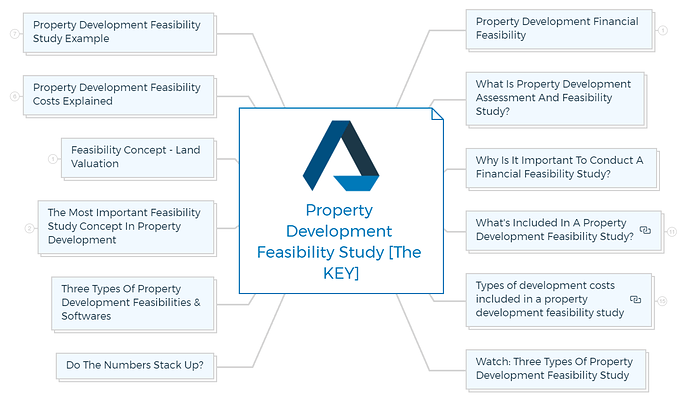

Property Development 101: Feasibility Study

Property development financial feasibility

One of my mentees recently asked me what I thought to be the single most important step in my property development process.

I suspect my response wasn’t the flashy sound bite he was looking for, but I still stand by my answer 100%.

The number one reason why property development projects fail is because of underestimating development costs and developers’ equity contributions. i.e. the money that comes out of your pocket to fund the development per cent.

And just as I did for him, in this article I will share with you an overview of the reasons why a robust feasibility study real estate should be the basis for your property development project.

Introduce you to the concept of a Property Development Feasibility Study and explain how a documented feasibility study plan will help you account for all project costs.

Cost of making a mistake

Developing property is extremely different to run-of-the-mill buy-and-hold property investment strategies. The stakes are much greater, the projects are much more complex and timeframes are much more volatile.

I don’t say this to try to scare you, but rather to stress that the margin for error when developing property is much smaller. Those who do their homework and careful planning will ultimately come out on top.

As Sun Tzu famously quotes in The Art Of War…

The battle is won before it’s ever fought.

Regardless of whether this is your first property development project or your hundred and first, the key to a successful property development project is careful planning and a meticulous feasible study real estate.

And for most developers, planning begins with a Property Development Assessment And Feasibility Study.

What is property development assessment and feasibility study?

You wouldn’t start a business without a business plan, right?

How would you know what legal requirements you need to fulfil? How would you tell if your pricing and sales forecasts are adequate? How would you know what advertising campaigns to run and when?

The same applies to property development.

A Property Development Appraisal or real estate development feasibility study is like a business plan. It helps you deconstruct complex projects and execute them in a manageable and timely manner – with as few surprises as possible - financially.

IMPORTANT

Your plan will help you reduce risks, forecast the investment required by yourself as a real estate developer, manage timelines, get legal and regulatory approvals and prevent bottlenecks.

Just as a property development business plan plays a crucial role in getting various stakeholders ‘on-board’ with a business vision, so too will your Property Development Appraisal And Feasibility Study.

From bankers to builders and beyond – their understanding and support for your project will prove invaluable.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Why is it important to conduct a financial feasibility study?

Preparing a comprehensive study takes a considerable amount of time and effort, but once completed, serves as a project guide, not only for the developer but also for the development team.

In preparing the property development feasibility study you will gain the following benefits:

- Preliminary property development feasibility software – This is the most important aspect and it is imperative that you are able to ascertain if your deal stacks up. This pre-property development assessment will determine an approximate profit and will save you from wasting your time, efforts and money.

- Concept Testing – Cost overruns can cripple a property development project. A systematic property development assessment allows you to make mistakes on paper, rather than when the project is completed.

- Confidence – A thorough feasibility study will increase the developer’s confidence in their ability to proceed with the development. Sometimes, it may even compensate for a lack of experience if the concept is sound and there is good demand for the end product you are developing.

- Finance – Property development feasibility shows the level of finance required and for how long. Under capitalisation and early cash flow problems in a project are two major reasons new developments fail. Feasibility analysis also allows you to convey your ideas to bankers & potential investors, and help them to understand and appreciate the reasoning behind these ideas.

What is a feasibility study in real estate?

In order to make sure that the development project provides a certain level of profit, a financial feasibility study of real estate is undertaken during the initial due diligence phase.

The sole purpose of the feasibility study is to determine the numbers (financial viability) and to evaluate a return from the development.

