Continued from…

How To Become A Property Developer? In 10 Easy Steps [Part 1-2]

How To Become A Successful Property Developer?

- You must have a Predictable System in place that you can follow, over and over again without thinking.

- You have to be willing to push through your comfort zone.

- You can never allow your “self-doubt” to stop you from achieving what you truly deserve.

- And you need to play the game to win. Are you playing the game to win or are you playing the game, so you don’t lose?

In property development, there are winners and there are losers and then there are people who haven’t learned how to win yet. All they need is the right system, the right course in property development for them to move forward. However, no amount of property development courses can help you, if you don’t have the right mindset.

There is an old African proverb, “if there is no enemy within, the enemy outside can do you no harm”.

So if you know that you have the right mindset, if you think you are ready to take the leap from being a property investor to a property developer, if you think that you are ready to learn the property development process and the strategies involved, then it’s time for you to move forward and take the next step.

This means that you have the first “HOW” of How to get into property development. You start with working on your mind, you spend time listening to audiobooks or mindset programs, whatever rocks your boat and when you are faced with challenges, you push through them, you create a big enough WHY i.e. all the reasons of why you want to get into property development.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How To Find Your First Property Development Project?

I get a lot of emails everyday and from experience I can conclude that the one thing every developer absolutely must master is, their ability to find lucrative property development deals on a consistent basis. This is the number 1 skill that you need in order to stay ahead of the competition.

And if you haven’t got it packaged into a system that you can follow every time, you will either get frustrated, because you will spend numerous hours looking for deals that don’t stack or you will end up paying too much for the site and shoot yourself in the foot.

This is a very important video for anyone starting out in property development and you must pay attention if you would like to become a master at finding deals.

Because Bad Deals = No Profit

3 Major Mistakes Made By Property Developers When Getting Started In Property Development

Property Development Mistake 1: Following The Heard

Have you ever noticed a newbie say, “Everyone is developing here, so should I”. Or “Everyone is buying here and so should I”. That’s how novice property developers make decisions. It’s the heard mentality and it only works in the short term, only for as long as the property market is in an upward trend. This approach, however does not work over a long period of time or in other words, if you wish to be able to continually keep developing as your source of income, you need to take this to the next level and have a system behind it.

If you don’t have a replicable system behind your systematic property research, you will never know where to start in property development.

Why do you plan on developing in Melbourne, Sydney or Brisbane and why aren’t you developing in Perth, Adelaide and so on. The answer to this question shouldn’t simply be, “because I live here”.

For example, I am from Melbourne, however, my first development was in Brisbane and it was based purely on my market research and nothing else.

You have to dig deep on the macro level, chose the state first, then zoom in further to suburb level, and then finally to street level. Most, novice developers cannot back their answers with market research and facts. And over the years in my property development career, the more I have based my decisions on research and numbers, the more successful my projects have been and the more detached I have been from the projects I undertook. So everything I did during the project contributed straight towards the bottom line of the project.

Property Development Mistake 2: Listening To Negative Media

The second mistake, novice developers make, when getting into property development, is to listen to negative media. There are two things that you must always remember, 1st only “Bad news sells” – so everyone talks down the property market. 2nd you must not pay attention to the news sites who hire content writers to spin negative stories.

Their job is to amplify the negativity. Because, I assume, you are going to be into property development for a long time, you need to have a property research system that you can fall back on to so you are making decision based on facts not just negative media.

Property Development Mistake 3: Blindly Believing The Economists

- Have you ever seen a rich Economist? – I haven’t, & I don’t think they even fall in the top 100 disciplines that make people rich.

- Have you seen a rich property developer? I am sure you have and I am pretty sure I have too.

Learn More

So What Is It That The Property Developer Knows That An Economist Doesn’t?

Property developers know the rules of property development and property economics and take action by following a replicable system of research and property development. They do their research and understand the difference between the demand and supply of various suburbs. They understand the various factors that play a role in determining house prices. They know exactly where to start and they maximise their up side and cover their downside.

To be exact, they have a working knowledge of Property Economics. In a nutshell, they understand that a deal is a deal – no matter where it is, what suburb it is in. If it stacks up, it stacks up.

They understand the important concepts that you need to understand in order to find your first lucrative property development project.

