Continued from…

10 Financial Property Investing Mistakes Made By Investors [Part 1-2]

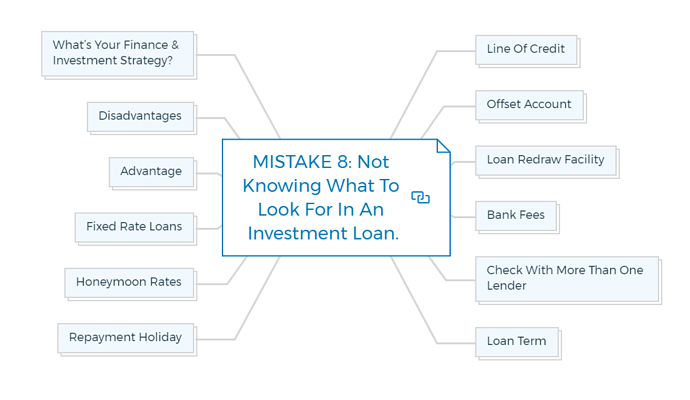

Financial Mistake 8: Not Knowing What To Look For In An Investment Loan.

Most people when considering a home loan or an investment loan, only look at one factor, INTEREST RATES. They get blinded by all the other factors and their long term objective of acquiring investment properties to begin with.

They are not to be blamed for this. It’s just that psychologically as human beings we are trained to look for cheaper alternatives for the same value. And advertisers and lenders know that.

Therefore, the media is always talking about cheaper interest rates and interest free periods to use as their main point of distinction.

However, you as an astute property investor must understand and look at the complete picture and factor in other features like:

Your Financial & Investment Goals:

Property investors should consider the following features in a loan:

Line Of Credit

A line of credit is like having an overdraft facility which is secured by equity in your property. Interest rates on a line of credit are similar to any other loan facility that offers a variable rate.

The limit depends on the equity that can be accessed in your home, which enables the LOC to have greater limits.

A good feature of Line of Credit is that you pay interest only on the amount you draw down from the entire line of credit. It is always good to have a line of credit, that way if an opportunity flies past, you are ready to cease it.

In some facilities you can also capitalize the interest, which means that you may not even pay interest at all, until you have completely drawn the facility.

All astute property investors will have a LOC in place even before they need it, so if you need it, it’s there & ready to go.

Offset Account

Usually offered with most home loans. An offset account is a transaction account that can be linked to your home or investment loan.

The credit balance of your transaction account is offset daily against your outstanding loan balance, reducing the interest payable on that loan. An offset account can reduce the term of your loan.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Loan Redraw Facility

Very similar to an offset account, A Redraw facility allows you to access additional repayments you have made on your loan above the required minimum repayments.

Minimum redraw amounts vary from loan to loan. Redraw is not available on Fixed Rate Loans. Usually banks charge a small fee for the flexibility of redrawing the money.

Bank Fees

Banks have various fees built into the loan. Before getting the loan, property investors must check the kind of fees that are built into the loan. Some of those fees could be:

- Application Fees

- Risk Fees

- Mortgage Discharge Fees

- Extra repayments fees

- Monthly account keeping fees

- Valuation Fees

Check With More Than One Lender

For some people this can be very daunting and time consuming.

This is where brokers and expert property investors can, not only check but can also recommend you different options from various lenders who’s lending criteria best matches your borrowing needs.

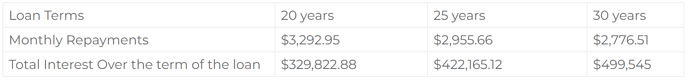

Loan Term

As long as you are in your portfolio growth phase of property investment, it is better to stick with interest only payment.

However, at some stage you will move into the consolidation stage and that’s when the length of your loan term will have an impact.

Let’s look at an example: Loan Amount: $500,000 Interest Rate: 5.3%

Although monthly repayments for a shorter term are more, but the difference between 25 & 30 years in interest payments is $77,379 approx. So just by paying the loan 5 years early, you can save around $77K in interest.

Repayment Holiday

Various lenders can offer a repayment holiday, where you can put your monthly repayment on hold till you sort out your career or your life.

Man proposes, god disposes, so we never know what circumstances we could face down the line.

However, it is always good to know for property investors that your lender can provide you with this facility, if there was such a need.

Honeymoon Rates

Some lenders will offer you a slightly lower interest rate, usually for the first 12 months. The best way to utilize this period is to keep paying the same size instalments, that you would if you were on a normal interest rate.

