Free Property Development Feasibility Template

How To Choose The Right One To Fit The Purpose

Hi, Amber Khanna here from Lead Developer with some short real-life experiences for you from my actual experiences.

Hopefully, these anecdotes will keep you from using the numerous property development feasibility templates that you find on the internet.

Many people have asked why I created the Lead Developer Feasibility Suite - the property development feasibility software… What’s the story behind all this hard work and dedication?

I’m all about helping you get great results with your development & investment projects. That’s my #1 goal!

But my commitment and dedication to helping you know your numbers and avoid wasting a ton of time messing with free development feasibility spreadsheets and excel templates.

And still not being sure if you’ve got your numbers right goes deeper than that.

So I wanted to share with you my experience & the numerous stories behind the Lead Developer Feasibility Suite so you can understand why I have created multiple Property Development feasibility templates and converted them into a feasibility software suite.

My First Property Development Feasibility Calculator

When I started my career in real estate development, there was no one to show me how the numbers came together.

I had a property development mentor who gave me a two-decade-old version (yep, it was the year 2000 version) of a complex property development feasibility template with no training and no explanation of decision metrics and no method behind the madness.

Believe it or not, I never used it because I was scared of numbers like most people. I hated them & most of all, I hated doing financial feasibilities.

But the ONE THING I wanted to do was real estate development projects. And grow to a level where I could do that for others. I understood very early that if that’s what I wanted to do, there were no escaping numbers.

No matter what, I just had to master the property development feasibility study.

Property Development is the most lucrative property investment strategy under the sun. And at the same time, if you get your numbers wrong, your project has the potential to suck up a whole lot of profit $$$ from your bottom line.

But if this is what I wanted to do, I knew I had to Know My Numbers, as they determined everything

- from what I was going to pay for land (residual value of land) to what I was going to inject from my pocket and precisely what did the project needed to bring it home.

I started with a simple property development spreadsheet on excel - and did my first project, only to find out that I had missed allowing for a big chunk of costs and that so much more was missing from my feasibility template…

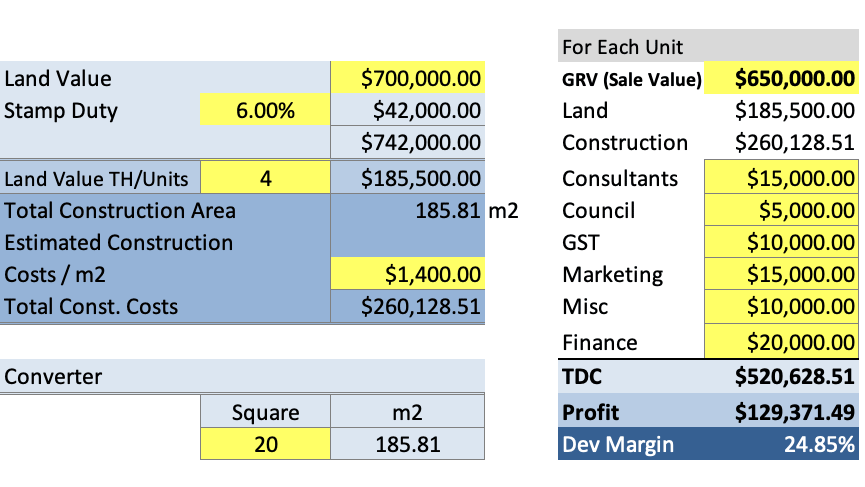

This is what it looked like when I started…(it was like going to war in my underwear. I wouldn’t recommend anyone do this ever.)

Then I improved upon it and did my next project and again realised that my feasibility template calculations weren’t up to scratch. So I improved upon it again & have been doing so since 2012.

I have lost money due to my bad judgements and incorrect feasibility assumptions. My gut feelings, hunches, thumb rules, and ballpark numbers have often landed me in hot soups.

