unique and has standard terms to cover. Depending on the deal of a particular property, you can include special conditions of sale in your contract.

In some states, a seller may also need to attach the mandatory seller disclosure statement, problems of any defects, warranties, and the document for the conditions of the sale.

Who prepares a contract of sale during the property purchase process?

A licensed real estate agent practicing law, a real estate lawyer or a conveyancer can draft a contract of sale. Getting your contract prepared by a qualified solicitor or licensed conveyancer is recommended. It will ensure the protection of all the parties present in the deal.

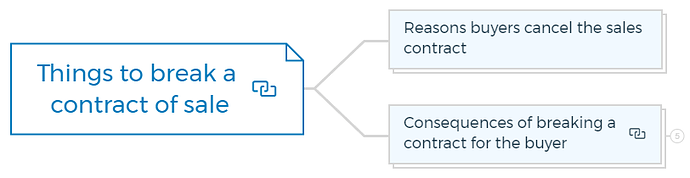

When to break a contract of sale?

The process of selling or buying real estate is lengthy and complex. Many things may go wrong, and breaking a real estate contract of sale is one of them.

You should be aware of your rights and legal actions while backing out of a property agreement.

Reasons buyers cancel the sales contract

A potential buyer can back out of purchasing a property for several reasons.

- Job loss

- The seller doesn’t disclose issues/easements.

- Title issues

- Failed home inspection

- Not qualified for the mortgage

- The seller doesn’t make agreed-upon repairs or improvements.

Consequences of breaking a contract for the buyer

A buyer will face the consequences depending on the signed contract for an existing property.

- If a buyer breaks a real estate contract, they may be required to pay damages to the seller. The amount of damages will depend on the terms of the contract of sale and the extent of the breach.

- Sometimes, the buyer may be required to pay the total property price.

- In other cases, the buyer may only be required to pay a penalty fee.

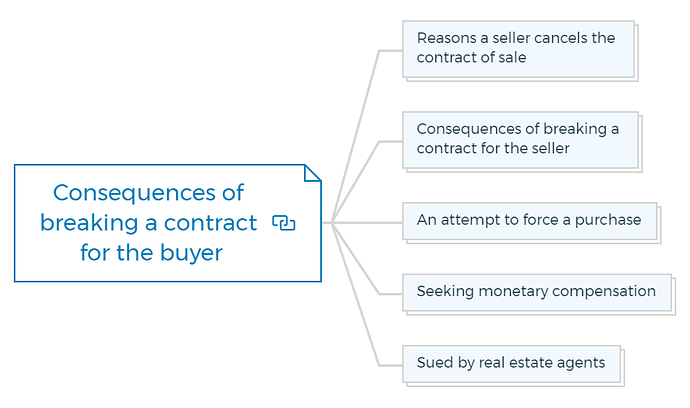

Reasons a seller cancels the contract of sale

The seller also has the right to break a standard contract of sale in real estate. Though a legally binding agreement looks good on paper and provides a considerable sum of money to the seller, he may still wish to break the contract of sale.

The reasons a seller back out of the purchase agreement are -

- Not being able to find a new property.

- Unexpected events

- Appraisal concerns

- Unclear land or strata title

- Buyer missed the deadline or failed to do scheduled deposits.

- Using the attorney review clause

No matter what reason sellers give, there is only one reason they want to get out of a contract. They think they can find a better deal somewhere else.

Consequences of breaking a contract for the seller

The buyer has the right to sue the property seller for breaking the real estate deal, and there is always a termination penalty. According to their needs, buyers might take several different approaches, such as:

An attempt to force a purchase

If the buyer files a “specific performance” lawsuit, the court may decide to force the sale to go through and transfer the title to the buyer despite the seller’s objections.

Seeking monetary compensation

If the buyer claims damages, the seller needs to pay for it. It may include legal fees, bank valuation fees, appraisal and inspection fees, etc.

Sued by real estate agents

The seller’s real estate agent or listing agent could also sue them since they are often paid by commission, which they will lose if the deal falls through.

What is the backup contract?

