Continued from…

13 Golden Rules Of Investing In Commercial Real Estate [Part 1-2]

Rule 8 - Love Your Deal And Add Value To It

One of the most common mistakes investors make when purchasing or investing in real estate is falling in love with the property. When it comes to commercial real estate, the tenant and the lease are usually the most critical factors.

The house could be useless without a renter – or it could be a fantastic opportunity. It is entirely dependent on your level of education and experience.

You’ll have to wait for inflation to raise the value of your rentals and, consequently, the capital value if you acquire a wholly leased commercial property at a fair market price.

Alternatively, suppose you acquire property with some vacant space, below-market rents, unused rooftops, unleashed storage space, and various other attributes that you can do something with.

In that case, you may swiftly swap your ideas, thoughts, energy, and passion for significant sections of capital value. Ultimately, it is you who plays a critical role in the real estate you buy.

Rule 9 - You Only Need One Single Deal To Make Dollars

You can make a million excuses, or you can make a million dollars.

A serious property developer will opt for making million dollars. But what does it take to earn handsome money? JUST A SINGLE DEAL.

Commercial real estate isn’t always about numbers, where the more properties you purchase, the better your chances of becoming financially independent.

Two deals are better than one. Focus on one commercial property and manage it well rather than juggle five different projects and barely track who owes how much rent.

Mastermind your first and subsequent property development and create your successful property development strategy.

Rule 10 - The Tenant’s Ability To Pay Rent Limits The Property’s Value

This commercial real estate development rule defines the cap rate differently. If you can’t find a tenant for a building, it won’t be worth anything, and no bank will offer you money to buy or refinance it.

Your capacity to build a portfolio, as well as the value of that portfolio, is contingent on your ability to find steady, long-term tenants.

More specifically, the value of a building is not solely determined by how much one tenant pays in rent. What if that one high-rent renter left? The worth of a building is determined by the amount of rent you can persuade any renter to pay in an acceptable amount of time.

As a result, always strive to improve the environment for current tenants—it will make them less likely to quit. It will be much easier to find replacement tenants if they do depart.

Rule 11 - Ensure You Have A Contingency Fund

Any investment entails some level of risk. Unknown factors will always impact your overall yield, no matter how much study, verification, or preparation you do. Accounting for cost contingencies is one strategy to mitigate this risk.

You can set aside additional funds as part of your initial acquisition cost to cover unexpected expenses such as rent increases, management changes, renovations, rezones or building costs. These funds can be used to cover debt service costs until the property stabilizes.

If there is negative cash flow, cost contingencies can be very helpful. They also help to improve the property’s performance. Commercial real estate has a standard contingency budget of 5%-15%. However, this will depend on the asset and sub-performing properties.

Learn More

Rule 12 - Choose Your Associates Carefully

Even if you have a great team of lawyers, real estate agents, accountants and private detectives, crooks are hard to beat. Even if you win the case and get what you believe you owe, the scammers may have taken something else.

Not to mention the time and effort you spent dealing with them in the first place and cleaning up afterwards.

Only one solution is available: Work with ethical people. Although you may not make as much money quickly, it will last longer, and you will feel happier about it.

The most significant advantage of dealing with ethical people is that they are more likely to be friends with other ethical people. A

s you grow in your circle of friends, you will find yourself surrounded by people who are more open to fairness, kindness, compassion, and awareness.

Rule 13 - Invest In Commercial Real Estate With No-Money

Last but not least, learn how to invest in commercial real estate with no money. This last commercial real estate investment rule has transformed many developers’ lives. However, very few are able to execute the no money down investment strategy.

Spend time learning how to structure deals, negotiate, run a number of projects so you can put together investment projects for yourself and your investors in a way that requires little or no money investment from your side.

If you would like to learn more about investing & developing residential and commercial real-estate with little or no money, click here.

