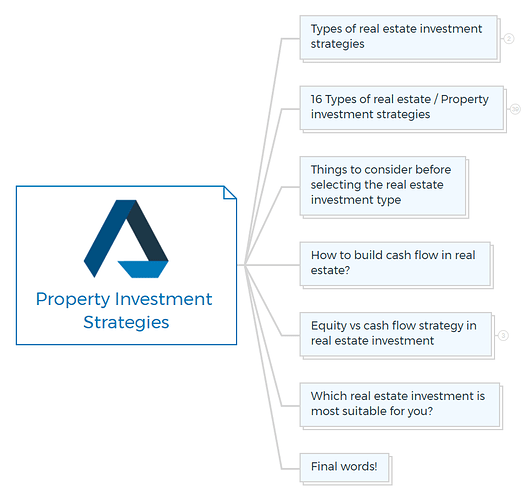

16 Proven property investment strategies you may not know about

Numerous investment options are available to investors to diversify their hard-earned money, ranging from equities to bonds, mutual funds to deposits, gold, and real estate.

Among all, investing in property generates enormous profits as it is the only option that provides Financial Freedom. It allows you to create a solid financial portfolio that increases your cash flow and savings.

If you play your cards well, there are numerous advantages to investing in real estate, which is why it is one of the most popular investments. Real estate is driving people in the USA, UK, Australia, Sydney, and many other countries to become property developers.

Types of real estate investment strategies

When you think of real estate investment, the first thing that comes to mind is buying a property and renting it out. It may seem a most viable option to you, but it is just a drop in the ocean regarding real estate investment types.

Real estate investment majorly falls into two categories that are active and passive.

Active real estate investments

Active property investments require you to contribute money, time, and physical work. Active investments include things like flipping houses and managing residential rental properties.

These investments are often more profitable than passive investments but are also more expensive and risky.

Passive real estate investments

These are property investments that do not need you to own or manage a property personally. REITs and Crowdfunding are known as passive property investments.

These strategies allow you to invest in real estate without putting down a large sum of money or managing any properties.

Let’s quickly dive in and understand the best real estate investment types.

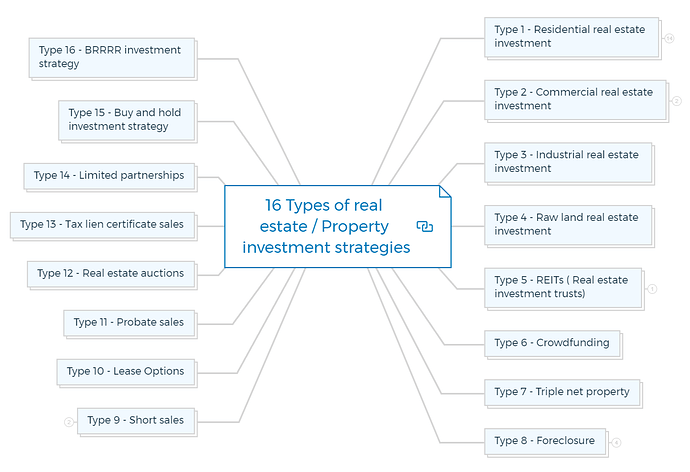

16 Types of real estate / Property investment strategies

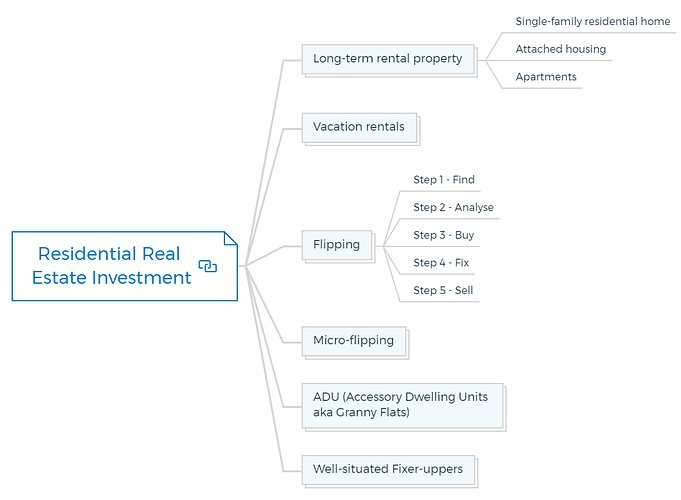

Type 1 - Residential real estate investment

Residential real estate is the most popular investment type in the property development system. It comes in the active investment category, meaning you have money and labour contribution.

