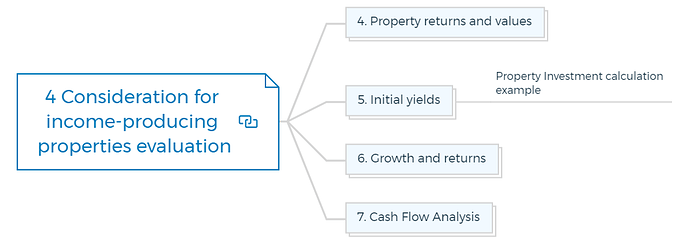

How to invest in rental property? - 10 quick steps

When it comes to rental property investments, there are a lot of things to consider. How do you know which ones are the right ones for you? Here are 10 must-have criteria to help you compare and select the best rental properties for your investment!

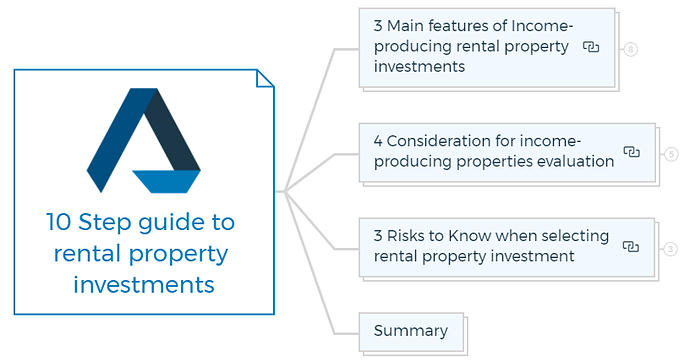

In order to find the best rental property investment, you need to analyse and compare features, evaluation, and risks. These categories are broken down into subcategories here -

Quick Tip

Key Takeaways

- The internal rate of return is the discount rate at which an investment has a net present value of 0.

- If the net present value is positive, you should accept the investment.

- Sensitivity analysis, which measures the degree to which unsettling market, financial, or property-specific risks impact an investment’s performance, allows for a straightforward risk evaluation.

- Location, building maintenance, and tenant strengths are the significant elements of income-producing assets.

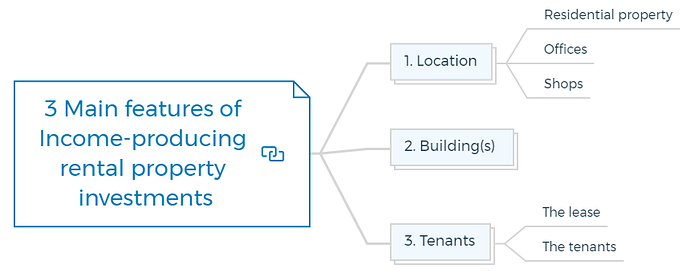

3 Main features of income-producing rental property investments

Many variables influence the income from residential, commercial, and other properties. Commercial properties include office, retail, industrial, and other sectors with vastly diverse needs. The influences on residential properties are primarily visible.

It is crucial to conduct in-depth research into the specific properties and real estate markets that interest you. Experienced property investors refer to this as the “due diligence” that goes into buying a property.

This “fundamental analysis” in the share market can be less significant for property investors who hold diverse stock portfolios or purchase “index-tracking” funds.

However, the features of each property are crucial for the majority of property investors.

1. Location

Location can refer to a property’s neighbourhood, the city or area in which it is located, or the specific location inside the neighbourhood or on the street.

Additionally, the property has site-specific characteristics, such as the site’s layout, vehicular access, and the land-use restrictions that apply to it.

The strength of the economic basis and the demographic characteristics should be looked into at the local or regional level.

Residents will pay more to live in prestigious, safe, and suitable structures in the suburbs and pay more for easy access to their frequent connections.

Economic geographers say a superior location’s cost and time savings are reflected in higher rent. Pleasant surroundings, outlooks, and views are equally valuable in the suburbs.

Here is a comparison of how location affects a property’s earning potential for residential and other commercial applications.

Residential property

City/region - Regional economic and employment base changes affect affordability, household formation, and migration. Age, average income, and family composition will influence home popularity.