So before you get into property development, here is what you need to get proficient in. Don’t worry, if you don’t know what these are or how they work, check out one of my property development courses to get started in property development.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Property Economics For Property Developers

Property Economics – A working understanding of New Govt Policies, Unemployment Rate, Impact of Interest & inflation rate, population growth, house price index, Australian dollar and the over all state of the economy are essential for any property developer starting out.

Property clock & market cycles – an understanding of property clock and the ability to read signals for Maturity, Decline, Bottom & Recovery

Listening for Signals – The ability to separate the Gossip & the Hype from what exactly is happening in the market, is another important skills every novice starting out in property must understand. Another complimentary skills required to efficiently listen for signals involves, leveraging the internet to hear for side kicks and other important announcements that impact property prices.

Understanding Statistics – new developers do not need to be statisticians to read market signals, but they must understand the 8 most important stats to get the pulse of the market.

Understanding Capital Growth – An understanding of capital growth, how it impacts property prices, how it is related to other forces in the market helps in identifying Suburbs with greatest growth potential. There are 6 important metrics that determine a capital growth trend. An understanding of these metrics will help you with suburb selection.

Demographics - Why do people move and how to find out where are they moving now is a very important insight for any property developer. Understanding, this not only helps developers refine what they are you going to develop, but also determine the expected demand for a certain kind of design. And the ability to forecast demographic movement sets them apart from “wanna be” property developers.

Validating Signals – know all of the above signals is not enough. The ability for novice developers to find proof for market indicators is another important skill that you need to know before starting out in property development.

Auto Alerts – And on top of all of the above, automating the entire process using web and technology will give you an edge over any developer in the market.

Here Is What Is Important For Any Newbie To Get Into Property Development:

- Do not base your development decisions on what every one else is doing. i.e. do not follow the heard.

- Do not listen to negative media.

- Do not blindly believe what the economists say, always do you your own research and find data to determine whether it applies to your particular suburb.

Invest time to understand the following important concepts and develop a property development research system:

- Property Economics

- Property clock & market cycles

- Listening for Market Signals

- Understanding Statistics

- Understanding Capital Growth

- Demographics

- Validate the signals you are getting

- Automate the entire process using web and technology.

Getting started in property development requires a lot of things, Due Diligence is one of the most important skills that you need, when you are embarking on your property development journey.

How To Get Started In Property Development?

Following a due diligence system that you can REPLICATE, over and over again.

This article discusses, the Property Development Due Diligence process that you must following when getting started in property development.

Location Analysis

Location Analysis covers more than just the site. It is everything about how your site is located relative to amenities that your prospective buyers perceive as desirable.

Let me explain, for instance, everyone needs to travel for work, so if your site is located near a train station or public transport, it is perceived as desirable by the end buyer. Another example would be, proximity to schools, shopping centres, shopping streets, groceries, infrastructure and various other activity centres desired by investors and or first homebuyers.

Determining the demand and supply in the area is paramount for location analysis. You can do so by contacting the local council’s website to find out the development pipeline.

As a thumb rule, I have always developed projects within a 200m radius of activity centres. In fact, I have filters in place to flag prospective sites that fall in my selection criteria. This leads into a discussion about Supply and Demand.

The more desirable the location of your property development project will be, the higher the demand for the units you can expect. In other words, when getting started in property development you must have the skill to conduct a rock solid location analysis.

Here are some projects that I have developed and their proximity to amenities:

- 9 Apartments – with a bus stand right in front of the development and 6 minute walk to the train station.

- 2 Townhouses – 1 minute walk to Eastland Shopping centre

- 3 Townhouses – 180m from train station

- 4 Townhouses – 50m from the beach.

- 16 Apartments – with a walk score of 97%

- 12 Townhouses – opposite the train station

- 6 Townhouses – 175m from train station

Site Analysis

Has everything to with the actual site. Making sure that the site is not on a slope is the first thing that I look for in a site. A sloping site for me means more costs in retaining walls, which means lesser profit.

A sloping site may also attract various other costs that you should avoid when starting out in property development. The second thing that I look for in site analysis is the tree(s) on the site. More trees could mean either of three things for me and I like to avoid them as much as I can, if not completely.

Two other important things that I am always wary of are the width of the site and the depth of the site. The reason being that they both directly impact the ability to maximize the site.