Purchasing a property to lease it to someone to live in is a residential real estate investment. This category encompasses a wide range of properties available on the market.

You could buy a family home and rent it to a family, or rent it out as rooms to a range of people who want to share a living space. Alternatively, you may buy a block of apartments and rent each one to a renter, which could result in a significant return on investment.

Another alternative is buying a property and dividing it into two apartments; both can be rented independently. Your choice might depend on your money, the properties available, and the demand for real estate in your area.

There are different types of residential real estate investments that you should know.

1.1 - Long-term rental property

A long-term rental property is a piece of real estate purchased to rent out to tenants for an extended period. This property might be a four-unit multifamily residence to a small single-family home.

As an investor, you profit from these properties by receiving rent from tenants or profiting from increased property value if you choose to sell them later.

When it comes to maintaining a rental property, some real estate investors prefer to live on-site, which is an owner-occupied multifamily property. However, this is by no means needed.

1.1.1 Single-family residential home

Single-family detached homes perform better than attached or shared dwellings as investments. Single-family homes outperform other property types in a good real estate market because:

- Single-family houses attract more buyers because they offer more solitude.

- Attached or shared housing is cheaper and easier to develop and overbuild; hence it tends to value more slowly.

Single-family homes with one tenant are easier than multi unit apartment buildings with several occupants and units. Vacancies cause lost money.

Check your estimated revenue and expenses with 0% occupancy for a few months. One vacancy in a four-unit apartment building (with the same rents) still brings in 75% of the potential gross rent.

Quick Tip

Be a successful landlord by avoiding emotional attachments to your properties. The more a tenant makes your rental property their home, the more likely they will stay and return it in good condition, with less regular wear and tear.

Early profiting from a single-family home’s monthly cash flow is difficult. Such properties sell for a premium relative to their rent. When you have one tenant, you have no rental income.

1.1.2 Attached housing

As the land cost has risen in many locations, attaching several housing units to a given site makes housing cheap. Property investors that don’t want to deal with building maintenance and security choose shared housing.

- Condos - Condominiums are apartment-style properties offered to individual owners. When buying a condo, you buy the unit’s interior plus a proportionate interest in the standard facilities, such as the pool, tennis courts, grounds, hallways, and laundry room.

The homeowner’s association owns and maintains the common areas and building structures.

CAUTION

Avoid investing in condominiums that have been converted from apartments. Although they’re generally the most economical housing options in many country places and may have a great urban location, they may have some hidden issues.

These converted apartments are usually older properties with aesthetic updates (new floors, appliances, landscaping, and paint).

- Townhomes - Townhomes are a hybrid between an airspace-only condo and a single-family dwelling. Like condos, townhomes share walls and a roof. Townhomes are two-story dwellings with a small yard that offer greater privacy than condos because no one lives above you.

Before buying, you must read the governing paperwork to know what you legally own.

Townhomes are organized as planned unit developments (PUDs). Each owner has fee simple ownership of his unique lot that comprises his dwelling unit and frequently a tiny section of nearby land for a patio or balcony. Each owner owns a proportionate amount of the common area, part of a larger property.

- Co-ops - Co-ops are communal housing like apartments and condos. You receive a stock certificate representing your building share when you acquire a cooperative, including usage rights to a specific living area per a documented occupancy agreement.

Unlike a condo, co-op associations must approve unit remodels and rentals. In some co-ops, you need association approval to sell your unit.

1.1.3 Apartments

Apartment buildings have good long-term appreciation potential and positive cash flow in the early years of ownership. Like a single-family home, you’re responsible for apartment building maintenance.