Suburb - The quality and proximity to facilities (schools, shops, reserves, beaches, etc.), access to essential employers, and distance from disagreeable land use determine suburb prices.

After a suburb’s facilities and links change, its reputation might alter pricing, providing property investment opportunities.

Position and site - Corner blocks are also desirable, somewhat larger (or wider) than standard blocks with subdivision potential, elevation blocks, park-adjacent blocks, and blocks with views.

Offices

City/Region - Regional economy and tertiary employment developments affect office demand; vacancy rates impact rental growth.

City and other centres - Changes in business sectors prefer city, near-city, suburban, and office park locations. Occupants check if the location is over-or under-supplied with offices for growing industries.

Position and site - Occupants prefer positions central to connected business operations and easily accessible by public transit and parking lots. Some prestigious addresses in Central Business Districts for which occupants will pay extra.

Shops

City and other centres - People look for changes in population, household types, or income in the shop’s catchment area. Are rival malls’ new or expanded amenities luring away shoppers? Do travel restrictions keep customers loyal?

City/region - Population expansion, disposable income fluctuations, and spending trends affect retail sales, helping some businesses more than others.

Position and site - Most shops’ success depends on synergy with neighbouring stores.

Surrounding businesses determine pedestrian traffic (and casual sales).

“Tenancy mix” in malls fosters complementary trades and comparative shopping. Is the centre or shop easily accessible by road? How busy is the shop or showroom?

Industrial

City/region - Does the region’s economy need extra manufacturing or storage/distribution space (for logistics or retail)?

Suburb - How accessible is the region for workers or commercial uses? Is access to arterials improving?

Position and site - Can trucks easily enter and exit the property? Does the showroom have street access?

Learn More

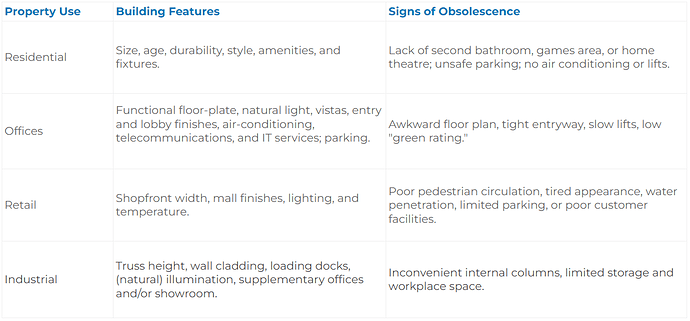

2. Building(s)

Buildings should be functional for current users, and adaptive to future inhabitants’ changing needs to create a stable and growing income. Residential tenants’ needs are pretty evident, but they change gradually over time as customs and trends change.

Whether they are manufacturing things, offering services, or engaging in retail, the needs of business tenants reflect how they are adapting their use of technology to satisfy those needs.

Investment properties have the quality of obsolescence, which does not directly influence most other assets. Because it causes a long-term drop in rental and capital values, its effects on returns are simple to ignore.

Some homes are prone to becoming outdated, while others retain their attraction to residents or may be easily renovated or modified to fit new needs.

Long-term trends and early warning indications warn property investors of potential risks to their income streams, even though it is difficult to determine which building elements help to prevent obsolescence.

Some of the symptoms of obsolescence that you should know before investment and are currently present in urban Australia are discussed below.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Tenants

If the renter can afford the payments, rent is paid in line with the conditions of the Lease. The income stream for the investor is somewhat predictable because of leases.

Due to the tenant’s contractual duty to pay rent before the business declares a profit, leases resemble bonds or other debt instruments in several ways.

Except under unusual circumstances, such as a residential renter losing their job or a business going bankrupt, a tenant is unlikely to default on their rent commitments. Therefore, the rent due under the lease is more specific than the anticipated rent once the contract has expired.

If the tenant does not extend the lease, vacancy and pricey “leasing incentives” can entice new tenants in particular areas. Vacancy results in non-payment of rent, non-recovery of running costs, and perhaps even building degradation.

The “lease expiry profile” is a crucial risk indicator for buildings with several tenants or a portfolio of properties since the variety of lease expiry dates makes it unlikely that no rent would be paid.

