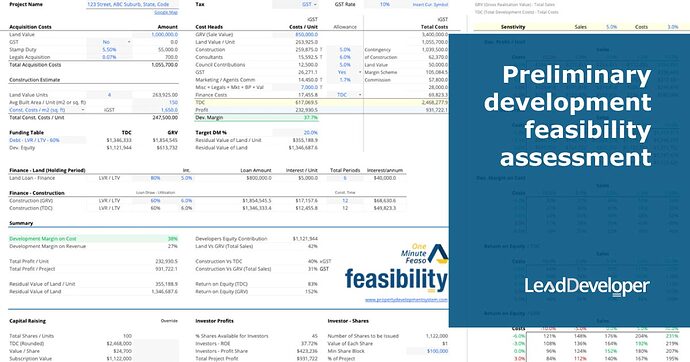

How To Conduct Preliminary Development Feasibility Assessment In Under One Minute?

Best Tool To Conduct Preliminary Development Feasibility Assessment

One Minute Feaso is a One Minute Feasibility Application. It is undoubtedly the best tool to conduct Preliminary Development Feasibility Assessment.

It is one of the most used tools that I use in my arsenal. The reason I created it is to quickly and easily vet development projects and potential development projects and figure out exactly :-

1)What should you be paying for the land?

2)What are the costs involved?

3)Whether or not a project has any money in it, in other words, it helps you calculate residual value of land.

One Minute Feasibility allows you to run a preliminary development feasibility assessment quickly and easily on a myriad of development projects from townhouses, town homes, apartments etc. quickly and easily without becoming a nerd in the process.

One Minute Feasibility Overview

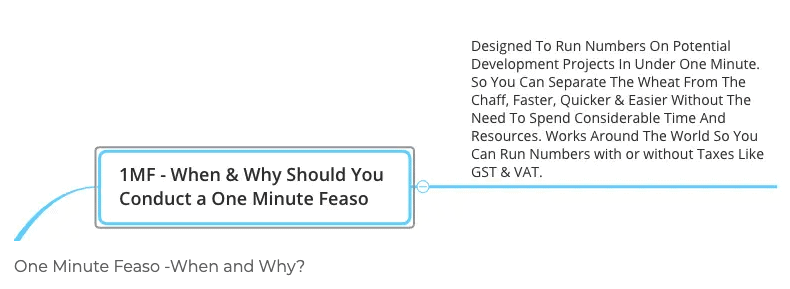

So let’s get into it. It’s super, super easy to use. And I’ll just quickly go through everything that its got here:-

-

One of the first steps is to go through is the Setup.

-

Then we work out what the Acquisition Costs are going to be : Acquisition costs are the different cost that we look at and we allocate a percentage to all those costs.

-

We figure out what will the Construction Estimate be : This is going to be super easy to do when using the One Minute Feasibility. There are 2 different ways to work out construction estimates and I’ll explain everything in detail below.

-

Next we estimate the Sale Values: When you are developing a townhouse, unit etc., you would want to know what will you be able to sell it for?

-

One of the most important is the different Cost Heads, we will go through in detail later.

-

Time and there are 2 aspects to time , I’ll explain that as we move forward.

-

Then we have Targeted Development Margin which is the amount of money that we want to make and based on the amount of money that you want to make, you would decide what you would want to pay for the land.

What does that mean? What it means is that if you want to take that X amount of risk, and you’re going to borrow money to do the development, In doing so there is a certain amount of return that you want on all your costs. That is what a Targeted Development Margin is.

Now just imagine if you put that amount in the One Minute Feasibility Application based on your cost this tool calculates the figure(amount) that you should be paying for land, which is fantastic!!.

-

Then finally we get into another aspect where I show you all the different Metrics that you’ll get back after you’ve done the feasibility.

-

And then we will deep dive into Capital Raising and what money you need to raise when you work with Investors?

You would want to figure out how much money do I need to raise and what sort of return you can offer to your clients? All that is coming up.

- Finally a look at What is Sensitivity Analysis? How to do a Sensitivity Analysis easily using One Minute Feasibility? and how it helps you keep an eye on different scenarios anytime you are doing a development? .

Below is the One Minute Feasibility Application Overview . We will continue our discussion on How to SetUp Your Project Feasibility When Using the One Minute Feasibility next.

How To Setup Your Project For Preliminary Development Feasibility Assessment?