Property Development Process

One of the essential aspects of the property development process is determining the right place to invest in. Consider the area’s accessibility to public transportation, schools, colleges, stores, entertainment, and its safety.

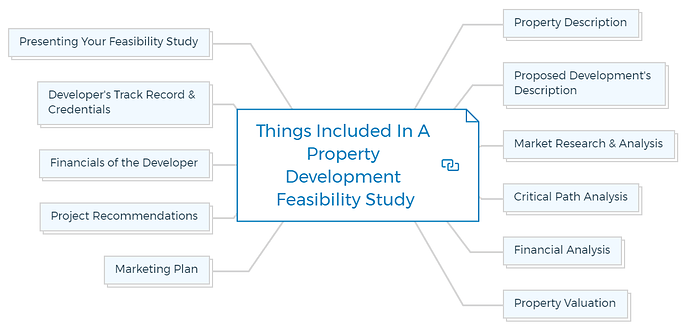

What’s included in a property development feasibility study?

The goal of every property developer is to achieve the maximum potential or highest best use for the development. In other words, realizing the best possible profit they can extract from a development site. A good study helps the developer meet his goals, whether to gain a deeper understanding of the project, establish its viability, or acquire additional funds.

Feasibility study looks into cash flow (the amount of money left after all expenses and costs have been paid) and equity (developer’s money left remaining after paying interests and borrowings).

Usually, a preliminary property development feasibility study is done on a ‘per lot / per unit’ basis whereby the profits and expenses are bifurcated on an individual property basis.

Make sure you include the following in your property development feasibility study…

- Development property’s description

- Details of the proposed development

- Market research & analysis

- Total project costs of the development from start to finish

- Complete financial analysis, including sensitivity levels that accounts for interest rate, cost assumptions and or sale price & vacancy fluctuations

- A real estate valuation [if available]

- A promotional strategy

- A final suggestion

If you are submitting a loan application, you should additionally provide the following information:

- A collection of financial data, such as balance sheets.

- A description of the developer’s background.

Property description

Under this section, you should include the following information:

- The property’s geographical location (a locality map will help)

- Dimensions of the property and its surrounding area (a survey plan will help)

- References to the lot number and title

- Existing improvements, if any, encumbrances such as easements and mortgages.

- Description of neighbouring properties

- Conditions of the soil (a report from a geotechnical engineer might be helpful)

- Town planning zoning and rules

Proposed development’s description

The developer or his architect should produce this part of the feasibility study, which should include the following:

- A general explanation of the project

- An explanation of the proposal’s most significant details

- Plans

- Building’s elevation

- Parts (depending on the magnitude and complexity of the project)

- Perspective, or a three-Dimensional rendering of the project

- A list of the materials used.

Market research & analysis

Market research conducted by a research firm can be costly, and it may only be essential if the project is small enough. You can also perform your research and gather information from:

- Real estate agents working in the development area

- Valuers with experience in the field

- The office of the Valuer-General -

- Housing Industry Association (HIA)

- Journals and newspapers.

The market study should include all of the information needed to support the proposed idea. The following items are required:

- Customer profile

- Demography of the population

- Competition

- The kind of product

- Pricing structure (current and future)

- Material for promotion

Critical path analysis

A programme or critical path analysis can help you formulate capital input and, more critically, cash flow over the project’s life cycle.

A critical path analysis depicts the development process, including the several stages from the concept’s inception to the project’s end.

Your building contractor or quantity surveyor will prepare a development programme and associated cash flow.

Financial analysis

The financial analysis aims to determine the expected return on investment for a project. The development programme and cash flow timing are essential because they will affect profitability.

The majority of developments will only see revenue at the end of the project; therefore, the more prominent the project, the longer the programme, and the more critical the cash flow timing.

A sensitivity analysis should be performed as part of the financial analysis, as this will reveal the project’s worst- and best-case situations.

It is a “what if…” exercise, and the essential variables to examine are: land price, construction cost, and sales and holding costs.

Adjusting the above factors by a percentage, usually 10%, and then recalculating the profitability or internal rate of return (IRR), whichever is suitable, is one way to examine the sensitivity of the development.

Graphed results are used to show the sensitivity of a development’s alterations and their impact on its future value. You may pay greater attention to the most vulnerable changes if you are aware of them, ensuring that the project remains feasible.

Property valuation

A sworn appraisal from a qualified and registered property valuer will instil confidence in your investors. The charge for the valuation can vary depending on the quantity of work that the valuer must accomplish.