In real estate financing, apartment complexes are separated by several units:

- Four or fewer units: Because they’re considered residential real estate, apartment buildings with four or fewer units have better financing alternatives and conditions.

- Five or more units: These are classified as commercial property and don’t enjoy the preferential lending terms of one- to four-unit complexes.

Apartment complexes, especially those with more units, create a tiny positive cash flow even in the early years of rental ownership (unless you’re in a pricey market, where it may take two to four years to break even before taxes).

Quick Tip

Converting an apartment building into condos might enhance value if allowed. This transformation involves knowledge of zoning and remodeling/construction costs.

Real estate development and investment come with inherent risks. To be a successful property developer, you should know the secret the managing and calculating risks in property development.

1.2. Vacation rentals

Vacation rentals are similar to long-term rental properties. You acquire a home, usually in a touristy area, and then rent it out (typically short-term) to tourists who will only be staying for a few days.

Because you or someone who works for you will constantly have to supervise the home’s upkeep between guests, this can be a more labour-intensive residential real estate investment.

Most people buy a vacation property for consumption, not investment. Owning a second house might be profitable.

Second-home expenses include mortgage interest, property taxes, insurance, repairs and upkeep, utilities, etc.

Most people don’t rent out their vacation homes; therefore, they don’t add to real estate investors’ returns. If your second house is in a holiday region, you or your property manager can rent out the property.

Quick Tip

Here are some tax tips from the tax code:

- If you keep your vacation or second home as personal property, you can still make tax-free cash on the side. You can rent your home for up to 14 days a year tax-free.

- You can deduct mortgage interest and property taxes as with other personal properties.

- If you keep the property as a rental (you rent it out more than 14 days a year), you can still use it as a vacation home for up to 14 days a year or 10% of the days gainfully rented, whichever is more significant, and it still counts as a rental.

1.3. Flipping

One of the most active investments you can make is flipping a house. When you flip a home, you buy a fixer-upper that needs a lot of work, then fix it up and sell it.

It is risky because you’ll have to put a lot of your own money into the house, and there’s a possibility you’ll run into further issues and lose money instead of making money. However, if everything goes according to plan, you could make thousands of dollars from the sale.

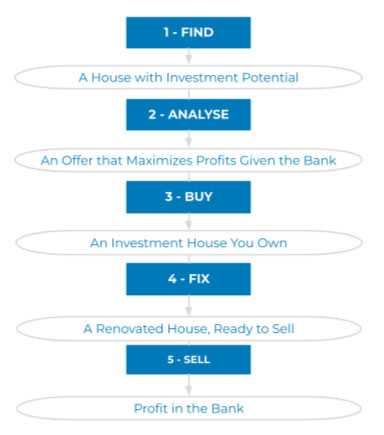

Here is a brief of the different stages of flipping in real estate investment.

You are missing out if you haven’t yet subscribed to our YouTube channel.

The Five stages

Step 1 - Find

You’ll define your unique investment criteria for selecting a house at the start of this step, including price range, acceptable condition, and location.

You’ll develop and implement a strategy to find potential investment properties, which you’ll approve or reject based on your criteria.

Most properties will not make the cut, but those that do will progress to the Analysis stage.

The result is a house with investment possibilities.

Step 2 - Analyse

The actual testing begins once you’re standing in front of a house that fulfills your criteria.

To optimize your profit, you’ll need to decide which renovations to do, prepare a detailed and precise improvement budget, and figure out how much you can sell the house for once it’s been fixed up. You’ll come up with a viable offer by analyzing these numbers.

As a result, an offer that optimizes revenues while minimizing risk.

Step 3 - Buy

This stage begins with your offer to the seller and ends with your decision to abandon the flip. After accepting an offer, you’ll hire professionals to do a final inspection of the property, including a professional inspector and maybe an appraiser to double-check the statistics.

If everything checks out, you’ll close on the house and move on to the Fix stage.

The result is you own an investment property.