I’ve learned from the university of hard knocks…

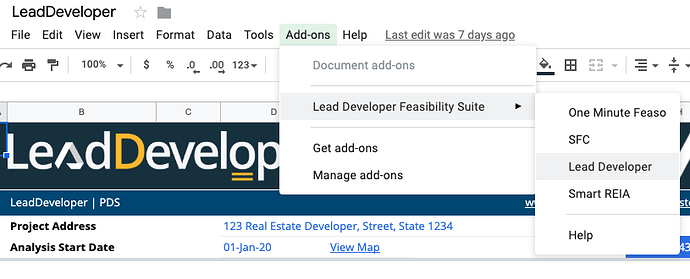

One Minute Feaso - My Back Of Envelope Calculations On Steroids

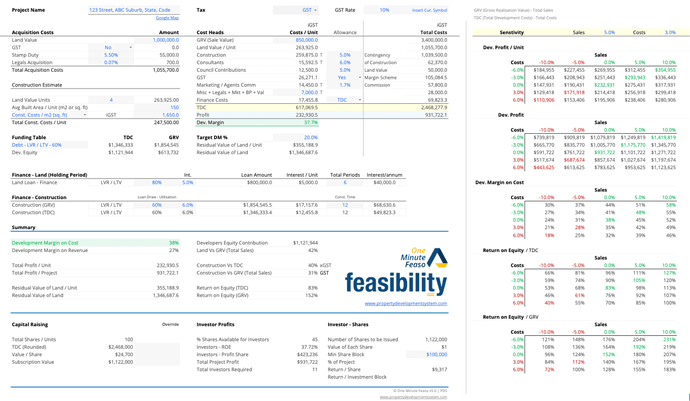

Created after years of iterations, the current version of One Minute Feaso (quick feaso) lets you estimate development margin, stamp duty, the residual land value and much more.

It is so powerful that it even lets you calculate the amount of money you need to raise to do a No Money Down Project.

It gives you the rate of return your investors will enjoy if they invest in your project.

And that’s not all; all property development feasibility software and templates include Sensitivity Tables, letting you see the impact of Costs and Sales on your bottom line at a glance.

My obsession with getting my numbers right got me to do several financial modelling courses to ensure that my calculations were 100% correct.

The Ultimate Back Of Envelope Feasibility

One minute Feaso is Back Of Envelope Calculations on steroids. All calculations are hardcoded, i.e. they are not dependent on formulas, so the chance of accidentally breaking or deleting formula cells is zero.

That’s not all; One Minute Feaso is included with Lead Developer Feasibility Suite because it based on the core components of any real estate development feasibility.

This makes it the perfect feasibility software for anyone who wants to learn property development feasibility.

If you are starting and have no idea about real estate development feasibility, then One Minute Feaso is the best one to begin.

One Size Does Not Fit All

There is no such thing as one feasibility template that’s fit to use for every type of development.

In this journey of obsession with property development and now numbers, I realised that no one feasibility template could accommodate all the scenarios.

A Different Feasibility Template For Each Stage Of Your Development

Preliminary Assessment

Sometimes, as developers, we are in a hurry and don’t have complete information.

However, we still need to decide whether or not we want to proceed with this project and whether or not we should invest more time & resources in this project.

At other times, we have more time and information on hand to refine our project feasibility.

Detailed Feasibility Template

And when we are in the due diligence period, we need to plan our cash flows and think through our financing options before committing to the project.

Investment Analysis

And finally, once the project is complete or when we are buying an investment property, we need to make sure that it is financially viable to hold an investment property that will profit us in the long run.

I have personally experienced these scenarios and have needed to use each of these feasibility templates.

And that’s the reason I created Lead Developer Feasibility Software Suite with an ever-growing library of feasibility templates.

How I Almost Derailed My Project With An Incomplete Feasibility Template.

A few years ago I was doing a 12 Townhouse Project in Melbourne. It was a $9m project, pretty significant for me at the time. From day 1, I was closely watching and tracking the project like a hawk.

I was constantly keeping an eye on the bottom line. I had pre-sold 6 out of 12 Townhouses to meet my lenders’ requirements.

I had already negotiated the loan to cost with a lender, and I was just waiting for a commercial valuation to get the construction loan across the line.

I had done a few projects before; however, never with a top bank. At the time, I only had experience in dealing with hard (shark) money lenders.

They are pretty strict with terms and have higher interest costs, but they usually allow you to borrow more.

But this time, I was dealing with a top bank, and I learned two costly lessons that almost derailed my project.

Lesson 1: Professional Valuations

So here’s what happened…

My first setback was when I got back to the valuation. As you know, major lenders will only consider the value of your project as per a professional valuation or appraisal.

And for a construction loan, the developer always needs a commercial valuation.

