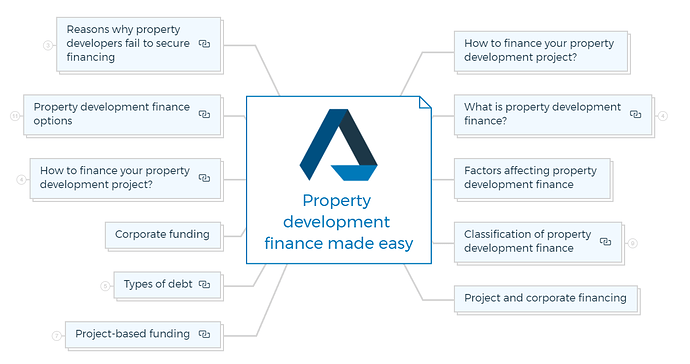

Ultimate guide to property development finance and property development loans

How To Finance Your Property Development Project?

Property Development Finance is very different from normal retail finance. However, in order to understand it correctly, you must first understand real estate financing in detail.

If you are new to Property Development, I would recommend that you first read the following three articles as the information in these articles is interrelated and you will understand the property development finance section much better if you under stand the Property Development Process first.

- Ultimate Guide To Getting Started In Property Development

- Property Development Feasibility Study &

- Our Property Development Books

To begin with you need to understand the classification of property development finance.

The Classification Of Property Development Finance

Finding a real estate deal requires a proper understanding of property development financing. Investing in real estate can provide a steady passive income, but it takes a large sum of money. Obtaining a loan for an investment property may be the only way to seal the deal.

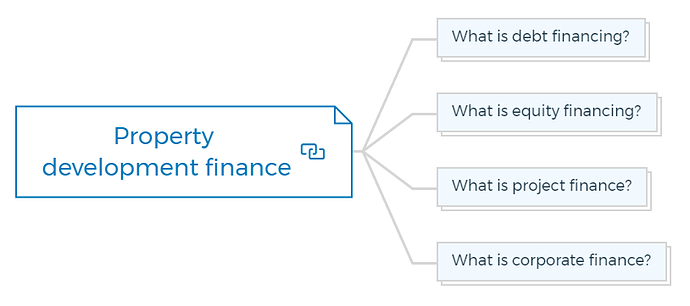

What Is Property Development Finance?

Property development financing is the process by which real estate developers or investors receive funding to purchase a target property.

As the name implies, development financing allows investors to borrow capital from outside sources to purchase and or to develop a property.

Property development finance has a plethora of creative options available, but most of them fall within equity or debt financing. Debt and equity financing options have their advantages and disadvantages.

What Is Debt Financing?

Debt Financing is defined as loans obtained from banks and other sources against a project or non-project-specific loans obtained from the market.

It happens when an individual or organization takes out a loan to buy a property. The loan is subject to specific underwriting requirements and accrues interest in addition to the principal payment.

What Is Equity Financing?

Equity Financing refers to funds and resources contributed by the developers, partners, investors, and funds participating in the scheme’s risk and profit. This form of financing is typically available to Institutional Investors, but it can be a valuable method to diversify your portfolio. I have already shared my secret strategy to generate equity fast that you can use for your upcoming property development project.

The lines between debt and equity are sometimes blurred as corporate financing, raising funds against a company’s assets, can be done using both equity and debt.

Before you explore the major categories of real estate financing, you should learn a little about project and corporate finance.

What Is Project Finance?

Project Finance is a type of financing in which the property serves as the primary or exclusive security for the loan; however, it may require supporting guarantees and additional collateral.

What is Corporate Finance?

Corporate finance refers to the raising of funds on behalf of a firm rather than a project.

Factors affecting property development finance

Consider the below variables for determining whether to proceed with development from a financial standpoint:

- Inflation

- Interest rates

- The status of the economy (timing) the flow of the money supply

Remember - An increase in interest rates usually results in an increase in capitalisation rates, which leads to a decrease in market prices. This has a particularly negative impact on commercial property.