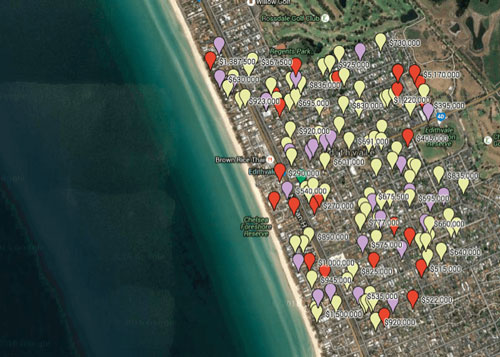

Zoning And Overlays

Zoning defines the permitted and prohibited use of land. Zoning determines whether a block of land can have a low, medium or high-density design.

In simpler terms, it stipulates the FAR or Floor area ratio. It is important because it tells us whether we can put townhouses on a block or we are allowed to develop apartments, just increasing the population density on that block of land.

It is imperative for any property developer to find out the zoning for a potential site, as this information forms the basis of calculating a sites’ yield. All financial feasibilities are then based on the yield.

Overlays are mapped within local planning schemes and they provide more information about the land. There are various kinds of overlays, like Design and Development Overlay, Vegetation Protection Overlay, Heritage Overlay etc. if your site falls within an overlay, you will be required to meet other planning requirements for your site.

Highest Best Possible Use

This is all about gathering all the above information first, and then maximizing the foot print and the height of your development to accommodate the maximum number of saleable units, apartments or townhouses that meet the planning scheme requirements. This is a vital skill that you must know when getting started in property development.

If you don’t know what how to do this, you must engage and town planner and architect who work together to maximize the land utilization so you can get the best possible returns.

In my property development course, I discuss various examples of maximizing the land so you are not leaving dollars on the table.

Data Collection

Now you may ask why do I need that?

Well, this is so you can determine the end sale value of what you are planning to develop. That value is then used in your financial feasibility to find out whether or not your project works on paper.

This data collection would include collecting sales history within 500m-1km of your site for last six months, it would include the ON SALE data for similar units around your site and it would also include a list of properties that are available for rent around your site to determine what you could rent them for or use the same data in your marketing efforts to show prospective buyers a list of comparable sales in the area.

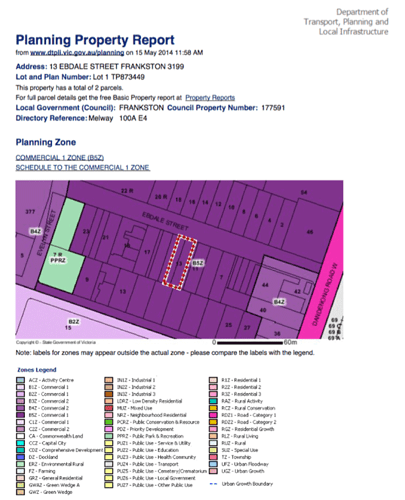

Spatial Analysis

Spatial Analysis is optional, but a solid property development system, would not leave any stone unturned. So I take the extra step to plot all the data that I have collected on a map to figure out where my site is at in relation to the comparable sales around it. This helps me to ascertain visually what I can approximately hope to achieve for my development.

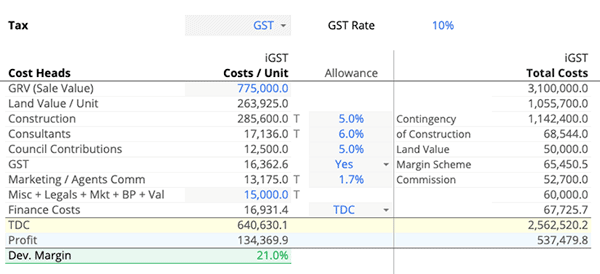

Preliminary Property Development Feasibility Assessment

Conduct a property development feasibility using Smart Feasibility Calculator and vet real estate development projects quickly and easily.

I have developed various financial feasibility study calculators to run numbers on my potential property development sites. My financial feasibility applications are included in my property development course. There are two different versions of financial feasibilities that I do for any project.

Preliminary Development Feasibility Assessment

One Minute Financial Feasibility – the above image shows a screenshot of my one-minute feaso or quick feaso. This feaso tells me what I can expect to make for each unit. For example, the above image is from my recent 16 townhouse development. So if you look carefully, I have designed this financial feasibility to quickly tell me what I should be paying for land in order to achieve the Target DM (Development Margin) %. It is so easy to use that even people starting out in property development can use easily; there are only 10 input fields that you may have to fill out to get answers. So as you can see, it is ridiculously simple to run numbers using my financial feasibility applications.