SetUp In Lead Developer Suite > One Minute Feaso

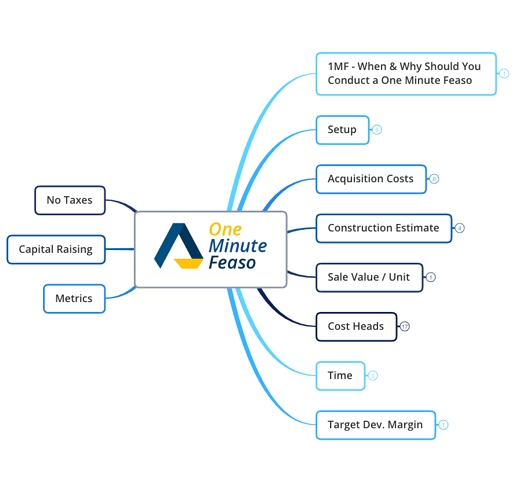

In order to Setup the One Minute Feaso, what we need is the:-

-

Address of the property that we are going to run the numbers on .You would first need to type in you project name and address .When you type the address details and select Google map it comes up with the address.

-

Tax for example, GST, VAT or In case it is not applicable, then you select NA and X% Rate of tax in case its applicable.

For Tax code you select whether your project has GST or VAT or whether it’s applicable at all for example, in Australia GST is about 10 % similarly in New Zealand I think it is about 15 %.

So if you are from New Zealand, you will change GST% to 15 percent. In case its NA just type 0 against X%.

- Currency symbol: The last thing that you need to select is Insert currency symbol. So say, for example, you want to use pounds or euros or whatever. And you’ll notice that if I put a dollar sign here, it is going to go ahead and put the dollar sign on everything that is a dollar value.

That is all you have to do in terms of setting up your projects so that you can quickly run numbers on it, all it is, is that you have your name and tax and currency details. Below you can see an example of a project Setup in a One Minute Feaso.

We will continue our discussion on How to Add Acquisition Costs When Using the One Minute Feaso next.

Learn More

How To Add Acquisition Costs In One Minute Feasibility?

Acquisition Costs In Lead Developer Suite > One Minute Feaso

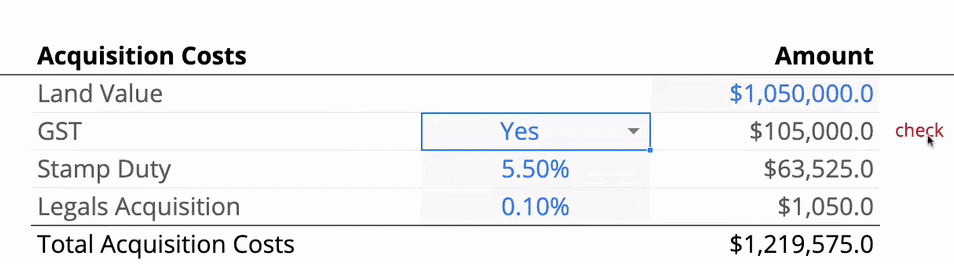

Land Value : Acquisition costs are basically what you’re going to pay to a lawyer or a solicitor or attorney who actually settle the block of land for you or the conveyancer for example.

These are your legal costs. Also how much are you buying the property for? And the third thing is stamp duty, and it would probably have a different name depending on which part of the world you’re from.

If you look at Australia, UK, South Africa it is known as stamp duty.

Stamp duty/Property Tax : is an ad valorem tax of the levying of tax or custom duties these are proportionate to the estimated value of the goods or transaction concerned. That’s just a definition I got off the Internet.

But simply put, what it is? Let’s say you’re buying a block of land or any property for that matter for a million dollars and if it does have stamp duty its usually a percentage of that amount on top of the sale value.

So if I’m buying something for, let’s say $1050000 and there’s a stamp duty or an ad valorem tax which in Victoria, where I’m from, is 5.5% (It could be a different value or a different percentage in your part of the world) you put that value.

In case you don’t have any such duty you don’t have to worry about it, just type in zero. Nothing would be added to the value of the land over there(see Example 1 below).

The Acquisition Costs are the costs that you can claim as part of the cost of the land when you’re purchasing.

Even costs for setting up a different trust or a separate company that is going to hold the land for you is also Land Acquisition Cost. However, that cannot be claimed as part of the cost of the land.

