Equity finance: It’s place in funding property developments

Equity finance is a way for developers to raise money for their property development projects. In any development project, the developer is often required to raise money to fund the equity portion of property development finance. This equity portion of the project’s funding from their own resources is called developer’s equity.

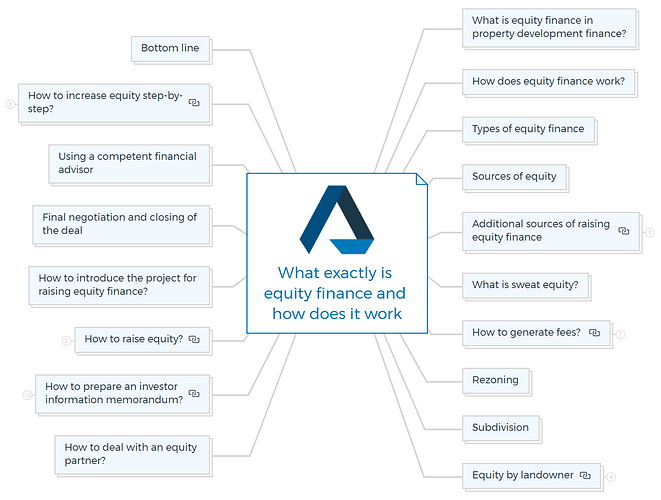

What is equity finance in development finance?

Equity finance is a type of financing in real estate where the lender provides capital in exchange for an ownership stake in the borrower company. The equity stake can be in the form of common stock, preferred stock, or convertible securities.

This type of financing is typically used by small to medium-sized businesses that have difficulty accessing debt financing from traditional sources such as banks. Equity financing can also be used by larger businesses to finance expansion projects or acquisitions.

Equity capital is also the worth left in the property after all debts and other obligations have been paid off or when the capital value of the property or asset has increased over time.

The interest over and above the mortgage debt is equity in a property. If a long-term mortgage burdens the property, the developer’s equity in the property grows with each monthly principal mortgage payment, excluding the increased value through appreciation.

Quick Tip

There are several advantages to equity financing for both the borrower and the lender. For borrowers, equity financing can provide much-needed capital without incurring debt or giving up control of the company.

For lenders, equity financing can provide a higher potential return than debt financing, as they will share in the profits (or losses) in the company.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How does equity finance work?

A developer who wants to borrow money from a lender will often only get a part of the project’s total cost. The developer will need to provide the rest of the money as their equity. The lender usually wants some cash equity upfront in the development agreement.

A lender will calculate the maximum debt as a percentage of the total hard costs for any development project. The remaining soft costs and a percentage of hard costs not funded by the lender make up the developer’s equity.

Hard costs include construction costs, and soft costs are all other costs incurred with consultants until the construction loan kicks in.

The developer can contribute equity by purchasing the land or a portion of the total debt, a cash equivalent deposit with the lender, or using the equity in another property as collateral.

Depending on the developer’s cash status, the developer may personally contribute the required equity, borrow funds, or have other people contribute it.

Developers working on larger projects, where funding is typically in the millions, will need to put up a higher percentage of their own money. Not every private developer will start a project with the requisite capital. If a developer cannot get the requisite equity, he must seek funding from other sources.

Self-funding developers are more likely to give attention to a project, improving its chances of success.

Lenders typically utilise loan-to-value ratios (LVR), aka Loan To Cost (LTC %) ratios, to estimate the amount of equity necessary. With this, the lender avoids taking the entire risk and shifts some risks to the developer.

Types of equity finance

There are two main types of equity finance: primary and secondary. In primary equity finance, new shares are issued to investors who are then given a stake in the company or project.

In secondary equity finance, existing shareholders sell their shares to new investors. This type of transaction can be helpful when a company needs to raise additional funds quickly and doesn’t have time to go through the process of issuing new shares.