That way property investors can create a buffer that can be re-accessed at a later date depending upon the type of loan.

Fixed Rate Loans

Advantage

- Guaranteed rate, even if interest rates go up, your repayments will remain unaffected.

- Usually at the end of the term, the client has an option to renew their fixed term or switch to variable rate loan.

Disadvantages

- If you pay your loan early, an Early Repayment Adjustment (ERA) fee will often apply.

- An ERA or an admin fee may also apply, where the borrower decides to switch to another interest rate option.

- Restrictive due to their nature

- Usually the lender goes to the money market & borrows the money over a similar period.

- Due to this fact, lenders restrict the additional repayments

What’s Your Property Finance & Investment Strategy?

The kind of loan you get will depend upon what you intend to do with the investment property & how long you intend to hold it for.

If you are developing, would you be looking at holding what you develop or would you be looking at selling after your development is complete. Or would you prefer to sell enough and retain others for the long term.

So your financial strategy will change depending upon your decision.

When you look at the bigger picture, you will notice that interest rates are merely a suggestion in the bigger scheme of things.

The ultimate aim for an astute investor is to grow its wealth and generate equity to be able to keep growing his/her property portfolio.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

Financial Mistake 9: Paying Off Your Mortgage Too Soon.

Most people when considering a home loan or an investment loan, only look at one factor, INTEREST RATES. They get blinded by all the other factors and their long term objective of acquiring investment properties to begin with.

Quick Tip

The thumb rule for creating a multimillion dollar property portfolio, is to be able to control as much property as possible with as little of your own money as possible.

The key to amass a property portfolio overtime is to keep refinancing your existing portfolio, to keep accessing the increased equity. Then use that equity as a deposit to buy further properties.

Your own principal place of residence (PPR) or your owner occupier home is not included in this strategy as interest payments on your PPR are not tax deductible.

However, for residential investment properties, there is no reason to pay them off. In a nutshell, the aim should be to have them re-valued, access new equity, use that equity as a deposit to pay off another property.

Example:

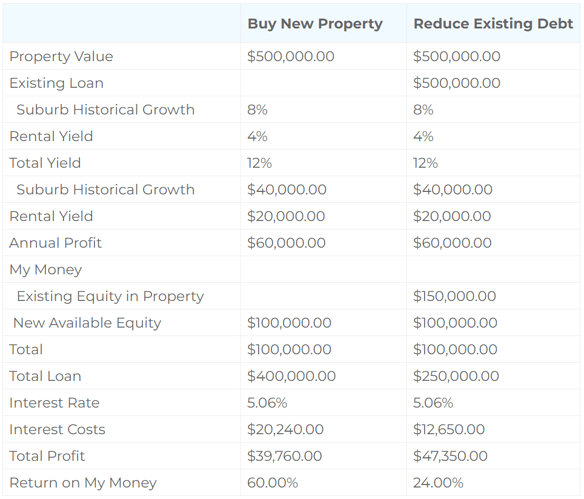

Amelia has an investment property worth $500,000 with a mortgage of $350,000. She receives an inheritance of say $100,000 from her father. She now has 2 options.

She can either use that $100K to reduce her debt on existing property or she can use that money to purchase another property.

Let’s look at both scenarios:

My Question: Why Would Amelia Use The $100k Windfall From Her Father To Pay Off The Existing Mortgage?

If Amelia pays off her mortgage, she loses the leverage she has which in turn reduces the return on equity or return on her money. Which basically means an inefficient use of her money to bring more money in.

As an investor you should look at every dollar you own as a soldier, everyday you send out your soldiers to capture & bring more soldiers back.

If property investors are not utilizing your soldiers in the most optimum way, you are essentially losing the leverage that your soldiers can provide you.

From the table above you will notice that although Amelia made a higher profit in that one year, she lost almost 2/3rd of the leverage she had on her money.

Don’t get me wrong, if you have a PPR with debt, it would make sense to pay off the mortgage for your owner-occupier home first, as interest payments are not tax deductible.

However, if you have an investment property, mathematically it makes sense to buy another property, rather than reduce debt on your existing investment property.

Here is another important insight to take away, the only way you can generate wealth without contributing your time and money, in essence while sleeping, is by achieving capital growth.

And to achieve maximum capital growth you need to make sure that you control as much property as possible with as little of your own money as possible.

And in order to do that you need to make sure that every soldier you own, goes out everyday to bring back more prisoners.