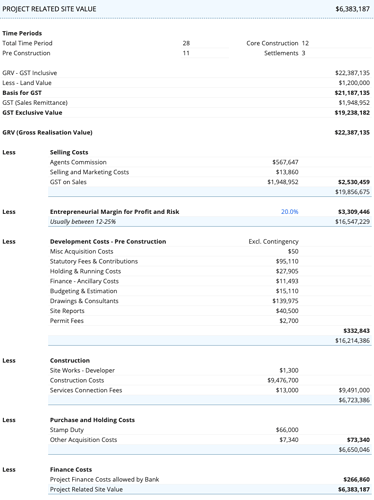

It is also known as PRSV - Project Related Site Value

PRSV = Residual value of land

PRSV is similar to the residual value of the land; however, it is a slightly different calculation method considering GST and VAT if applicable in your country.

The valuation wasn’t where I wanted, so I disputed it with the valuer and the Bank… (I explain everything later down the page).

For now, let’s get to the blunders I made; well it was a NAÏVE mistake. But as you know, NAÏVE mistakes in developments are a big NO-NO.

IMPORTANT

Lesson Learnt

The first thing I learned in this transaction was that a bank will always use its own total development cost. It might have cost you X, but when a lender calculates the total project costs, they may or may not include certain soft costs.

Let me explain; let’s say you allowed 70% of Total Development Cost (TDC) for your construction loan.

What does that mean?

It means that if your TDC is 100, the Bank will fund 70, and the developer will have to come up with 30 to complete the project.

However, if the Bank decides that your TDC is not 100, it is 80 - then that means it will only fund 56 & you now have to come up with 44 instead of 30.

Suddenly you are out of pocket another 14 - which you never accounted for in your feasibility. And that’s exactly what happened to me in this project.

I had done numerous feasibilities and looked at funding tables with shark lenders, but it had never impacted me before. Because shark lenders always allowed me to borrow more.

Well, let’s just say I didn’t sink. I managed to gather the shortfall, some in cash and some in credit, as I was controlling the construction side.

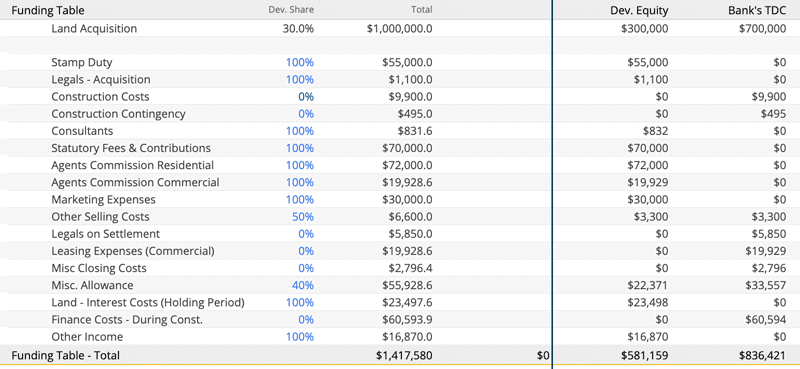

But the lesson I learned in this transaction was that I needed to have a funding table in my feasibility that was flexible enough for me to allocate costs to the developer as a percentage & then come up with what I like to call, Bank’s TDC for your project.

Both Smart Feasibility Calculator (SFC) & Lead Developer - you have 100% flexibility to foresee what could be your BANK’s TDC.

I have never seen a funding table as part of feasibility in any software before, and that’s why I wanted to make sure that Lead Developer Feasibility Suite has everything that developers and investors face while doing projects.

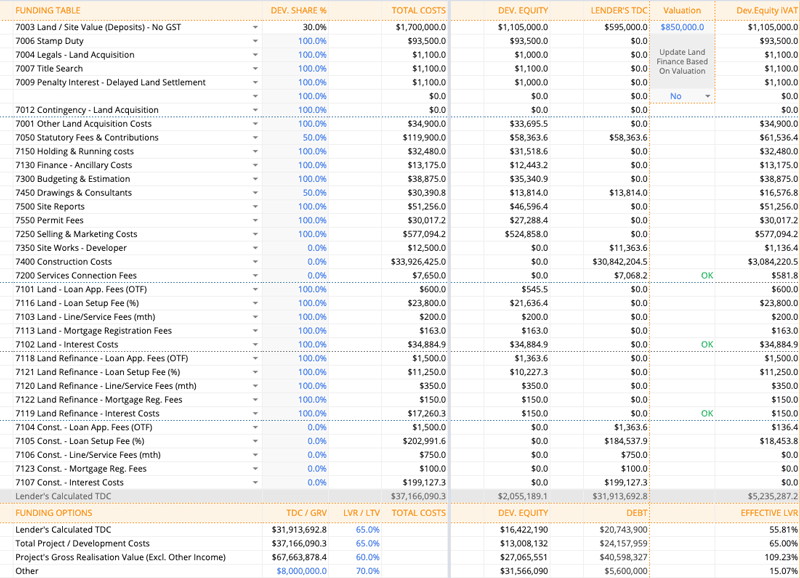

Does Your Feasibility Template Have A Funding Table?