Sources of equity

After determining the amount of equity, the developer should compile a list of potential equity investors, such as:

- Friends

- Business associates Brokers/dealers who specialise in real estate

- Financial planners who specialise in real estate

- Brokers who have contacts with private money

- Accountants who have clients who want to invest in property

- Attorneys who have clients who want to invest in real estate

- Bankers who have potential investors

- Insurance agents who have potential investors, property Investment firms or funds.

- Angel Investors

- Crowdfunding

- Syndications

When looking for possible equity investors, developers should gather information about them, such as their investment expertise, income, financial resources, and net worth. This information gives developers a thorough grasp of the possible investor and indicates whether they will be an asset or a liability to the project.

You should never do business with family or friends.

If you’re encouraging relatives or friends to join as investors, ensure to clarify the project’s hazards, as well as the risks of property development in general, and your property development process and remuneration.

If they have no or little experience with equity financing, this could lead to misunderstandings if the project fails. Don’t oversell any equity financing advantage of your project, or they’ll blame you for the project’s demise or failure to meet its financial goals.

Additional sources of raising equity finance

There are many investors for property development, especially if the profits appear attractive. There are three other sources of possible equity partners, in addition to the list of investors mentioned above: new or prospective migrants, financial institutions, and construction contractors.

Newcomers to the country

Wealthy migrants always look for business and investment opportunities when they arrive in a new country. Prospective business migrants may be required to start a business to qualify for permanent residency in specific instances.

Migrants who invest in a development opportunity earn a return on equity and better understand how development projects work in a particular state.

However, persuading migrants to invest in your initiative is not always as simple as it appears. They are inclined to be too cautious and double-check every detail because they are unfamiliar with the country and its economic conditions.

This could cause you to waste a lot of time and effort only to discover that they have found another option at the last minute. Furthermore, migrants, particularly those from Asia, anticipate a substantial return on their investment.

Financial organisations

Some financial institutions will lend equity on a larger project depending on the location, the development’s profile, the developer’s credibility, and the project’s financial sustainability.

The institution will give 100% funding, with 25% being stock and 75% being interest-only debt. The institution will receive 25% of the net profit if the development is sold.

Suppose the venture is intended to be a long-term investment. In that case, the institution will require the developer to purchase their 25% share within five years at a price determined by a licensed property valuer.

During this time, the developer can invite more investors or refinance the property.

Architects and builders

Builders are always seeking new building contracts. If the size and style of the project fit well into their construction programme, they may be willing to infuse equity in exchange for securing the contract. Their cash resources, balance sheet, or known investors could all be equity sources.

When entering into a contract like this, you should have your independent quantity surveyor check that the builder’s contract price is within an acceptable range.

What is sweat equity?

Free equity, also known as sweat equity, is money made or built up over time, whereas equity is defined as earned real money you invest into a property or an item. All property developers strive for this free equity.

The more free equity you build early in a project, the less risk you will face and the less money you will need for the property deposit.

If you work in the construction sector, you have a distinct equity financing advantage in property development. You will be able to supply the cost of your job on your development project for free as an architect, builder, building estimator, engineer, bricklayer, plumber, or carpenter, thus creating sweat equity.

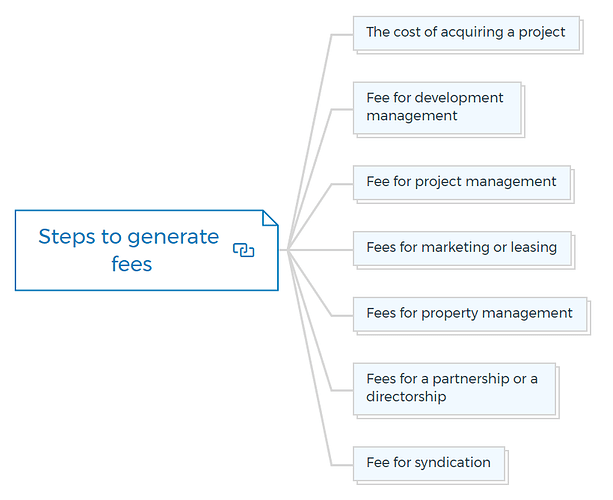

How to generate fees?

