Have You Included These Property Development Costs In Your Budget?

Make sure you include these costs in your next development budget

Developing a property can be a costly process. There are numerous expenses that come with the territory, from acquiring the land to putting the finishing touches on the building.

It’s important to have a realistic idea of what these costs will be before you get too far into the project.

This article will provide a detailed breakdown of all major costs associated with the property development cost budget.

Formulating a project budget is an essential aspect of the loan structure for the project.

A budget can never be 100 percent accurate because it is nothing more than an initial prediction influenced by the analyst’s expertise, education, risk preferences, and expectations.

Variations are common and can be justified perspectives on the project’s challenges. After the project is completed, the analyst’s goal is to say that the budgeted expenses were close to or somewhat higher than the final actual costs.

There are dozens of property development costs to consider when budgeting development projects. Categorizing and laying out project costs can be tricky. By separating hard and soft costs, you can see where your money is going.

It isn’t just vital for you as the project owner; it’s also crucial if you want to attract investors and take out loans.

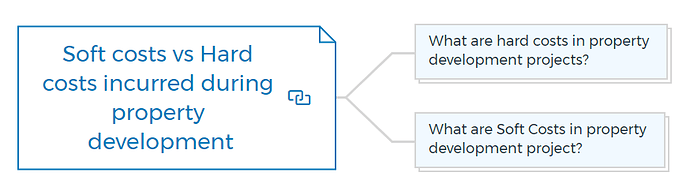

Soft costs vs Hard costs incurred during property development

The budget for property development cost is divided into two categories: hard costs and soft costs. Because they are always employed to measure reasonableness and efficiency in development initiatives, it is necessary to understand their distinctions.

What are hard costs in property development projects?

Hard Costs:

In real estate, hard costs are the actual expenses incurred during the construction or renovation of a property, such as the cost of materials and labor.

They consider all of the materials used in the project, including door knobs, refrigerators, wine coolers, and washer-dryers. All labour directly linked to the physical building is included in hard costs.

Demolition is considered an upgrade to a place and is a hard cost, like planting the surrounding grounds or building a parking lot. A hard cost is a sum paid by the developers to the construction managers or general contractors.

Learn More

What are soft costs in a property development project?

Soft Costs:

In real estate, soft costs are not related to property purchase or construction but are associated with its overall management, marketing, and sale.

Soft costs are almost all development costs not included in the hard cost category (except the buying price of a home).

Legal fees, engineering and architectural fees, surveying fees, real estate and mortgage recording taxes, loan interest, insurance premiums, and brokerage fees are just a few examples.

Be careful that some specialists will describe an item as a soft cost while others may classify it as a hard cost. Fines, payments to professionals who confirm municipal regulations and codes work, and some engineering fees are examples.

You can compare job expenses to those on projects you’ve underwritten and possibly others in your department’s loan portfolio if the budget is divided into hard and soft costs and adjustments are made to the gray areas.

Make sure the comparisons are for comparable line items.

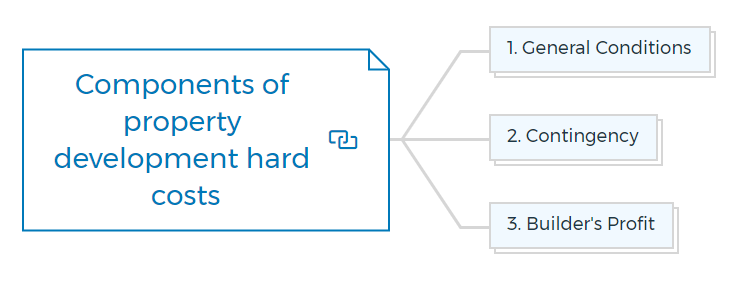

Components of property development hard costs

The Construction Specifications Institute (CSI) has produced 16 defined divisions for hard costs.

Classifications or subdivisions inside each division allow the budget to be as detailed as needed for each end-user.

Each subdivision can function as a separate line item. A line item is a category of work or materials assigned a dollar cost in a budget. Each category is represented by a row or line that forms a cost list. The budget for the real estate project is detailed in this list.

The general conditions line, the contingency line, and the builder’s profit line are three hard cost line items that require special attention. If certain lines are missing from the budget, you should ask why.