An appraisal by a valuer of the property in its original condition and one upon completion, depending on the scale of the project and the quantity of money, investors, or syndication you are attempting to attract, would undoubtedly be more persuasive to the would-be financier or investor.

Marketing plan

Your personal goals will determine your marketing plan and whether you are constructing for rent or for sale. Whatever the situation may be, you and your team should develop a marketing strategy with the help of your marketing and advertising advisors.

This section of your research should include a brief overview of the marketing campaign and a budget estimate. It should include the following:

- The marketing division

- Budget projections

- A study of the current state of the market

- A clear statement of the marketing goals

- The development’s position and distinctiveness from its competitors

- The process of laying out your marketing mix plan

- The market selection, assuring that such a development is in demand

- Essential success factors identification

- To assess if the marketing plan is working, define a measurement system or a checking system.

Project recommendations

It is an executive summary of the project’s development and prospective returns, as well as documentation of the activities you and your team intend to take.

This section should include the following items:

- an examination of the dangers associated

- an examination of the available funds

Financials of the developer

This information is only necessary if you’re looking for a loan and want to demonstrate your creditworthiness.

The development company’s or your balance sheets, any additional assets to support the project, and any references from other lending institutions or traders to verify trustworthiness are all items that should be presented.

Your accountant can supply the most up-to-date returns and financials, which financial lenders require.

Developer’s track record & credentials

This is essentially your resume, and it is necessary if you plan to sell the project. It will also aid in the preparation of a financial application. The data should demonstrate your credibility and ability to carry out the development.

Although earlier development records are valuable references, they are not as crucial as proven management and business skills. It is beneficial to add business and career references, but it is not necessary to include your school grades or athletic achievements.

Presenting Your Feasibility Study

Because several people will see your feasibility study, including the financing authority’s management, your document must be impressive and professional. All research mentioned above and information should be kept in a bound folder, preferably in A3 format.

Color graphics and color pictures are important because they leave a lasting impression. If your work is lengthy, a table of contents at the beginning that refers to numbered pages will help the reader locate relevant information.

Learn More

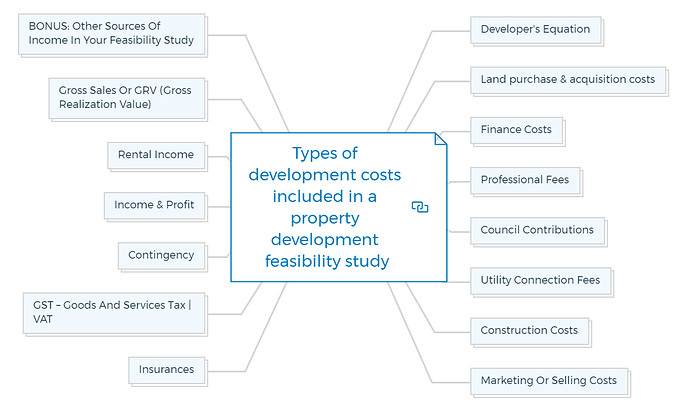

Types of development costs included in a property development feasibility study

IMPORTANT

Developer’s equation

The developer’s equation considers elements such as land costs, building costs, finance costs, and potential profits from the completed project. The following is a representation of the equation:

VALUE = LAND COSTS + BUILDING COSTS + FINANCIAL COSTS + PROFIT

Land purchase & acquisition costs

This includes all costs associated with acquiring the development property/site. For instance, land value, stamp duty, legals (for example lawyers fees/conveyancing fees), rates and tax adjustments.

Finance costs

Can come in two parts, for example, you may want to settle for the development site first and you, later on, you may decide to develop the site.

In this scenario, you can get a retail loan first to settle for the land. Once you are ready with your development approval or planning permit, you can then get a construction loan.

Other fees that become part of finance costs include application fees (usually 1% of the loan amount (different banks charge different application fees and they can be negotiated), establishment fees, bank valuations, and Legals.

Some brokers may charge a raising fee for arranging the loan. All ongoing interest charges starting from the first bank drawdown are also part of finance costs.

Professional fees

These fees must include all fees charged by consultants and professionals. Not all consultants and professionals are used on every project. Professional fees vary depending upon the size of the project.

Some of the professionals required for property development are architects, building designer, civil engineer, Hydraulics Engineer, Structural engineer.

Council contributions

Councils charge for a lot of things. To start with there are two main application fees for residential property development – Development approval or planning submission fees and building permit fees.