As a professional developer, you will devote a significant amount of time and effort to researching and analysing potential projects. You’ll also be in charge of overseeing and managing the project from start to finish. You should be compensated for your efforts with a fee payment, which should be put into the development budget as an expenditure. These fees might be utilised to cover your overhead costs or kept in the development as equity. Here are a few examples of what I’m talking about -

The cost of acquiring a project

This fee is provided to developers for taking the initiative to discover a viable project, which includes researching the property market, networking with various people in the property sector, formulating a vision, and arranging a contract with the landowner on their own time. The fee for this service is usually a fixed amount based on a percentage of the development cost. Depending on the project’s size, kind, and complexity, fees might range from 1% to 2% of the total development cost.

Fee for development management

Development managers are typically employed for large or complex projects due to their experience and knowledge of such projects. Their job is to represent the developer or investment group and steer the development to be financed, and you will realise an expected return on equity.

They would also assess the development’s potential, establish a strategic policy framework, and monitor the project manager’s performance—fees for development management range between 1.5 and 3% of the entire development cost, excluding land.

Fee for project management

You can also hire a project manager to guarantee that the project runs smoothly. The developer or development manager supervises the professional property development team and the construction contract on behalf of the developer or development manager.

Their fees are usually calculated as a percentage of the total construction contract amount, typically 1.5 per cent for larger and more complex projects and around 3% for smaller and fewer complex projects.

Fees for marketing or leasing

One should adequately compensate the developer for the development’s marketing and leasing. Fees are set according to industry norms, which is to say, the going market rate.

It is preferable to hire the services of a third party with the appropriate credentials unless a developer has the time, money, and marketing experience to focus on ‘creating.’

Learn More

Fees for property management

Rather than hiring a third party, some developers who hold on to their developments and have an extensive portfolio take on the function of property managers themselves. Their fee is usually calculated as a percentage of the money collected.

Fees for a partnership or a directorship

For managing the project, administration, accounting, tax concerns, and general correspondence, the developer could be the appointed managing partner or a managing director of the development business typically charge a fee or be paid a salary. The price can be based on a predetermined monthly sum.

Fee for syndication

These fees cover services such as forming an investment syndicate, negotiating with possible investors (links need to be added), forming a new partnership or corporation, negotiating debt financing, and establishing management and accounting systems.

The developer or managing partners could accept a minor fee and a more significant stake. The charge can be either a fixed fee or a percentage of the equity raised, ranging from 2.5 to 5% of the funds contributed by syndicate members.

Rezoning

Developers who research a region or suburb of interest will know future town planning ideas and rezoning of certain streets. For example, new plans could include increasing residential densities in a specific zone of a burgeoning neighbourhood or converting a corridor strip along a critical arterial road from residential to commercial use.

However, some property owners may be unaware of these suggestions and will sell their homes at a lower price than they would have if they were rezoned.

An astute developer can get equity financing advantage of the situation by offering a property subject to rezoning, giving the council a reasonable amount of time to approve it. If the rezoning is allowed, the property’s value will rise dramatically, and the developer will have built up his free equity.

Subdivision

Subdividing semi-rural lots into new suburban lots or suburban lots in older suburbs into smaller green title lots can provide a residential property developer with significant financial benefits.

As previously said, understanding the local town planning scheme and scouting for growth zones will offer you a distinct equity financing advantage when new houses become available.

When the opportunity arises, make an offer on a property conditional on subdivision permission by your state planning commission, but give plenty of time to get it done. A municipal planner or land surveyor can help you figure out how long it will take to get approval.

Equity by landowner

This is a simple concept used when a developer is considering developing a site, and the seller is willing to participate in the project by:

- Joining as a joint venture partner.

- Granting the developer development rights over the land.

- Providing vendor finance to the developer with a later settlement date.

The land subsequently becomes a component of the total development’s equity. The remaining finances for the renovation are secured by a first mortgage on the property, which a bank finances.