Under Legal Acquisition Costs the Legals that you spend on purchase of the land ,

In case you hire a Conveyancer (Conveyancer term is used in the UK, New Zealand, Australia and South Africa is a person trained to deal with all aspects of property law).

Then you have a lawyer who coordinates with your bank and with the seller.

There could be other people involved in the other authorities who might have a lean on the property or who might have a mortgage on the property.

There could be some property taxes owed to a local government body those costs get involved in here. So that’s the person, that legal guy or the legal entity that is handling your transaction. Those are your legal costs.

So, for example, my legal costs are 1% then I know that, $1050 will need to be paid to a conveyance or lawyer. And those are my total acquisition costs.(see the Example2 below)

If in your part of the world there is a stamp duty, put that in and you know, that will be added to the costs of the land over here.

If you’re planning to buy a block of land and you get the list price whatever the listing prices for that block of land, put that in there. Select GST if its applicable if it’s not just select NA and nothing will get calculated over here.

GST : If it does apply to you and it’s a commercial property which is usually applied on top of that, as soon as I select GST, I get a section which says check and all it is trying to do is trying to figure out whether or not I have a margin scheme that applies to me.

Now, this is only applicable to people from Australia I’m not sure if this applies in New Zealand.

What it is, is that there’s a margin scheme. The scope of this course does not actually include me trying to explain you what margin scheme is, but you’ve got to put that in.

In case you have selected GST and you a have a commercial property, margin scheme does not apply to it . That’s why it gives you a check over here, saying “Hey, check this out” .If you select no over there, that checks going to disappear.

But at anytime you’re doing a feasibility on something and you select yes when you buy this property, GST applies, It is going to warn you to do a check on the margin scheme.

When you’re entering the value of a residential block of land, there’s no GST applicable on buying residential, if it doesn’t apply to you, don’t worry about it. Just skip on it.

Don’t worry about what it says about check or any of that and keep moving on. And that’s pretty much it. On the Acquisition Costs.

We will continue our discussion on How to Estimate Construction Costs When Using the One Minute Feaso next.

How To Estimate Construction Costs When Doing Your Preliminary Development Feasibility Assessment?

Construction Estimate In Lead Developer Suite > One Minute Feaso

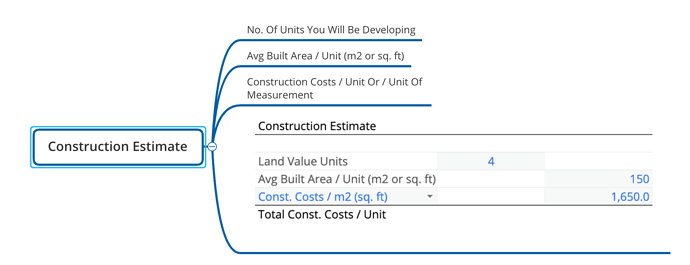

3 Things You Need To Calculate Your Construction Estimates

Under Construction Estimate in the One Minute Feasibility all you need to do is find out these 3 things:-

1) The Number of Units that you will be developing. Whether you’re developing apartments, townhouses, condominiums it does not matter so long as you know that when you buy a block of land, how many of those units are you going to develop.

2) You need to find out what is the average area of that unit that you’re going to develop, is going to be .

Whether it’s square meter or square feet it doesn’t matter but you need to figure out an average size of the built area because that’s the basis for you to calculate the construction cost .

3) Cost Of Construction/m2 OR Construction Cost per unit. You need to basically have a ballpark figure of what that unit is going to cost you for construction. This is super important and you can find this out easily.

Whatever area that you’re at and if you’ve got developments going on in that area, usually those construction sites have details of the builders working in the area.

Pick up the phone, call them up and ask them for estimates .Tell them what you are planning doing a development say there are 10 townhouses to be built in there. Ask them what is a ballpark figure to build a townhouse which is X square meters in size of the built area?

Now they might come up with saying it’s going to cost you about say $375000 in order to actually build a unit, a townhouse.

So you can either go with the square meter rate or the square feet rate or you can go by a ballpark figure for that.

Why are we actually doing this?

What we are trying to do is run numbers on the side in under a minute. And the reason we do that is because:-

a) We haven’t got all the information yet. All pieces of the puzzle not yet given to us.

b) When you are trying to make an offer on something and even when you are trying to determine whether this site is feasible or not and whether or not this site has any profit left in it you cant be doing a detailed feasibility on every site that you come across that you feel is a potential site.

c) There is not enough money and there is not enough time for anyone or any developer to do a full, detailed feasibility on site, specially in the Preliminary stage, where at this stage an Agent gives you a call or you came across a site that you think has potential for development.

d) At the Preliminary stage you want to save time and you want to save your resources so that you can run numbers and figure out whether or not you need to go a step further in this project. So that’s where we are at.

