Continued from…

Property Development Finance made easy [Part 1]

Non-Recourse Loan / Debt

- Secured by collateral, real property, but the borrower is not personally liable.

- If the borrower defaults, the lender can seize the property pledged as security - but the lender’s recovery is limited to that property i.e. the lender cannot come after the borrower even if the collateral does not cover the full defaulted amount.

- LVR is only 50-60% of Valuation.

Commercial banks

- Commercial banks specialize in mostly short-term commercial credit, focusing on liquidity than savings, and their appraisals are more conservative.

- The overdraft facility is one of the most common forms of short-term financing provided by commercial banks.

- In Australia, the National Australia Bank (NAB), the Commonwealth Bank of Australia (CBA), Westpac Banking Corporation, and the Australia and New Zealand Banking Group are prominent commercial banks in Australia.

General or savings banks

Depositors are the primary source of funding for general banks.

- General banks operate and participate in property finance the same way as building societies did previously.

- General banks handle the majority of residential property mortgages and suburban development.

Merchant banks or investment banks

- These individuals or institutions act as underwriters or agents for corporations, providing securities, investing advice, and facilitating corporate mergers and restructuring. Merchant banks are often also called investment banks.

- Essentially, merchant banks borrow money on the wholesale market and lend it to businesses and industries but not to the general people.

- Merchant banks can provide bridging and permanent capital finance for property development. However, they primarily focus on office and larger shopping center projects.

Building societies

- Building societies operate similarly to banks, with most of their funding coming from consumer deposits. These clients are building society members. ‘Mutual societies’ is a term used to describe building societies.

- Several building societies have amalgamated and diversified into health and travel insurance and business financing due to competition and a lower proportion of the house mortgage industry.

- Building societies do not have a set limit and will advance up to 90% of the property’s value. The interest rates charged by building societies are equal to those charged by most banks.

Credit unions

- Credit unions are co-operatives owned and governed by the individuals who use their services.

- Each union member is both a shareholder and a client.

- Members’ deposits are used to fund loans to other members.

Companies that provide life insurance

- These institutions are primarily interested in long-term investments with growth and capital appreciation.

- They are not interested in minor development initiatives because they receive substantial cash flows from contracted depositors (their policyholders).

- Insurance companies, on the whole, prefer to invest in completed developments by other developers at a predetermined price with guaranteed profits.

- Some more giant corporations have subsidiaries that will finance projects and then sell them to the parent corporation once completed.

Superannuation funds

- Superannuation funds are comparable to life insurance firms in terms of significant, reliable cash flows.

- These funds are typically invested in long-term real estate ventures that are profitable, stable, and potential to rise in value.

- Some superannuation funds are bound by the trust deed (a legal document that lays out the trust’s rules and procedures) and may be limited to investing no more than 5% of the fund’s value in any single project.

Property trusts and unit trust companies

- Property and unit trust businesses differ from managed fund operators, who deal primarily with stock portfolios and do not participate directly in the real estate market.

- Some unit trust businesses, such as property managed fund equities, solely invest in shares of property and construction companies listed on the stock exchange.

- These unit trusts have a portfolio of shares from various property development companies.

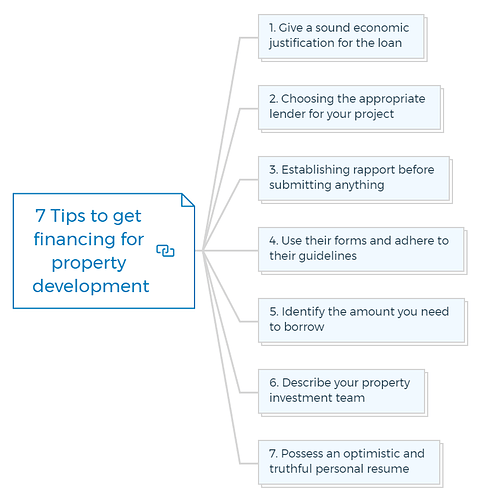

7 Tips to get financing for property development

Aspiring property developers need to be aware of the many ways they can finance their next project. From borrowing against their own home equity to securing government loans, there are a number of options available. Here are some tips to help you get financing for your property development project.

1. Give a sound economic justification for the loan

You may be looking for a loan to purchase an existing property or a property that requires a fresh spark in life that only you can provide. The purpose of the loan is crucial.

Commercial lenders want to feel confident that the loan’s security will be financially stable and that the revenue disclosed or expected is accurate and realistic.

They prioritize knowing that the loan will be repaid when recommending it to their loan committee.

The calibre of your property investment team and the regional real estate market conditions will determine your estimates’ credibility. Never rely on the lender’s ignorance of the area’s circumstances.

You must augment and reinforce their expertise by supplying thorough and precise data to support the income you anticipate receiving. One of the most acceptable methods is to have a triple-A-rated tenant sign a triple-net lease.

A triple-net lease is one in which the tenant is responsible for paying the rent and all expenses incurred to keep the property in good condition, such as taxes, insurance, and local assessments.

