Continued from…

Property Developments: The Lazy Way To Generate Equity, Fast [Part 1-2]

Property Development Vs Property Investment

Hi my name is Amber Khanna. I help property investors become property developers. Even if they’ve got no prior experience but not how you might think. To find out more all you have to do is go to pdsblueprint.

People come to me because they want to fast track their investment goals in the shortest amount of time.

Even though they’re just starting out with a small amount of equity, or cash, or have already one or more investment properties and they are really dedicated to getting results.

They can’t seem to get off the ground or take the next step because they feel stuck.

Either they’ve got no knowledge, or the tools, or they’ve got no idea where to start, or they’ve got investment properties but they can’t move forward because they’re all dead latent and they are not happy with the return that they are getting.

They tell me this makes them feel frustrated, overwhelmed and sometimes even cheated. Especially if they’ve been to expensive seminars and have no results to show for it.

All this is happening because of this paradigm shift in property investment. As a saving investor you need to learn how to take advantage of this paradigm shift.

By the way if you want to find out more, all you have to do is go to pdsblueprint. It’s pdsblueprint.

If this sounds familiar to you, by the way you’re not alone. A lot of people go through this. I have gone through this when I was starting out myself. I can totally relate to this. How can you not feel overwhelmed.

There are so many things to learn. The cost of making a mistake is very high.

Anyone would get nervous. Have I got the structure right? Have I got the numbers right? Have I chosen the right location?

Have I accounted for all the costs that I was supposed to account for? Is my equity injection going to cover the whole development?

Just when you thought that the recent seminar you attended gave you everything you needed, you find yourself holding the shorter end of the stick. It just goes on, and on, and on.

The lack of knowledge, uncertainty and the cost of making a mistake can be overwhelming.

Before I forget make sure you download the blueprint from pdsblueprint.

Before we get into the paradigm shift in property investment, let’s find out the difference between the conventional and the contemporary property investment.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Conventional Property Investment

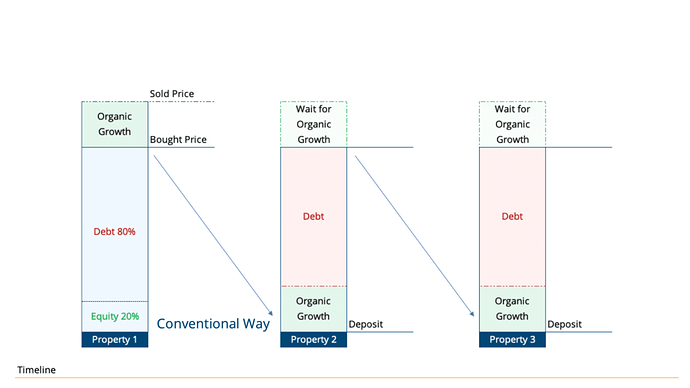

Here’s how the conventional model works. The conventional way of investing is basically you buy the property at 20%. With 20% of your own money or your equity. You borrow 80%. That is 80% of the debt.

Then you wait for some organic growth to occur. You then use your organic growth from the first property as a deposit to purchase your second investment property and pile on more debt.

Then again sit and wait for the organic growth to occur again. By the time you’re buying your second investment property, which by the way only a few people manage to do, you’re again using the organic growth from your second property and first property as a deposit for your third property.

I don’t know if you’ve noticed. I see a lot of red. Red for me is debt. Debt that I don’t want to have but there’s a better way. The PDS way.

I can’t say anything about anybody else but this is exactly how I’ve gone about acquiring my investment properties, which by the way I’m not only positive but I also have access to my equity so I can rinse and repeat.

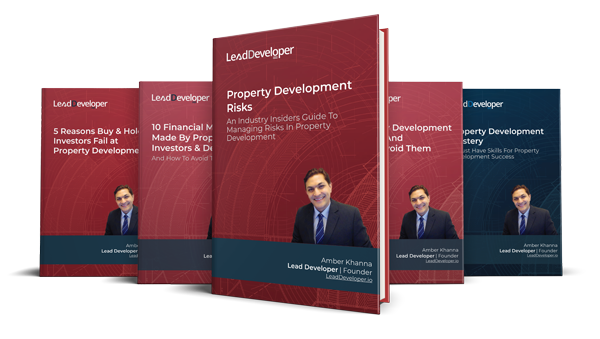

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

Here’s How The Property Investment Model Works Via Property Developments

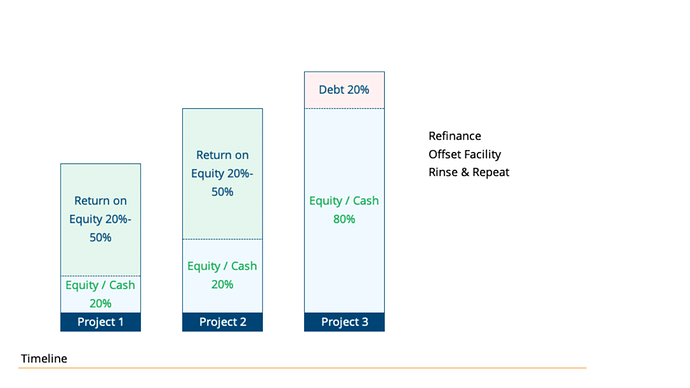

Here’s how my students are doing it. This is exactly how I’ve done it. You start with any amount of equity or cash that you bought. It could be 50K or 100K. All you seek is a return on your equity from your first project, which if you’re developing can range from 20 to 50 percent.

By the time you’re doing your second project, you have grown your equity. Then you invest that equity in your second project and get another 20 to 50 percent return on your money.

Depending on what you started off with, by the time you’re doing your third project, you are in a position to be able to roll over your equity into the third project and be able to hold one of your developed units as an investment property. If you notice, in project number three, you have essential reversed the debt position. Your investment properties positively geared. You have access to your equity. Your service ability isn’t impacted. All you now have to do is rinse and repeat.

If this is something that you would like me to help you out with, all you have to do is go to pdsblueprint and download my 65 page content rich property development blueprint.

Two Things that make you money in Property Development.

Morning everyone. A beautiful, sunny morning in Melbourne just after the long weekend. I wanted to talk to everybody today about the 2 things in property development that will make you money.

Everything else in between is a cost. The 2 things are innovation and marketing. No matter what you do in property development there’ll be just 2 things that will make you money in property development, innovation and marketing. What do I mean by innovation?

Innovation could be in the way you structure deals. Innovation could be in the way you get your finance.

Innovation could be in the way you negotiate your settlement terms & conditions and innovation could be in the way you design your stock or townhouses or apartment that you are about to develop, the one that you want to sell.

Innovation in finance is the way you get your finance or the way you get your funding. It could be set up in so many different ways.

It could be a JV with the landowner, it could be a JV with the builder, and it could be JV with the money partner. It’s the way you source finance, different kind of finance … Sorry, different ways to finance your deal.

You’ve got to be really creative with all of this and the only way you can be creative with all of this is if you know all the rules, if you know all the strategies, if you know how the mechanics of these deals work.

You can innovate in finance, you can innovate in the way you structure your deals.

This is related to financial structures and you will need to consult your accountant in order to do that but you’ll have to also determine what your end purpose is, what you really want to do when the project is finished.

That will determine the structure and you will need to get advice on it from your accountant. I know that there are some really innovative ways to structure a deal.

The third thing is terms and conditions. You could basically ask for anything and negotiate anything. It all boils down to you being innovative enough to be able to negotiate the kind of settlement terms for your property development project that are most favorable to you.

For example, no matter what I do I always, even if I buy something with plans and permit, I always make sure that I’ve got …

I always make sure that I’ve got enough time so I can go out and sell my project before I settle so I can save on interest and all those things.

The fourth way you can innovate in property development is the way you design everything. It could be something, which is environmentally sustainable, or something that’s created with good energy rating, for example solar.

The second way is marketing and the reason I say marketing is because you’ve got to really make something that you can sell.

If you develop something that you can’t sell it’s going to be a problem towards the end of your project because the only time you actually get your money back is when you actually sell your stock.

Marketing, my friends, is very different from just engaging an agent, any more.

The reason for that is the lenders and the banks are actually getting stricter and stricter with the amount of pre-sales they want, the amount of debt they want to cover before they can let you start construction.

Marketing comes in a lot earlier than it used to. When it comes in earlier that means you’ve got to have, you’ve got to sell everything off the plan.

Imagine you going out and buying something off the plan, which has not been built, and you’ve got to be really certain about so many different things.

You got to make sure that you’ve got a good builder. You’ve got to make sure that you’ve got favourable terms. If the project is good, then everything boils down to the actual product.

Can they actually see the floor plan? Can they actually see what it’s going to look like? Are the renders good?

Of course you can go and get some cheap renders done from overseas but are they going to do justice to the product that you’re selling? I tried to cut corners when I started and said, “Yeah, no problem, I’ll go overseas, get some really cheap renders done.” But in this industry you basically get what you pay for. If you’re offering peanuts you’ll get monkeys.

Don’t do that, just make sure that the kind of product that you are selling …

If you’re selling something for $200,000 I’d say don’t bother with the render because it doesn’t work but anything above 500 and above 600K that you want to sell as your product towards the end of it or even off the plan you got to make sure that you’ve got some really good renders.

It is difficult for people, people who have been in the industry can visualize what it would look like but people who are getting in, buying your stuff, they won’t be able to visualize it. They really have to see what it looks like.

Marketing involves material and finishes schedule. You give them a schedule what the colour schemes going to be like, what the materials you’re going to use.

I even go out and get a materials board done so people can touch, feel the tiles, the floorboards, any kind of stone tops or anything. I have a sample of it stuck on a board that people can touch and feel and say, “Okay, this is what I’m getting into.”

Those are the 2 things that will make you money. Everything else in the middle of your property development project is going to be a cost.

If you can really nail the 2 ends, this is the front end and there’s a back end and the front is innovation and creativity and the backend is marketing, making sure that everything that you’re developing is saleable, you’ll be a good property developer.

I’ll see you next week.

The One Skill You Need To Be Successful At Property Developments

Disadvantages of Property Development

When opposed to straight forward property investing, there are significant drawbacks to property development.

Budget Overruns

Buyers are usually aware of the bottom-line price that the seller is willing to accept when a completed building is offered for sale. This gives the investor some peace of mind, as the only new expenditures are stamp duty and conveyancing fees.

Developers know the fixed price of land when creating a new property, but they may find themselves in a situation where the final cost of the construction has blown out beyond their established budget.

Many other costs, such as landscaping, fencing, floor coverings, curtains, and so on, are not generally included in the advertised price of a new structure.

Furthermore, it is possible to go carried away and overcapitalise on the building, making it difficult to find a buyer willing to match the amount invested in the structure when it comes time to sell.

Purchasers Are Unable To See What They Are Paying For.

Unless you’re replicating another building, most new structures start with an idea or a concept and then evolve into a set of workable designs.

Reading and visualising the finished home from architectural plans is challenging for most people. However, with an existing building, you can walk through and get a feel for the layout and see the actual sizes of the rooms.

Contractor Disagreements

‘Shady’ builders are frequently featured in the media, highlighting unethical practices and instilling scepticism in the construction business.

Disputes with builders may cause the project to be delayed, increasing the holding cost and diminishing earnings. These reports are enough to put most people off taking on new challenges.

Fortunately, not all builders are dishonest, and the majority have a solid reputation for high-quality work and good customer service.

Immediate Return

When you invest in an existing property, especially one that already has a long-term tenant, you will be able to determine the worth of your return almost quickly.

On the other hand, when you create a new property, you can determine the value of your return only when the building or buildings are completed and completely leased, which could take many months.

Developing A New Building Vs Investing In An Established Building - The Comparison

Building new property can be less expensive than buying an existing property. Furthermore, the free equity generated by building your investment property can be used as a down payment on future transactions.

Personal preference and the variables outlined earlier will help you determine whether to invest in a completed building or design a new one.

Nothing beats the excitement and stimulation of having a new development if you are willing to go through negotiating land deals, negotiating the design with your architect or designer, selecting and then negotiating with a builder, and putting up with a certain amount of annoyance during construction.

Final Words

Even if you start to find the ideal existing home, you may wind up preferring to construct your own to achieve what you want. On the other hand, you can plan to construct and then decide that an existing home is a better fit.

Working with a knowledgeable and experienced professional in the real estate world can ensure that the process goes as smoothly as possible in either scenario.

FAQs

Is property development profitable?

Many developers earn from development solely because the real estate market has been good. Prices may have risen by 10% by the time the development is completed.

If they hadn’t bled blood and spent a fortune on development, they would have earned just as much profit (if not more).

How do property developers make money?

Developers of residential properties generate money by maximizing the actual worth of the land they deal with. They do this by constructing separate residences and subdividing them to be sold individually.