The lease expiry profile is a list of all the leases’ remaining terms, sometimes just the average number of years before expiration.

The main factors to consider when examining the leases and the tenants for an investment property are discussed below.

The lease

Lease Length - What is the remaining time left on the lease? Has the tenant got the opportunity to extend?

Basis of rent review - What’s the rent-hike potential? Rent reviews may be a fixed percentage increase or inflation adjustment on the lease anniversary.

Rent may be reviewed to market level or connected to retail turnover. A “ratchet” or “upward-only” rent review clause may be in the lease.

Responsibilities - Who pays the landlord’s operational expenses? Which costs can be recovered from tenants?

Learn More

The tenants

Financial strength - How likely is the renter to default? Default risk is similar to tenant loan non-payment risk.

Potential growth - Can the tenant afford higher rent? It means income or profit growth for a business. It refers to renter wage growth.

Potential vacancy - In addition to default risk, there is vacancy risk at lease expiration — will the tenant renew?

All these and other aspects of real estate investments are considered to estimate the revenue both now and in the future.

Advanced Property Development Books Bundle

Looking for an edge in the property development game?

This Advanced Property Development Books Bundle is for you. 572+ pages chock-full of insights on residential + commercial property development and investment, this bundle spans 18 ebooks. Whether you’re a beginner or a seasoned pro, these books will take your development game to the next level.

Get The Advanced Property Development Books Bundle

Includes 18 x advanced detailed eBooks

✓ 7 Real Estate Negotiation Tactics That Win More Deals - 25 pages

✓ 7 Easy Steps To Market Your New Development Project - 30 pages

✓ Improve Your Development Game With Development Economics - 40 pages

✓ How To Get Development Approval FAST? - 49 pages

✓ Advanced Real Estate Market Analysis In 13 Easy Steps - 34 pages

✓ Invest In Commercial Property To Achieve Your Investment Goals - 22 pages

✓ 10 Finance Options For Your Next Property Development Project - 29 pages

✓ 13 Golden Rules Of Investing In Commercial Real Estate - 28 pages

✓ 6 Ways To Invest In Commercial Real Estate – The Complete Guide

✓ Commercial Development 101: Become an Expert - 34 pages

✓ Definitive Guide To Commercial Property Investment - 24 pages

✓ A Beginner’s Guide To Apartment Development (Tips & Principles) - 33 pages

✓ How To Build Townhouses And Develop Villas Successfully? - 41 pages

✓ How To Sell A Commercial Property In Record Time? - 25 pages

✓ Raw Land Development - What you need to know - 34 pages

✓ Single Family Homes: Learn Property Development Without Financial Risk - 33 pages

✓ What Exactly Is Equity Finance And How Does It Work? - 42 pages

✓ Real Estate Market – 6 Tips for Timing The Market - 19 pages

Evaluating income-producing rental properties

In this section, you will learn the relationship between the anticipated revenue streams, the rate of return on the assets, and the current value of the properties.

This is demonstrated via simple techniques for assessing income attributes and computing returns.

4. Property returns and values

Property investment is worth the predicted or anticipated future revenue streams, discounted at its present value. At a rate of return, the income is discounted to reflect its current worth.

There are several ways to express the expected revenue or cash flow, which you must do first.

For example -

Is the income net or gross of:

- Operating costs

- Possible loss because of vacancies?

- Loan obligations?

- Income tax

Is it assumed that the existing income will last forever?

Is it modified to account for transient abnormalities like upfront costs or rent-free periods?

If income increase is anticipated, is it in nominal terms or real terms?

Does each period’s growth have a set rate, or is it presumed to be constant?

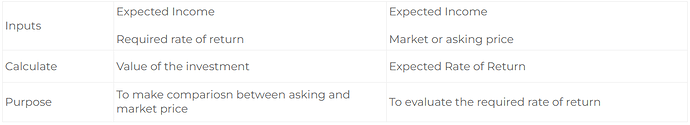

Second, there is a significant difference between an investor’s required rate of return and the expected rate of return.

Quick Tip

The required rate of return:

For the investor to earn the requisite rate of return, the income is discounted to its present value using the required rate of return.

