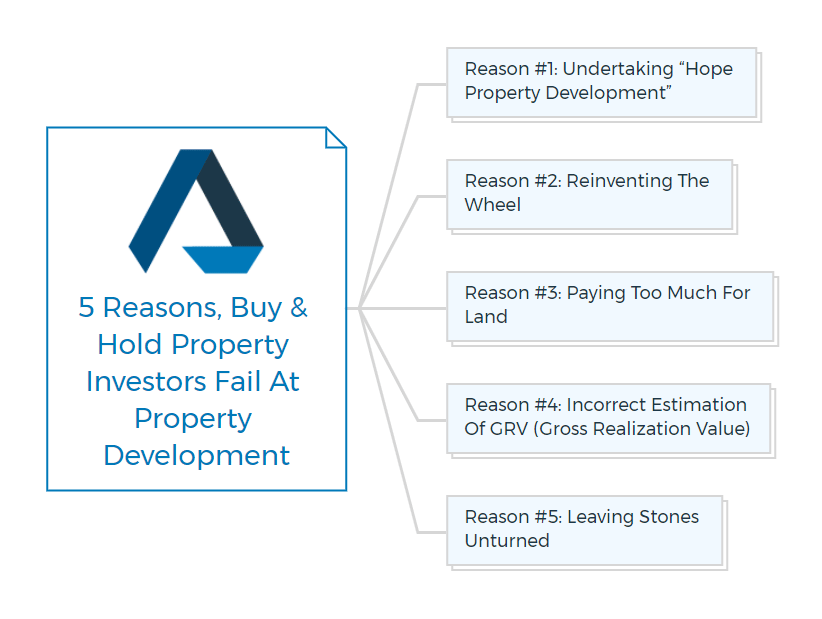

5 Reasons Investors Fail At Property Development

Making the leap to become a property developer is a goal of many ambitious property investors.

There’s no hard and fast rule that says you need a buy-and-hold investment property under your belt before you undertake a development, but that path is certainly common enough to be considered the norm.

Whilst buy-and-hold property investing and real estate development are two sides of the same wealth-via-property coin, success in one pursuit does not guarantee success in the other.

In this article, I’ll share with you my observations on why investors fail at property development to replicate their investment success as property developers. You’ll also discover how you can use these five shortfalls to learn from their mistakes and dramatically improve your own approach to property development.

Reason #1: Undertaking “Hope Property Development”

In some situations “hope” is great. It can see you through adversity and keep you in good spirits when the odds seem stacked against you.

Suppose you were shipwrecked at sea, hope would be your friend. However, when it comes to property development, it is not. Yet I see what I call “hope property development” everyday.

This is more than just failing to adequately plan. What I’m talking about here is blind faith that everything will workout as long as you keep moving.

People rationalise, "I know the team of professionals that I need, let me buy a property and “hope” to make some money.” What they don’t realize is that this happy-go-lucky attitude is setting them up to fail.

People spend their time, effort and money; get their permits only to realize that it is not feasible. And usually it is when they get a tender price back from a builder telling them that it’s not feasible to build. They’ve spent all this time and money only to put it back on the market - with plans and permits and think that, just because they’ve got the permit - they can get a lot of money for their land. That’s what I call, “hope property development”.

Any good architect can back me up here. About 70% of projects that they design never go further than the planning stage or development approval (DA). Think of that… Only three in ten developers proceed with their planned development!

Why do you think that happens?

It happens because 70% of the people cannot see it through, get caught out with wrong decisions or run out of money. They fail to see the development all the way through and jump on the hope development bandwagon without spending any time on property development courses and or correct property development feasibility study.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Reason #2: Reinventing The Wheel

There have been hundreds of thousands of successful development projects in the last few years alone, yet so many would-be developers feel compelled to work everything out on their own.

Property development isn’t rocket science, but your development project will require a multifaceted, multidiscipline execution plan.

Going at it without a plan is the biggest mistake you can make. Creating your plan from scratch is the second biggest.

When you build an experienced team around you and deploy a step-by-step execution plan, you’re setting yourself up to learn from their mistakes and greatly reduce the likelihood of costly setbacks.

Shockingly, only about 1% of the people actually take that extra step to ensure that what they are about to spend money on is actually a viable deal. Most people incur losses in Property Development because they have no system to follow along the way. They don’t know what they are doing and they don’t know what’s coming. So through the course of the development they are reacting to what is required.

This causes two major problems, the first one being, running out of money mid-stream. Not knowing the cash/equity requirements at different stages of the development causes many a novice developers to get caught short, forcing them to sell a perfectly good project. The second major issue with developing without a system is delays.

In property development there are many factors, which in spite of your best intentions and hard work are out of your control. Since there are likely to be holding costs all through your project, delays result in lost profit. Not knowing what’s required next or being in reaction mode will without a doubt lead to delays.

