Things you should know for apartment development

When it comes to property development, there’s nothing more exciting than creating a brand new apartment building from scratch. No matter if you’re new to the game, you can always make a good start.

Here is everything you need to know about developing apartments, from finding the right location to securing funding and marketing your finished product.

Explore some tips on how to maximise your return on investment. So whether you’re a seasoned developer or an investor just looking to get into the market, this guide is for you!

What is an apartment?

Apartments are the most popular housing space, especially in cities. The phrase refers to any residential unit within a building. It is a solitary living area among several others within the same building.

It can be anything from a single-family home to a townhouse, a large residential building, or even high-rise condominiums.

Types of apartment development

Apartment developments are of two types: urban and holiday. The accommodation and size of these flats may vary depending on the target market, but the essential elements will be identical.

An apartment complex is simply a structure with five or more housing units on various floor levels, and it can be further classified as follows:

- Low-rise: A system with two to three stories and no elevators.

- Mid-rise: Three to eight stories with elevators.

- High-rise: A system having more than eight stories and elevators.

Low-rise apartments

You will typically find low-rise apartment complexes in the suburbs, where density regulation is less restrictive than in the city centre. They’re also known as three-story walk-ups because they don’t have elevators.

A low-rise apartment building’s structural system discipline is less stringent than a mid- or high-rise building, allowing for more design flexibility.

Furthermore, the building codes are significantly more lenient, especially for fireproofing. Parking is often available ‘on grade’ at ground level, which is less expensive than parking in a basement.

Mid-rise apartments

Buildings of up to eight stories are known as mid-rise apartments. You can determine the height by the length of a fire-engine ladder, which measures 24 metres. Any building above this height requires sprinklers, which adds to the developer’s costs.

These structures, ranging from five to eight stories, are constructed in the suburbs near the CBD or on TOD sites. An apartment in a mid-rise building is less flexible than one in a low-rise due to the greater loads.

High-rise apartments

The structural system, which is primarily concrete or steel frame, limits the design of a high-rise apartment building, and the vertical lift core plays a significant role.

The high-rise apartment’s sheer repetition necessitates a high level of architectural rigour, which means that, with a few exceptions, all apartment levels are identical.

You will find such high-density residential developments in the CBD, offering larger plot ratios and fewer parking constraints. From studio apartments to penthouses on the top levels, high-rise apartments often offer a wide range of accommodations.

Mixed-use development can also include high-rise apartments with retail, commercial, or restaurant space on the ground and first floors.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What are the different types of apartment units?

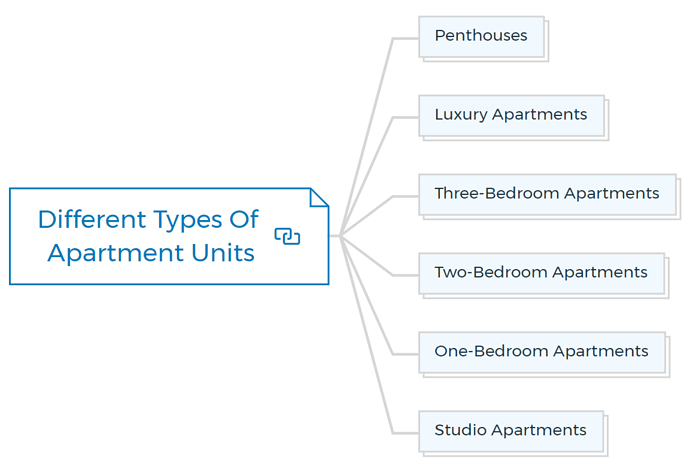

Apartment units can be classified or designed into the following segments, depending on their location and market demands:

Penthouses

Usually found on the top floor and typically take up the entire floor.

Luxury apartments

With at least two bedrooms, two bathrooms, a study, and a floor area of more than 150 square metres, this design appeal to the executive.

Three-bedroom apartments

These buildings are primarily for growing families, internal floor area 100 square meters to 150 square meters.

Two-bedroom apartments

For singles and married couples, with one or two bathrooms and internal areas ranging from 70 to 90 square metres.

One-bedroom apartments

These are primarily for singles and young couples, with 50 to 65 square metres of interior areas.

Studio apartments

Often known as bedsitters, are designed for singles who want to live alone and have a minimum area of 40 square metres.