So let’s look at what it looks like when we type these 3 numbers in the One Minute Feasibility-

3 Simple Steps To Get Construction Estimate Using Lead Developer Suite > One Minute Feaso

Lets see how we can enter in all the details required under Construction Estimate:

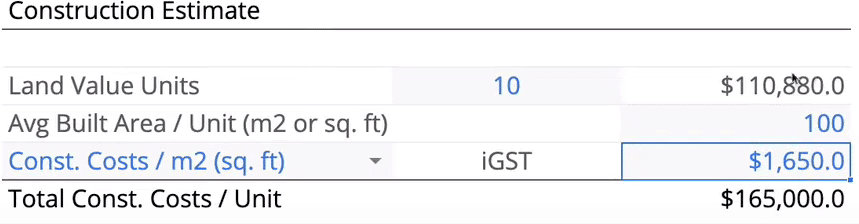

Say we want to construct 10 Apartments on a block of land. The Average built area of the land is 100m2 and cost of construction we have found out from a local builder is $1650/m2. This is how easy it is to get the construction estimate from the One Minute Feasibility

Step 1: First of all type in number of units or apartments you wish to construct next to Land Value Units which in our case is 10 we simply type in 10 for the number of units in the One Minute Feasibility.

Step 2 : And you figured out what the average build area per unit is going to be say its 100 .

Step 3: The other thing that you need to select is that construction costs per square meter or square feet by talking to local builders. In case you have selected GST, everything will show up as GST automatically you do not need to worry about it .Now say my cost of construction is $1650 /m2 just simply enter that in.

That’s all you need to do in this section in order to get to a value that you can use in your property development feasibility for construction.

Now when we do these numbers, we do it for each individual unit because we are averaging out the numbers for the entire project. And that is the only way to do it really quickly and efficiently.

Construction Costs/ M2(Sq. Ft.) Vs Construction Costs/ Unit Feature

Another option you can select in here is that of Construction Costs/Unit.

Now, that’s a ballpark figure you got when you picked up the phone and called a construction contractor or a builder asked them what is it gonna cost me to build say a townhouse, 100m2 a two bedroom, one bathroom.

And the builder said to you. Look, they average about 200000 thousand with the median finish. And that’s the number you are going with over here. In this case you need not worry about the typing in the Area 100 m2.

You just type in the amount given by builder to you .For this you make sure you select construction costs per unit.

The One Minute Feasibility incorporates both the options that you can be use depending on what information you can get easily to calculate your construction estimate.

If however you’ve got more details or if you’ve done this before or if you have run numbers on similar projects before and you know what Construction cost/m2 is going to be, you go with construction costs per square meter or square feet.

And in that scenario you must know the value to put in like built area because otherwise you wouldn’t be able to get the accurate number for construction.

Lets look at the example above .Lets say Construction cost /m2 is $1700 and it includes GST in the example above and number of units is 4.

The Average built Area is 150 because I’m building 3 bedroom 2 bathroom ,standard finish units .My Total Construction Costs/Unit will be $255.000.

That’s Construction Estimate , I’ll catch you in the next section where we can continue discussing How to Allocate Various Costs In you Property Development Feasibility when using the One Minute Feaso next.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How To Allocate Various Costs In Your Property Development Feasibility Assessment Using One Minute Feasibility?

Sales Value In Lead Developer Suite > One Minute Feaso

Next we move forward to find out the end value of the unit that you are planning on developing on your site.

So if you’re developing townhouses or apartments, a two-bedroom apartment or a three bedroom townhouse whatever you are developing you find to find out how much is it selling for in that area (see picture below).

You need to do a preliminary research and find out that if you were to develop say 10 townhouses on this site, what is the going rate or the market value that you are selling them for?

Now, that’s where this sale value or the GRV, which stands for Gross Realization Value that’s where that kicks in.

