Continued from…

2 Superannuation Tax Saving Tips to Keep More of Your Money [Part 1-2]

9. Property purchase within SMSF

Many claim they don’t trust super and would invest in real estate to pay for retirement. However, more and more people are becoming aware that they can utilise their SMSF funds to purchase real estate.

Quick Tip

Superannuation tip -

Within your super fund, make an investment property purchase. When you can buy a property for only 15% down, please don’t pay for it with post-tax money, which can be as high as 47%. Additionally, paying 10% or even no tax on capital gains is preferable to paying 23.5%.

Superfunds are increasingly favouring the asset class of real estate. It is partly because of the favourable tax rates, but because super fund balances increase over time, buying a home through an SMSF becomes easier. Superannuation is a safe vehicle for asset protection because it is typically safeguarded from “creditors and predators.”

Until the age of 60, any SMSF members who get pension income are subject to a reduced tax rate; beyond that, the income is tax-free for them. There is a sense of utopia while living in one of the best countries in the world with potentially no taxes to pay in retirement.

An SMSF may purchase any property from unrelated parties. Still, it may only do so from connected entities and people if it is commercial property and will be utilised solely and exclusively for one or more enterprises. Your SMSF should have a defined investment plan permitting real estate ownership.

It would help if you typically took on more risk to increase your return on super. However, your investment approach must coincide with your risk tolerance. Don’t go after profits that seem too good to be true because they might be.

Always keep in mind that 5% of something is always preferable to 50% of nothing. First, conduct research. Don’t take needless chances if you have enough money in your super to cover five retirements.

If the declines, a hazardous plan will only upset the cautious investor. It is highly advised that you speak with a financial advisor.

Before buying real property in an SMSF, there are a few things to consider.

- Possessing a home. You cannot use the property that belongs to your SMSF as a private residence.

- Related commercial leases. A linked company entity may rent commercial buildings only if a documented lease exists.

- Costs. Having a property will increase the initial and annual costs of managing an SMSF.

- Funds. You need to have enough money in your fund to buy the house.

- Lending. You might consider having your SMSF borrow some of the money needed to buy the home.

- Diversification. You could wonder if the assets in your superfund are sufficiently diversified.

- Liquidation. You might consider the asset liquidation needed if a member retires or passes away.

10. Materialising a super fund

Given the dangers, not everyone is a good candidate for a super fund gearing plan. An SMSF can purchase a portion of an asset outright and borrow the balance using an installment warrant.

The asset is kept in trust while the debt is owed, but the SMSF retains its beneficial interest. Through the payment of installments, the SMSF will have the option but not the responsibility to acquire ownership of the asset legally.

The dividends that an SMSF earns while purchasing a portfolio of shares through an installment warrant are often used to reduce the loan. Additionally, the SMSF is allowed to buy real estate through installment warrants.

IMPORTANT

Example

John has $400,000 in cash in his retirement account. His super fund uses an installment warrant to borrow a further $200,000 to purchase a $600,000 house. Bob’s rental income and super contributions will pay off the loan. The fund can deduct interest payments from its taxes.

Quick Tip

Superannuation Tip -

Take out a loan from your super fund to buy a share portfolio. The super fund’s interest payments will be tax-deductible and reduce any dividend income. Franking credits may be applied to other fund earnings. Additionally, depending on the final sale of the portfolio, there may not be any capital gains tax.

Only properly structured purchases allow SMSFs to borrow money, but because of banks’ increased comfort with lending to SMSFs, this form of borrowing is less complicated than it was a few years ago. However, it should be highlighted that over the past year, several of Australia’s leading banks have stopped financing new purchases made by SMSFs.

The member’s total superannuation and $1.7 million transfer balance cap estimates incorporate limited recourse borrowing agreements.

Any net return analysis must consider that interest rates associated with gearing within super are typically higher than standard home loan interest rates. Additionally, the banks will require more time to arrange financing for an SMSF, so get your permission before you make any real estate transactions.

Superfunds may gear up to 75% (depending on the borrower’s constraints), but you should consider dropping asset values and cap borrowing limits at 50%.

11. Transition to Retirement

Some people adore their jobs and have no plans to stop working. Others want to work fewer hours but depend on the money to get by. Most people believe that for your super to be released, you must either retire or quit your work. However, according to the transition to retirement (TtR) laws, you are allowed to take regular withdrawals from your super to supplement your income.

You can access your super before retiring once you reach your preservation age, but only as a non-commutable income stream and not as a lump payment. As a result, once you reach age 58, you can reduce your working hours without losing your job or income.

You can also use a regular income stream from your superannuation accounts to supplement your income if you’d like.

Quick Tip

Superannuation Tip -

Suppose you start a TtR and are 65 years of age or older; salary sacrifice any extra money back into your superannuation. As a result, you will save some tax along the way and increase the benefits you can assemble for your retirement fund.

If correctly set up, your daily income might essentially stay the same. But you can dramatically raise your superannuation retirement savings.

According to the TtR guidelines, the sole restriction on the annual amount of super benefits that may be withdrawn must be at least 4% but not more than 10% of the member’s account balance at the beginning of the income year.

Like all other revenue streams, TtR income streams are subject to taxation. The taxable portion of your income stream will be taxed at your marginal tax rate if you have achieved your preservation age but are younger than 60.

In this case, no tax offset is available, and the fund’s earnings will be subject to a 15% tax rate. Any income from a taxable super fund after age 65 will be tax-free if you have not yet retired.

TtR arrangements can be challenging to set up and manage; thus, you should consult with an expert before deciding if this is the correct option for you.

12. Pensions Based on Accounts

Some people want to be disciplined by receiving recurring payments rather than a big sum since they don’t trust themselves with it. Simply because you reach a specific age does not mean you have to withdraw all of your retirement savings.

Alternatively, you can use a transfer balance account to move up to $1.7 million of your superannuation balances from the accumulation phase into the pension phase and begin an income stream like an account-based pension (formerly known as an allocated pension).

Another reason people start an account-based pension is the favourable tax treatment of income streams. Any earnings that people who cash out their super may be required to pay income tax, but these earnings would be tax-free in a pension setting.

The taxable portion of your income stream will be taxed at your marginal tax rate if you reach your preservation age but are under 60. If it is paid from a taxed source, you will receive a 15% tax offset.

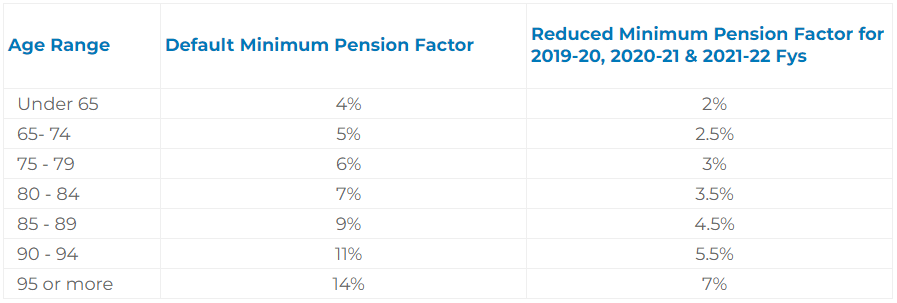

Once you begin receiving a pension or annuity, you must get a minimum annual payment based on age. The table below shows how it’s computed as a proportion of your July 1 superannuation sum (overleaf). Other than the balance in your super account, there is no maximum amount.

You must pass the income and asset requirements to be eligible for the Age Pension.

Income tests

Senior Australians may be eligible for the full age pension if their income is less than $178 per fortnight for a single person or $316 per fortnight for a pair.

Income from financial investments is calculated using deeming rather than actuals. For the first $53,000 in financial assets possessed by a person or the first $88,000 by a couple, the deeming rate is currently 0.25 per cent. The deemed rate of return is 2.25 per cent above these thresholds.

Assets Test

Single homeowners must have assets worth no more than $268,000; for couples, it must be no more than $401,500. For non-homeowners, these thresholds rise by $214,500 ($482,500 for singles and $616,000 for couples).