Parking facilities for these various types of flats depends on two factors: first, local council requirements, and second, market considerations. If the apartment development’s location does not have adequate public transportation, a minimum of one parking space per apartment may be required.

If the site is near a transportation centre, parking will be easier to come by.

The mix of units will depend on the developer’s and team’s market and demographic study.

Demand for apartment living

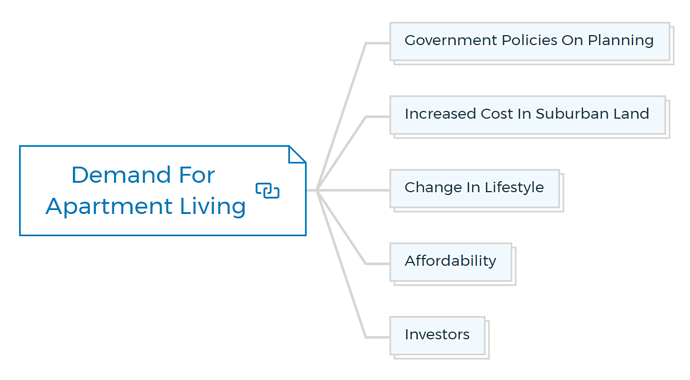

Several factors have influenced the types of houses added to housing stock over the last decade. Changes in the population’s age structure, household and family composition and size, and the need for lower-cost housing and housing closer to employment centres, have all influenced the demand for more variety in dwelling styles.

If you are still unsure about apartment developments, consider the stats of RealPage, the apartment demand in the USA in 2021 surpasses the previous high by 66%.

Government policies on planning

During this time, the government and urban planners have supported and encouraged more housing options, effectively boosting the availability of different types of higher density housing.

Other factors influencing this policy push for higher density housing include the rising cost of land in city centres, the infrastructure expenses of developing a non-urban territory, and environmental worries about urban sprawl.

Urban sprawl necessitates extra road infrastructure and public transportation, costing the government and taxpayers, making it unsustainable.

Increased cost in suburban land

Aside from the cost of raw land, subdividing land currently costs between $60 000 and $100 000 per lot.

Property developers have a more challenging time absorbing unforeseen costs because of hurdles such as the government planning system’s complexity, unclear time frames, and unpredictable expenses.

Lack of process transparency, inconsistent planning requirements across local government areas, and a lack of trust between local councils have emerged as significant roadblocks to negotiating the planning system. It also substantially impacted development costs, passed on to homebuyers.

Change in lifestyle

Life is changing rapidly. Households are contracting, and people are working longer hours, having children later, and having less time for other activities. These changes imply that being close to cafes, shopping, transportation, and other lifestyle amenities is more important than having a large backyard for the dog and extra bedrooms for the kids.

Furthermore, after their children have moved out, baby boomers are increasingly looking to sell their large, high-maintenance four-bedroom homes and move into smaller, lower-maintenance lock-and-leave flats near amenities, shops, and café strips.

Learn More

Affordability

According to a housing affordability report of the Australian Institute of Health and Welfare, the availability of rental apartment real estate properties increased in various capital cities, resulting in a decrease in median rentals for inner-city flats.

Between the first and third quarters of 2020, median rents in the north and west Melbourne fell by roughly 5%. Sydney experienced a ten per cent drop.

As demand rises for new developments that provide luxury living at low rates (solving Australia’s growing population problem), developers are building smaller units to keep them affordable, leading to higher interest in Apartment Development.

Investors

Investors are buying apartments near amenities due to the increase in the rental market. Negative gearing and capital gains tax reductions are among the many advantages that encourage housing investment, with one in every seven taxpayers now owning one or more investment properties.

Investors from other countries are contributing to the demand in several expensive countries.

Benefits, drawbacks, and challenges in apartment development

Compared to other forms of developments, apartment developments have the following advantages:

- Higher plot ratios represent more building to land value, resulting in more effective land use.

- High-profit margins as a reward for entrepreneurial endeavours.

- Because of the repetitive construction, less sophistication is necessary.

- Various sizes and budgets, ranging from one to three bedrooms, are available to satisfy a wide range of buyers.

- Because of the location and attractions, there is a large rental market.

- If well-located and well-designed, there is a good resale market.

- Long-term investing requires reasonably constant financial flows.

- Depreciation write-off is quick, and there’s a lot of tax shelter here.