There are specific requirements for each loan, which the property lenders will insist you record. The rival properties in the same market region and a history of other existing and planned development that may impact your development project will all be shown in a property appraisal, which may also be necessary.

Any modifications to the local infrastructure that might have a positive or negative effect should also be displayed.

You must consider the lender’s distance from the project. More background information will be required the further they are from the project.

There are numerous elements that your pro forma may not need to provide if the lender’s office is located across the street from the project. However, you must presume that the lending committee will know little to nothing about the region if you work with an insurance firm 1,000 miles away.

You are missing out if you haven’t yet subscribed to our YouTube channel.

2. Choosing the appropriate lender for your project

Assume you have been working on a project you are confident will be successful, such as an idea for a private student housing building close to two separate colleges.

You know that there is a dearth of nearby accommodation for students because you did your research with the personnel in charge of it at each of the two colleges.

Based on a 90% occupancy rate, your calculations show that the project will generate a 17% return on your expected capital investment.

Now all you need is a lender who believes that building student housing is worthwhile and will provide you with the necessary property development finance on the most favourable terms.

You need to shop around for a lender who loves anything that has to do with the educational atmosphere since you are starting without the lender’s prior approval on what kind of projects they like to loan on.

The solution is relatively simple. Ask the student housing administrators again who they would advise you to contact for the property development finance.

Someone, somewhere between the two institutions and their respective housing offices, will offer a lender. It could be a bank whose president holds a position on both institutions’ boards or is an alumnus of one of the colleges. Find a relationship between the colleges and the lender to contact by digging deep.

Naturally, there comes a time in every financing arrangement when the loan-to-value ratio is in the lender’s favor and the property development loan amount might not be sufficient to cover the need for the loan.

You will have to shift categories or find other property financing options if you find yourself in one of these financing jams and the lenders are stubborn about a particular type of real estate.

Find an alternative when the first solution is no longer workable. Other sources of needed funding exist besides banks and savings and loans; on occasion, a private lender can come to the rescue.

Private lenders can be found wherever there are affluent people. You might also inquire whether someone you know who is affluent and in a position to know whether would lend money. Who is that, exactly?

It’s good to start with your accountant, attorney, stockbroker, banker, or representative of the student housing system.

When someone gives you a recommendation about someone who provides residential development loans, try to learn as much as you can about that person.

Check the local society register if the person has lived in the area for some time. These social directories, which are occasionally offered for sale, contain many of the area’s notable and wealthy residents.

Even the slightest background knowledge about someone might be helpful when you schedule your initial appointment.

Then set an appointment with a target you are optimistic you can achieve.

Don’t ask for a property development loan on this initial visit. Do that only when you have successfully achieved your primary objective.

Learn More

3. Establishing rapport before submitting anything

Almost everything you do in business follows a logical process like this. Either you show that you are the kind of person who would be a reasonable loan risk, or you ask friends or professional contacts to go ahead of you.

Having some of each factor working for you is typically a good idea. But be careful not to brag too much. It benefits you to appear and behave like a successful real estate investor.

It can be challenging to advance past this rapport level. The idea is to establish as high a level of contact as possible with the decision-makers, who are frequently concealed behind impenetrable barriers.

Building a solid relationship with the possible lender’s secretary or personal assistant is one of the best methods to ensure you receive above-average treatment during the appointment stage and at subsequent meetings with the potential lender.

4. Use their forms and adhere to their guidelines

Every lender, even private lenders, typically have their papers that must be completed. Although they may all have similar appearances, they are not identical.

Do not bother lenders by filling out your forms that you might have copied from another lender because they know where to search on their forms to uncover essential information that you have filled in. It will endanger them, and you don’t get the loan.

It’s good to try to be as exact and concise as you can when filling out forms. Without being wordy, provide the reader with the necessary information.

5. Identify the amount you need to borrow

Include the amount that you need to borrow in the loan application. Asking your loan officer whether to indicate a net amount of loan charges or include the loan expenses in the overall loan is a good idea. Some lending committees prefer to do this, whereas others don’t.

The loan committee will significantly weigh the property evaluation if you ask for an acquisition loan. Thus, the crucial loan-to-value ratio is established.

Because some lending regulations may impose different payback terms and interest rates, the closer the loan is to the property’s value, this ratio is significant in single-family homes or small apartment buildings.

Different payback terms and interest rates may also apply to commercial loans, but this is typically due to the nature of the transaction rather than the rules governing lending.

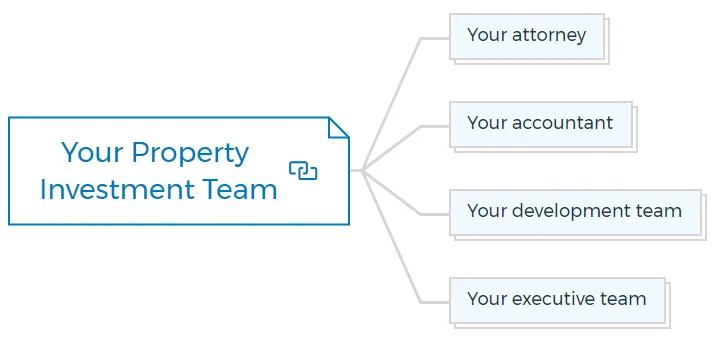

6. Describe your property investment team

Create an investment team if you don’t already have one. Because you chose this team, keep in mind that you can be evaluated on how successfully you assembled your property investment team by a lender and others.