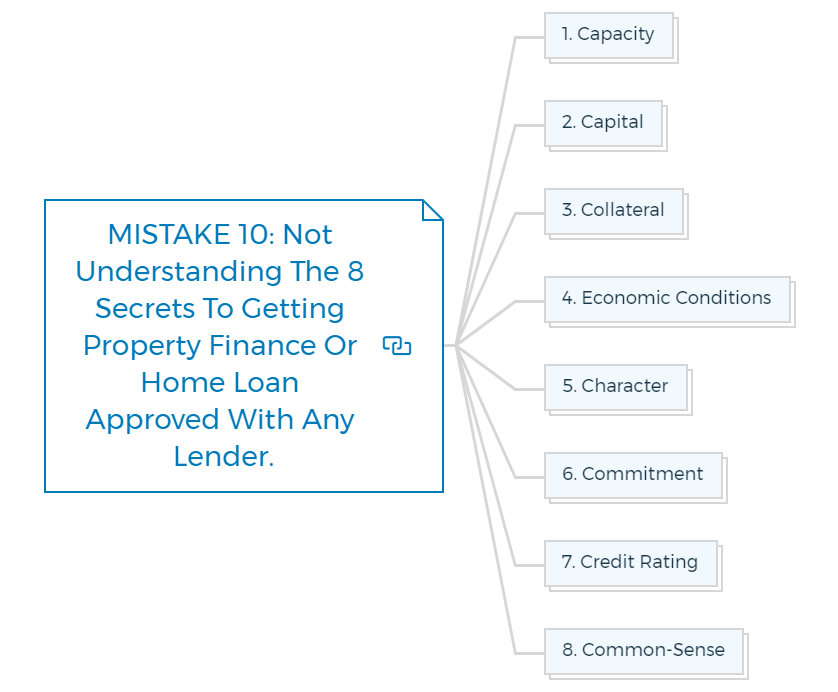

Financial Mistake 10: Not Understanding The 8 Secrets To Getting Property Investment Finance Or Home Loan Approved With Any Lender.

Most people when considering a home loan or an investment loan, only look at one factor, INTEREST RATES. They get blinded by all the other factors and their long term objective of acquiring investment properties to begin with.

We are all in the business of making money & banks/lenders are no different. They are also out to make money.

So when they lend money, they need to make sure that first and foremost they don’t lose any money and secondly, they must make money.

So make sure that the loans they give out are paid back, lenders need to have enough evidence on borrowers capacity to repay the loan.

For that reason, every lender goes through their secret process of risk elimination & mitigation from the borrower. If you understand the following 8 secrets, you will be able to obtain your home loan or any kind of finance for your investments.

Following are the 8 secrets to being loan worthy:

1. Capacity

Capacity to repay the loan is the most important secret that every lender will scrutinize at various levels as it answers the question - “Can the client afford the loan?”.

If you were to lend money to someone, wouldn’t you wish to know how they are going to repay you back? The lender is no different, it seeks to find out exactly how you are going to pay back the loan.

To determine your capacity to repay the loan, the lender will consider the following:

- Source of Income

- Cash at bank or your savings

- Your business or other financial commitments

- And the timing of repayments of your prior financial commitments

Income verification needs to be presented to the lender in an up-to-date, accurate and complete manner.

2. Capital

Capital is the money the client has personally invested into assets or a business along with the cash offered in the form of a deposit for the new loan.

It is an indication to the lender of how much the client is willing to place at risk. You may call it HURT MONEY or skin in the game.

Important: Any finance and mortgage broker will assess where the deposit has been sourced from and whether it is a case of genuine savings, or a loan from a relative/friend or a gift from parents. If you are a first home buyer you will be required to provide at least 6 months history of ‘regular’ savings.

For Business loans, usually all lenders expect to see a contribution from the client’s own assets and that the client has some personal financial risk to establish the business before asking the lender to commit any funding.

If the borrower has some SKIN IN THE GAME, the lenders believe the client would be more likely to do whatever it takes to make the business successful.

3. Collateral

Collateral refers to the security that the client can provide the lender. If for some reason, the borrower cannot make repayments, the lender wants to secure the debt against a secondary avenue.

Lenders can consider both business and personal assets as collateral for a loan. Nonetheless, the lender will assess if the security offered can be sold on a short notice & will retain its current value.

That’s where LVR or Loan to Value Ratio comes in. Some lenders may require such a guarantee in addition to collateral as security for a loan.

4. Economic Conditions

Economic Conditions like interest rates, stock market fluctuations, the real estate industry’s fluctuating prices, natural disasters etc., all play a part in the ability of the client to service their commitments.