Large apartment complexes may have advantages over smaller apartment buildings in terms of lower per-unit operating expenses (owing to scale economies) and ease of rental due to additional amenities (pools, tennis courts).

A report by CNBC stated that apartment occupancy in the USA hit a new record of 97.5%. The rate is around 250 basis points higher than the long-term norm of approximately 95%.

Apartment development, on the other hand, may have some drawbacks:

- A lack of complete market analysis, such as of consumer needs.

- The inability of consumers to pay expected sales prices or rents.

- Competition from other projects, both present and in the planning stages.

- A site or area that is improper.

- Community objection to the apartment building.

- The project faces funding challenges because the developer lacks a track record or experience.

- Increased time, talent, and financial demands.

- Exposure to government regulations.

- There are no long-term tenants and no significant tenants to bankroll the project.

The developer must overcome the following obstacles to be successful in apartment developments:

- Obtaining sufficient working capital.

- Preparing for long-term obligations.

- Constructing or contracting for specialized financial and asset management expertise.

- Gaining a broad understanding of the housing market in the short and long term.

- Managing a vast development team that includes both employees and contractors.

- Battling community and political resistance.

- The accessibility of viable and cost-effective building sites.

- Recognizing and dealing with complex laws and regulations.

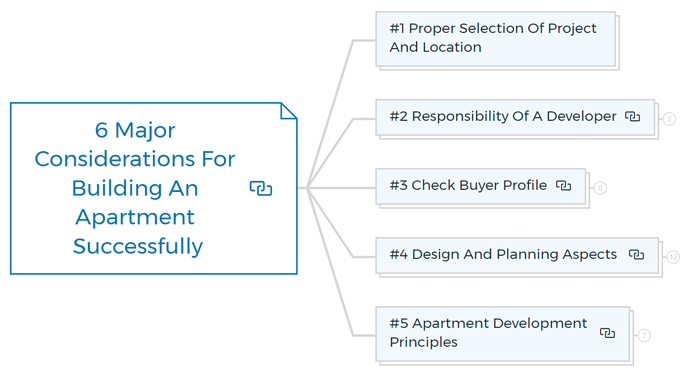

6 Major considerations for building an apartment successfully

#1 Project and location selection

The size and location of an apartment construction project are essential factors. The intended project scale depends on available cash, market demand, lender attitudes, site constraints, and the developer’s ability to take risks and manage operations at various project sizes.

The location may be a matter of opportunity or personal preference. If the terms are fair and the place appears practical, experienced developers will frequently seize an available option. When you choose, it’s a good idea to weigh your options before deciding on a location.

The ideal location should be large enough to handle a project of the appropriate size and in a neighbourhood or area that will appeal to potential buyers willing to pay the price.

In addition, the apartment development site should provide the following features:

- High level of visibility

- Optimum soil conditions

- Excellent drainage

- Services availability.

- Pleasant environment and surroundings

- Proper exit and entry

- Distinguishing amenities

- Public transportation and shopping Access to eateries and entertainment facilities

- Public parks and other communal facilities are accessible.

Within a reasonable amount of time, the required zoning should be in place or available. Environmental or other development constraints should not be overly stringent.

The site should be accessible on terms that allow the developer the most latitude to study the location before investing substantial sums of money, preferably under an option agreement that you can extend if necessary.

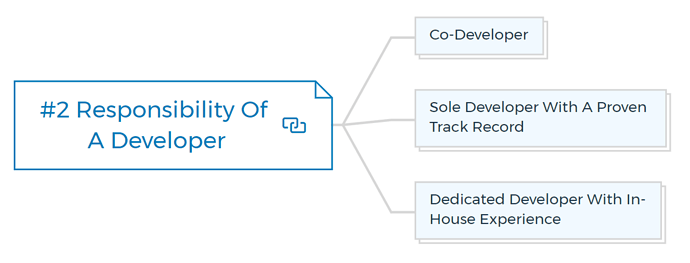

#2 Responsibility of the developer

A new developer considering apartment development as a long-term business should consider their long-term ambitions and available resources. They must be aware of two significant external constraints to their objectives: the availability of suitable development sites and their financial resources.

Because most apartment buildings require more money and time than smaller villa developments, developers can choose from one of three roles, depending on their financial situation.

Co-developer

This structure necessitates the least amount of personal involvement and time. It’s a great place to start for a new developer who wants to learn about apartment construction from a seasoned pro with a proven track record.