Borrowers are often confused by the variety of real estate loan options available. Therefore, they must evaluate the interest rate, the establishment fees, annual administration fees, early repayment penalties, and the cost of refinancing arrangements if necessary.

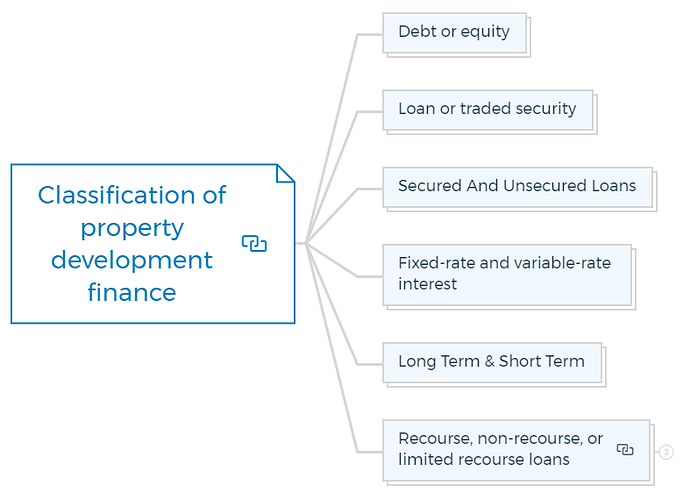

Classification of property development finance

There are different types of property development finance that you should know before signing a deal.

Debt Or Equity

The difference between debt and equity is whether the money is borrowed (debt) and the borrower has no direct involvement in the project or whether the money is provided on the grounds of sharing both the business’s risk and rewards (equity).

A borrower needs to repay the funds, and interest will be charged on the outstanding balance until the loan is paid off completely.

The success of the business determines the equity return for the person who put up the money. If there are profits, the person shares them, and if there are none, there is no return.

Cash subscribed as ordinary share capital is the most apparent type of equity. Equity shares are also possible in development situations where a financier can receive a share in the profits.

Convertible loans, for example, are a type of deferred equity. These loans start as debt with a fixed rate of return and later change into equity shares.

Acquisition financing, SBA loan, private lender, Bridge loan, Mezzanine financing are common forms of debt financing.

Loan Or Traded Security

Borrowed money can be a simple loan or borrowed by allowing investors to subscribe for a bond, resulting in a transferable piece of paper. Instead of a simple loan, this is a type of IOU note known as a security.

Investors can trade this security to other investors. Investors earn interest each year in exchange, and the actual money is refunded after the security’s agreed period.

They can also sell their rights to investors if they don’t want to wait for the repayment date. In this case, they will be entitled to the interest and eventual repayments. These securities can be bought and sold on a stock market.

Learn More

Secured And Unsecured Loans

Understanding the differences between the two is a crucial step toward financial literacy, and it can have a long-term impact on your financial well-being.

A secured loan requires that borrowers provide collateral. An unsecured loan doesn’t. This difference can affect your interest rate, borrowing limit, repayment terms, and other factors.

A valuable asset backs a secured loan. As collateral, the item bought, such as a house or car, may be used. Until the debt is paid, the lender will keep the title or deed.

Stocks, bonds, and personal property can also be used as collateral. If you don’t pay back the amount in a secured loan, the lender can sell your collateral to cover the debt.

Mortgage, Home equity line of credit, auto loan, boat loan, recreational vehicle loan are examples of secured loans.

Student loans, credit cards, and personal loans are examples of unsecured loans. As there is no asset to reclaim in the event of default, lenders incur a more significant risk by issuing this loan.

The interest rates are therefore higher. Secured loans may still be available to you even if you are turned down for unsecured credit. However, you must have something valuable to utilize as collateral.

Although a secured loan is safer than an unsecured loan, well-established corporations may raise unsecured loans since the lender’s protection is the company’s available profit record used to pay the interest.