Why Do We Need A Funding Table?

In A Nutshell:

To make sure that we don’t run out of money halfway through the project.

That’s the most straightforward answer. Lenders will always use one, but we plan our development and our cash outflow one step ahead when we use it.

If we have a table that lists all our project costs and we have the flexibility to ascertain if and what percentage of it will get funded, we can estimate the total cost the Bank is likely to consider for our project.

Which will affect what we can borrow, which will directly impact the amount of money that we need to have to do the project.

IMPORTANT

The only way to maximize the return on your own money is by using it as little as possible & completing your project as early as possible.

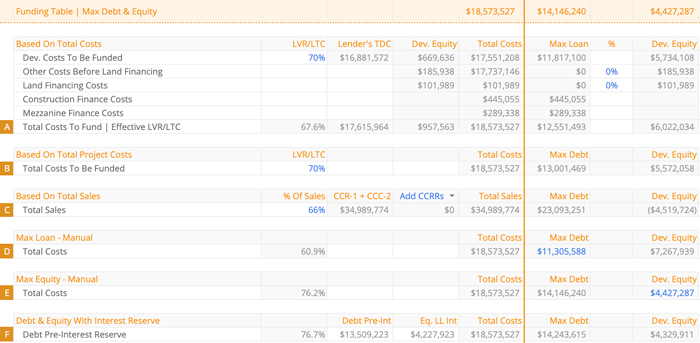

Funding Table in Smart Feasibility Calculator

Funding Table In Lead Developer - full scale feasibility

Funding Table In Lead Developer+ - full scale feasibility

This Breaks Excel Feasibility Templates

This is one concept that takes a while to understand, but it is super important to clarify. And if you try and code it, it will break your excel spreadsheet.

Total Development Costs (TDC) Include Finance & Interest Costs.

The Total Costs for any development project include finance and interest costs, especially for construction. The banks have to allow interest costs as part of total development costs.

Interest costs are calculated on maximum debt

The total interest for the project is calculated on the maximum loan amount or maximum debt that the Bank has approved for your project.

Maximum Debt is calculated based on the Bank’s loan to cost ratio

The maximum amount of money you can borrow depends on the loan to cost ratio, i.e. a percentage of the Total Development Costs of your project.

Has Your Brain Exploded Yet?

I know mine did when I first tried to get my head around it.

This is an infinite loop.

To simplify… This is how it works…

- TDC Includes Interest On Construction

- Interest Is Calculated From Maximum Available Debt

- Maximum Available Debt Is Calculated As A % Of TDC

Got It ?

It doesn’t matter - because you don’t have to worry about a thing…

It’s been taken care of in all Development Feasibility Templates of Lead Developer Feasibility Suite.

You just go about with your business & the code works in the background.

You have no idea how many times I’ve broken an excel template trying to code this loop. But excel templates are not meant to handle these kinds of calculations.

But I made sure that all development templates in our software suite do this in the background without breaking anything.

- One Minute Feaso

- Smart Feasibility Calculator &

- Lead Developer

- Lead Developer+

…were coded go in a loop 10000 times before a probable (most likely) interest cost is calculated for your project.

This is where Lead Developer Feasibility Suite excels against anything that can be built at home using spreadsheets. I have never seen this function in any other software program or any property development feasibility template or excel spreadsheet.

Phew… I need a head massage…

Do you find Property Development feasibility daunting?

Especially the ones with cash flows, financing options… the ones that scare people off?

The Best Development Feasibility Templates Are Designed To Be Your Friend

They have all the features of advanced feasibility software without the “scariness” that comes with them.

You are missing out if you haven’t yet subscribed to our YouTube channel.

A Good Feasibility Template Should Allow For The Following:

- Allows you to customise every cost centre, so you are familiar with the nomenclature.