It delegated most of the day-to-day development tasks to a seasoned programmer. By collaborating as a co-developer, the inexperienced developer can contribute one or more of the following resources to the project:

- A combination of cash and up-front development funds

- Equity for land purchases.

- A solid financial balance sheet

- A wide range of business experience and contacts

- Enduring ties with other possible investors

Sole developer with a proven track record

The experienced property developer with a track record works independently in this development paradigm but is often surrounded by independent and informed consultants. This developer is in charge of the following responsibilities:

- Locating land and assessing the project’s viability.

- Collaborating with a group of reputable advisors.

- Organizing all financial aspects.

- Collaborating with potential investors and silent investors.

- Taking care of all economic and cash flow requirements.

- Handling the project on behalf of the investors.

Dedicated developer with in-house experience

The real estate developer in this model must have extensive technical knowledge and experience in tax, financial, legal, and building. The concept also necessitates an ongoing apartment development commitment to justify the high administrative expenditures.

This developer is a private or public corporation that has made apartment construction a long-term business. This developer:

- Identifies and acquires potential development projects

- Has a design and estimating team

- They have a construction section that handles all work

Has a financial division that uses a fund or a syndicate to raise equity capital from investors.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

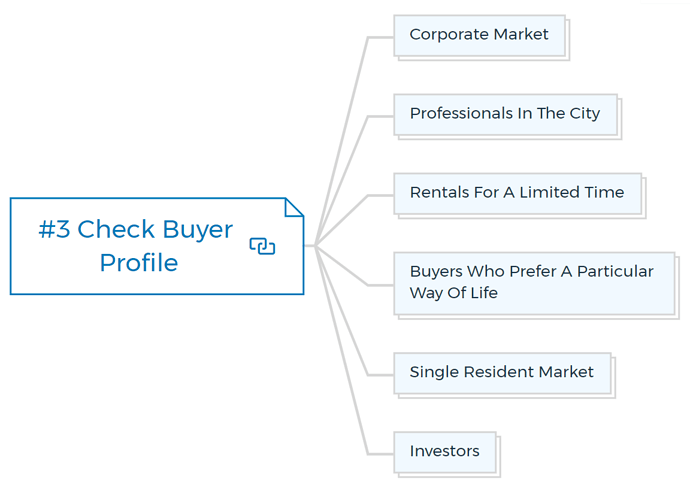

#3 Check buyer profile

There are different types of markets or buyers for an apartment building.

Corporate market

A corporation or an interstate company will usually be willing to spend a much higher price or rent for the apartment they want because it will still be less expensive than providing hotel accommodations for an employee.

For appealing to the corporate market, an apartment should be a modern-styled building with comprehensive security, located within a few minutes’ walk of the inhabitants’ workplace, and fully serviced.

The optimum size for this market is in the CBD, within walking distance of their workplace.

Professionals in the city

Professionals in the city are increasingly choosing to reside near their workplace. These folks choose a city lifestyle, which includes cafes, high-quality restaurants, and a vibrant nightlife, over accommodations.

The finishing quality is more significant than the space available, and the location is also crucial. Competent developers will build as close to essential office towers and city living amenities as possible.

Rentals for a limited time

Short-term rentals or short-stay accommodations obtain much higher rental than longer-term residential rents for tourists and business travellers. The building should be completely furnished and well-managed to attract such renters.

The developer’s plan in creating such apartments would be to either hold the property as a long-term investment or sell specific apartments to offset some of their financing costs while keeping the rest.

Learn More

Buyers who prefer a particular way of life

Young professionals, semi-retired couples, and empty nesters all appreciate the idea of living in a building that caters to their specific needs. Common area amenities such as a gym, swimming pool, view terraces, and concierge service can help to create a lifestyle.

Single resident market

Unmarried or divorced people who live alone seek out one-bedroom apartments, studio-style apartments, loft-style flats, or bedsitter-style apartments.

The style of the building isn’t essential, but the price and rental should be reasonable, and there should be restaurants and entertainment nearby.

Investors

Investors might purchase an apartment for the short or long term. When it comes to the former, the investor usually buys off the plan in the hopes of reselling the unit at a higher price once it’s finished.

The long-term investor purchases as part of their property portfolio or purchases and rents for a length of time till they eventually occupy the building in their older years.

Learn More

Continued at…

A Beginner’s Guide To Apartment Development [Part 2-2]