Fixed-Rate And Variable-Rate Interest

A fixed-rate loan has a fixed interest rate for the duration of the loan, whereas a variable rate loan has a rate of interest that fluctuates over time based on money market movements.

Fixed-rate loans are preferable for persons who want predictable payments. They won’t increase or decrease in cost.

Variable-rate loans have varying interest rates. This means that the cost of variable-rate loans will fluctuate over time. Borrowers who expect lower interest rates prefer variable-rate loans.

This type of loan is often used to fund short-term needs.

A fixed-rate is more common for long-term borrowings, such as mortgage debentures.

For floating rate borrowing, the borrower may opt for a cap, an insurance policy that sets a maximum limit on the interest rate that a borrower needs to pay, regardless of general interest rates.

Long Term And Short Term

To create money and gain experience in real estate investing, investors might employ long-term and short-term strategies.

One to two years is often considered short term by many people. This is the equivalent of the development period for most projects. Two to seven-year are considered medium-term. Seven years or more are considered long-term.

Purchase and rehab, often known as fix-and-flip, is an excellent short-term technique for transferring funds to the new properties. Long-term investing is another alternative, which often involves a 30-year loan and passive income.

Long-term rental (30 years) is a great way to generate passive income. This method requires less work upfront than a typical fix-and-flip project.

Buy and hold is a long-term investment strategy that many property developers employ.

This technique provides a plethora of opportunities to learn valuable skills. Property management, professional relationship building, market research, tenant selection are skills you can learn through this strategy.

Recourse, non-recourse, or limited recourse loans

Recourse loan

The lender has recourse to the parent company’s assets if the parent company guarantees the loan for a specific project or subsidiary firm.

Non-resources loan

The loan is non-recourse if the only security for the lender is the project itself, as in a pure type of project-based finance, and the parent business has provided no assurances.

In reality, a non-recourse loan is doubtful to be approved because banks often require limited recourse loans. The parent may have guaranteed interest payments but is not obligated to return the debt in some instances.

Limited recourse loan

A limited-recourse loan would still be based on the borrower’s reputation and the company’s track record, as well as the project’s quality.

I gave you a brief overview of the project and corporate financing at the start of this article. Let’s dig a little more and look at how the project and corporate finance are handled, as well as the fundamental differences between the two.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Project and corporate financing

The money borrowed to finance a project is called project finance and is used mainly for development projects. The project itself serves as the primary security for the loan.

Larger companies may be able to borrow against the strength of their assets rather than individual projects. This is corporate finance. Because there is more collateral to secure the loan than one project, interest rates for corporate loans will generally be lower than those for project loans.

Sometimes, even large companies can undertake development projects that exceed their resources. The developer may be worried that if the project fails, the lenders may have recourse to the company’s other assets, thereby affecting its finances.

This could mean that each development would need to be funded separately, and companies might try to make the project “off-balance sheet.”