- You should be able to customise, Tax Codes like GST and VAT - allocate a percentage to them and customise the currency symbol.

- And you should only have to do this once.

- Allow you to project cash flows using an S-Curve

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

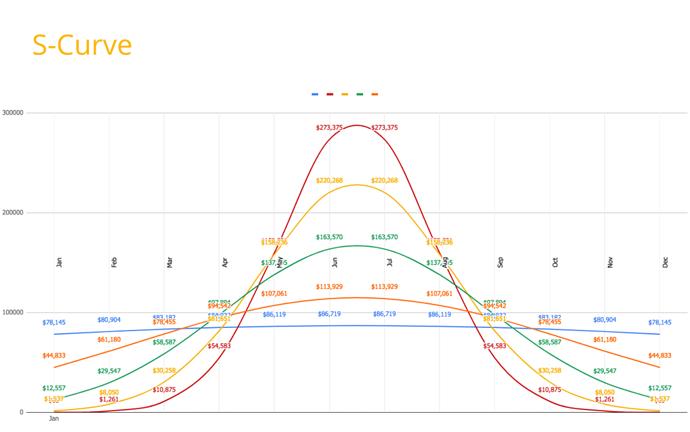

Have You Heard Of S-Curve Distributions?

Now I don’t want to bore you with technobabble, because that’s not my intention.

In Case You Are A Geek Like Me and would like to know more about the mathematical implications of a Sigmoid Function or Sigmoid Curve, feel free to knock yourself out.

For Everyone Else, Here Is A Simple Explanation…

When we forecast development and construction costs to determine our project’s monthly outgoing cash flow, we don’t know exactly how much costs we will need in months 2, 3, 4, 5…. & so on.

So to simplify this process, we project our costs in the future using an S-Curve, which helps us distribute our costs over time.

We need this because…

- It helps us determine monthly outgoings.

- It helps us to find out the amount of money we will need as developers’ equity.

- And it helps us to calculate our interest costs based on the drawdown amount. Interest can only be calculated on the amount your project has used or drawn down. And S-Curve is the best mathematical way of distributing cash outflows over time.

In real estate developments, cash flow is king. And managing it is an important skill.

Not only does a good feasibility template allow you to distribute cash flow using an S-Curve, it should also allows you to select the steepness of the S-Curve

Now, What Does That Mean?

Well, not all cash distributions are equal, some costs are incurred at a more rapid rate than others, and Lead Developer gives you the power to do that.

The image below distributes or expends $1m using an S-Curve over 12 months, but at different rates i.e. according to the steepness of the S-Curve.

In Lead Developer, you can select from 5 different options:

- Flat

- Moderately Flat

- Moderate

- Moderately Steep

- Steep

To forecast your estimates more accurately.

Earlier in the article, I shared with you how Bank’s TDC nearly derailed my 12 Townhouse project…

Lesson 2 - the Double Whammy…

When the Bank used their own Total Development Cost to calculate the maximum debt for my project… I figured a lower debt i.e. more money from my pocket, was my only problem…

But little did I know, there was one more thing that was about to hit me like a wrecking ball…

Construction Interest Reserve

The Bank calculated their approximate construction interest, which was around $160,000 and then deducted this amount from the total debt available for construction…

Did you understand what just happened here (apart from me being hit by the wrecking ball - I fell off the chair )…

Let me explain…

From Lesson 1

Let’s say the actual Total Development Costs for my project were a $100 & I assumed that I will borrow 70% of those costs - i.e. Bank will fund $70 & I have to inject $30 as developer’s equity…

But then Bank calculated their TDC and used $80 as total costs - which meant that Bank was funding $56 & I was funding $44

Here’s the double whammy…

Bank then decides that $16 is the approximate interest on the $56 that they will lend me… so they will deduct $16 from $56 & hold on it to as a construction interest reserve…

This means that the total debt available for construction is now $56 - $16=$40 & $60 needs to come from my pocket… i.e. developer’s equity…

This is what all top banks do… although the loan is approved to you - but they will hang on to the interest reserve and not release it to you as debt…

One way to look at this is, since I am using less debt, I’ll be paying less interest…

However, on the other hand.. It means that you as a developer can be out of pocket mid way… because suddenly you have to come up with cash or equity that you didn’t account for.

Secondly, it brings down your Return on Equity & IRR - because now more money is required by you for the same amount of profit.

Project Related Site Value

Don’t get confused by PRSV, it means the site’s value based on it’s approved development permit or highest best use. This is where most property development feasibility templates fall short.