Advantages to the parties

Not every landowner or seller will consider this proposal because they may need the equity to buy another property. Still, those who can participate will gain the following benefits:

- a probable increase in the selling price

- a higher interest rate from the bank on their money

- a faster sale

The developer also benefits in terms of equity for the following reasons:

- The project can begin sooner because the equity is immediate.

- Because the property is included in the project, less money is necessary upfront to get development approval.

- If there is a shortfall in equity, other investors will feel more comfortable because the landowner is willing to bear the risk.

Consider the following points in connection to this opportunity:

Suppose the landowner does not want to be a joint-venture partner who shares the developer’s risk but instead wants to grant development rights or offer vendor financing. In that case, you should think about the following considerations before signing a contract.

Rates of interest

If the landowner is charging interest, try to negotiate a better rate that is lower than the average rate charged by banks. If possible, get an interest-only equity finance loan with final payment due at the end of the project or the agreed-upon duration.

Term

Ensure the agreement specifies a longer time frame for the project to be completed or for you to pay the money to the landowner. Include a clause that allows for an extension without penalty or interest rate change.

Finance for construction

Ensure the landowner is aware and accepts that you will seek an equity finance loan for the construction from a senior lender. Any debt payable to them for the land will be a subordinated obligation, meaning the land debt will rank after the senior loan if things go wrong.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

How to deal with an equity partner?

Many people hold significant sums of money in low-interest savings accounts. As most people are looking for more significant returns, a developer who can persuade them that the development would generate higher rewards quickly has a queue of possible partners.

New or undercapitalised developers should cultivate investor partner connections when they are financially stretched. It’s essential to have at least four or five potential partners on hand when the time comes.

Successful developers will discover that they never run out of potential partners, and they may never need to utilise their own money for subsequent projects. You could also be a successful developer by enrolling on a property development starter pack.

While it is simple to persuade people to become partners, these partnerships can become problematic if some basic guidelines are not followed. Stick to the following guidelines, and you’ll have fewer issues in the future:

- Form partnerships only when necessary: It is critical to forming partnerships only when necessary. New partners should contribute where the developer’s resources are inadequate, such as a lack of cash. When partners complement each other and work as a single unit, a partnership works much better.

- Be picky about your partners: If you’re thinking of partnering with relatives, friends, or business associates, make sure their personalities don’t conflict. Preferred partners will be familiar with the real estate industry. Nothing is worse than a partner who does not understand the issues accusing the developer of being reckless because the development does not meet the expected returns.

- Define each partner’s job: If the developer’s function is to manage the development based on their experience, and the partner’s role is to give or seek cash based on their financial situation, ensure to state these responsibilities before the partnership is formalised.

- Define how revenues will be distributed early on: If the project is profitable, the developer should work out a fair deal for both parties in terms of their roles. There are a variety of models to choose from. For instance, the equity finance partner could be provided with a percentage return per year on the capital invested, with the remaining profit split 50:50.

- Reduce the partner’s fear: If a partner is putting up the money, it’s critical to assuage any fears he may have about losing it. This can be avoided by putting the property in shared names or forming a corporation with agreed-upon shareholding. Have a plan for managing the development and how much to pay the manager.

- Maintain control of the partnership: If you find the project and know how to complete it, you must keep control. If your partner proves incompatible and prevents progress in development, dissolve the partnership quickly.

- Retain a partnership for a single property: Each development project should be evaluated independently. The revenues should be distributed, and the partnership should be dissolved at the end of the project. Following this rule helps you be more flexible when another equity finance property development opportunity emerges. The cooperation is only temporary and relates to a single project.

- Prepare resolutions in case the partnership must be dissolved: Not all partnerships work out, and there may be miscommunications or personal problems along the way, or one partner may die. It’s critical to decide right away what processes should be followed in such situations.

It’s critical to establish credibility and trust if you’re developing property based on your knowledge and experience but without your funds. Treat your partners decently and don’t abuse the relationship; if you do, word will travel quickly, and future partners will be tough to find.

Learn More

Continued at…

What is equity finance, & how does it work? [Part 2-2]