The expected rate of return:

It is the rate that will be earned if the property is bought for its asking or market price and the anticipated revenue is received.

The expected income or cash flow is necessary for both. The investment property value at a required rate of return or the projected return at a given price can both be determined using this.

The price is reasonable if the predicted rate of return does not fall below the needed rate.

The table below explains the difference between the decision-making process based on required and projected rates of return.

The required rate of return is affected by -

- The method you use to estimate the income stream

- Alternative uses for the capital, such as using it for personal purposes or investing elsewhere

- The expected rate of return on alternative investment properties is adjusted upward if the income stream is subject to more significant risks

- The required rate of return on funds used to buy the property (the cost of capital).

Learn More

5. Initial yields

Commonly, property values are estimated by discounting the current income net of operational expenses as if it continued perpetually. The present value of a “perpetuity” is income divided by the required return (as a decimal).

V = NI/y

where,

- V is the investment property value;

- NI is (constant) net income;

- y is the initial yield as a decimal or percentage.

This is determined by annual revenue and yield.

Gross income minus all expenses of owning and operating the property, excluding borrowing costs and income or capital gains tax, is net income.

Net (operating ) income = Gross (potential) income - vacancy allowance - Total Property expenses

Gross income includes all rents needed by the leases, except GST, payable on all except residential rents.

The US uses “potential” and “effective” gross income. They separate prospective gross income from gross income after vacancy and bad debts.

The vacancy allowance is given as a percentage of gross (possible) income and should reflect the building’s history and market occupancy trends.

Property management manuals and records provide detailed checklists for each type of property.

The maintenance subcategory excludes rare capital expenses, but they may be authorized through a “sinking fund” into which regular amounts are put to fulfil future capital liabilities.

Landlords will be taxed GST on most operational expenditures; however, non-residential landlords can claim ITC.

The starting yield is also the capitalisation rate, if the present income accurately reflects current property market conditions.

Property investment calculation example

John wants to buy a home. He wants a three-bedroom home. It’s in a pleasant inner area that he feels has lagged behind faster-growing suburbs. This strata-titled unit overlooks a park from an older tower. The lifts and air conditioning were updated last year, and the foyer and unit are well-kept.

Middle-aged, childless renters have lived there for years. They signed a 6-month lease at $700/week.

John estimates his net rental income based on rent and running costs. Quarterly council and water fees total $350. $850 is this year’s State Land Tax.

The Strata levy is $900 per quarter. John can’t find out how much the current landlord has spent on repairs or repainting, so he allows $3,000 yearly. John allows 5.5% of the rent for vacancy and bad debts, even if the current renters seem settled.

In this case, the net rental income is estimated as -

Gross Potential Income ($700 x 52 weeks) = $34,400

Vacancy (6.5% of gross potential income) = $2,236

Statutory charges ($350 x 4 quarters + $850) = $2,250

Operating Expenses ($900 x 4 quarters + $3,000) = $6,600

Net Rental Income = $ 23,314 per annum

John has looked at several comparable properties, and the majority provide an initial yield of between 3 and 3.5 per cent on the net rent. John’s initial estimation places the value of the dwelling unit at roughly $666,114 based on the higher end of the yield range:

Net Rental Income = $23,314 per annum

Required initial yield = 3.5%

Investment property value ($23,314/0.035) = $666,114

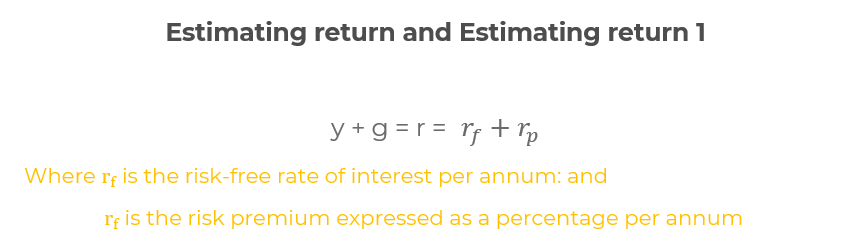

6. Growth and returns

Initial rental yields on Australian urban residential homes are 2.5 to 4% per year. It seems low compared to term deposits at the central banks (6 percent per year for 3 to 6-month deposits in 2008, considerably lower in 2009).