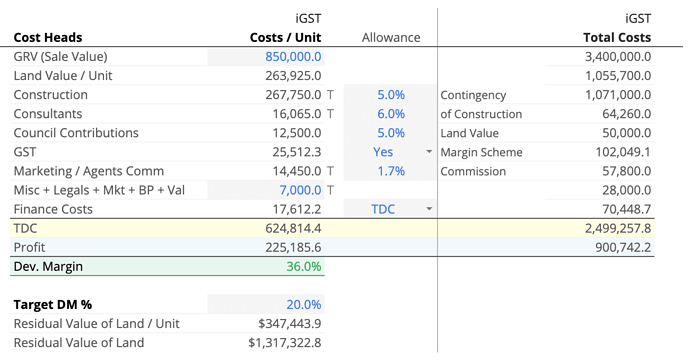

Cost Heads In Lead Developer Suite > One Minute Feaso

In the above picture let’s look at the Costs. In terms of Costs the Land Value per unit gets automatically calculated in the One Minute Feaso you don’t have to worry about it. Construction and Consultants, they are all triggered by these percentages and I’ll go over them in a second.

Then you’ve got Council Contributions or Statutory fees. And I’ll explain what it is in a second too. Moving forward you have Marketing and Miscellaneous Legals. All these are different kind of allowances.

So let’s get into it. In terms of Costs all you need to figure out is that, If you, for example put four townhouses in this area how much will you be able to sell each one of them for.

Now let us assume that amount is $850000. You enter that amount next to GRV(Sales Value) all the other things, they get calculated here automatically for you.

You don’t have to worry about the Value of Land and all the other Cost heads.(Refer to the Example 1 below)

How To Allow For Contingency In Your Preliminary Property Development Feasibility Assessment?

Construction Costs And Allowance

The Construction Costs will get calculated automatically the only thing you need to put in here is a % for Contingency. So if you’ve got 5% contingency in your construction costs, this is what the banks like to see.

Any time you’re calculating Construction Costs and you haven’t got a contingency unit the banks are gonna ask you to actually go and add that contingency . They usually like to see a 5 % contingency in there.

In the example below T stands for GST . If in case you have selected GST the letter T will appear here under the Costs so you know that value includes GST. If GST is not selected the T will not appear.

Allowance% this could be different based on which part of the world you’re from, but a 5 percent contingency is a must must thing to have in your construction costs. So let’s say we’ve got 5 percent contingency here. If it’s 10. I’ll just add 10 over there. If it’s five. I’ll just leave that at five.

Consultant Cost And Allowance

Consultants are usually charged or calculated when you’re doing your broad strokes feasibility or a back of the napkin feasibility or one minute feaso .

The way we calculate the consultants in the One Minute Feaso is (please refer to the example above)

a)Costs for each unit the entire first section on the left , is costs calculated for each unit.

b)The total cost on the the right hand side

In the example above what I’m doing is in allowing about six percent for consultants.

That would include all my architectural drawings, quantity surveyor , if there are all sorts of reports, such as an arborist report or energy report or any kind of other report, **engineering ,**my working drawings , construction issue drawings, all that is included for per unit and is based on the value of the construction.

Diving a bit into consultant costs allowance .Let us assume if your site hasn’t got a permit. So say, for example, you go from blank site that has got nothing on it or a single house on it, and then you want to develop four townhouses on it.

You have to go through a planning process. You have to go through your local government authority or a council. Apply for a planning permit or a development approval, so to speak, or change of zoning.

I think in US it’s called Zoning. When you go through them or I have students in Canada, they say It’s called a municipality in Canada, I think.

When you go through that, you get is a building approval that is what you can actually build on the side, what the setbacks going to be ,how high can the building go, Also those things like the density of it, which is the highest, best possible use of the site.

So if you’ve done my other course, Property Development System courses , I go into a lot of detail, about all those things in there.

But for the purpose of this one minute feaso, we are trying to figure out what our allowance for consultants is going to be I’m going to allow 6% for each unit and on the overall project, about $64000.

Any more than that would be an overkill for a project this size.

Council Cost And Allowance

When you come to Council Contributions. Each council has a different way of calculating this. This would inevitably be applicable to you. Does not matter where you are from in the world.

Because what is happening is you’ve got a site which only has a single house or hasn’t got that main development. That site is actually hooked up with council services or your local government areas, services that are provided. What are services?

There is a storm water , a sewer, all those things, all your water connection and all those things.

Now imagine a site which only has a single dwelling at the moment. The amount of load that it actually generates on the existing infrastructure is not that much. But suddenly you can now put 10 townhouses on it or you can develop a 50 apartment building on it.