Step 4 - Fix

The step-by-step building plan you’ll create in this stage depends on the improvement budget you generated in the Analysis stage. Your ability to implement the plan swiftly and fully determines your profit.

Any big blunder can reduce or eliminate your earnings; thus, following a step-by-step improvement approach is essential.

The result is a refurbished home that is ready to market.

Step 5 - Sell

You are set up for success in this final stage if you found a good buy, completed the correct analysis (including a realistic selling price), and successfully implemented your development plan.

You can increase the earnings from your flip by adding effective marketing and some well-chosen finishing touches.

Result: Money in the bank

These five levels correspond to the five hats you’ll wear during a flip. Each one symbolizes a primary concentration area and skills you’ll master.

1.4. Micro-flipping

Micro-flipping is a less extreme variant of flipping a house where you buy homes for less than their potential market value and resell them rapidly, usually without extensive modifications. Micro-flipping is less beneficial than traditional flipping and comes with less risk.

1.5. ADU (Accessory Dwelling Units aka Granny Flats)

ADUs, or accessory dwelling units, are additional living spaces on your property that you rent to a tenant, usually a family member. Examples of ADUs are granny flats, basements, and sheds transformed into tiny dwellings.

Operating an ADU is often less expensive than maintaining another property, so it’s an excellent alternative for individuals looking to generate some ongoing passive income from their current residence.

1.6 Well-situated Fixer-uppers

Serial home selling is a variation on the tried-and-true real estate investment technique of buying well-located fixer-uppers and adding more value than they cost.

To get the entire homeowner’s capital gains exemption of up to $250,000 for single taxpayers and $500,000 for married couples filing jointly, you must live in the fixer-upper for at least 24 months.

For example, you buy a fixer-upper for $275,000 and use the following 24 months to invest $25,000 in improvements (paint, repairs, landscaping, appliances, designer items, etc.) and sweat equity.

After transaction charges, you can sell one of the nicer homes in the neighborhood for $400,000 net. Your $300,000 investment ($275K + $25K) yielded a tax-free $100,000 profit.

You’ve averaged $50,000 yearly, which isn’t bad for a tax-free second income without office hours. Many states also let you avoid state income taxes on the sale of your home, using many of the same rules as the federal government.

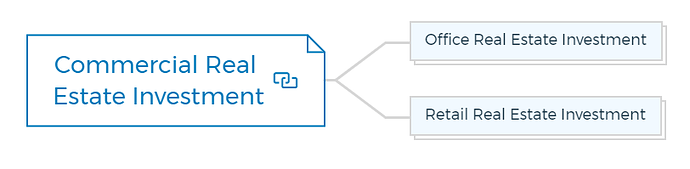

Type 2 - Commercial Real Estate Investment

2.1 Office Real Estate Investment

As it is clear from the name, office real estate investment is the acquisition of office space that is rented to a company for an extended period. Business leases are often long-term, which means that once you’ve found a dependable tenant, you won’t have to worry about your investment for a long time.

The advancement of technology and everyone’s reliance on it gives rise to several organizations needing office space.

Property developers with several offices in their portfolios can benefit from this type of property investment.

Be cautious while investing in this commercial real estate project because it is one of the first victims of an economic downturn. Even though most leases are for an extended period, a corporation might go out of business overnight, leaving you without a way to pay your rent.

The situation becomes worse if you discover that the firm owner has not been held personally accountable.

Learn More

2.2 Retail Real Estate Investment

The second most common commercial investment is - retail real estate investment. You will hardly find any big city without a shopping mall or a series of shops on the main street. Even small towns have developments in shops, cafes, and restaurants.

Not every business owner can afford to buy their property, especially when they are just starting. It simply indicates that there is a strong demand for firms looking to lease space. A lease will be created for a certain period and at a set rate, with predetermined times when the rent will be reviewed.

Once the property has been leased to a business, this gives the investor some peace of mind. It would help if you hunted for either a single property or a group of properties; property developers with a substantial sum of money would prefer to buy the entire mall.