Property investors expect rents and capital values to rise, lowering residential property yields. Initial yields, growth rates, and total return are related.

We can modify the formula to estimate the present value of perpetuity to value a growing investment property assuming a constant annual growth rate.

V = NI1/ (r-g)

Where,

- NI1 is the net income

- r is the property’s total return per period

- g is the periodic growth rate in the net income.

The total return is a percentage used to calculate the present value of current and growing net income. A constant percentage rate to current net income estimates future net income growth.

Example of estimating the return on property

John compares the yield and risks of an investment property (house unit) with a less risky long-term bank account generating 6% per year. He believes that a 4% “risk premium” above the 6% deposit rate is enough to compensate for rent and growth uncertainty. He wants 10% annually. Is it achievable?

John bases his argument on 7 per cent annual rent and property price growth. With an initial return of 3.5%, he might earn 10.5% annually. John knows that property buying costs are high, and legal fees and stamp duty will eat into his return. If these buying costs are 4% of the price, John’s 10.5% per annum drops to 10.15%,

being r/(1 + T), where T is the decimal buying costs;

10.1% = 10.5/(1+.04)

This formula approximates buying costs but ignores selling. John concludes that his house unit’s rents and capital worth must grow 7% per year for him to earn 10% each year. As a long-term investor who believes the property market expansion will continue, he analyses this residence.

John may not realise it, but he’s comparing his required return (based on a risk-free investment plus a risk premium) with the expected return from the home unit (based on the initial return at his bidding price and the expected growth rate). Equilibrium occurs when:

- Required total returns are a combination of a risk-free rate and a risk premium to represent investment uncertainty.

- Total projected returns combine initial yield and growth rate. Prices adjust to balance expected and required returns.

- Initial and total returns fall if prices rise, but initial net income stays the same.

The total yearly return (r) on a property is the sum of its original yield (y) plus annual rent increase (g), which is constant. You can earn the total return if rents and capital values grow simultaneously.

7. Cash flow analysis

Initial yields and total returns are accessible property investing indicators, but they lack transparency. Cash flow analysis’ period-by-period calculations allow for flexible projections and are time-efficient when done with a spreadsheet or other software.

Buying property investment is paying now for future income. Initial cash outflows for the investor include the property price and purchase charges, and cash inflows are periodic income and resale proceeds.

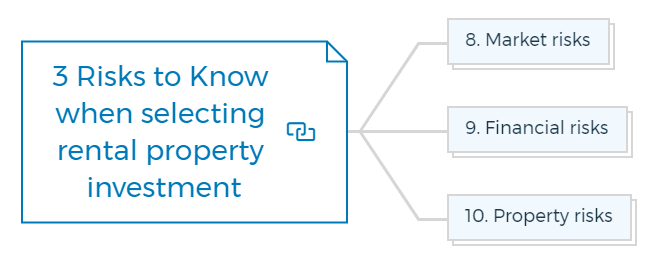

3 Risks when selecting rental property investment

You can’t judge property investment without considering the risk of underperformance. Investors who are worried about these dangers either don’t buy or insist on a greater return.

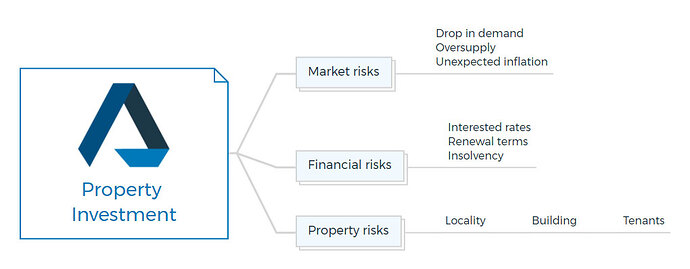

The diagram below shows three property investing risks. Market risks affect all properties in that market and result from regional economic shifts or commercial or social trends.

Financial risks emerge from property purchases financed by loans. Each property’s risks are distinct to its location, structures, and tenants.