1. General Conditions

The general conditions category includes development costs that are broad in the scope required to complete the project, may or may not result in the completion of actual work, and cannot be ascribed to a specific trade.

They cover the costs of a construction office trailer, tool sheds on or off-site, salaries for the construction manager, and a crew of handymen who work directly for the property developer.

Cleaning, office supplies, telephone and administrative charges during construction, copying fees, messenger services, and general operating costs are all included in the general conditions costs.

General conditions are typically paid using the percentage of completion method, dependent on the total property budget. You can advance them in equal monthly sums over the loan’s tenure.

For example, a 24-month loan with a $2 million general conditions line will advance $83,333 per month:

$2 million/24 months = $83,333.

The general conditions budget typically accounts for 5 to 10% of the total hard cost budget of property development. You should question anything outside that range.

2. Contingency

The contingency line is used to finance unplanned and unknown future expenses known as overruns in the construction business. Anyone who has visited a building site can grasp the business’s intricacy and dynamic nature.

It is naive and pragmatic not to expect adjustments and overruns even on minor development projects. Overruns can result from a variety of events and activities. For example, there can be

- Oversights and omissions of detail in the plans and specifications due to unfamiliarity with municipal laws and regulations, resulting in changes and delays.

- Design changes due to a change of mind about the materials, layouts, or construction details.

- Subcontractors who perform subpar work that must be repaired or replaced.

- Accidents that cause damage to already completed work.

- Materials and fixtures may be delivered late or become unavailable due to shortages or unacceptable lead times from order to delivery.

- Delays due to subcontractors not performing on time.

- Mistakes in coordinating the trades and materials that must work together on the job.

The majority of cost overruns and delays are minor, but they can erode a contingency line when added together.

A local requirement to use heavier sheetrock in a common-way corridor that was not specified in the plans, can be an extremely costly surprise (and one for which many developers rarely have recourse to the architects except in good faith negotiations).

The impossibility of obtaining a specified type of ousted air handler must be replaced with a more expensive equivalent air handler.

The hiring of a security firm as a result of a random vandalism incident, the failure to obtain a $300 Saturday work permit, causing a building inspector to issue an order to stop work at the development site, forcing all trades to leave the job early in the morning, and a window design in a designated landmark building that causes manufacturing delays because the landmark agency repeatedly requisitions.

Even if they appear to be justified, you should avoid requisitions seeking relatively substantial amounts under the contingency line.

Early or mid-construction overruns might reduce the contingency reserve to the point that it becomes unbalanced, putting the loan at risk.

Learn More

The best thing you can do is follow your consulting engineer’s recommendations and use your judgment to keep contingency line drawdowns to a minimum early in the project to avoid depletion.

Rather than permitting drawdowns from the contingency line, the borrower must expend more equity. You can partially compensate the borrower later if the job is proceeding well and contingency funds appear to be sufficient to meet future obligations.

Like the general conditions line, the contingency line should be 5 to 10% of the total hard cost real estate budget.

3. Builders Profit

Depending on how the budget is presented and how the job is managed and done, there may or may not be a line for the builder’s profit. If the borrower also works as a general contractor, it may factor his profit into several of his budget line items.

He will work without earning a profit as a builder in such circumstances.

Instead, he’ll deduct his gains from the project’s revenues when it earns net sales or leasing income. This expense should be accounted for whether or not it is listed. You should inquire about it if you don’t see it.

Like the general conditions and contingency budget lines covered earlier, the builder’s profit line is in the range of 5 to 10% of hard costs.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What are the closing costs of a property development project?

Most development loans require you to make your initial advance at the loan closing. Suppose the loan contains a property acquisition component.

It is not uncommon for the advance to consist entirely of closing expenses, which are soft costs, distinct from any cash paid toward the property purchase price.

Closing fees vary greatly depending on the state and municipality where the property is situated.

For example, in a city, where costs are generally high, taxes and fees are a percentage of the purchase price and mortgage. It makes closing costs a big part of the total cost of buying a property.

