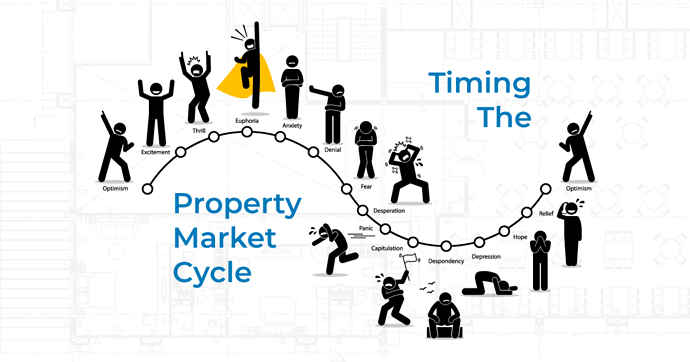

Property Market Cycle – Get In Or Get Out?

What Is A Property Market Cycle?

And Why Property Developers Must Understand Property Market Cycles?

Imagine If You Could Continue With Your Property Investment Journey, Irrespective Of Property Market Cycles…

Most developers are astute and keep in touch with what’s happening in the market. Australia is made of many small pockets and there are various factors impact the demand and supply of property in any area. However, there are 7 Key Property Market Economic Indicators, that give property developers an edge & the ability to develop in all property market cycles.

You don’t need to be an economist to be a successful property investor.

But having at least a rudimentary understanding of the economic fundamentals that impact upon and drive the property market will give you an edge when it comes to undertaking a property development.

There’s no science or precise formula for getting it right, but one of the first steps any developer should take is to get educated, as this will help you choose the right project and significantly improve your profit margin at the end of the day.

There are 7 major fundamentals of property economics every property developer must know before getting started in property development.

You won’t learn this in your $5000 conventional property development course, as they focus on the nuts and bolts of the practicalities of developing, rather than taking a holistic approach that begins before you even secure a development site.

How To Successfully Invest In Property?

There are three crucial elements that a property developer should consider before investing in real estate.

- Understanding economic and market conditions

- Take a look at short and long term trends

- Assessing market conditions

Quick Tip

Opportunity is a haughty goddess who wastes no time with those who are unprepared.

Real estate is one such opportunity. You must plan and prioritize the aspects mentioned above to invest successfully in property. You will be able to make informed decisions about real estate investments once you have mastered the issues and the solutions.

Understanding Economic And Market Conditions

The overall health of the economy highly impacts the value of a property. You can measure this by understanding and using specific economic indicators such as GDP, household formation, employment data, wage growth, etc. The cyclicality of the economy has an impact on the pricing of a property. This will also affect your investment strategy.

In simple words, when the economy grows, lenders tend to lend too much credit. Consumers are happy to accept this credit because they believe in the housing market.

Many people end up taking out mortgages that are larger than they can afford. This leads to increased borrowing on credit cards, as well as hire purchase agreements.

On the other hand, excessive borrowing makes it difficult for consumers to meet their monthly payments as the economy worsens. This can result in a lack of confidence in the housing market, a drop in property values, and even home repossession.

You are missing out if you haven’t yet subscribed to our YouTube channel.

8 Indicators Of Property Market Cycle

New Government Policies

Property developers should be up to date with current affairs as the market can be impacted by new announcements, including government policies, which can have a multitude of effects on the market.

At the last Federal Election voters were well aware that negative gearing could potentially be abolished or scaled back, and all investors were holding their breath to see the outcome. This would have had a huge impact on the market, potentially leading to a fall in demand and consequently, property prices.

Another policy that has been mooted by the Federal Government is a ban on borrowing to buy property within self-managed super funds, which could also lead to a fall in demand and a drop in property prices.

Indeed there has already been a significant tightening in lending for investors, following new regulations imposed by the Australian Prudential Regulation Authority (APRA) in 2015.

APRA introduced restrictions on growth in investment credit, which led to subdued demand for property from investors, which in turn restricts price growth.

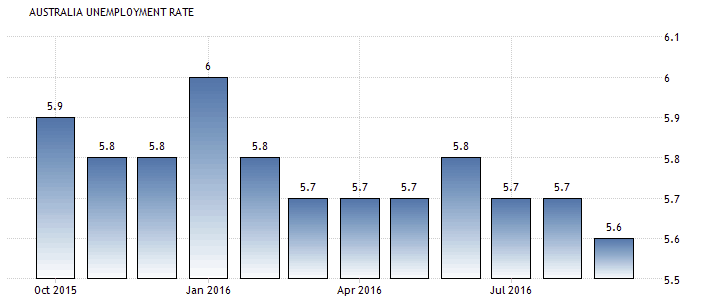

Unemployment Rate

Employment – or the lack of – can have a major impact on the property market.