For example, when GFC hit, most banks squeezed all lending.

5. Character

Character is the first general impression of the client on the potential lender via the broker’s interpretation and presentation of supporting documents.

That’s why any borrower must select a finance real estate broker carefully, and make sure that the broker does everything to create an impression on the lender.

The lender through the information presented will form a subjective opinion as to whether or not the client is sufficiently trustworthy to repay the loan.

- If it’s a business loan - the lender will consider the following to form a subjective impression.

- Educational background of the borrower

- Experience in business and in their industry

- Business references and quality of references

- Background and experience of employees may also be taken into

- consideration.

- Client’s character is always assessed in combination with the other secrets so it is important the broker closely examines what is provided to him.

6. Commitment

A client needs to demonstrate Commitment to repay the loan, which can be demonstrated from a stable employment history, educational commitment, and long term residence.

7. Credit Rating

A Credit Rating is held on every adult in Australia who has ever bought something on credit. To get any loan across the line, the client must be able to demonstrate their worthiness to credit.

From the lender’s perspective a good credit rating means the client is able to pay their debts on time.

Payment history on existing loans & financial commitments is also considered an indicator of future repayment performance.

8. Common-Sense

‘Common-sense’ focuses on the intended purpose of the loan sought by your client. That is, the application and intended purpose of the funds needs to make sense to the lender.

A lender will not look upon the application to handle favorably if it appears that the loan is an attempt to fix a problem rather than to improve the client’s situation.

If the reason for the loan is to consolidate debt, the lender will need to feel confident that the client will not be in the same situation a short time down the track.

If property investors are looking for a home loan or looking for any kind of property investment finance, you need to make sure that you have made all efforts to address each of the 8 Secrets to getting property finance or home loan approved with any lender.

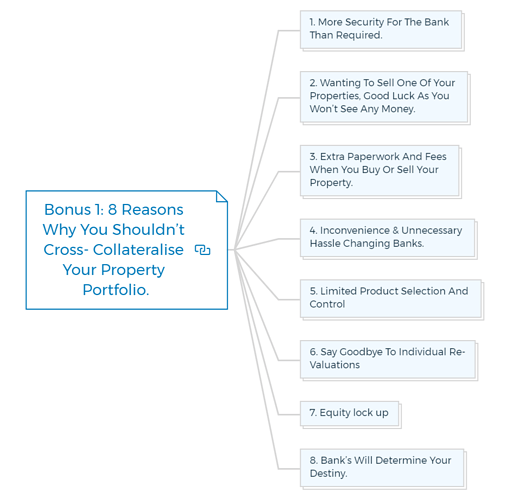

Bonus 1: 8 Reasons Why You Shouldn’t Cross- Collateralize Your Property Portfolio.

1. More security for the bank than required.

For instance, Your PPR is worth $550,000 with a loan balance of $50,000. You have an investment property valued at $300,000 with a loan balance of $100,000 (secured against your home).

You wish to purchase your second investment property worth $570,000 with a loan balance of $370,000 (secured against your PPR and your 1st investment property.

If you do your math right, you will notice that the bank’s exposure is under 40% which is far more security than necessary for any lender, considering they can easily lend on 80% LVR.

2. Wanting to sell one of your properties, good luck as you won’t see any money.

When a property is sold in a cross- collateralized structure, accessing the funds for yourself is harder than you expect.

The bank may request some or all of your funds to go back against the existing loans you have with them to strengthen their position or they may ask you to reduce the debt.

The irony is, it’s your properties, it’s your money, but the bank does not need your permission to gobble any proceeds that come from the sale.

Bank was smart enough to get you to give them permission when you first accepted the loan terms. All the bank has to say is, “Sorry, it’s our credit policy & you’ve already signed your acceptance on it”.

3. Extra paperwork and fees when you buy or sell your property.

Every time you try and sell your property, the bank will require a revaluation on your entire portfolio (sometimes at your cost) to determine their risk exposure & to determine the extra money they can take from your sale.

After the revaluation you also have to complete additional paperwork known as ‘Variation of Security’. The same process will repeat itself, if your property has gone up in value and you wish to access more equity in it.

Any guesses, what would happen if the revaluation shows that your property portfolio value has gone down?

4. Inconvenience & unnecessary hassle changing banks.

The more properties your bank has cross-collateralized, the harder it becomes to change banks. If you move banks, you may be subject to exit fees, break costs depending upon the kind of loans you have with them.

5. Limited product selection and control

If you’re with only one bank. Having multiple loans with a single bank hinders your options on the kind of loans and facilities you may have. This may cause problems when you want to borrow again.