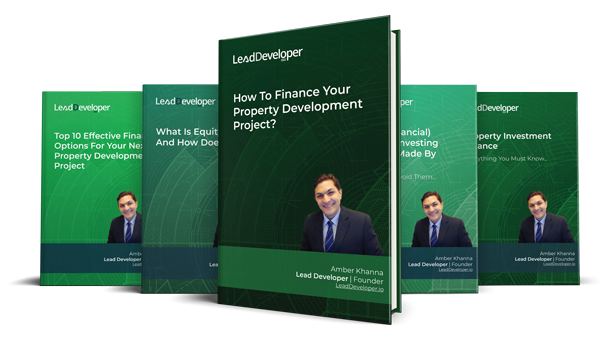

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

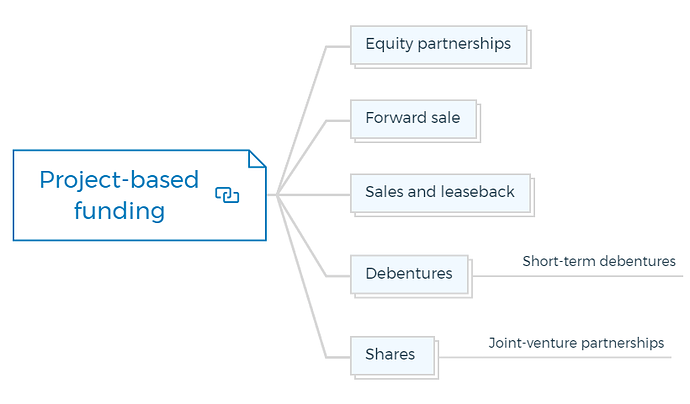

Project-based funding

Project finance can be a helpful instrument for smaller property development firms that do not access the stock market. The current assets may fully secure the loans in certain situations.

The companies’ financial situation may potentially not give enough security for the financier.

The following types of financing are typically provided for project funding:

Equity Partnerships

A share of profits (equity) is an incentive mechanism used to structure an Equity Partnership arrangement with a Real Estate project. Experienced investors are always willing to contribute money to a successful real estate transaction.

Equity partnerships is a type of development financing that includes arrangements like participation lending and forward funding.

In participation lending, the lender receives a portion of the scheme’s proceeds, and this may occur when a lender is willing to take a higher risk by lending more or at more favorable rates.

Forward funding is when a buyer of development contributes to the development’s funding. This action assures the buyer that he will have some control over the development project as it progresses.

The forward funder may finance the project at a lower interest rate.

Forward Sale

A forward sale contract can encourage short-term funds because the bank will know it will get its money back within a specific time frame.

Alternatively, the entity that is offering the forward sale contract could also be providing bridging finance.

Pre-funded projects often require an upfront commitment by the institution to purchase the development upon completion.

The agreement would be that the institution regularly extends interim credit at a lower interest rate than the current market rate.

When construction is finished or the building is leased, the institution purchases it by paying the purchase price minus the total development cost and rolled-up interest.

Learn the secret and improve the skills of making a no-money-down property development deal.

Sales And Leaseback

A developer sells a completed project to an investor and concurrently takes back a long lease at an agreed rent based on a reasonable rate of return applied to the purchase.

The developer sub-let the project to tenants and receives a profit from the difference between the rent paid to the funder and rent received from tenants.

The lessee’s financial stability mainly determines the risk. When a corporation seeks a sale and leaseback deal, it usually signals to experience financial troubles.

The majority of leases are between 15 and 20 years long. Taxes and insurance are not included in the lease payments to the lessor. The lease payments are set out such that the investor may pay for the building while still making a profit.

The investor and lessee agreement will most likely allow the lessee to either repurchase the building or renew the lease arrangement after a specified period has passed.

This clause is in the lease agreement to protect the lessee, although most investors prefer to delete it. Only the interest parts of mortgage payments are tax-deductible, whereas lease payments are entirely deductible.

Modern sale and leaseback arrangements, particularly for new developments, include seller guarantees about rental income, leased areas, maximum expenditure, and, in many cases, an agreed minimum return.

In most cases, the developer’s guarantees are valid for the first five years of the developed property’s operation. With new developments, the developer will often take a three-to five-year head lease over the property, ensuring a return for the investor.

According to the lease agreement’s agreed percentage, the surplus is split between the investor and the developer if the expected returns are higher than predicted.

With a head lease in place, the investor is guaranteed a particular return on the development for a set length of time. As a result, the developer will sell the development at a more significant profit margin.

Debentures

When high-profile corporations need money for expansion, they issue debentures to raise the funds they need.

Debentures, in simple terms, are fixed-interest securities sold to members of the public who purchase them based on the viability of the proposed development.

In effect, the public funds the corporation (or invests in it) in exchange for a medium- to long-term income yield.

A trust deed typically governs debentures, and a trust or merchant bank represents the debenture holders. When interest or principal payments are not made, charges are assessed against the company’s assets.

You can redeem the loan’s capital in the following ways:

- By making annual part-payments

- At a predetermined time

- There is also the option of not redeeming the capital.

A firm may authorize several debenture issues. Debentures issued after the initial offering are ordered in preference order.