During my early days in the real estate industry, I feared investing in and through property development. It occasionally prevented me from making a huge decision, and I began to observe several other investors.

I want to share my observation on why so many property investors fail to replicate their investment success as developers. You can also take what I’ve learnt from their blunders and apply it to your own success.

Learn More

Type 3 - Industrial real estate investment

All lands, buildings, and other structures that accommodate industrial-sized activity are considered industrial real estate. Most industrial properties are less expensive to buy than residential, office, or retail assets.

It is because the average industrial unit is wholly unfurnished and only has access to power and water. Production, assembly, warehousing, manufacturing, research, and distribution of commodities and products are examples of industrial-sized activities.

Businesses choose these units because they may modify the space to meet their specific needs; this is usually less expensive than adapting an existing setup. Industrial real estate investment could be the best option for first-time investors as it requires low operating costs and little management.

When looking to buy an investment industrial unit, location is quite essential. It should be conveniently accessible near a good road network, rail, or maritime routes. Moreover, industrial development must not affect residential or neighbouring areas during its activities. It’s also crucial to ensure that a potential building has enough height clearance for forklifts or other machinery that a company might want.

Are you scared about getting started in real estate development? Enrol in QuickStart Property Development Course. The quickest way to grasp the fundamentals of real estate that are essential for your every development project.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

Type 4 - Raw land real estate investment

The type of property that has nothing on it is raw land. Developers commonly refer to this type of land as undeveloped or agricultural land.

Many property investors believe raw land to be a desirable investment option because it has finite resources and is less expensive to purchase than developed land. I recommend a land loan to buy land for planning and development.

Investing in raw land also saves you the effort of renovating and worrying about stolen or damaged property. There is no need for property insurance in this type of investment. This investment type has the disadvantage of not generating revenue on its own.

Savvy investors have made billions of dollars by taking the raw property, getting the proper entitlements, and then selling the plots to commercial and residential real estate developers (primarily home builders). Investing in land requires:

- Do your homework - It would help if you bought land in a fast-growing location with a housing and land shortage. Learn the area well. You shouldn’t follow the advice to buy property in another state. Nor should you buy raw property because you heard an attractive opening bid price for the government excess land sale.

- Know costs - To estimate your annual cash drain, total your annual carrying costs (such as real estate taxes). Will you be able to fund your tax-advantaged retirement accounts completely? If not, consider missed tax benefits a cost of land ownership.

- Identify land improvements - Engineering fees, map and permit expenses, running utility, water, sewer lines, roads, curbs and gutters, landscaping, etc., cost money. Suppose you plan to construct on the land you buy, study costs. Improvements usually cost more than expected, so don’t create optimistic estimations.

- Know zoning and environmental regulations - Developing land increases its worth. Never buy land without knowing its zoning and what you can build. It also applies to environmental limits that may be in place or come into force without warning, reducing your property’s value (with no compensation).

Type 5 - REITs ( Real Estate Investment Trusts)

REITs, or real estate investment trusts, act as trusts and manage various real estate investments. REITs, unlike many of the other possibilities, are considered passive investments.

Instead of owning assets, you can invest in a REIT and get income from the properties the company manages. Real estate investment trusts are real estate investments that outperform the market, resulting in higher returns on your investment.

You can choose from various REITs in Australia to better leverage your portfolio, including retail, office, healthcare, residential, and mortgage REITs.

Public vs Private REITs

REITs often have conflicts of interest that aren’t disclosed or pay above-market fees, which lowers cash flow and ROI. REITs listed on major stock exchanges must meet SEC reporting standards.

- Public REITs trade daily on a stock exchange so investors can buy and sell at will. Liquidity, like other liquid investments, has its downsides. REITs may encourage frequent transactions due to emotional decisions or market timing.

- A public business must have independent directors. Shareholders elect directors.

- REITs must publish quarterly financial reports like other public firms.

Unless you’re an educated, experienced real estate investor willing to perform extra homework, avoid private REITs. Private REITs don’t have transparency obligations because they’re not publicly listed.

Continued at…

Property Investment Strategies [Part 2-2]