Depending upon what you are developing there could be fees for land subdivision, strata title, and rezoning. Councils also charge a council contribution fee also known as development contribution. These fees basically offset the extra load or new load on council infrastructure.

Utility connection fees

There is a fee involved when connecting utilities to a development site including water, electricity, drainage, storm water, telecommunication, and gas.

Construction costs

Are calculated on the basis of the design or the size of the townhouse/dwelling that you are developing. For example, construction costs can be calculated as a per square meter rate or a per square rate (in Victoria) a per square rate is usually the norm (1 square = 9.290304 square meters).

It is important that these figures are REAL when putting together a property development feasibility study, as they can also kill a deal if your figures are off or you can get caught out if you have the wrong fees.

As a developer, you can estimate construction expenses to a degree of precision. You should account for the overall cost to account for increases and decreases in labour and material expenses. These changes can be measured using published construction indexes that support the construction industry.

This category would contain all professional fees and expenses incurred on the project. Expenses for water, electricity, and gas connections, as well as fees for planning and building permissions, should all be included.

IMPORTANT

Total Development Costs = professional fees + construction costs + approval fees + building cost

Marketing or selling costs

If an estate agent is hired to market and sell a property, their fees have to be taken into account. Normally a sales agent commission ranges between 1%-2.75%. What you do need to know is that by law, these commissions are allowed to be negotiable.

Insurances

A necessary expense but not always welcomed. In property development, there are always risks involved due to a large number of people being involved.

It is important to ensure that all parties involved starting from consultants, your own entity, professionals, builders, and their contractors have insurance to cover the project.

As a property developer, you will be liable for insurance when the buildings are handed over, including public liability and insurances against fire, storms etc.

GST – Goods And Services Tax | VAT

When you do the accounting for a property development project, you usually file BAS (Business Activity Statement) monthly. This way you can claim your input tax credits monthly and it keeps your cash flow healthy.

However, you have to pay the GST on the sales of the developed property or townhouses at the end of the project.

Contingency

Like all developments, there are always cost overruns or challenges that are faced by developers. This is a percentage of construction costs that a developer allows for, usually ranging between 5-10%. This percentage is to cover costs that you don’t know about.

A classic example could be a delay in obtaining a building permit, which increases holding costs or a tribunal hearing required to deal with objections.

Income & profit

After your development project is complete and your investment properties available for sale or rent, your profit/income is dependent upon your strategy to sell or hold them.

These decisions are taken even before you get in the project, however, there’s no hard and fast rule, should your financial position change by the time your developed product comes to market.

Rental income

Should you decide to rent out your developed properties, you would have to ascertain the rent per week your developed property can fetch you.

Gross sales Or GRV (Gross realization value)

Is the sum total of cash that you receive after you have sold all your properties. This value is a major component of your income, as this is what you are left with after selling all your development properties.

Banks also use this value to calculate a percentage that they can safely lend against the project. The end sale value of the project is ascertained by the bank’s commercial valuation.

BONUS: Other sources of income in your feasibility study

Are there any other ways of extracting cash from your development site? Let’s look at some cash generation strategies from a development site.

- Existing Trees– does the existing development site have trees on them? For example, if your site has Palm trees they can be sold in the market for up to $1000 each. So if the development site has 10 trees, you are up for $10,000 in extra profit.

- Removing Existing Property– Old and run down houses present on many development sites offer a potential source of cash. There is a wide market for second-hand houses and your existing property if it matches certain criteria can help you generate cash. Relocating an old home can give you anywhere between $15000 - $65000.

- Timber Houses– Old houses made of timber can fetch you thousands of dollars to the tune of $10,000-$15,000. You can easily generate this cash by selling just the timber in the old property.

- Resources & Chattels - Some other ways to generate cash is by selling existing bush rocks, grass turf, soil and other resources & chattels present on the property.

- Interim Rent – Your property development site can be rented, in case you have to wait to get the town planning permits for the property.

All of the above will be accounted for when calculating income and profits for a development project.

Learn More

- Real Estate Market Analysis - precedes feasibility study & must be conducted prior to undertaking financial feasibility.

- Real Estate Development Proforma - Ultimate Guide

- How to choose a property development feasibility template?

Watch: Three types of property development feasibility study

Do the numbers stack up?

If you’re yet to get started on a project or you’re only at the very early stage of vetting a development opportunity and you don’t have hard figures for everything listed above, don’t worry.