If you would remember, I wasn’t happy with the valuation because a lower commercial valuation based on my existing permit meant that I would have to chip in more from my pocket.

And as a developer… your aim has to be able to borrow the maximum amount to increase your Return On Equity / IRR.

PRSV or Project Related Site Value is very similar to Residual Value Of Land - and is commonly used by professional valuers in Australia and New Zealand. Where it differs from Residual Value Of Land is in it’s treatment of GST.

I use PRSV to ensure that I will get the valuation I am after, given my allocated costs.

However, if you are only after the Maximum Amount, You Should Pay For Land, based on Its development potential - stick with the Residual Value Of Land.

Enter your target development margin, and Lead Developer will tell the maximum you should pay for the land, based on all the costs you have assumed for the project.

My Dispute With The Professional Valuer…

As I was going through the valuation i.e. PRSV, provided by the Bank’s Appointed Valuer, I was doing my calculations to reverse engineer the valuer’s method of analysis to arrive at the site’s value.

I could figure everything out, except for one little thing…

Entrepreneurial Margin For Profit And Risk

The valuer had allowed for a very high percentage of risk margin in the valuation, which had pushed the land value way down.

I first raised this with the bank manager I was dealing with, who shot me down, saying the Bank has to go with what the valuer says in their report.

So I put it to the Bank differently. I said I could understand every value that the valuer has placed in the valuation.

Some costs are pretty high, but I know where they are coming from, so I accept, but I cannot understand the entrepreneurial risk margin of 24%.

How did the valuer come up with 24%? - if they can explain the logic behind 24%, I would happily accept the valuation.

It turned out that the valuer had used this figure out of thin air & after a few phone calls and emails - the valuer revised this number to 18%, which increased the value of land for me, which meant that I could borrow more & hence use less amount of my equity.

IMPORTANT

Entrepreneurial Margin For Profit And Risk is the same as Target Development Margin

Its job is to put pressure on land value - because, given a certain amount of costs, the only thing that can go down is the value of the land.

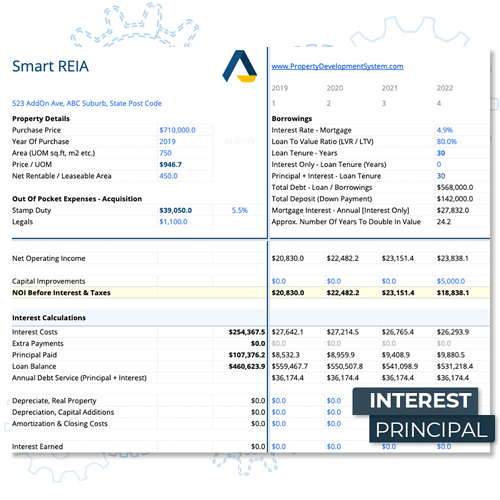

Real Estate Investment Analysis

I have never found this feature in any feasibility template. And this is another reason, Lead Developer Feasibility Suite let’s you have your cake and eat it too…

When You Buy An Investment Property, You Are Not Buying A Physical Property. What You Are Buying Is It’s Future Income Stream. So What You Pay For The Investment Property Must Justify The Potential Income & Cash Flow That It Brings In.

Most Property Investors Are Oblivious Of What This Means For Their Investment Decision.