For example, the bank may force you to take “Principal + Interest” loans in order to reduce their debt with you.

This is quite common when the dollar value of your debt is high with one lender, regardless of your overall asset position. Having at least two lenders lets you play one off against the other.

Competition keeps both lenders on the edge.

6. Say goodbye to individual re-valuations

Once cross-collateralized, you will lose the ability to revalue properties individually to obtain equity. Let’s say you have 2 investment properties in your portfolio.

One property for some reason, goes down in value and another goes up in value. In this scenario, the bank will consider a zero effect in valuation in your property portfolio, as they have all in one basket.

However, in an uncrossed structure, you could increase the loan balance on the property that has increased in value without the lender considering the other properties.

7. Equity lock up

Every now and then, property investors find themselves in this situation.

This situation typically occurs when property investors have low LVR to begin with and you approach the bank to release some more equity & the bank simply refuses to release that equity.

This could happen due to the bank’s policy, their risk exposure in the suburb you have your property in, your financial position, rising interest rates etc.

If property investors have crossed all your properties with a single bank, the only way to get what you want would be to break out of that bank, which can be expensive and time consuming.

8. Bank’s will determine destiny of property investors.

In other words, banks will control the growth & the speed of your wealth generation. That’s what they essentially want.

They don’t care if property investors make money, or grow - all they want is a maximum number of people who keep earning to keep paying their installments.

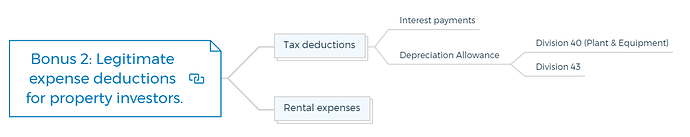

Bonus 2: Legitimate expense deductions for property investors.

Tax deductions

Any income that you earn from your investment property(s) is taxable. Since that income can be taxed, there are genuine costs & expenses incurred to earn that income that are tax deductible. Let’s look at a few:

Interest payments

Most property investors will have some sort of a loan or borrowing against their investment property or any other property.

Irrespective of what property you borrow against, the interest on that loan is an expense for that investment which is making you money.

Therefore, this interest is deductible from your total income for tax purposes, including any salary that you earn from your day job.

Since interest payments are the biggest expense in any investment, it’s great to know that the government allows you to deduct these expenses from your total income.

Depreciation allowance

I like to call this the BONUS, as it doesn’t cost you the property buyer, anything extra at all. This is where it really starts to show how much our government loves property investors.

Most of us buy property for capital growth & in essence, property goes up in value over time. However, the government let’s us assume that the actual building i.e. the constructed portion or the structure of the property loses its value over time.

In fact, as per the taxation office, all properties built since 17th July 1985 will lose all of their value in 40 years. This however, only applies to the built up area which will age due to wear and tear and will be worthless in 40 years.

The fixtures & fitting can however, be only depreciated over a shorter period.

In order for a property to be qualified for depreciation allowance against your total income, it should meet the following criteria:

- It must be built after 17th July 1985.

- It must be used as an investment property for rental purposes

The Total Depreciation Allowance Is 2.5% Of The Built Cost.

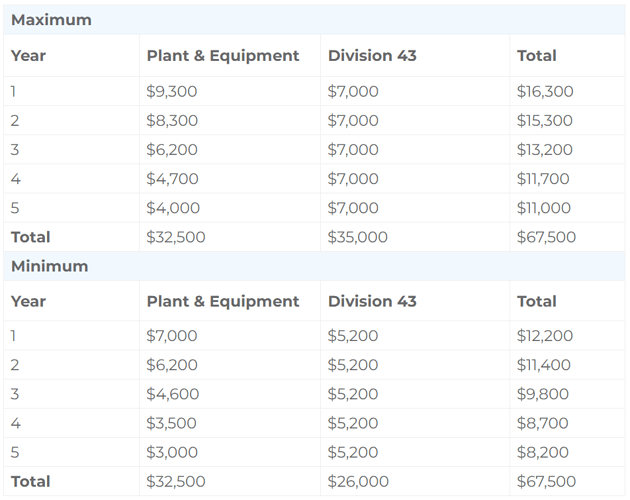

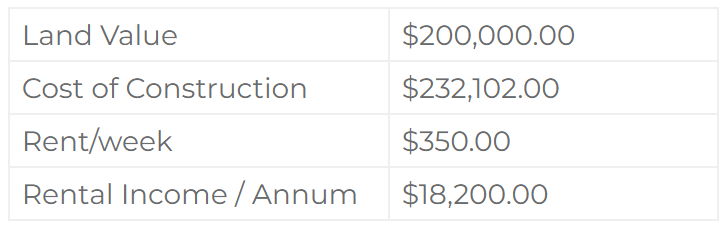

Let’s look at an example:

If you buy an investment property today with a built up area of 180sq. metre, the standard built cost will be approx. $232,102.

For personalised depreciation schedules, you should contact a specialised tax depreciation or a quantity surveying company.

Let me explain further as I want you to thoroughly understand this.

Maximising property depreciation deductions requires a clear understanding of how the different parts of a rental property qualify for Division 40 or Division 43. A property depreciation report needs to be structured so that deductions are maximised and accelerated when needed.

This is achieved by creating an effective balance between assets that qualify for Division 40 and Division 43.

Division 40 (Plant & Equipment)

Division 40 is the legislation that covers the depreciation of “plant and equipment”, i.e. the removable fixtures and fittings within an investment property.

Each plant and equipment item has an effective life set by the Australian Taxation Office (ATO) and the depreciation deduction available on that item is calculated using this effective life.

Some of the Division 40 items commonly found within a property include:

Division 43

Otherwise known as ‘Capital Works Allowance’ or ‘Building Write-Off’, Division 43 covers the deduction available to owners for the structural elements of a building and the items within the property that are deemed irremovable.

It includes the foundations, walls, ceiling, roof and also includes fixed assets like tiles, toilets, built-in cupboards, windows and doors.

Properties qualify for this allowance depending on their age and type; either 2.5% or 4% of a property’s historical construction cost or estimated cost can be claimed by a relevant professional such as a Quantity Surveyor.

The Difference

The main difference between Division 40 and Division 43 is that Division 40 items depreciate faster.

For example, while the building structure (Division 43) can be claimed at a rate of 2.5% over 40 years, carpet (Division 40) in a residential property depreciates at a rate of 20% over 10 years (using the diminishing value method).

Some items can create confusion when categorizing them into a Division 40 or Division 43 deduction.

For example, an air conditioning unit will fall under Division 40, whereas the ducting throughout the house for the same air conditioner falls under Division 43.

A swimming pool falls under the Division 43 allowance, however the pumps for the pool qualify for Division 40.

The figure of 2.5% per annum doesn’t look huge, however, as you can see from the table above, the claimable depreciation can amount to one third of your income from rent being tax free.

Let’s break it down:

Excerpt from taxreporter.com.au

You can claim a minimum of $5200 or a maximum of $7000 as depreciation allowance against your rental income under Division 43, which is almost 1/3rd of your rental income.

If it is a new construction, which it is in this scenario, you can claim almost $16,300 in the first year as a depreciation allowance.

What if you own a property that was built prior to 1985?

In 1985, ATO introduced two things, the building depreciation allowance and the Capital Gains tax.

The key to understanding the two is to understand that the building depreciation compensates for what the Capital Gains Tax takes away.

If you buy an investment property that was built before 1985, you still have to pay the capital gains tax if you sell it, but you do not get the trade off benefit of building depreciation allowance.

Rental expenses

Rental Expenses can be claimed for the period your property is available for rent or has been rented out to tenants. Some of the common rental expenses are:

- Interest on loans

- Repair & Maintenance expenses like

- Cleaning

- Pest control

- Painting

- Any electrical or plumbing repairs

- Gardening

- Council Rates

- Sewerage supply from your water authority

- Land Tax

- Property Management Agents fees

- Bookkeeping costs

- Any costs that you incur for the upkeep, maintenance or management of your investment property.

As you grow and start becoming a serious investor, you will be able to claim a lot more expenses against your property investment business without property investing mistakes.

For example, if you have properties interstate, you can claim your travel costs to those cities for upkeep of your property. If you have a home office, you can claim part of those expenses as well.

If you spend money on educating yourself on property, all those courses, books and cd’s will become tax deductible as well.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

FAQs

What is the most significant mistake people make when investing in property?

The primary goal of real estate investment is to make money. However, there are times when individuals put their money in without considering the drawbacks.

You might get into difficulty if you underestimate the expenses of developing, converting, or building real estate.

What happens if you don’t depreciate property?

In plenty of other terms, you are preceding the possibility to claim a sizable tax gain.

Whether or not you claimed depreciation during your time as the property owner, you will still have to pay depreciation recapture tax if you decide to sell it.