Financial feasibilities are an evolutionary process. It is extremely rare for the initial financial feasibility to exactly mirror the final outcome. There are many variables in property development and to keep the financial feasibility current it needs to be updated every time variable changes.

The most important part is to learn from what the numbers are telling you. As tempting as it may be to reflect your ideal outcomes through your figures, the short-term momentum you’ll gain from doing so will only create long-term pain which could have seriously detrimental financial implications for you and others involved in your project.

Remember, your Property Development Assessment And Feasibility Study is an extremely valuable asset for the lifetime of your development project.

In addition to the obvious concept testing to ensure your profitability, this report will boost your own personal confidence and has the potential to open doors for additional finance, approvals, and support from important stakeholders.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

Three types of property development feasibilities & softwares

One solution does not fit all types of real estate development feasibility studies.

When you are simply looking at projects to determine if it has any legs, or whether or not you should spend more time on it - you need a tool that can quickly determine if you should spend more time on it or move on.

That’s exactly what our One Minute Feaso for real estate development does for you. It basically real estate development feasibility in under a minute.

1. Validation Feasibility | One Minute Feaso - also know as a back of envelope feasibility or quick feaso. As a property developer, you cannot afford to spend all the money and time to evaluate every project in detail.

So to make it easier, most developers use a Validation Feasibility that lets them quickly ascertain financial numbers to see whether the project stacks up or not. This feasibility does not require hours to complete.

In fact, with the right tool, it can be completed in under two minutes.

At Property Development System we have gone a step ahead, we created a Smart Feasibility Calculator which sits somewhere in between our One Minute Feaso and Lead Developer - our detailed real estate development pro forma.

If you are looking for a development feasibility application or a property development feasibility template, check out Lead Developer a full suite of property development feasibility Softwares and applications.

It is the most detailed and comprehensive property development feasibility suite on the market.