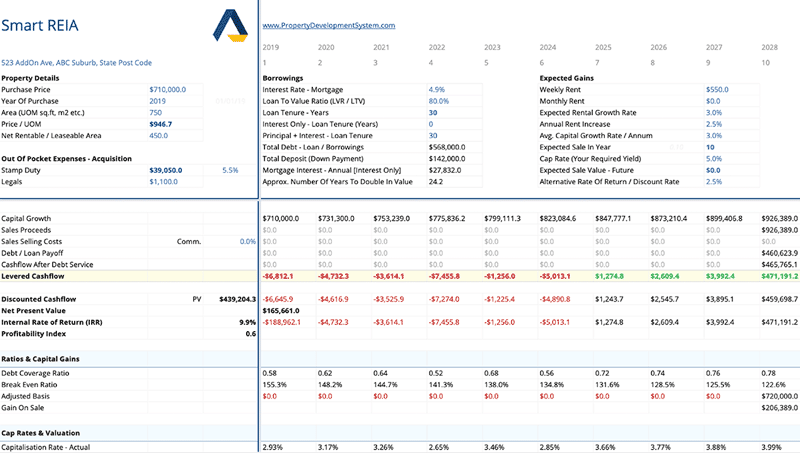

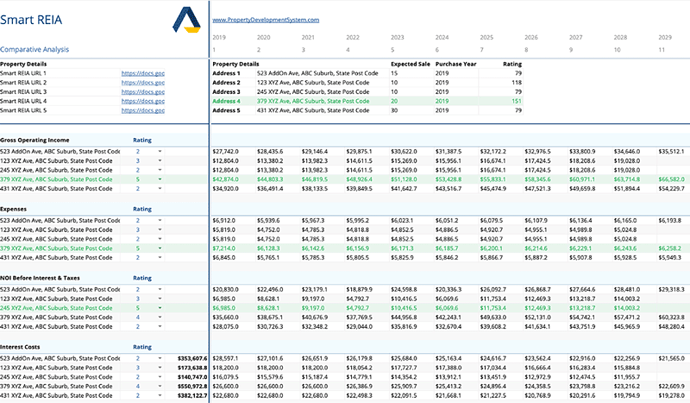

With Smart Real Estate Investment Analysis, You Can Not Only Figure Out Exactly What Your Investment Is Worth, You Can Also Compare Up to 5 Different Investment Opportunities And Make The Decision Based On Facts And Numbers Rather Than Hunches.

Moreover, as an investor/developer, if you decide to keep one of your developed units, you need to figure out whether or not you holding on to that unit as an investment makes sense.

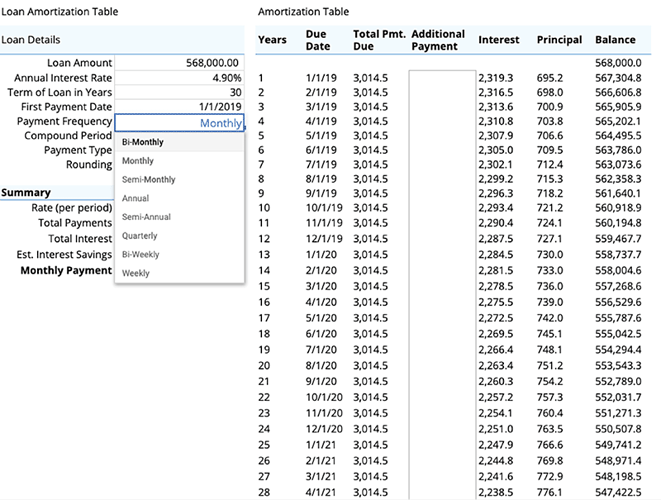

With various options for you to select the best Buy & Hold Finance, Smart REIA helps you truly analyze your investment property…

Not only for yourself, even when you need to entice your end buyers for your development, but you will also need to impress them and show them the actual value of their investment if they were to buy one of the units from your development.

And finally, if you are planning to buy an investment property for yourself and have been looking around various options to buy… you need to be able to compare their cash flows and income streams.

To ascertain which one of the investment opportunities is the best long & short term investment, Smart REIA, lets you compare up to 5 investment properties, so you can grade them and make an informed decision.

Conclusion

Best Practices when selecting property development feasibility template

- Your template should allow you to vet a potential property development deal in under one minute.

- It must have an incorporated funding table to calculate maximum borrowings based on project costs.

- It must include calculations for construction interest reserve

- It should allow you to project your development costs across project timeline using an S-Curve, preferably where you can select the steepness of your S-Curve.

- It MUST give you the highest price you should pay for the land based on its development potential.

- It should allow you to conduct a develop and hold analysis as well as a buy and hold analysis.

Learn More

Because in real estate development the one required skill is your ability to know your numbers, so you can flip, develop or control and property for profit. You need to know your numbers when you…

- Negotiate

- Raise finance

- Impress lenders

- Wow investors

- Do Joint Venture deals

- Do No Money Down Deals

- Creatively structure a deal

FAQs

What is feasibility study templates?

A feasibility study template is a valuable and practical project management tool that assists businesses in researching and assessing the risks associated with a planned project or operation.

Project managers and the relevant department are ultimately responsible for creating a detailed feasibility study template.

Who conducts a real estate feasibility study?

Land development firms and land investors are two types of entities that may consider performing a feasibility study in real estate. If they find the land worthy, both of these bodies will devote time and money to it.