These investments are typically predicated on fixed interest rates, making them unappealing to investors during periods of rising inflation.

Short-term debentures

In bridging finance, short-term debentures are sometimes utilized. Government stock rates and interest rates are inextricably linked.

Debentures are frequently convertible into shares, giving investors the following options:

- Changing the loan into stock or a fixed-term loan allows for capital appreciation if the company grows.

- If profits aren’t realized, you can continue with the loan.

The commodity is more liquid and frequently more accessible to sell than an entire structure, advantageous for holding debentures. Debentures can also be made freely transferable without regard to time limits.

Although a corporation does not have to be listed on a stock exchange to issue debentures, it can still be managed by state regulations.

Some organizations must also facilitate the sale and acquisition of debentures. Merchant banks and trust corporations frequently aid in purchasing and selling debentures.

Shares

When a firm decides to ‘list’ or ‘float,’ its shares are frequently sold on the stock exchange. This is especially true of huge syndicates with a wide range of interests and is too big to raise money from their members.

A corporation doesn’t need to list on the stock exchange to issue shares, though larger companies frequently do so.

Joint-venture partnerships

A joint venture agreement is an alternative method to get finance for property development quickly. Lenders are often unwilling to lend money at low rates, but they may be prepared to partner with the developer in a joint venture.

Depending on the project, these joint ventures might take several forms. Some lenders may form a partnership and pay the land acquisition and the development costs in exchange for a share of the profits.

Other lenders may purchase the land and enter into a contract with the developer for their services, receiving a portion of the possible profits.

In either case, the developer has been given a chance to put his talents to work with other people’s money.

Types Of Debt

Based on loan durations, debt for any financing project is divided into three different categories

Short-Term Finance Or Bridging Finance

This loan can be up to three years. Because interest is rolled up until the development is sold, the developer must pay both interest and principal at completion.

To do so, the developer would either sell the scheme or refinance the bridging finance using long-term loans.

Bridging finance is a complete funding package. A buyout replaces the interim funding offered at a rate somewhere between short-term borrowing and investment yield.

Bridging finance is often used for short term purposes such as six months or less to bridge the gap between the purchase of one property and the sale of other or to release equity while refinancing or selling another.

Clearing banks and specialist lenders dominate the market.

Medium-Term Loans Or Syndicated Loans

This is where multiple lenders come together to lend large amounts of money that would be too costly or risky for one lender.

The lenders then diversify their loan book to include loans on multiple assets to reduce risk. The lead banks arrange the loan and then syndicate it.

The syndicating bank may not finance the loan, but the bank may charge fees for underwriting it.

Characteristics of a syndicated loan -

- The borrower’s existing bank underwrites the loan and, in most situations, actually lends the funds.

- The loan agreement is written as an advance syndicated loan arrangement, allowing the original lending bank to transfer tranches of the original loan to other banks.

- The original lending bank’s asset team then sell tranches of the loan in the banking market, acting as an agent bank.

The risk of investing in property syndication is higher than investing in a property trust, for example, because the purchaser will only own a single property rather than a portfolio of properties.

You can invest through various legal forms such as partnerships, incorporated joint ventures, or a unit trust structure.

The syndicate typically has a 5- to 10-year tenure. After which, the property is sold, and the net proceeds are distributed to the investors.

The following are the two types of syndicates:

Private syndicates

In this type of syndication, a small group of people, such as friends or business associates, band together to buy and develop real estate.

Public syndicates

Most public offers will necessitate preparing and filing a prospectus or information memorandum with ASIC by the promoter/developer or management.

The prospectus contains thorough information on the syndicate, development/risks investments, and potential rewards. Licensed securities dealers, property managers, financial advisors, and accountants may market the syndicate to the general public.

To be a successful developer, you must understand risk management in property development.

Long-Term Loans Or Mortgages

The mortgage term is generally between 10 and 25 years, with a maximum advance of two-thirds. Developers can choose to have a fixed or variable mortgage interest rate.