You don’t have to learn everything the hard way. Hundreds of thousands of developers have already made just about every mistake under the sun so you don’t have to. As Benjamin Franklin put it:

“If I have seen further, it is because I stood on the shoulders of giants”

You too stand to benefit from the learnings of others. The best way to do this (if you are ready) is to join GameOn, my action oriented property development mentoring program.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

Reason #3: Paying Too Much For Land

Buy-and-hold investing has a dramatically different cost structure than property development. Typically, property development costs are more complex, far greater and take a lot longer before you start generating income.

Perhaps it’s blind ambition or naivety (I call it recklessness), but would-be developers frequently pay way too much for land. Unlike more forgiving buy-and-hold strategies, this can set novice developers on a crash course. Leaving them stranded at the planning phase and doomed from day dot.

I’m not kidding. This is very difficult to come back from and should be avoided at all costs.

The post-GFC buying environment and the onset of foreign investors threw property markets into a feeding frenzy. The problem is was rife that I literally saw rookie developers, plans and permits in hands, fighting bidding wars for overpriced land. And now, after APRA put the breaks on investing, the same property developers are hurting as there is no funding available.

This isn’t limited to sites with plans and permits, in Melbourne any site with a potential for development was gobbled up, because there were developers out there who had no clue about the maximum price they should be paying for the site. So they are willing to pay more or over and above the marketing.

Understanding this basic concept where you can arrive at the residual value of land after taking all your costs out is so important. Overlooking this point is a fast-track for property investors failure.

Think I’m being dramatic? Think again. Of those developments that never go ahead, in nine out of ten cases it’s because the developer has paid too much for the land.

Reason #4: Incorrect Estimation Of GRV Leaves Investors Fail (Gross Realization Value)

A GRV is used in a project’s financial feasibility to determine what would each unit/townhouse will sell for at the end of the project. Usually, the development manager determines this number after carefully analysing the market comparable sales or gets it from a commercial valuation.

However, for smaller projects, developers do not get a commercial property valuations, as it can cost anywhere between $4000-$6000. Nonetheless, they still have to come up with a GRV or gross rental value figure to compute the project’s profit. Most developers do not take the time to carefully analyse the market sales data to ascertain the JUST RIGHT figure to use in their feasibility.

This figure has to be JUST RIGHT because if it’s a bit less and you can kill an absolutely fine deal. A higher figure can make you go after the deal in a big way, as the feasibility would look great and show attractive profit at the end – but you’re only kidding yourself and you could be in for a rude awakening when the project is done and dusted.

You have to understand that the feasibility software is only as good as the numbers YOU put in. A reasonable estimation of GRV or total GRV distribution will reduce wasted opportunity costs and spare you unrealistic expectations.

Reason #5: Leaving Stones Unturned

Picking the right site can sometimes feel like trying to find a needle in a haystack – especially in a competitive buyer’s market.

Some developers find themselves settling on properties that don’t exactly fit their needs. Others make brash decisions with the hope of bringing forward their payday.

Naturally both are setting themselves up for failure.

When you shortcut decisions, you are conceding to a “hope” development strategy. Things might end up okay or they might hold seriously detrimental consequences.

The only way to avoid this is to employ a step-by-step system to conduct property development due diligence.

With a robust due diligence system to follow, chances are you will not leave any stone unturned and you will not settle on a lemon.

This also helps you mitigate and manage risk. Most “hope developers” have no system that they can follow to ascertain that they have identified every possible hole there is or could be in the deal. It also keeps you accountable to fulfil your most important criteria if the market is tough and you’re tempted to ‘settle’.

There is always an opportunity cost of your time, money and efforts. As a developer, you need to leave your heart aside and make sure your decisions are based on facts, figures and numbers. You MUST go through a property development system to make sure that you are making an informed decision.

As you may have already noticed, the biggest challenges and risks that buy-and-hold investors face when undertaking their first development are not concerned with securing a site or even accessing finance, but rather, they are to do with planning.

I can attest to the fact that it’s not brain surgery. However, would-be developers need to understand that property development is a different kettle of fish. Unlike buy-and-hold properties, property development is more complex, more costly and more involved. As such, a systematic process must be followed and careful planning must be adhered to.

If you approach property development expecting it to be as forgiving as buy-and-hold strategies, you’re in for a nasty surprise. On the other hand, if you plan carefully, do your due diligence, find a site to suit your goals and learn from the mistakes of others, I have no doubt that property development can be a lucrative and exciting wealth creation channel for you as it has been for me.

Here is my story as to how I’ve put together these property developer courses to help property investors to take the leap and become property developers.

If you think you are not yet ready, but are still curious about property development and would like to learn and take it slow, check out my Quick-Start Property Development Course.

FAQs

Why do property developers fail?

Things may go wrong at any time.

Interest rates rise, the property market falls, your builder goes out of business, your development approval is delayed, your budget blows out, your builder meets the occupation deadlines.

Still, your buyer misses the settlement date, and so on.

What percentage of real estate do developers fail?

Considering this, 95% of real estate buyers fail. One cause is that too many real estate investors see it as a pastime or part-time occupation.