8. Market risks

Almost all of the properties in the submarket are subject to certain risks, albeit maybe to varying degrees.

For instance, a drop in business or order volume can result in less of a requirement for office, industrial, or warehouse space. It’s possible to see a drop in the district’s market rents.

Long leases with fixed rents or rents tied to an index other than market rentals may shield some properties from this drop.

Other risks associated with market imbalances include changes in supply, such as overbuilding, overconfidence among lenders or investors, which can cut yields and lead to potentially unsustainable prices, and shifts in demand for the goods and services that drive the local economy.

Rising yields, excessive vacancies, and dropping rents are anticipated outcomes.

9. Financial risks

Financial risks are those that result from the property’s financing. The consequences of loan default, the possibility of interest rate rises, the difficulty of refinancing expiring loans, and the volatility linked to leverage are just a few of the hazards.

Financial hazards are frequently added to other risks and are the leading cause of investment property being “insolvent”.

10. Property risks

Risks that affect individual property investments but not the market are considered property-specific risks. These dangers can harm a single income-producing property by harming its location, structures, or tenants.

By owning a variety of properties, you can frequently reduce their influence.

Examples of risks to the location include reduced pedestrian access due to improved pathways elsewhere, ruining the trading potential of a shop, and the popularity of an office building decreasing if a nearby parking lot is closed to be used for something else.

These risks can negatively impact a community, such as sharp increases in crime or the encroachment of inappropriate land uses in a residential area.

Learn More

Summary

Although separate variables influence property space and capital markets, their rents link them.

The critical characteristics of rental property investments are:

- Their location.

- The buildings’ capacity to continue serving occupant demands.

- The qualities of the tenants.

You must thoroughly examine these traits to see how they affect rents, returns, and hazards.

The correlation between predicted incomes and prices is quantified through investment analysis. The initial net rental income as a share of the purchase price or value is the initial yield on an investment property.

The majority of properties are bought for their potential for expansion as well as their initial rental revenue. Cash flow analysis is explicit and flexible in assessing growth and its effects on returns.

An investor or advisor must quantify shifting income streams from property to perform a discounted cash flow analysis. The net present value is the discounted worth of all the future cash flows from an investment, less the original outlay.

You can now easily streamline your due diligence and feasibility process with Property Development Feasibility Suite.

FAQs

What type of rental property is most preferable?

A single-family home is most preferable for a rental property. It’s easier to find quality tenants for a single-family home than it is for a multi-unit building, and you’re more likely to receive stable monthly rent payments when you have just one family renting from you. Additionally, you’ll have more control over the condition of your property if it’s just one unit, as opposed to multiple units in which tenants may be less conscientious about keeping things tidy or repairing any damage they might cause.

Is rental property a good investment?

It can be, but it depends on a lot of factors. For example, does the property have good rental potential? Is the market growing or shrinking? What kind of repairs or updates will need to be made?

Overall, rental property can be a good investment as long as you do your research and are prepared for the associated risks. Keep in mind that it’s important to consult with a financial advisor or real estate expert before investing in rental property, as there are many things to consider.

How do you decide if a property is a good investment?

You should consider a variety of factors when deciding if a property is a good investment. Some important factors to consider include the following:

- Location: The location of the property is key. Consider whether the property is in a desirable area with plenty of potential tenants or customers.

- Size and layout: The size and layout of the property can be important, especially if you plan to rent it out. Make sure the property can comfortably accommodate the number of people you plan to house or office there.

- Age and condition: The age and condition of the property can be important factors to consider, especially if you need to make repairs or renovations. Make sure you’re aware of any necessary repairs before buying any property.

Discover, Engage, Innovate: Edge Awaits!

✓ Explore with Demos: Watch our Feasibility Suite demos and see what’s possible.

✓ Learn from Success: Dive into real-life case studies for practical insights.

✓ Engage, Inquire, and Innovate: Ask questions, request features, and engage in lively discussions.

✓ Showcase Your Projects and Gain Insights: Share your projects and get personalized feedback.

✓ Free Resources Galore: Access a treasure trove of free resources to keep you informed.

✓ Exclusive Training: Enjoy members-only training to sharpen your skills.

Make It Real