Lead Developer Feasibility Suite – involves a lot more details and helps break down costs further in lot more detail. It also takes in to account the time value of money, for example, the cost of interest is calculated based on the time it is injected into the project rather than a flat per annum rate.

Risk Management

If you are in property development, it is simply unavoidable to have no risk at all. Let me put it this way, there are inherent risks when driving on the road. However, we all take those risks everyday, to the point we don’t even think about the bad the stuff that can happen on the road when leaving our house.

We do that because, we follow a system, we that because we are going to follow rules. Property Development is no different. There are rules and systems to follow at each step to manage risks. In fact, everything that I have discussed in this article is to manage risk, avoid it, minimize it or contain it.

But above all, you must always have an exit strategy from your project at hand. Following is a list of various types of risks that everyone should be aware of when getting started in property development. Not all of them apply to all developments and it is your responsibility as a property developer to identify them and mitigate them for each project. Read more about managing risks in property development.

Decline In Property Values

- Market could take a down turn and the end value of your development may not be the same as in feasibility.

Obtaining Planning Permit

- There is a possibility that the council may

- Decline the planning permit application.

- Add conditions to the planning permit, which may add costs that may not be included in the feasibility study.

Delivery Risk

- There is a risk that cost overruns may exceed the contingency amount or that the builder is bankrupted during the course of construction.

Economic And Political Risks

- In the course of the development, the property developer could be exposed to the direct and indirect consequences of political, economic and social changes in the investment environment.

Legal, Tax And Regulatory Risks

- Legal, tax and regulatory changes in the Australian investment environment, or otherwise, may occur during the investment term which could have adverse effect on the return of the development.

Investment Risks

- Time delays, building disputes, unforeseen litigation, planning and environment controls, loss of sales, competition for similar developments, adverse market conditions are just some of the problems which may confront the project.

Time Delays

- Development approvals, slow decision making by counter parties, complex construction specifications, changes to design briefs, legal issues and other documentation changes may give rise to delays in construction completion, loss of revenue and cost over runs.

- Other time delays that may arise in relation to construction and development include supply of labor, scarcity of construction materials, lower than expected productivity levels, inclement weather conditions, land contamination and unforeseen environmental issues and industrial action that may arise from Occupational Health and Safety issues, which may give rise to difficult site access and industrial relations issues.

- Objections raised by community interest groups, environmental groups and neighbors may also delay the granting of planning approvals or the overall progress of a project.

Design Risk

- There is a risk that design problems or defects may result in rectification or other costs or liabilities which cannot be recovered.

Risk Of Counter Parties

- There is always a risk that, notwithstanding appropriate safeguards, parties with whom you as a developer has dealings with, may experience financial or other difficulties with consequential adverse effects for the relevant project or asset.

Force Majeure Risks

- Acts of terrorism and events of force majeure may affect projects and insurance may not fully cover these risks.

So before you get started in property development, make sure that you understand the Due Diligence process in its entirety. Watch the video above to understand these concepts in detail.

If you would like to learn more and get a better understanding of the complete Due Diligence process, I would highly recommend that you checkout one of my property development courses that can help you get started in property development.

So to conclude this post, here is what is important to get into property development and become a property developer:

- Location Analysis – make sure you understand the suburb that you planning to invest into thoroughly.

- Site Analysis – a thorough analysis on the actual site to make sure that you are not buying a lemon is essential.

- Understanding zonings and overlays is essential to determine the highest best possible use of the site. i.e. determining if you can accommodate the maximum number of units that make you profit on a site is the basis for any financial feasibility.

- Data Collection and Spatial analysis go hand in hand. Gathering and organizing data visually that speaks to you about the past sales, rental information and currently on sale properties will help you determine the end value of the units you are planning to develop.

- Risk Mitigation – always have an exit strategy and make sure that you have identified all risks and have a plan for each one of them.

FAQs

What do you need to study to be a property developer?

You do not need any required qualifications to work as a property developer. You will, however, require adequate funds to make the first purchase.

Self-employment – can establish and grow personal property portfolios by hiring construction teams or doing the job themselves.

Why do you want to work in property development?

Planning and development may be a very fulfilling profession.

Daily, you will be faced with new obstacles and possibilities, and you will be expected to deliver innovative solutions to locations and cities to make them more livable and appealing.