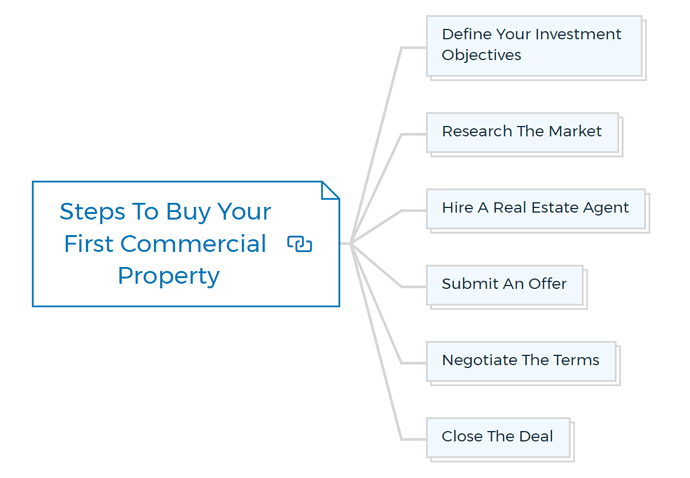

How to buy your first commercial property?

The process of buying a commercial property can be complex, so it’s essential to do your homework and work with a qualified real estate agent or broker. Here are the basic steps you’ll need to follow:

Define Your Investment Objectives

What are you hoping to achieve by buying commercial properties? It will help you focus your search and narrow down the options - the later section of this blog details 8 primary property investment objectives and ways to achieve them.

Answering the following questions will help you understand what type of commercial real estate to buy and where and how?

- What is the purpose of the property?

- What is the location of the property?

- How much space does the property have?

- What is the condition of the property?

- How old is the property?

- Do you want a lucrative cash flow?

- Do you want a profitable total yield?

As an individual investor, you must determine what your primary objectives are.

- Is it to generate a positive cash flow?

- To generate a profit in the long run? It’s worth noting that a high initial yield often translates to a small capital gain. The total yield is a combination of both income and capital gain.

- To be able to save money on taxes?

- To protect yourself against inflation?

You may want to accomplish all four of them, though one or two of them will likely be more significant than the others. Make sure that property is the best way to increase your wealth.

Two of your primary concerns will be to

- safeguard your first investment.

- reap a valuable, long-term benefit from it.

If these are your primary concerns, the investment options available to you are likely to be limited. That is why making a plan and sticking to it is so important.

Research The Market

Get familiar with current market conditions and prices for different Commercial real estate properties. It will give you a realistic idea of what you can afford. Check out this 13 Easy Steps Real Estate market analysis blog for researching the market.

Hire A Real Estate Agent

A good agent will have extensive knowledge of the local market and can help guide you through the buying process.

Submit An Offer

When you find a commercial real estate property you’re interested in, submit a written offer to the seller.

Negotiate The Terms

Once the offer is accepted, you’ll need to negotiate the final sale price and other transaction terms. You can seal a great deal with these 7 real estate negotiation tactics.

Close The Deal

Once all of the negotiations are complete, you’ll need to finalize the purchase by closing the deal.

Dos And Don’ts Of Commercial Properties Investing

Here are some “dos and don’ts” that have survived the test of time:

- Keep enough cash on hand to cover several months’ worth of mortgage payments if you lose a tenant or if the tenant is late in paying. Having enough cash to satisfy any due or unplanned obligations cures investment sleeplessness faster than anything else. Keep an eye on more minor expenses as well, such as equipment and maintenance bills, as they may quickly mount up.

- Make an investing plan that you are comfortable with and stick to it—set attainable goals and work toward them. More goals have gone unachieved due to a lack of planning than a plan’s failure.

- Invest in a solid financial calculator or software application like the feasibility suite and learn how to use it correctly.

- Continue your quest for education by following real estate news and laws, attending seminars, and keeping up with current trends. Knowledge can help you reduce your risks while increasing your income.

- Hire a top property consultant and a capable property lawyer, and hire means to pay for their services. To get back what you pay them, they should get you better deals than they charge you.

- If feasible, avoid personal liability on mortgages by making the property your sole security.

- Only put a modest portion of your money into speculative ventures. On the way in, they may appear dazzling, but on the way out, they are frequently painful.

- Never make a contract based on a handshake; instead, put your agreements in writing.

- Consult with your retained advisers before entering into joint ventures or partnerships.

- Avoid mortgages where there is an influence of factors outside your control on the payments. Don’t take out all of your mortgages at the same time. At the very least, have a 50/50 split of fixed-rate and variable-rate mortgages.

- Don’t invest in commercial real estate properties with significant negative cash flows (i.e., where your expenses far outnumber your income).

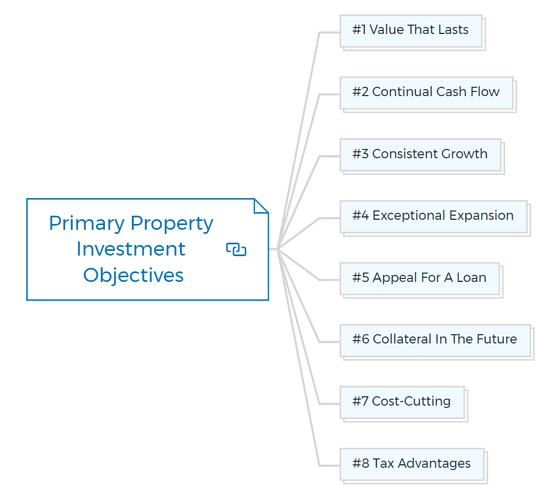

8 Primary objectives of commercial real estate investing

Now that you’ve worked through some ‘big picture’ difficulties to help you clarify your overall approach, it’s time to create a list of particular goals and buying criteria. It will assist you in finding suitable commercial real estate properties within your price range.

There are eight goals for commercial real estate investing.

When developing your investment strategy, you may choose to change the particular order of significance for the following set of objectives.

It’s up to you to figure out how they’ll fit into your overall plan. Furthermore, you are likely to have competing objectives, necessitating the development of strategies and procedures to determine how you will achieve each one.

Let’s look at some of the leading financial goals that have lasted the test of time. The property in question should:

- Be valuable in the long run

- Maintain a steady cash flow

- Maintain a stable rate of growth

- Encourage super-growth

- Keep the loan appeal going

- Come up with future collateral

- Provide for expense control

- Provide tax benefits.

#1 Value That Lasts

If you’re a long-term investor, you’ve probably already learned from my articles that a property’s enduring value - remaining appealing even after many years and multiple tenants change.

It links with understanding current trends (both cyclical and emerging) how they will affect different property types and time frames. As a result, the enduring value should be at the top of your priority list.

#2 Continual Cash Flow

An investment in a prime location that does not guarantee steady income will not assist you in meeting your monthly mortgage payments. As a result, anytime you plan commercial real estate investing, you should always look beyond the first few years.

That is why it is critical to developing a marketing plan from the start. When it comes to selling or re-leasing the property, you should be able to choose from a variety of possibilities.

#3 Consistent Growth

Although inflation has been under control in recent years, you should ensure that each investment provides you with consistent and predictable capital growth.

The type of property will depend on the location and the anticipated market for that property at the time.

#4 Exceptional Expansion

With a good consultant, you’ll occasionally find investments that offer real growth potential above and beyond the market average. It can happen as a result of a clever change of use. Componentization can result in subdivided properties.

Always be on the lookout for hidden jewels that might help you boost the total worth of your portfolio.

Furthermore, as you gain a deeper understanding of the influence of your buying criteria, you’ll be able to zero in on exactly which properties might provide you with this type of rapid development.

#5 Appeal For A Loan

To keep your lender happy, make sure you have a steady cash flow, long leases, minor maintenance requirements, and a desirable location. It would help if you began to consider each of your potential investments from a lender’s perspective.

That way, you may be confident that practically every financial pitch you make will be successful.

Learn More

#6 Collateral In The Future

It is critical to be able to borrow money right away. To reassure your financiers and underpin your future borrowing capacity, you must also look a little further ahead to when should you consider a piece of your core portfolio as being retained for the long term.

#7 Cost-Cutting

Even if your rent money is secure, you should look for properties with net leases wherever possible (where your tenant pays all the building outgoings).

What is the significance of this? Because without careful management, your property’s operational costs (such as rates, taxes, maintenance, and service contracts) may unexpectedly arise, affecting your overall return.

As a result, you must defend yourself on two fronts. Controlling costs is equally as effective as raising rentals to improve your bottom line.

#8 Tax Advantages

You should view tax benefits as a subsidiary rather than the primary purchase motivation. There’s no denying that depreciation allowances can provide significant benefits (as well as income protection).

However, if the bargain isn’t viable before considering prospective tax savings, you shouldn’t be acquiring it in the first place.

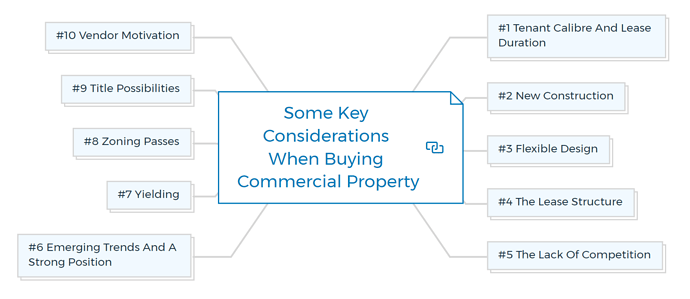

Key considerations when buying commercial property?

Let’s take a closer look at the specific things you’ll need to consider when buying commercial property. Below are 10 significant criteria for investing in commercial property.

You’ll need to create specific purchase criteria to meet the investing goals discussed above. You can use these to evaluate every property investment you make.

These criteria depend on their relative relevance for making sound property investments, as most investors determine over time.

#1 Tenant Calibre And Lease Duration

The tenants’ calibre and the lease length could be the most critical factors in attaining your financial goals. You’re well on your way to making a successful commercial property investment if you have solid corporate (or government) multiple tenants and a minimum five-year lease term.

#2 New Construction

In general, when a commercial real estate is newly constructed, it will continue to appeal to future tenants and will require less maintenance to preserve its current aspect.

Because of this, you can achieve many of your goals, including enormous tax advantages due to generous depreciation allowances during a building’s early life.

#3 Flexible Design

A flexible design also means you won’t be left with an inefficient floor plan if your primary tenants leave at the end of the lease period. When it comes to re-letting, you’ll have an easily flexible plan that allows you to tap into a large market, along with an excellent rental income.

At that point, you can take advantage of further savings available on property taxes by depreciating any necessary renovations.

#4 The Lease Structure

The frequency and method of your rent reviews, who pay the operational costs, and the extent to which a tenant is liable for total building maintenance are all factors to consider when negotiating a lease.

You can negotiate these elements deal-by-deal, but they affect many of your goals.

#5 The Lack Of Competition

In the past, many commercial landlords were local investors. These days, large, national corporations have started to buy up these properties as they offer both stability and economies of scale.

The lack of competition can be a good thing for new investors, as it gives you the opportunity to get in on the ground floor and grow with the property.

It also means that you’re more likely to get a fair price when you’re buying a property.

However, it’s important to remember that the lack of competition can also lead to higher prices for properties and fewer negotiating power when it comes to leases.

So while it’s good to be aware of the lack of competition, don’t let it dissuade you from investing in commercial real estate.

#6 Emerging Trends And A Strong Position

If all other factors are equal, the better the location, the better the performance of your commercial real estate property. What defines a good location depends on various criteria, some of which are subjective.

The nature of the property, including factors such as visibility, public transportation accessibility, and location within a defined area, determines it for that sort of commercial property. However, as with the other criteria, you should not use this as your sole criterion.

What is the meaning of emerging trends? Demographic dynamics, such as population shifts, always lead to new investment opportunities.

New trends in building, design, energy conservation, security, elevator technology, automation, and so on are also emerging. All of these will affect the future demand for and appeal of the sites.

Taking advantage of a new trend as soon as it emerges can significantly boost the performance of any sites you already own, as well as provide you with the ability to improve underperforming properties you’re looking to buy or build.

Keep looking for hidden opportunities to obtain a competitive advantage.

#7 Yielding

Passing yield refers to the current yield on an existing investment. You are unlikely to receive any increases from your market reviews if you derive it from rentals regarded as ‘above market’ (that is, more than the rents already being paid by tenants of similar sites).

Alternatively, suppose the rent is below market and with fixed future reviews, incremental, or tied to the Consumer Price Index. In that case, you’ll be adding to (and deferring) the problem until the lease expires.

On the other hand, your passing yield may be at market rentals. It should imply that your cash flow will improve, and you may even see some exceptional growth if you spot an opportunity that many investors may have neglected.

#8 Zoning Passes

Zoning refers to the current and potential uses of your commercial real estate. Your local government can provide you with zoning laws and other related information.

A ‘non-conforming use permit’ can sometimes be obtained, allowing residential property as an office space. While you can currently utilise it for workplaces, it may only be possible to use it for residential purposes in the future.

Suppose many of these non-conforming properties have existed in a specific neighbourhood in the past. In that case, some inner-city towns have introduced ‘mixed use’ zoning to legitimize (and actively encourage) the coexistence of uses.

It’s something you should be aware of because specific zoning and density changes occur regularly, and if you’re lucky, you can profit from them.

#9 Title Possibilities

A property surveyor can tell you (for a small fee) if you can subdivide the title into a parcel of land or an entire structure, in which case you can significantly increase the marketability and thus the value of your commercial property.

You can still sell the property as a whole. Still, new buyers may be drawn in by the added flexibility of selling off a section of it if the need arises - and people are willing to pay a premium for that flexibility, which is typically well above the cost of constructing it.

#10 Vendor Motivation

Although vendor motive is essential, it should not be your primary reason for purchasing a commercial real estate property. A motivated provider will invariably give you some additional fascinating perks after you’ve analysed all of the fundamentals and satisfied your prior standards.

These can range from leaving some money in the property at a low-interest rate on a second mortgage to allowing you to up value all of the plant and equipment so that you can depreciate it from a much higher base.

A seller may specify the written-down value of a property’s plant and equipment (also known as chattels). However, the contract is frequently silent on the specific worth of these assets.

It allows you to apportion the contract price by valuing the plant and equipment at their current-day worth, resulting in a more extensive depreciation base and an immense tax advantage. This process is known as ‘up valuing.’

When working with a motivated vendor, your primary focus shifts away from price to establish the most favorable contract conditions.

Summary

So, if you are looking to invest in commercial property, make sure that you ask yourself the following questions to buy a property that meets your investment objectives. Have you determined your primary investment objective?

What type of commercial real estate do you want to purchase (office space, retail plaza, industrial park etc.)? What is the length of the lease terms?

I’ve covered all of these questions and more in this article. But if you want to learn more or take your property investment and development skills to the next level, I suggest you enroll for my Property Development Courses.

In some weeks, you will gain an in-depth understanding of the real estate market – from finding deals and negotiating leases to maximizing your return on investment. You can confidently achieve your property investment objectives with my course under your belt.

FAQs

Is It A Good Time To Invest In Commercial Real Estate?

Absolutely, concepts like shared workplace, hot desks, 2 days office and 3 days from home get adopted on a broader scale; we will see a paradigm shift in commercial real estate. And that shift is already evident in the office workspace.

With uber concepts like cloud-kitchen and on-demand services will rise, which will, in turn, drive demand for warehousing. Most retail will move online, and office spaces will be repurposed to mixed uses.

Irrespective of this shift, human beings are social creatures at the end of the day, so commercial spaces that offer [covid compliant] entertainment, support social gathering, and provide cheaper storage or shared spaces will be in high demand.

What is the golden rule of investment?

Having a well-diversified portfolio is one of the golden laws of investing. To accomplish so, you’ll need a variety of assets that will typically perform differently over time, allowing you to diversify your portfolio and lower overall risk.

What to look for when buying a commercial property?

When buying a commercial property, it’s essential to consider the potential for future growth in the area and how you can use it to meet that growth. Additional considerations include:

- Tenant calibre and lease duration

- New Construction

- Flexible design

- The lease structure

- The lack of competition

- Emerging trends and a strong position

- Yielding

- Zoning passes

- Title possibilities

- Vendor motivation

What factors are influencing the commercial property market?

Several factors are currently influencing the commercial property market, including but not limited to: interest rates, the economy, consumer spending, inflation, supply and demand.

For example, when interest rates are low, more people may invest in commercial property since it is relatively safe. And when the economy is strong, businesses may be more likely to lease or buy commercial space to expand their operations.