Property Developments: The Lazy Way To Generate Equity, FAST

Property Developments: The Only Strategy You Should Learn

Here’s Why?

Okay, let’s get an understanding of why you should learn property development? Why as an investor you should now look at becoming a property developer and learning property development.

So let’s look at a few things. The number one reason is profit.

When you develop your own project, you end up with townhouses or apartments at cost and I’ll explain that to you in an example a little bit later, which you can either sell in the market for instant cash profit or you can decide to keep the profit in your property or you can have a mix of both.

So the number one reason nonetheless is profit. That’s why we do everything. That’s why we do business and property development is no different than a business. Every little deal is actually a business venture.

Free Equity

There is always the possibility to purchase land and negotiate a building contract at discounted rates if you have done your research and are a competent negotiator.

You can save money by doing part of the project yourself if you are an experienced developer. You are creating ‘free’ or ‘sweat’ equity in each instance.

This is the difference in value between the total cost of the land plus construction expenditures and the bank value at the development’s completion.

Deposit

Deposit – you can use your profit or your equity as a deposit for your next investment property or your next deal because you’ve generated all this equity in your project and your holding it down so without actually even selling it you can use that extra equity as a deposit for your next venture or your next investment property.

Most financed property deals demand a deposit or other form of equity, usually about 20%.

A deposit is required for new development if the land purchase price is lower than that of an existing building, including the land and the buildings. In a completed building, additional expenditures are often higher.

It includes stamp duty and conveyancing fees.

Capital Gains

Capital gain, the moment you develop there is instant capital gain. As you know, because you actually got it lower than the market there is instant capital gain when you do develop your own property.

Rental Yield

Rental yield, your total cost of the development for your unit will always be less than the market value, which gives you higher rental yield.

Now there could be somebody else who bought the house right next to yours and they paid full retail, let’s say $700,000, but you on the other hand only paid 550,000.

So the rental yield is exactly the same because he’s got a 4 bedroom house and maybe you’ve got a 4 bedroom house and you both can rent it out and you get the exact same rent, however, because you’ve got it at a lower rate, your rental yield is always going to be higher than anybody else’s.

Tax Benefits

There’s also some tax benefits. If you develop and hold your properties, you can claim substantial depreciation.

You can avoid capital gains tax if you are holding them for long term and if you hold them for 5 years, you don’t even have to pay GST on them (Applicable for property developers in Australia).

The depreciation allowance is the amount or book value of a building. This can be deducted annually as a legitimate cost. It is usually determined by the original cost against the expected life of the building.

At the time of writing, the allowance is 2.5% every year for forty years. You will be able to enjoy the benefit of 40 years as a developer for a new project.

Highest Return On Your Money

Higher return on capital, well because you leveraged off the existing equity in your property, the upfront payment is far less than the return.

Therefore, your return on new capital invested can be in the range of 80% to 100% and I will show you an example very soon.

Portfolio Explosion

Portfolio explosion – When you acquire properties at cost you acquire a lot more properties in a shorter amount of time. That gives your portfolio an instant boost.

Greater Savings

Greater savings if you are following a develop and hold strategy, you can avoid agent’s commissions, marketing costs, GST and all of which will add to your bottom line.

This applies when you are actually holding them so there are no other extra costs associated with it.

Property Development Allows You To Acquire Property At Cost

Let me give you an example. So if you were an investor and you would have bought each unit at an average value of $700,000 or $651,000.

For example, if you were to buy ah this as an investor and you would have paid full $700,000 for it, but as a developer because you got in the deal from the very beginning and you made everything happen, you get to keep your developer product with an average profit of almost $173,000.

Would you consider this a good discount for your next investment deal?

So these are the main benefits when property developing and each one of these, the rental yield, the capital gain and the deposit, they all help you really exponentially grow your property for portfolio.

Design To Suit The Current Market Trends.

Some investment properties may be too old or will outlive market needs in terms of accommodation and architectural design, depending on the age of the structure.

For example, the rooms could be too small, no family area, the kitchen could be outdated and poorly organised, and the bathroom colours could be excessively bright.

An older property can only be brought up to date with the latest trends by spending a lot of money and making significant changes.

However, with new development, you can plan and design the structure to fit market trends.

For instance, new house plans: computer room, gaming room, home theatre, patio space, or open plan living are all standard features.

Building Excitement

It can be fascinating to witness your development plans grow as the architect or designer presents your design, selects your finishing, and observes the various building stages.