Who are the members of this team? Naturally, they may vary based on the specifics of the transaction, but they will generally cover the four crucial areas from the lender’s perspective: law, accounting, development, and management.

Your attorney

Is this person well recognized for being a real estate attorney? If not, regardless of how good a probate counsel you find, you made a poor decision.

The most significant name on the list is the attorney on your team. Your choice of legal representation reflects your desire to obtain excellence where it matters. Choose the person who best completes your team for the property development project or acquisition.

Your accountant

You should hire an accounting company with a solid national reputation. This company should focus on real estate accounting that corresponds to the property.

Your development team

Ensure you have information on the backgrounds of people you hire if you are not a general contractor or architect. Here, precise information on these team members that satisfy the lender’s requirements may be required.

Your executive team

Do you have an internal management department, or do you contract out management? In either case, identify the department’s chief and other employees.

A summary of their experience should demonstrate that you are skilled and qualified to manage the property more effectively through your decisions about the administration of your real estate assets.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

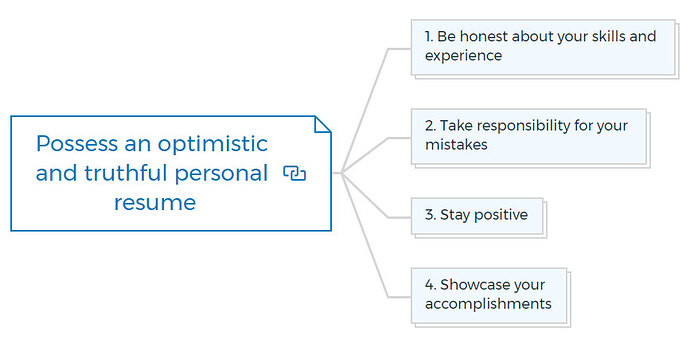

7. Possess an optimistic and truthful personal resume

1. Be honest about your skills and experience

Don’t inflate your qualifications or make things up; lenders can easily check the facts.

Learn More

2. Take responsibility for your mistakes

If you’ve made some wrong decisions in the past, own up to them and explain what you learned from them.

3. Stay positive

Even if you’ve had some tough times in your life, focus on the lessons you’ve learned and how they’ve made you stronger.

4. Showcase your accomplishments

Instead of just listing your job duties, highlight the results you achieved in your previous roles.

Reasons why property developers fail to secure financing

Below are 3 main reasons why developers don’t get the financing for property development-

1. Expecting lenders to fund their projects.

Developers need to remember that getting finance from a bank or lenders is not an automatic process. Your loan may not be funded even if it meets lending policies and requirements. This is especially true if developers don’t research the market’s funding demand.

Lenders can become more discriminating when the number of good real estate projects coming across their desks increases. You must work smartly to convince the lender to be a part of your deal over the many others they are considering.

2. Negotiating before the lender understands the deal.

Everyone wants a good finance deal, but asking for, or even dictating, the terms you want before the lender knows anything about your project makes the process difficult.

Smart developers are patient and explain their motives, background, transaction specifics, and risk mitigation techniques first. Because of this, the lender will be motivated to offer competitive terms that reflect the risks and meet the deadlines.

Learn More

3. Not crunching numbers

Elite property developers crunch their numbers repeatedly to guarantee their feasibility modeling is accurate. They often create their own spreadsheets to tweak pricing points, costs, and deadlines as they acquire more data and do more due diligence on the sale, and they never stop iterating the numbers.

People who are having trouble usually can’t tell you their break-even point for each product, how much cash flow they need from now until the project is finished, or marketing details like cost per lead and conversion rates up to unconditional presale.

Know your numbers if you want to make a good impression on the lender and your broker.

Improve your ability to know your numbers well with Property Development Feasibility Suite With 4 Powerful Applications

FAQs

What is property development finance?

Property development finance is a form of commercial financing used to support residential, commercial, or mixed-use property. Repayment terms, loans, bridge loans, and even personal loans fall under this umbrella.

How are real estate projects financed?

The cash flow created by the project is utilized to repay the loans and equity used to fund the project.

A loan approved to construct or develop a new real estate project is referred to as real estate project finance in the real estate industry.

How does property development finance work?

Traditional mortgages are not the same as development funding. Lenders often examine the property’s valuation before making a loan decision based on it and the borrower’s eligibility.

When making development loans, lenders examine the property’s expected worth once the development project completes.

What are the sources of finance for real estate development?

Lending in the mainstream (which is the banks). Lending from the private sector (It’s when you team up with someone who recognizes the worth in your project and strikes a contract with them.).

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber