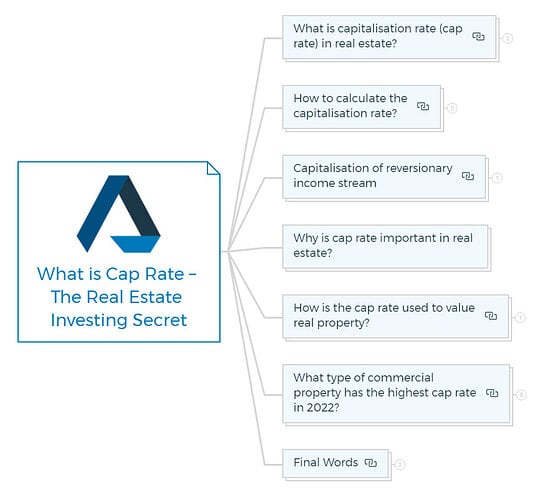

What is cap rate (capitalisation rate) and how is it helpful in property investment?

For real estate investors and developers, the cap rate is one of the most important concepts to understand. In short, the cap rate is a measure of how much cash flow a property will generate each year relative to its purchase price.

It’s one of the most important calculations you can make when assessing a potential investment property. But what is it exactly? And how do you calculate it? Keep reading to find out!

Key Takeaways

- The Cap Rate measures the return on investment for a property.

- The cap rate is most useful when comparing the relative worth of similar real estate investments.

- The profitability of an income-producing property is measured by net operating income (NOI), which excludes financing and tax expenditures.

What is capitalisation rate (cap rate) in real estate?

In the simplest terms, cap rate is the rate of return on a property investment. It’s calculated by dividing the income generated by a property (in the form of rent) by the purchase price of that property.

This metric is important for both investors and property managers because it provides a measure of how quickly a property is generating returns on investment. And as with any other type of investment, you want to make sure your cap rate is as high as possible.

In simple terms, the Capitalisation Rate converts rents into prices and can be expressed as

IMPORTANT

Cap Rate = Risk free rate + Risk premium

Total capitalisation rate:

An income rate for a total real estate investment that indicates the relationship between a year’s expected net operating income and the total property price or value; used to transform operating revenue into overall property worth.

The terms’ total cap rate’ (or simply ‘cap rate’) and ‘all risks yield’ (or more simply and popularly ‘yield’) are interchangeable for property return rates.

The distinction between cap rate and yield is minor and has more to do with semantics than content; both terms refer to the same notion, while yield usually refers to the annual percentage return on investment.

Although the two phrases are sometimes used interchangeably, the yield is a rate of the current return (actual or predicted) resulting from a formula. While the cap rate explained above is a capitalisation rate used as an input in the valuation method, i.e. the element that converts income into value.

In a metaphorical sense, they are the two halves of a coin: yield is the result of computing the current return. At the same time, the cap rate is the data used in the Direct Capitalisation Approach valuation process. Here you can learn the rocket science behind rental yield calculations.

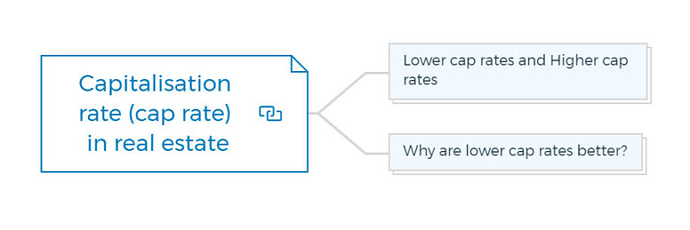

Lower cap rates and higher Cap Rates

The capitalisation rate is inversely related to price: the lower the cap rate, the higher the price (all other things being equal).

This relationship exists because a lower cap rate means that a greater portion of the income produced by an asset is being used to service its debt, leaving less income available for distribution to equity investors.

As a result, equity investors require a higher return (in the form of a lower price) to compensate them for this decreased income.

Conversely, when cap rates are high, less income is required to service the debt on an asset, leaving more income available for distribution to equity investors.

As a result, equity investors are willing to accept a lower return (in the form of a higher price) to compensate them for this increased income.

Why are lower cap rates better?

A lower cap rate is always better than a higher cap rate from an equity investor’s perspective.

A lower cap rate means that more income is available for distribution to equity investors, which results in a higher return on investment (ROI).

However, it is important to keep in mind that the relationship between cap rates and prices is not linear.

For example, a small decrease in the cap rate will result in a much larger increase in price than a large decrease in the cap rate.

It is important to understand how changes in the capitalisation rate will affect the price of a property before making any investment.

How to calculate cap rate (capitalisation rate)?

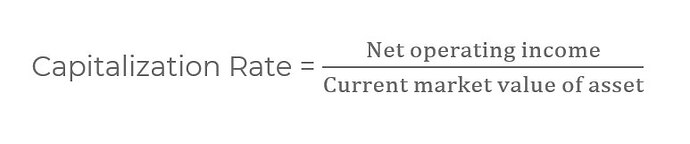

The income capitalisation rate is the most common way to estimate the value of an income-producing property. The cap rate is the net operating income (NOI) ratio to the property asset value.

You will need to know two things for cap rate calculation: the property’s net operating income and purchase price (or current market value).

The formula for calculating the capitalisation rate is as follows:

For example, let’s say you are considering buying a rental property for $200,000 that has a net operating income of $12,000 per year. Using the formula above, we can calculate that the capitalisation rate for this property is:

IMPORTANT

Cap Rate = $12,000 / $200,000 = 0.06, or six percent.

CAUTION

Q.1 A $50,000 net operating income (NOI) is generated by a property. What is the capitalisation rate if you buy it for $300,000?

Q.2 In your city, the average cap rate for small office buildings is 10%. You own a building with a $70,000 net operating income. What is a fair estimation of its worth?

Rule of Thumb

It’s critical to know your market’s cap rates. You can get the data through brokers, appraisers, and the internet.

Learn More

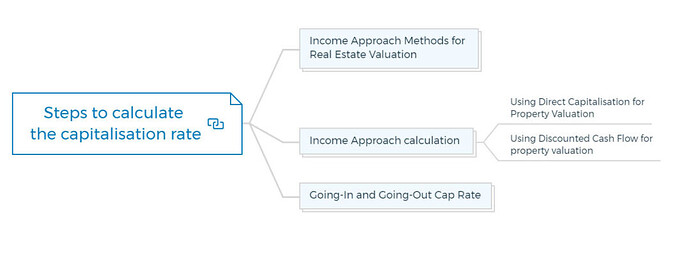

Income approach methods for real estate valuation

Because the income method assumes that a property’s market value is a function of the income it is expected to generate, appraisers calculate the net income that a typical investor would expect for the subject property over the expected holding period.

The valuation estimate for the subject property will be believable as long as the appraiser correctly determines what a typical investor would expect to happen.

Common Terms used for estimating net operating income.

CAUTION

Potential gross income

Potential Gross Income is the estimated revenue that a company could generate in a given year. You can determine this number by multiplying the company’s projected sales by its average profit margin.

Effective gross income

Effective Gross Income is the amount of money that a person makes after all deductions and expenses have been accounted for. We use this figure to determine a person’s tax liability.

Operating expenses

Operating expenses are the amount of money that a company spends each year to run its business. It includes items such as rent, employee salaries, and marketing costs.

Capital expenditures

Capital expenditure in real estate is the amount of money a company spends on acquiring, constructing, or improving real estate. It includes land, buildings, and other fixed assets.

The income approach’s second step is to transform the NOI projection into a property value estimate. Income capitalisation is a term used to describe this process.

Income approach calculation

For income capitalisation, the appraiser has a variety of models and methodologies to choose from. However, there are two types of models:

- direct capitalisation models

- discounted cash flow models.

Using direct capitalisation for property valuation

Direct capitalisation is a valuation technique that assigns a value to a property based on the estimated future cash flows that the property is expected to generate.

You can use this value to determine the worth of the property for investment or lending purposes.

The approach of calculating a property’s market worth by dividing a single-year NOI by a “capitalisation” rate is known as direct capitalisation.

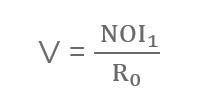

The basic income capitalisation equation expresses the general connection between estimated market value and operating income:

- where V denotes the current value

- NOI1 is the predicted revenue for the following 12 months

- R0 is capitalisation rate

Try yourself

Assume the subject property’s expected first-year NOI is $500,000. Assume that data from comparable property sales suggests that the optimum cap rate is 10%. What is the value of the property?

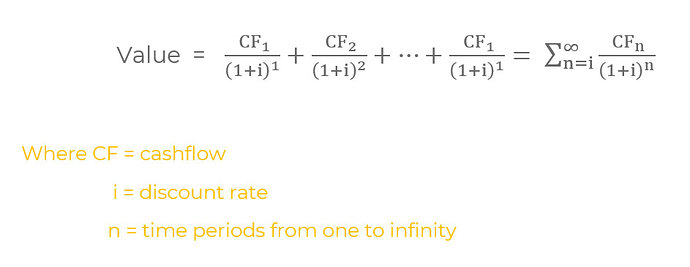

Using discounted cash flow for property valuation

Aside from the heterogeneity of commercial real estate leases, the rising complexity of many deals necessitates revisions to difficult-to-quantify comparable sale prices.

The usage of DCF valuation models is frequently required for various reasons. Furthermore, investors’ primary financial instrument for evaluating the advantages of commercial real estate transactions is DCF analysis.

Because appraisers are often compensated to estimate a subject property’s most likely selling price, it may be advantageous to apply the valuation framework used by most investors.

The term discounted cash flow (DCF) analysis refers to the process and procedures for estimating future annual cash flows from property operations, net cash flows from property disposition at the end of the projected investment holding period and the required total rate of return.

Learn More

Going-In And Going-Out Cap Rate

The Direct Capitalisation Approach can assess an asset’s worth in the present, past, or future.

To value an asset, one might apply the Direct Capitalisation Approach to a given date in the present or past. The market at these dates provides information on the cap rate by extracting the yield based on income and the price of comparables.

The DCFA uses the Direct Capitalisation Approach to determine the Terminal Value.

Thus, depending on the time horizon, two definitions of cap rates are often used:

-

Going-in cap rate (GICR): the link between initial income and asset value/price at the valuation date. This is also called ‘initial cap rate’ or ‘initial yield’.

-

Going Out Cap Rate Expected value of the asset after the valuation time (Terminal Value).

Unlike the former, you can’t derive this rate from the market due to the lack of current knowledge about future transactions. It is the predicted ratio of final income to future asset value/price.

Learn More

To avoid any confusion, let us state that the GICR is commonly referred to as the cap rate and is not to be confused with the GOCR.

The GICR and GOCR are the same rate examined at two different points in time: the beginning (valuation date) and the end (last period in the future).

While there is only one GICR for a single date, usually the valuation date, different GOCRs must be utilised along the time horizon depending on the date.

The GOCR must be predicted using future market conditions. It can be estimated either by ‘guessing’ the future rate or by starting with the GICR and adding/subtracting a spread based on the time risk.

The (typically positive) difference between the two rates is expressed as basis points (bps). Only a few recent research support or dispute this commonly accepted association but can pinpoint a few key drivers.

Future uncertainty is the first cause, which translates into higher GOCR risk (and, therefore, a higher rate). For the GOCR to be determined, in the absence of any refurbishment work (CapEx), a reduction in the economically usable life must be taken into account.

As a result, the building loses economic potential and requires costly structural and functional care (building renovation). The wasting asset theory, which states that all assets lose productivity over time, applies to properties. Ageing causes a decline that you can’t avoid in practicality or economics.

If the residual building life is 25 years, the cap rate will be lower than if the residual building life is 5 years.

Quantifying a GOCR for use in determining the DCFA’s Terminal Value remains one of its flaws. While there is no universally true answer, it is prudent to consider a few factors.

The valuation time horizon: a difference between the GICR and GOCR makes sense if the time horizon is long.

For example, if the time horizon is only a few half-years, using the same cap rate may be more appropriate if the other elements are absent.

The building’s current condition, which, given the prior argument, can be a significant impact. If the building is new, a differential may not be required. If the time horizon is longer or the building is older, you must consider the consistency of maintenance expenses, CapEx predictions, and the cap rate spread.

Potential redevelopment work on the building (for example, a building that has reached the end of its life cycle) can significantly impact the GOCR. Theoretically intriguing but difficult to measure in practice, this may add to the valuer’s view on the rate to be applied.

It would depend on the general fluctuation of expectations regarding market circumstances, both in terms of the risk-free rate and the additional risk premiums of property investment in general or in particular.

All of the initial assumptions are valid if no significant economic changes, changes in predicted interest rates, economic growth, or other exogenous variables affect the asset’s future value.

While the GOCR may be larger than the GICR when estimating Market Value, an investor will likely seek investment opportunities where the predicted GOCR is lower than the GICR, yielding a Capital Gain Return.

Some real estate investors cautiously base their projections on GOCRs greater or equal to GICRs, covering any future losses with the larger income yield.

Increased demand for space and lower risk-free rates lead to lower future cap rates, whereas the increased supply of space and higher risk-free rates lead to higher future caps and higher property values.

Finally, the cap rate is closely tied to its historical value, and its volatility is closely linked to the performance of the market, particularly the vacancy rate.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

Capitalisation of reversionary income stream

In addition to valuing properties based on their current income streams, investors will often value properties based on their expected future income streams.

This is because many income-producing properties are not fully leased at the time of purchase, and the investor expects to increase the property’s income by leasing up vacant space.

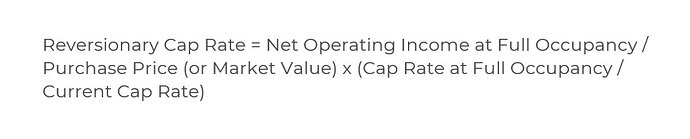

The capitalisation rate used to value these properties is known as the “reversionary cap rate.”

Reversionary or Reversion cap rate

The reversionary cap rate is simply the capitalisation rate that an investor anticipates achieving when the property is fully leased up.

To calculate the reversionary cap rate, you will need to know three things:

- The net operating income at full occupancy.

- The purchase price (or current market value) of the property.

- The capitalisation rate that the investor anticipates achieving at full occupancy.

The formula for calculating the reversionary cap rate is as follows:

For example, let’s say you are considering buying a rental property for $200,000 that has a net operating income of $12,000 per year. The property is currently 50% leased, and you expect to achieve a capitalisation rate of eight per cent when it is fully leased up.

Using the formula above, we can calculate that the reversionary cap rate for this property is:

IMPORTANT

Reversionary Cap Rate = $12,000 / $200,000 x (0.08 / 0.06) = 0.09, or nine percent.

As you can see, the reversionary cap rate is higher than the current capitalisation rate because the property is not fully leased up at the time of purchase.

Learn More

A reversionary cap rate is simply a tool that investors use to estimate the value of a property based on its expected future income stream.

While it is not an exact science, it can be a useful tool for estimating the value of an income-producing property.

When valuing any income-producing property, whether, for sale or lease, it’s important to understand how changes in the capitalisation rate will affect the price. Changes in the cap rate will directly impact the price of a property.

What is a good capitalisation rate?

This question does not have a simple answer as there are many factors to consider. Some people believe that a good cap rate is anything above five per cent, while others argue that it needs to be closer to ten per cent to make an investment worth your while.

The truth is that there is no right or wrong answer when it comes to what constitutes a good cap rate. It depends on your circumstances and goals as an investor.

If you are looking for stability and predictable cash flow, you may be more interested in properties with lower cap rates. On the other hand, if you are looking for potential appreciation and are willing to take on more risk, you may be more interested in properties with higher cap rates.

It is important to remember that capitalisation rate is just one tool you can use to evaluate an investment property. It is not the be-all and end-all when deciding whether or not to purchase a particular property.

There are many other factors to consider, such as location, condition of the property, and your personal goals and objectives.

There is no magic formula for success when it comes to real estate investing. However, by familiarising yourself with the concept of capitalisation rate and using it as one tool in your decision-making process, you will be well on your way to making smart and profitable investment choices.

Learn More

Why is cap rate important in real estate?

You can use the cap rate formula for three purposes:

- It’s self-evident that you can use it to figure out a property’s cap rate. Once you’ve determined its NOI and estimated value, you’ll want to do so—most likely a seller’s asking price.

In this case, you’re trying to figure out whether the property has a cap rate comparable to other similar homes in the region if you buy it for the asking amount.

-

You can use the procedure to get an acceptable value estimate if you know an appropriate cap rate for this sort of property in this area. In other words, disregard the seller’s asking price; what should it be worth, given the NOI and the current cap rate?

-

Finally, you can calculate the NOI by transposing it once again. When you call the listing broker, what NOI should you anticipate hearing if you know the current cap rate and the seller’s asking price?

Continued at…

What is Cap Rate? [Part 2-2]