It can be highly satisfying to see your development get a lot of attention, and you have your product quickly sold or leased.

This cannot be the case while purchasing a pre-existing building. The enthusiasm is limited, and it’s always possible that the market may require renovations or the addition of new rooms.

Longer Life Expectancy

All older structures will need to be maintained at some point due to wear and tear.

Engage the services of a building consultant to inspect and identify any structural deficiencies, electrical failures, roof leaks, and other issues before purchasing an older structure.

A newer building built to high standards is less likely to need maintenance in the short term.

Do property developers make a lot of money?

This is a great question. Because before you invest your time in anything, you must have an idea of what return you will get (ROI of time and money).

Now, in some ways, the answer is:

How long is a piece of string (i.e. there is no fixed answer to this question)?The truth is, the sky’s the limit when it comes to property profits.

Some people make a killing. Some people get killed (financially that is).

There is no guarantee of making a single cent. That’s why you need to follow a proven process like my Property Development System.

However, from my experience being personally involved in dozens of developments, and analysing hundreds more, here is a rough profit guide:

Beginner: A first-time developer spending time after work and on weekends could expect to complete one project per year and make $60k-$80k.

I emphasize that this is not a guarantee. There are risks. There is work involved. And things rarely go according to plan so you must be prepared to solve problems along the way. But this is a realistic result for a beginning developer.

Experienced: With 1 or 2 projects under your belt you’ll have the confidence and the contacts to find and complete more projects in less time.

Many of my students make $75k-$175k cash/equity a year developing part-time.

Professional: The sky’s the limit because once you turn pro, you won’t be limited by your own money – you’ll be leveraging other people’s money (something I cover at length in my Property Development System).

Yet, I must reiterate: There are no guarantees. And the best chance of success comes from following a proven process. And knowing your numbers.

Learn More

Property Development Vs Property Investment - What’s Best?

Why do individuals construct residential structures? Unless it’s a government organization, the obvious response is money and success.

Residential investments that provide ongoing income and capital growth have yielded big rewards for the discerning.

Every developer has their financial objectives, influenced by various factors such as income, age, taxation levels, and social standing, but the underlying drive to build property stays the same - success and money.

Almost every significant financial return comes with some risk; however, the risks associated with property development can be assessed and analysed.

Because everyone requires a home or some lodging, there will always be a demand for housing. This need will continue to rise as long as there is economic stability and population growth.

This opens up a slew of prospects for forward-thinking entrepreneurs. Because not all developers have the same priorities, they concentrate their efforts on different areas.

Some focus on industrial buildings, while others specialise in shopping centres, where the projects are more significant, and the returns are higher.

Residential developments might be equally profitable, but the rewards are proportional to the project’s size.

Residential property development has numerous financial benefits, whether restoring a home or creating a retirement village complex.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Should I buy an investment property or develop it?

In my previous articles, you will find several tips and strategies for property investment and development. Now let’s understand which one is best that is developing a new residential property or investing in a

Real estate professionals often write about the advantages of investing in already-established properties, but what about developing your own?

What are the benefits, and how will it help you financially? This is what I am going to discuss today.

For most people, the selection of a property will be based primarily on personal preference.

Still, it may also be influenced by various other criteria such as personal time availability, personal financial status, timing, and location.

The benefits and drawbacks of both investment and development are analysed below.

Property Developments: The Ferrari Of All Property Investment Strategies

All right, welcome to another video from Property Development System, a course in property development. My name is Amber. Property Development is the fastest way to generate equity, amongst all property strategies.

If you are looking to exponentially grow your property portfolio, the you should spend some time to learn property development.

A while back, I did a video on what are the benefits of property development and why you should …

Being an investor, you should seriously think about getting into property development or even if you do a couple of projects just for yourself to generate that extra equity and get that extra growth for yourself and your family.

In the previous video I discussed that there are benefits like profit, the kind of profit that you can make there, the deposit comes back, capital gain, rental yield, tax benefits, higher return on capital, portfolio explosion, greater savings, how you can acquire property at cost when you do property development.

If you haven’t actually seen that video, I would highly recommend that you go to my YouTube Channel and while you were there, don’t forget to click the subscribe button.

If you go right to the bottom of my playlist called “Free Property Development Course”, it was one of the first videos I released a while back named, “Why learn Property Development?”, or you just search on YouTube, Why Should I Get Into Property Development. This video should pop up if you haven’t already seen it.

Today I, actually wanted to build on that video and show you in terms of numbers exactly what it looks like if you were to get into property development or think about a property development as of a way to generate equity for your portfolio or use that money as cash, as profit, or you can use it in many different ways.

I just wanted to show you a financial feasibility on what it looks like if you were to do a 4 townhouse development and what kind of profit can you make?

How does it look like, and how does it compare and contrast with a normal person who goes out, buys something and pays full price, retail value for the property and whereas you as a developer, you go there and manage to acquire property at cost.

(To better understand the following section, watch the video above in HD)

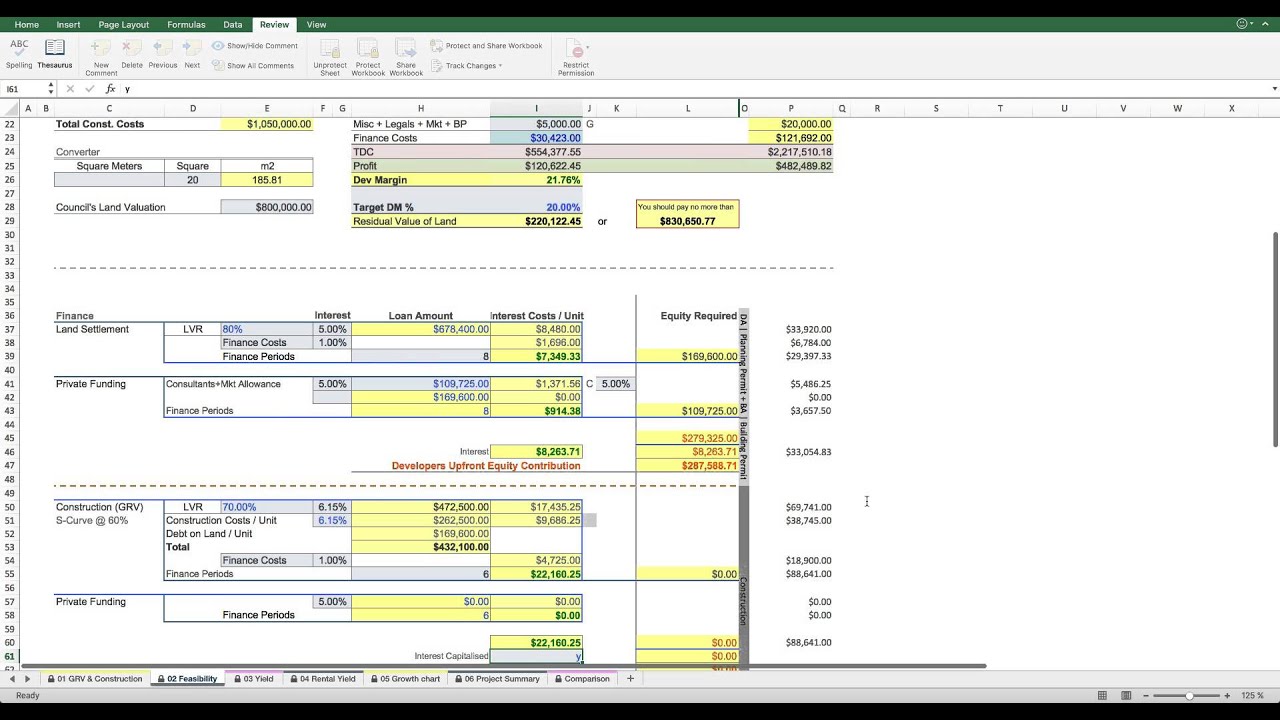

This is a financial feasibility application. I call it the smart feasibility calculator, which I have recently replaced with my Validation Feasibility.

This is only to vet deals and all of my students have access to it, so I’ll just use the same application to explain to you how it’s done.

If I was to do a 4 townhouse development, I buy, let’s say, for example, $800,000 land value and I’m going to put 4 townhouses on it.

Don’t worry about the commercial leasable because this is a little bit more advanced stuff and this is if you are doing a mixed-use development, but let’s come back here and let’s look at the cost of construction.

I’m in Victoria, so I’m using some numbers based on Victoria, say, if I was to get a demolition done, it will cost me 20,000 and $1,400 a square meter in order to build this. Let’s say, all my townhouses were 175 square meters.

There were 3 bedroom, 2 bathroom and 2 car garage. They will end up costing me $245,000 for the build price. I’ve got a 5% contingency on it, which gives me a $1,050,000 as the build price for my townhouses.

Let’s say the end value of these townhouses for each one of them, I can sell them for … (which is a gross realization value), I can sell them for 675,000 each, which gives me a total GRV of $2.7 million.

Let’s look at the numbers here. This is a quick feaso and in this section, all I do is I do it based on per unit or per townhouse. Over here, I do for all 4 townhouses. This is for the whole project. This is for a per unit.

I’ve put a stamp duty 6%, stamp duty in Victoria is about 5.5. I add a little bit extra. This gives me my total acquisition cost then I split that amongst the 4, and then I get the average cost of the building.

It’s picked up at 0.25 from 1 demolition that I had here, so don’t worry about that. This is just a converter and the council land valuation is about 800, let’s say.

My GRV per unit is about 675, land is 212, construction about 262,000 which includes the 5% contingency. For consultants, I’ve allowed about 5% of the cost of construction for getting plans, permit, SDA, and this going up to the working growing stage.

Council contribution in Victoria is, if I’m putting 4 townhouses about 4% of the land value, so I put 4% here. Then in GST, I am under the margin scheme and I can explain that in a different video some other time.

Marketing cost, what am I paying to my agent, usually, normally, it’s about 2.2. However, the agent that I use, I put 1.1 because that’s what I’m paying.

We work really closely with him, so he sells a lot of projects at the stage and we’ve got a mutual understanding of that right, so I put in 1.1. Miscellaneous legals, I’ve allowed about marketing or building permit and so on.

I’ve allowed about $3,000 per townhouse for this. For marketing, I’ve allowed $7,425 as commission. I can pump that up to about 5 grand to get my drawings and everything. This, I will show you how we can calculate that.

At the bottom, based on 80% LVR and that’s capital on the land and then 70% of the TDC. At this interest rate, my interest cost for this project would be about less 30,423, 30,000 per townhouse so that gives me about 21.76% of development margin.

This gives me a profit of 120,622.45 per apartment or almost half a mill on the whole project to do the 4 townhouses.

In this calculator, I can put that I want to make 25% development margin and if I do that, it tells me that I shouldn’t be paying more than 745,000 for land, but I just want to put in 20% because this one, I wanted to make, I’m already making above that.

I could put in 15% that tells me if I’m negotiating how much more can I pay and I still make 15% and so on, but I’ll leave that at 20% at this stage. All these sheet is telling me is that I’m making 120,000 if I develop this project by myself.

Let’s look at the yield amount and that’s the main thing that I wanted to show you in this because that’s what you get when you do the development.

Let’s say, the phase 1 of total offer in investment would be 554,000 but depending on your service ability and the level of equity that you got all this can be leveraged, but for the sake of simplicity, all I’ve got here is what is the total cost of the project which is this is your total cost.

This is coming in from my TDC which is Total Development Cost and that’s what my upfront contribution is.

If I was to buy this, either this comes as a loan and I’ve taken out the loan equation from this because everywhere there are so many different variables, so many different ways to get finance and depends upon your service ability, depends upon your equity contribution and so on.

It’s difficult to actually pinpoint a standard, so I’ve taken it out of the equation for this example.

In phase 2, you’ve got a development margin and return on equity. Let’s say, your instant development profit that you make if you develop it by yourself is 120,000 because all you’ve paid is the cost of full development.

This is going by each townhouse, so all you have paid is the cost of building and cost of doing the development by yourself.

You’ve made a development margin on 21.76 and your upfront equity and cash contribution was 287,588.71 and where is that coming from, it’s coming from because she’d also calculate the approximate equity that you would need to be able to put a development like that.

Your return on equity is about 41.94% which is basically the amount that was required to acquire the site then take it through all the way to permit and then all the way to building permit, and then all the way through construction.

That was the total equity that was required for you to pull off project like this. It costs you 41.94%, not cost you, it will actually give you a return on the money that you actually put in.

The phase 3 comes in, so if you were to develop this and hold this townhouse that will serve as a long-term investment, let’s say, the area that this was being developed had a capital growth rate of 3.4%.

This is the annual capital growth rate. All these data is actually available and the value of the property was 675, and you had a return on equity of 41.9 focusing on that.

Now, this is looking at in 2016 then 5 years from then, and then another 10 years from 2016, and then another 15 years from 2016. If we are looking at the first year and the first year you made 120,622.45 as you have developed but let’s look at what happens to 2021.

As per the capital growth rate, you enjoy the capital growth rate after the 5-year period at 3.4% per annum. This gives you a growth in your equity and it pushes that up to 243,000 from another 120,000.

If you were to do a development in this suburb which had a 3.4% capital growth rate, your equity in 5 years time from 120,000 would have been another 120,000 on top of that. That’s your profit at this stage.

This is what you’re making all up. Then in 10 years time, you would have made 388,000 in equity and in 15 years time, your 120,000 equity would have been 560,000 in equity.

This is considering that you pay down your debt as you were going along. In phase 4 which is the rental yield, let’s say you would rent this house.

Let’s look at if you can rent this out for $410 a week and you have a CPI which is the Consumer Price Index and you can push the rent up 3% every year. That’s what you [assumed 00:12:30] in 2016, ’17, ’18, ’19 and so on.

Every year, it actually pushes the rent up by 3% from 410 starting price, so there’s nothing in the first year and that’s what’s going on, so less outgoing in presenter’s less out just put a 9% which includes my agent’s commission for property management and I pay rates, and I pay insurances and so on.

You can push this up to about 10% and see what it looks like. That’s what it would look like. All I’m doing is I’m taking all this out and getting a net rental income and net rental yield which is about 2.87, 2.99, 3.14 and so on.

You will say, “This is too low.” You do have a really good capital growth rate in this suburb. Remember that capital growth rate and rental yield are always going to be, they’re always inversely proportioned to each other.

If you are enjoying 2 great off cap, a really good capital growth, your rental yield will be very low.

In some areas where you want to enjoy the capital growth that high, your rental yield would be very high. Look in [money towns 00:13:44], there’s hardly …

I don’t think there’s been any capital growth there, only at the time when there was a boom in that area, but I think everyone is in a negative right now whoever ever been to at money towns but the rental yield was really, really high in that area.

That’s what the whole point is just to explain you that. If you were to develop this and hold this, in 5 years, you would have collected about 109,000 in rent. That would have given you about 3.16% average rental yield per annum.

In 10 years time, you would have collected 148 which would have given you 4.31 average rental yield and so on. If you look at the growth chart, this is what I wanted to explain to you, these are the 3 drivers of exponential growth that you get when you develop.

If you were a normal investor who came in and paid for someone else’s development margin, you would have been buying the appropriate right here, right at the top here in paying both the cost and the developer’s margin to the other person, but because you do all of it yourself, in the first year, you make that 120,000 and pocketed that in equity.

In 5 years time, what happened was you had the development margin already then you enjoy the rental income for 5 years, and then you enjoy the capital growth for the 5-year period.

That happened in the 10th year and after 10 years, that’s what it looked like, and after 15 years, that’s what it looked like. If you look at this point, this is almost doubled, more than doubled right here, just right here it’s more than doubled.

If you just look at this dark blue bar here which is basically all your cost and you put it here in 10 years, this has already gone more than … This is also more than doubled.

The whole point of me explaining you this is to show you that the fastest way I know of to generate equity is to do a property development. You could put together a summary page but I just wanted to show you a comparison.

The total investment and development project was 554, but if you would buy this upfront, you would have paid 675 which would have required you to put in an extra 120,622 which was your profit basically.

If you were to buy this, just go out, pay 675 and buy this, you’ve just have operated your developer’s equity and your developer’s margin on cost. Then you’ve got an upfront and equity contribution which was 287 if you were to develop this but your upfront equity contribution in this scenario would be 80% of that which is 540,000.

Again, capital growth 3.4, so if you look at this, you basically lost. If you look at the return on equity and what you were getting if you were going to develop was 84.65, 135.13 and so on which is almost getting halved as the time goes on.

That’s what I wanted to explain. I’ve done a lot of property development and other property courses when I started out over 4 years ago.

I studied a lot of other developers, other property investment experts who are doing developments and plus I’ve done my own developments.

Property development is the fastest way to generate equity for ourselves that I know of. I hope you enjoyed the video.

Don’t forget to subscribe to my YouTube playlist called “Free Property Development Course“.

Property Development “How To’s” & Frequently Asked Questions

Includes 5 x detailed eBooks [142 pages]

✓ How To Become A Property Developer? In 10 Easy Steps (51 Pages)

✓ How To Overcome Fear In Property Development? (15 Pages)

✓ How To Become A Real Estate Developer? Without Experience (37 Pages)

✓ Property Developer FAQs – Who, What, When, How? (20 Pages)

✓ How To Become A Real Estate Millionaire In 10 Steps? (19 Pages)

Continued at…

Property Developments: The Lazy Way To Generate Equity, Fast [Part 2-2]