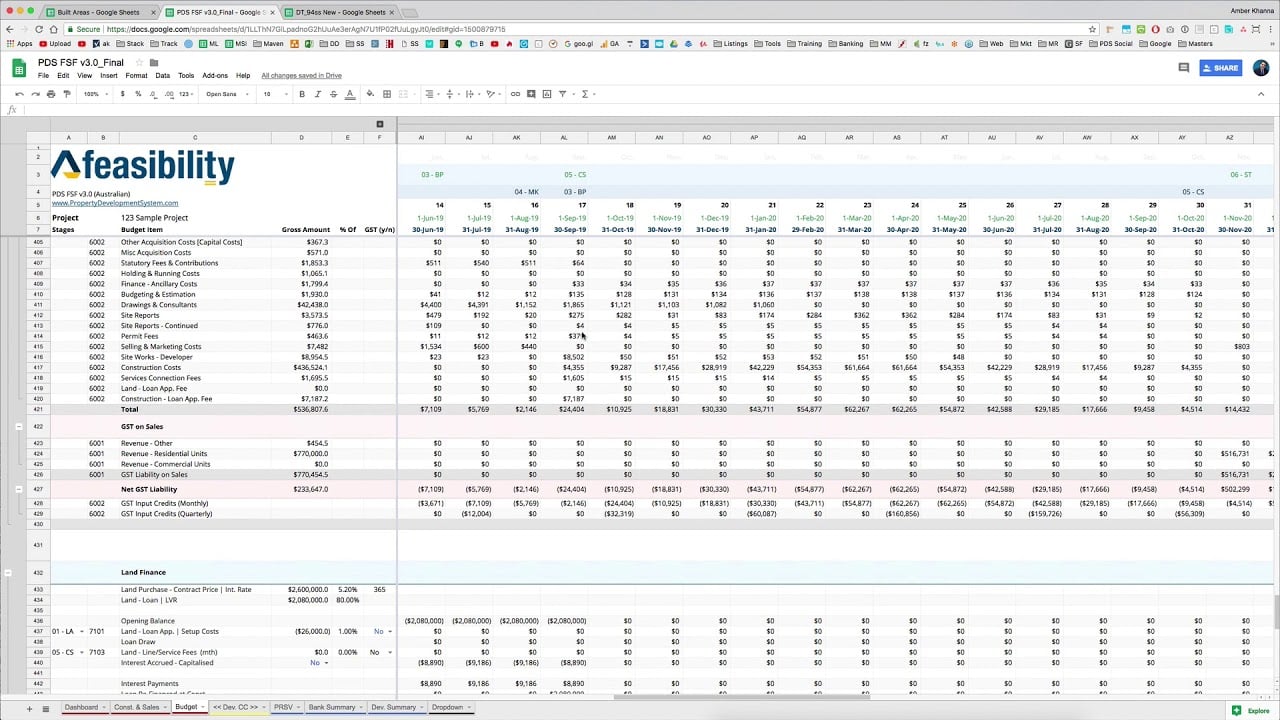

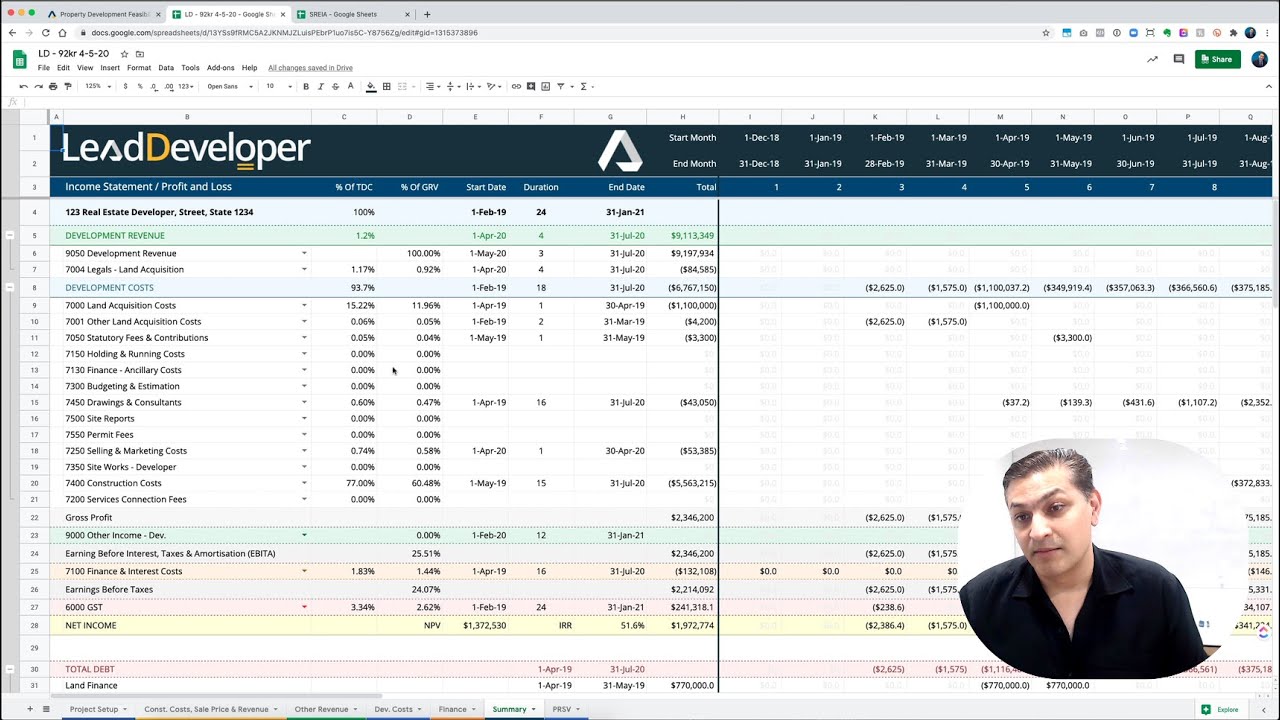

2. Advance Property Development Financial Feasibility - A detailed property development feasibility with cashflow projections and multiple financing options is usually conducted after getting a green light from your Validation Feasibility.

If your Validation Feasibility says this project is financially viable, that’s when you conduct an advance property development feasibility with your project timeline, cash flow projections as well as quotes from your property development team.

This feasibility also forms your baseline i.e. a financially viable result that you have accepted & used to make your decision to go ahead with the project.

Watch: How To Do An Advance Feasibility Using Google Spreadsheets?

3. Financial project tracking - this feasibility is maintained and benchmarked against your advance feasibility throughout the project. All change orders, monthly cashflows & property investment metrics are constantly compared with your detailed feasibility.

You can compare your monthly cash flow projects, costs, project timeline as well as calculate your EVM (Earned Value Management). Check out a list of all my property development courses.

Learn More

Continued at…

Property Development Feasibility Study [The Key] [Part 2-2]