The following fees are included in a city closing for a $12 million property purchased with a $10 million mortgage loan:

Sellers Cost

| Seller’s attorney | $5000 to $25000 (based on complexity) |

|---|---|

| City transfer tax | 1.425% up to $499,000 of purchase price 2.625% for portion of purchase price greater than $500,000. |

| State transfer tax Stamp duty | an Ad valorem tax charged as a percentage on the total purchase value |

| Closing adjustments | Include unpaid taxes, any owed payments, and net debits that have been agreed upon. |

| Real estate broker fee | 0.5 to 5% of the purchase price, depending on price and complexity; typically, the lower the fee as a percentage of the price, the lower the cost as a percentage of the price, but the higher the fee percentage, the greater the complexity. |

| Miscellaneous | $1,500 |

Purchaser Costs

| Lender’s Attorney | $15000 to $30000 (based on complexity) |

|---|---|

| Purchaser’s attorney | $15000 to $30000 (based on complexity) |

| Mortgage fee | 0 to 2.5% of loan amount |

| Environmental report | $3,000 to $12,000 |

| Engineering fee | $4,000 to $20,000 |

| Appraisal fee | $4,000 to $20,000 |

| Title fees | Around $35,000 |

| Mortgage broker fee | 1% to 3% of loan amount, depending on loan size and complexity; the higher the loan amount, the lower the charge as a percentage of the loan; the greater the complexity, the higher the fee percentage. |

| Real estate broker fee | 1% to 4% of the purchase price, depending on the price and complexity of the transaction; the higher the property’s sales price, the lower the charge as a proportion of the price; the more the complexity, the higher the fee percentage. |

| Recording tax | 2% up to $500,000 |

| Recording fees | $1,000 - $2,000 |

| Cash Reserve | $12,000 to $25,000 |

| Closing adjustments | Taxes paid in advance, additional advance payments, and agreed-upon net credits are also included. |

| Working capital reserve | Depending on the predicted deficit, the reserve is frequently funded by the lender. |

| Capital improvement reserve | The amount of money that must be put into the project before the lender will provide construction financing. |

Learn More

The total costs of purchasing a home are far higher than the agreed-upon contract purchase price between the buyer and the seller. Using the list above, you can ensure that the borrower’s preliminary closing forecasts are reasonably accurate.

Closing statements might be challenging to comprehend, especially if you are unfamiliar with the transactions involved.

They should, however, become more familiar and easier to read after a few closings. Regrettably, closing statements are not prepared until after the closure, taking many weeks.

As a result, a closure statement is a reference to examine how funds were spent, refunded, and escrowed rather than a budgeting tool.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

How to determine the interest carry costs

After you’ve gone over the closing fees, look at how much interest carry is allocated.

You should consider several factors such as -

- The amount of the loan will be outstanding.

- The time it will take to finish the job and obtain a certificate of occupancy.

- The time it will take for the project to generate positive operative cash flows.

- The time it will take for sales or rental revenues to pay down the loan.

- If there is a takeout lender, the time it will take to trigger that funding source.

Interest expense forecasting is far from a precise science. The factors aren’t predictable in any way.

Considering these factors and using the example below to compute interest carry, a simple rule of thumb is treating up-front advances as completely paid from the loan’s start (property acquisition).

Then, for the first year, add 60% of the hard and soft cost sections of the loan facility, and for the second year, add 80% because that is usually the average amount that will be outstanding until completion.

Then, carry the entire debt from the estimated completion date until the scheduled pay-down from a sale or takeout.

If there will be partial sales or revenues, reduce the loan balance by the estimated percentage reductions in the loan when paydowns occur.

IMPORTANT

Interest carry calculation example:

Loan amount (A) - $20,000,000

Acquisition portion (B) - $9,000,000

Construction portion (C) - $11,000,000

Construction duration (D) - 18 months

Paydown duration (E) - Six equal monthly paydowns through sales

Average interest rate (F) - 7.5%

- At loan closing

(B) X (D) X (F) = $9,000,000 X 18 months X 7.5%/12 months = $1,012,500

- Construction phase

First year [(A) - (B)] X (D) X (F) X 60%

Second year [(A) - (B)] X (D) X (F) X 80%

= ($20,000,000 - $9,000,000) X 60% X 7.5%

= $4,950,00

= ($20,000,000 - $9,000,000) X 80% X 6 months X 7.5%

= $39,600,00

- From construction completion

(A) X (F) X (E) X 1/2 = $375,000

Total interest carry - 1+2+3 = $5,842,500

The simple interest carry should be approximately $5,842,500

Continued at…

Important costs for your property development cost budget [Part 2-2]