A backup contract is a legally binding agreement that stipulates the terms under which a property will be sold to a second party if the first party is unable to close on the purchase.

A backup contract is usually put in place as a safety net if the first party encounters problems such as financing difficulties or failed home inspections.

The second party agrees to purchase the property under the same terms and conditions as the original buyer, but only if the first buyer cannot follow through on the purchase.

When to make the contract subject to an environmental check?

Suppose you purchase a property that was once a cattle dip, a farm, or a service station. You will need to excavate all the land and refill it with clean soil to make the land strong enough to hold a new building.

It can be costly, so it’s essential to include checks with the right environmental agency and consultants in the contract to ensure this isn’t a problem.

Quick Tip

Add a clause like this…

This contract is subject to the buyer doing any inquiries and investigations it considers necessary about any environmental issues related to the purchase within 21 days of the date of this contract.

It includes but is not limited to whether the property complies with all environmental laws of any local authority, state government, the federal government, or any other statutory or government authority and whether the buyer is satisfied with the results.

If the buyer isn’t satisfied with the outcomes, he has the right to back out of the deal.

In that case, this matter will be over, the buyer’s deposit will be returned, and neither party will be able to sue the other, except for any rights either party has against the other because of a breach of this contract before it ends.

Learn More

Should you get your solicitor’s approval before signing a contract?

It is always recommended to allow your solicitor to review the contract before signing it.

If a solicitor can’t review the agreement before signing, add a condition that makes it subject to your solicitor’s approval before a specific time.

This way, the property will be taken off the market, and no one else can purchase it before the solicitor reviews it.

Quick Tip

You can add a clause something like this…

This Contract is dependent on the buyer’s solicitor approving the terms of the Contract of Sale by (time) on the (complete) day of (complete) 20(complete). If that doesn’t happen, the deposit will be refunded to the buyer. Neither party will claim against the other except for any breach of their contract rights.

What are the risks for property buyers after signing the contract?

Within 1 to 2 days of the formation of the contract of sale, the risk of property damage passes quickly from seller to buyer.

Buyers should get a “cover” note, a temporary insurance policy that protects them in case the property gets damaged before the settlement date. Otherwise, they will have to take the property with the damage.

For some properties, getting a cover note is not possible.

You can add a clause like this so that the seller is still responsible for any property damage until the settlement -

Quick Tip

“The property is at the seller’s risk from the date of this contract until the settlement date, regardless of any other contract provisions.”

The bottom line

Real estate contracts are important documents that protect the interests of both buyers and sellers. It’s essential to understand the terms of the contract before signing it and to make sure that all of your contingencies are listed.

Choosing an experienced real estate agent or attorney who can draft a contract for you is vital.

Quick Tip

Now you can flip, develop, or control any property for profit in under a minute with the property development feasibility suite.

FAQs

Can a contract of sale be cancelled after the exchange?

It depends. Generally, a contract of sale is a legally binding agreement, and the parties involved are bound to the terms of the contract. However, there are certain situations in which a contract can be cancelled or voided.

For example, if the seller misrepresented the property or if there was fraud involved in the sale, then the buyer may be able to cancel the contract. If either party breaches the contract, then the other party may be able to cancel it as well. If you’re not sure whether or not you can cancel a contract after exchanging, it’s best to speak with an attorney who can advise you based on your specific situation.

How do real estate contracts work?

A real estate contract is an agreement between two or more people that outlines the terms and conditions of a sale or purchase of real estate. The contract will state things like the price, closing date, who pays what closing costs, and any special conditions that need to be met in order for the sale to go through.

The contract is usually drawn up by a lawyer, and both parties are expected to sign it in order for the sale to be final. If one party breaches the contract in any way, they can be held liable in court.

What is the difference between a conveyancer and a solicitor?

The main difference between a conveyancer and a solicitor is that a solicitor can provide legal advice, while a conveyancer cannot. A conveyancer’s primary role is to handle the administrative aspects of transferring property ownership, while a solicitor’s role is to provide legal advice and representation in court if necessary.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber