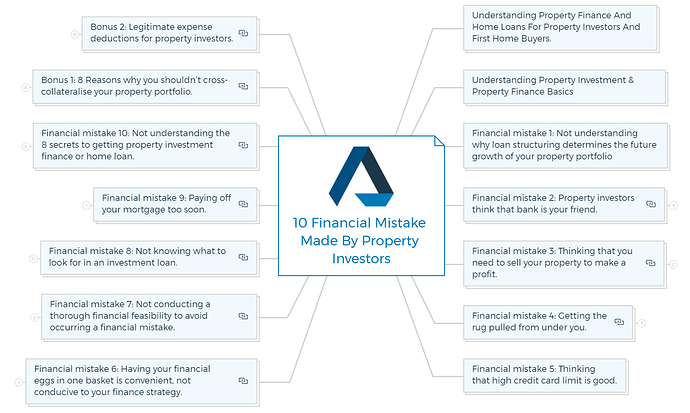

Property Finance And Home Loans For Property Investors And First Home Buyers.

Understanding property finance and investment basics

Did you know 57% of Australians generate wealth using property as their vehicle? If you own a property, you are already among the top 57% & I applaud your accomplishment.

Question now is, how do you go from where you are to a more FINANCIALLY FREE position where you are not doing any property investing mistakes. The answer lies in your property finance and investment strategy.

Simply purchasing a property without thinking will not generate wealth for you, at least not at a scale you are expecting. Over the long term, however, depending upon where you purchase the property, you may be slightly better off.

However, if you’ve purchased property without thinking, without having a well thought over property investment finance strategy, you will get caught out eventually and make financial mistakes.

If your portfolio does show growth & if your bank cross collateralised your investment properties, your bank will after a while start calling the shots on what you can or cannot purchase.

On the other hand if property investors have the right finance for your property, your investment property will out perform various other forms of investments. Let me explain:

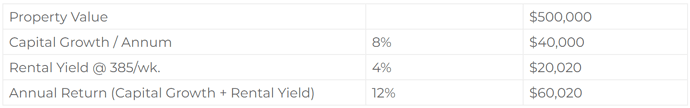

Let’s say the value of your investment property is $500,000 & the area you have purchased the property shows an annual capital growth of 8%. Post settlement, you plan on renting the property for $385/wk., which would give you a yield of 4% approx., which in-turn gives you an annual return of 12%.

See table below:

Since you are an astute investor, this is only the beginning of your journey. There will be high chances to make financial mistakes. Here is how it will unfold if you have a well thought out property finance and investment strategy in place.

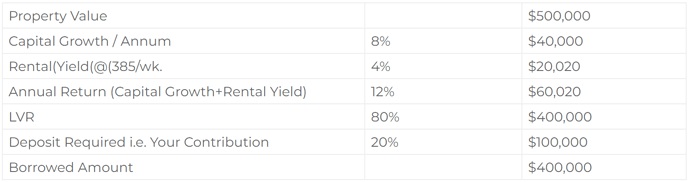

Banks usually can lend up to 80% of your property’s valuation, in other words LVR on a brick and mortar investment is 80%. Therefore, you only need 20% i.e. $100K of $500K to purchase that property.

Let’s continue with the table above.

Your return on equity or the return on your money is 60%. You had only invested $100K & at the end of the year you generated $60K.

This is where property investment outshines any other investment because of the way a property can be financed and leveraged over a long term.

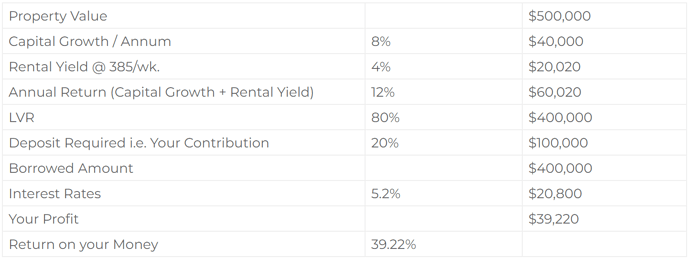

This is what makes residential property a great investment. You would argue, what about the interest rates?

Let’s continue with the example above.

The fact that banks can lend 80% of the value of your property, enables you to leverage off banks money and achieve a greater return on your money. This allows you to grow your portfolio exponentially over time and create a substantial property portfolio.

Financial mistake 1: Not understanding why loan structuring determines the future growth of your property portfolio.

Most property investors spend time formulating an investment strategy to keep away from financial property investor mistakes.

However, very few have a property investment finance strategy in place that allows them to reach their investment goals.

Property finance and investment cannot go too far without a solid property finance strategy. Finance strategy is not about interest rates and bank fees.

As you grow as a property investor you will realize that the bigger picture doesn’t even include interest rates and bank fees.

What really matters is your ability to get a loan that is flexible & that you have property finance buffers in place to carry you through rough waters in the event that you hit them.

Overtime, your circumstances and your needs would change & having a flexible loan can be the difference between slow and exponential growth of your property portfolio.

So make sure that when you start you have a sound financial structure in place that let’s you call the shots and not your lender.

To make sure that you continue growing your property portfolio, it is imperative that you understand loan structuring, so you can control & determine your future yourself.

Banks and all lenders are proficient at using ‘cross-collateralization’ of loans. Cross-Collateralisation occurs when more than one property is used to secure a loan or multiple loans.

Cross Collateralization is the practice of lenders using a property (whether owner occupied or investment) as security for other property that a borrower wishes to purchase.

In other words if a borrower owns one property and is borrowing to purchase another property then the lender may take security over both properties.

The lenders argue that they are protecting their security position so that should a borrower have problems with one mortgage the lender can cover their own position by the additional security.

Some argue that in some instances this will over-secure the lender’s position and that a borrower should not agree to it unless there is no other alternative.

They argue that it can limit a client’s borrowing capacity, security position and limit investment opportunities.

Example:

Clients have a property with a value of $500,000 and have a mortgage on that property of $150,000.

The clients could conceivably borrow an additional $250,000 and purchase an additional property with that borrowing and the LVR on the existing property for total borrowings would not exceed 80%.

However, the lender is likely to request that the two properties be cross-collateralized as the lender wishes to strengthen their security position.

The reason banks do that is to over secure themselves & would often lure clients by offering them lowered or no extra fees or a better interest rate.

Novice property investors fall in this trap for short-term benefits without realizing that cross-collateralization inevitably reduces their stability and flexibility of their property portfolio.

IMPORTANT

Cross-Collateralization = Giving Banks Too Much Power

Are your loans ‘stand-alone’ or are they ‘cross-collateralized’? Many property investors and business owners believe that their loans are standalone when in fact they are ‘crossed’ with other properties.

Recently, I came across a client from Brisbane, who had a huge amount of equity in their Owner Occupier home or PPR (primary place of residence) & a line of credit against it.

They found a positive property on rent in a 6 year lease giving them $900/wk. When they went to their bank to get finance for the next investment property, the bank tied everything up together and cross-collateralized both their properties.

If they had come to me earlier, I would have got their investment property financed from a different lender thus keeping both loans separate giving them far greater flexibility.

Cross-collateralizing is a very common practice that the banks use to OVER PROTECT THEIR INTEREST. In fact I would estimate that around 95% of residential property investors have their loans and properties cross-collateralized.

Cross-Collateralization inherently only benefits the bank, not the borrower. Getting out of this growth hindering structure can be an expensive affair and can cause the investor to miss opportunities.

Once the bank cross collateralized your portfolio, they call the shots.

In other words, banks will control the growth and the speed of your wealth generation."

Enrol for my 1-On-1 property development mentoring program and I won’t let you perform any mistake in your development and investment journey.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Financial mistake 2: Property investors think that bank is your friend.

Banks are in business too, they are not your friend, they have shareholders and they need to make money from you.

They may act like they are your friends and you may also get caught out in the LOYALTY TRAP with them, however, you are simply an opportunity for them.

If your argument is that you get service from your bank, ask yourself or an experienced property investor this question.

When was the last time your bank manager called you?

If you can recollect the last time your bank manager called you, it means that you are a high profit center client for the bank. If you are, try buying another investment property, without the bank cross collateralizing it from you.

That is why it is imperative to have a good property finance broker on your team.

An Investment savvy-mortgage broker will help you navigate the rough seas of potential lenders and plethora of lending products, saving you time, money, headache and even heartache.

What does a finance broker do to avoid property investing mistakes?

These days the lending process is less personal, more stringent and a lot more complicated. With literally hundreds of loan products available & the ever changing lending criteria, many property investors are overwhelmed by even the thought of getting a loan. A property finance broker acts as a medium between the lender and the borrower.

A finance broker’s job is to provide their clients with the best credit advice on the various options they have available and negotiate loan deals on behalf of their clients with various lenders.

As part of their continuous professional development requirements, property finance brokers by law are required to keep themselves updated on new rules and regulations. They have the latest information on a wide range of loans and through their industry software and can compare various loans to work out which product suits your situation better than others.

They represent you and shield you from banks, thus reducing your anxiety. The best part is that they get paid from the bank only when you get your loan. So it is in their best interest to make sure that your loan application is successful.

Different lenders have different criteria’s for assessing loan application. These inhouse policies are not public knowledge, however, a good finance broker can save you a lot of time by only going to a lender who’s lending policies match your particular situation.

Your finance broker can also help you structure your loan portfolio so you can achieve the best leverage of the equity in your portfolio i.e. help you maximize your borrowing capacity & your ability to leverage off more properties.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How can a property finance broker help you?

-

Intimidated by paper work? - Let your broker handle all the paperwork. It’s in fact a better option, as a broker knows the lender’s requirements & your application is handled more swiftly.

-

Access to numerous lenders, a myriad of loan products and an in depth knowledge and understanding of various finance packages.

-

When was the last time your bank manager called you? - Exactly my point. A broker you can give you a very personalized service second to none, which your bank manager will never be able to provide, unless of course you are a multimillionaire.

-

A property finance broker will spend the time to understand your personal requirements & your long term goals, to determine which loan product from which lender would best suit your needs.

-

If you are an entrepreneur, in other words, you control your pay-check and don’t have a 9-to-5 job, having a credit advisor can help you catapult to property success.

-

Time - your broker can save you a lot of time and practically eliminate your legwork all together. This means that you can also access lesser known lenders and products which are not known to the general public.

-

Credit and General Advice - your finance broker, particularly, if they are an investor/developer themselves will provide you good advice all throughout your life, in terms of refinancing and the best way forward for your property portfolio.

How To Find A Good Property Finance Broker?

There are brokers and there are property investors. While all of them can write loans, very few of them understand the intricacies of property investment, property development, construction and development finance, various tax structures and the pros and cons of each one of them.

Before you select a broker, you should determine whether or not they have an investment portfolio themselves or not. Do they have experience in settling on a property themselves? Have they done it before. Read more to get started in property development.

Quick Tip

To make sure that you never hit a finance snag in your wealth creation journey, you must have a property investment savvy finance and mortgage broker on your side.

Financial mistake 3: Thinking that you need to sell your property to make a profit.

Contrary to what most property investors think, you don’t need to sell your property to make a profit.

According to the Australian taxation system, you as an investor do not have to pay tax on the increased value of your property i.e. the capital gain. However, if you sell the property you will need to pay capital gains tax.

Capital Gains Tax (CGT)

IMPORTANT

Capital gain / loss = Cost of Acquisition - Sale Value of the Asset.

CGT is part of your income tax and is not considered a separate tax, although it is generally referred to as capital gains tax (CGT). If you make a capital loss, you cannot claim it against income but you can use it to reduce a capital gain in the same income year.

You can generally carry the loss forward and deduct it against capital gains in future years.

Some of your main personal assets are exempt from CGT, including your home, car, and most personal use assets, such as furniture. CGT also doesn’t apply to depreciating assets used solely for taxable purposes, such as business equipment or fittings in a rental property. If you’re an Australian resident, CGT applies to your assets anywhere in the world.

However, if you bought an investment property for long term holding & you’ve kept it for 12 months, you only have to pay CGT on 50% of the total capital gain.

Selling Costs

Every time a property is sold, following costs are triggered:

- Income Tax or CGT

- Selling Costs

- Finance Costs &

- Stamp Duty and Legal costs, if you purchase another property.

After paying these costs, there is hardly anything left and all your profit has just gone in paying fees and taxes. A smarter investor makes sure that they do not need to sell the existing property in order to purchase another one.

The smarter option is to refinance the property & draw out the cash against the increase in equity from the existing property.

So for example, your investment property has enjoyed a capital gain of $200,000, you should be approaching your finance broker to get an equity release loan. At any given time, you should make sure that your loan LVR is 80% of the current value of your property.

That way, you can continue reinvesting your capital gains rather than selling and incurring various costs.

Learn More

Financial mistake 4: Getting the rug pulled from under you.

Banks will never tell you or property investors, that they will only lend you a limited amount of money before they start considering you as a HIGH RISK, at which point they will start putting breaks on your borrowing capacity.

The concept called threshold

Threshold is a bank’s internal risk rating that transforms you from being the best customer to someone they do not wish to see anymore. Sometimes, even when you can service the loan, the bank will view you as a high risk investor. This could be because your property portfolio has more negatively geared properties.

The solution to this problem and to make sure that your lenders do not start viewing it as high risk, you need to either invest in positive cash flow properties or you need to seriously start manufacturing some equity in your properties yourself.

Property Development is my favourite long term, sustainable equity manufacturing strategy, that I personally use to generate wealth.

A lot of people will acquire a negatively geared property, as it is easy to acquire and most of us have grown with the negative gearing concept.

Negative Gearing is when the rental income from your investment property does not cover your property expenses, like interest payment, agent’s commission, property upkeep etc. This shortfall, after all deductions including all your interest payments, can come off your rental income & can also be offset against your other sources of income including your wages.

In order to become an astute investor, you need to have at least neutrally geared properties, if you wish to continually grow your wealth.

In order to avoid hitting the financial brick wall and to prevent the rug from being pulled from under you, you need to make sure that your portfolio to the very least is neutrally geared i.e. you are generating wealth, but you are not paying anything for it.

CAUTION

Negative gearing inherently only kicks in when you make a loss, even though some of that loss is offset against your taxable income, it is still a loss.

This loss can only be recouped if you either manufacture equity in your property or your property enjoys some capital gains.

Hence, the more negatively geared properties you have in your portfolio, the more wary the bank gets to lend you more money. Eventually, it will start tightening up the reins.

Financial mistake 5: Thinking that high credit card limit is good.

Credit Cards are toxic.

If you were to walk down the street, you would hardly come across anyone who does not have a credit card. Although convenient, in streamlining everyday expenses, credit cards can really limit your borrowing capacity.

RBA (Reserve Bank of Australia) estimates that all of us have a debt of $3250, but for some it may be a lot more. These days credit card debts have a serious impact on our borrowing capacities. Credit cards are unsecured personal debts, and unsecured debts can be the sticking point between getting a loan or your application being declined.

A credit card, debt of just $5000 can have an impact of reducing your borrowing capacity by up to $25000. So if you have a $15000 credit card debt, you just wiped for $75000 from your borrowing capacity.

Even if you owe nothing on your credit card, for a limit of $10000, the lender will consider $3600 per annum as your outgoings, further reducing your borrowing capacity.

Yes, credit cards are very handy and are embedded in our lives, however, you should consider getting a lower limit or only as much limit as you need and use it wisely.

If you are making monthly repayments on your credit card, that means you are not in complete financial control. You should consider paying off all your credit cards and get a visa debit card instead.

This will not only keep a check on your spending habits, it will also save you money on the interest payments on the loan.

Financial mistake 6: Having your financial eggs in one basket is convenient, not conducive to your finance strategy.

In my day to day dealings with clients, I come across many property investors and other borrowers who think that keeping all their accounts, business accounts, personal savings accounts, credit cards etc. with one bank is a good thing.

They boast of lower fees or no fees facilities from their bank, which they think has been given to them as a sign of honoring a loyal customer.

They somehow feel that they are privileged as the bank has granted them these facilities.

What every astute investor must remember is that the bank is watching your every move, your spending habits, your repayment habits, whether you make any extra payments and whether or not you have control over your finances.

The bank notices if your credit cards are paid and squared at the end of each month or are you making minimum payments.

Bank knows what you are making each month & it can infer if you are a saver or a spender. In fact it even knows where you shop for your groceries and where you stop every now and then to have a beer.

Let’s say, you lose your job and decide to only make the minimum payments on your credit card this month, instead of paying it in full like you usually do.

You also have a mortgage with the same bank, so in order to survive the no-job period, you decide to make only the interest payments.

Unfortunately, you are unable to find another job for a long period and are now living off on your reserve.

The bank notices that your savings account is dwindling & that you are not paying as much on your bills as you used to.

Always remember that the clauses on your mortgage agreement are in the favor of your bank, not you.

So at any time, should the bank feel that you are becoming a high risk client & you miss a payment, however small that payment is, the bank can decide to call on any one or all of the loans with that particular bank.

At that time it doesn’t matter if you have missed a payment on your credit card, the bank may still call on your home loan and force you to either reduce your debt or pull the rug from under your feet.

Quick Tip

In a nutshell, because that one bank you were so loyal for, knows about your entire financial position, you are totally at the mercy of that bank. And if it becomes nervous about your financial situation, it could sink you overnight.

Don’t have all your eggs in one basket

In other words, choose a bank for best internet banking, then choose another bank for the best savings account, then another one for your credit card etc.

Spread all your accounts across various banks, so at any given time not one bank knows about all your incoming income and outgoing expenses.

I am in no way trying to hide anything from the bank.

If the bank wishes, it can go looking for these details & can very easily find them out, but the bank that has your investment property loan, shouldn’t know that you stop at XYZ pub for a few beers every Friday night or that you shop at Target every month.

This is only to make sure that we do not reveal our spending habits to the banks. This ambiguity gives you power over whether a storm or a low period in your life, without the bank getting unnecessarily worried about it.

Financial mistake 7: Not conducting a thorough financial feasibility to avoid occurring a financial mistake.

If you are serious about property finance and property investment, you have to get in the habit of crunching numbers on your investment purchase by taking the help of expert property investors.

A financial feasibility gives you a thorough understanding of all costs involved. It allows you to work out whether your investment will be negatively geared, positively geared or will it be neutral when you settle on it.

Property investors must fully understand how to calculate the yield on your investment.

Let’s look at some financial costs that are involved in acquiring a property.

Acquisition Costs

- Establishment Fees or Application fees

- Deposit

- Any renovation costs

- Buyer’s agent fees

- Building and pest inspections

- Legals (conveyance fees)

- Stamp Duty

Loan Costs

- Establishment Fees or Application fees

- LMI - Lender Mortgage Insurance (only if you are borrowing > 80% LVR)

- Mortgagee’s Legal Fees

- Mortgage Registration

- Title Registration

Ongoing Costs

- Council Rates

- Interest repayments

- Landlord Insurance

- Repairs and Maintenance

- Body Corporate Fees

- Property management fees

- Letting Fees

- No-Rent Allowance or a vacancy period allowance

If you do not include all these costs, chances are that you will get an incorrect yield, which will lead you to make a wrong decision. If you spend any amount towards the purchase or upkeep of the property, it should give you a yield.

It is important that property investors use a software like PIA (Property Investment Analysis), to get a thorough understanding about your next investment property purchase.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

Continued at…

10 Financial Property Investing Mistakes Made By Investors [Part 2-2]