There are also interest-only, repayment, and capital holiday options.

Lenders have the legal right to repossess the property if the borrower doesn’t pay the interest and repay the borrowed money.

Corporate Funding

There are two main areas of corporate funding: equity capital (or shares) and debt capital (or loans). Equity capital is paid into or kept in a business by the shareholders or owners.

It is long-term capital that entails the most risk and yields the best profits. Debt financing is money invested in a business by third parties, usually for a shorter period and with lower risk and return than equity.

Corporate finance is concerned with the company’s financial structure. The key to financial management is choosing the right combination of debt and equity capital to meet the business’s investment needs.

The following are some of the major sources of finance for any development firm receiving corporate funding:

- Shareholders’ fund

- Retained profits

- Loan capital

Learn More

How To Finance Your Property Development Project?

The financing that a development entity (company, trust etc.) will use depends on the nature of the loan, whether long or short term. Clearing banks or, for larger firms, the stock market could be the source.

Funds are frequently secured on the project being done or by using other assets as collateral.

Large businesses or projects can borrow or raise money by issuing bonds, shares, units or rights issues.

It’s up to you to figure out which type of real estate financing is ideal for your situation. Watch this video below to get an overview of financing your development project.

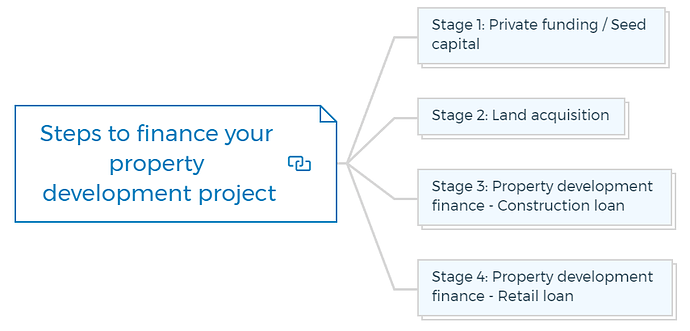

Stage 1: Private funding / Seed capital

- Usually required in the conceptual stage and funded by the property developer also known as developers equity.

- Covers the cost of consultants and more often than not will also need to cover the development approval soft costs or permitting costs.

- Everything required to put together a DA or Planning Permit Application.

- Reports

- Consultants

Stage 2: Land acquisition

- Usually a retail loan.

- Must have an existing house / dwelling on it for it to be a retail loan.

- Usually a Long term loan & can be both principal + interest as well as interest only with a shorter term.

- When purchasing just land - lender will only consider if it is part of a full development loan.

- Lenders do not like land banking loans.

- Land Sub-Division

- Lenders may require you to first secure the raw land with your own money.

Stage 3: Property development finance - Construction loan

- Interest only & often capitalized.

- Lenders may or may not finance GST/VAT costs.

- Interest is calculated on the drawn down amount.

Stage 4: Property development finance - Retail loan

- Develop & Hold

- Offset Account

- Line of Credit

Property development finance options

Bridging Loans

- Used to quickly move on a deal - more like not letting an opportunity pass by, so you developers often use a bridging loan and later refinance through another lender. Designed more to complete a transaction.

- Typically refinanced after a short-term with another lender.

- Comes at a higher interest rate

- Often used to obtain planning permits & cater to soft costs i.e. consultants, reports, permits etc.

- Comes from a specialized lender willing to take the extra risk & they would charge you a higher interest for taking that extra risk.

- Caveat Financing

Mezzanine Finance

- Debt Capital that gives the lender the right to convert to an ownership or equity interest in the company if the loan is not paid back in time & in full.

- Used by developers to secure additional financing for development projects, where there is a shortfall of equity required by the main or senior lender.

- More expensive - because it’s secured by a 2nd mortgage. Since it’s 2nd in line i.e. if something happens, 1st mortgage holder (senior lender) gets paid out first and then the second lender gets paid.

Continued at…

Property Development Finance made easy [Part 2]