Suddenly, that new load is going to be way too much for the existing infrastructure. So your local government or your council or even municipality might ask you to upgrade those services because you are trying to now maximize the site.

So that’s what these contributions are for. We call them Council Contribution, that’s what they stand for.

In Australia, in Victoria, where I’m from, it’s very easy to calculate them. There’s a given percentage but even in Australia if I move from Victoria to Brisbane to New South Wales, they all have a different way of calculating this.

You can easily go on their website or pick up the phone and call your local authorities and ask them how do you calculate these contributions? If you are developing something they’ll give you a formula you can use to calculate these costs.

For the purpose of the One Minute Feaso, you need to calculate these manually because these can’t be standardize.

In the One Minute Feaso you need you can play with this percentage and come up with your council contributions.

GST

With your GST, you would find out whether or not you are going to have a Margin Scheme with it. Margin Scheme is within the scope of this feasibility.

I believe that if you are at the feasibility stage, you would understand what a Margin Scheme is.

It’s a way of off setting and taking off the GST from the land value so that you’re paying GST only on the value additions that you’ve done or the construction, anything on top of the land costs that’s what it is.

So if it applies to you, you select yes or no.

If you’re not sure what this is or you want to understand what this is, you need to get the Property Development System full course to be able to understand, because there is a section where I explain what GST Margin scheme is and how it works and so on, just in a conceptual way so that you can to understand and get your head around, why is this important and why would this apply to you or whether it doesn’t apply to you? .

If there is Margin scheme you select Yes. If it’s not, you select. No. And you’ll see that your GST percent is going to start changing. Now this GST is the net GST liabilities, so to speak.

So it’s not your gross GST that will be collected. You don’t have to worry about how that’s calculated, but it’s calculated the correct way.

Marketing/Agents Commission

Marketing agent’s commission any time you sell your development, these are your selling costs. You go to an agent and you say, look, can you get all these sold?

And the agent say, look, whatever they sell for I charge 2.2 % commission and you put that in there, usually in the area that I operate in it’s about 1.5% to 1.8% so I’ve allowed for 1.7 percent and that’s including GST.

Miscellaneous Allowance

Now, the only other thing that you actually need to manually input is the Miscellaneous Allowance for each unit. If you look at the example above for the entire project is about $28000.

Now these are your settlement costs. So say, for example, you sold 4 units, and a conveyancer or a lawyer is involved in order to coordinate everything with the bank, with the buyer who’s bought your unit.

Somebody would need to coordinate with their **lawyer or their conveyancer in order to coordinate everything where they all exchange all these bank checks with each other, where the money comes back to the developer.

So we need to make an allowance for that

Also there’s our marketing allowance, for example you need to get a hoarding up where you need to get some brochures done, you need to get some photography done you make an allowance for these costs per unit.

If you’re not sure what this total cost is, just go to a blank sheet. Put down some estimates and add them in there. I usually allow anywhere between $7000 to $10000 depending upon the type of project that I’m doing.

So over here I’ve allowed $7000 for that unit and on overall project I’ve allowed about $28000.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

Finance Costs

At this stage, you need to figure out when you are selecting your finance costs, what you need to select is your finance costs the LTV or LVR/ LTV, which is your Loan To Value Ratio .

The maximum money that you can borrow, is your borrow going to lend you the money based on your total costs? So that LTV that we’ve got, which is 60 % for example, or 80 % and so on.

Whatever that percentage is, you need to figure out if that is going to be a percentage of total cost. TDC stands for Total Development Costs is it going to be based on GRV, which is the Gross Realization Value? Can your lender lend you money based on Total sales that you’re gonna make or are they going to lend you money on Total Costs that you got to incur?

So those are the only things that you need to find out. And if you don’t know what these are, all you have to do is pick up the phone, call your broker or call your local bank and say, look, I’m planning to do this development.

What sort of lending do you do? And they will tell you that, OK, we’ll give you a 60 % LVR are or 80 % LVR, . So they you want you can select the right metric, so to speak, total cost or total sale. So think of TDC total costs and think of GRV as total sales.

So you can select any of these two so that you can calculate your finance costs (This will also be be further explained in funding tables under project timeline below).

We will continue our discussion on How to Estimate Your Project Timeline for Your Development Project When Using the One Minute Feaso next.

Continued at…

Preliminary Development Feasibility Assessment [Part 2-2]