People need jobs to borrow money to buy – and keep making mortgage payments – and jobs also give them the confidence they need to commit to purchases.

What Happens When Unemployment Is High?

If unemployment is high consumer confidence is low, discouraging people from buying – or forcing them to sell – and stifling growth in the market.

What Happens When Employment Is High?

On the other hand, if employment is high people are encouraged to spend and with more demand for property, price growth is stimulated.

Property prices impact upon the unemployment rate too in the sense that they’re a leading determinant of consumer confidence and household consumption expenditure, which in turn leads to employment and economic growth.

What Happens When Property Prices Go Up?

When property prices rise consumer, confidence is boosted because people feel wealthier, so they’re more likely to spend more, which, in turn, creates jobs.

What Happens When Property Prices Fall?

On the other hand, if property prices fall households feel poorer and confidence wanes; consumers feel pessimistic and tend to save rather than spend, which triggers job losses and slows down the economy.

As you can see, it’s all interconnected, and one factor can impact upon another in a cycle.

For example, in the following graph, Australia’s unemployment rate fell 0.1% to 5.6% in September.

Source: www.tradingeconomics.com

While it’s important to look at the overall rate, developers should also look at employment in a region, as this can impact upon that specific area’s property market, as people will move where the jobs are.

Impact Of Interest Rates On Property Prices

Interest rates can stimulate or restrict growth in the property market.

When rates are low, money is cheaper and hence borrowing is more affordable, which in turn makes buying property a more attractive prospect for consumers. As there’s greater demand for the property than it’s supply, home prices get pushed up.

Conversely, when interest rates rise borrowing is less attractive because money is more expensive, and consumers are less likely to be active in the market, thus reducing demand and alleviating pressure on prices.

One of the early signs that the market will start declining or stagnating is a steady increase in interest rates.

We currently have record low interest rates in Australia, with the RBA keeping the cash rate low to encourage activity, boost the economy and stabilize the Australian Dollar, and it’s predicted this will continue for some time.

In determining the official cash rate each month the Reserve Bank of Australia considers inflation, employment, economic growth and the mortgage debt of the country in relation to gross domestic product (GDP).

Learn More

Inflation Rate

How Does Inflation Rate Impact Property Prices?

Generally it’s believed that low inflation means there is no growth in property values. But this isn’t the case – historically inflation hasn’t had a big impact on prices. When its low prices can still be rising.

As a rule of thumb it’s actually beneficial to be holding property in a low inflation environment as its low risk. If you consider the golden rule of investing, which is not how to ‘make the most’, but to ‘lose the least’, this makes sense.

The key is to understand that ‘real’ growth in property prices is the difference between the growth in the property’s value over and above inflation.

For example, if inflation is 12% and capital growth is 15%, the ‘real’ growth is 3%. If there is a period where inflation is high but values aren’t rising, then in real terms you’re losing money.

The point of investing is to have your capital increase more than the rate of inflation – if it’s not doing that you’re losing money, and in a high inflation environment investing becomes riskier.

Consider mining towns for instance, where prices rose significantly due to inflation; it’s safer to have your money in an established city that isn’t subject to such fluctuations.

Certainly, in a low inflation environment prices can grow significantly in ‘real’ terms, due to other factors such as a shortage of supply.

In Australia, the inflation rate has been low, which basically tells us we should be holding property for the long term.

Population Growth

How Does Population Growth Affect Property Prices?

Population growth is strongly correlated to property market growth as it determines the level of demand for homes. In simple terms, if a population is growing there will be more demand for property and hence more upward pressure on prices.

The reverse is also true – if a population is declining, or population growth is slowing, then demand slows and there’s less pressure on prices. In some cases, prices can go backwards.

Again, consider mining towns or country and regional areas for instance – if the work dries up and people move away there’s a decline in the population and significantly less demand for property, which leads to price falls.

Population is therefore crucial to property price growth and economic growth, with the cliché ‘populate or perish’ still ringing true today.

Indeed, if the Australian population went into a long decline, the result would be catastrophic, hence governments continue to encourage the birth rate with tax incentives and social benefits, while immigration continues.

It is often argued that for each immigrant, three new jobs are created due to their demand for goods, services and housing.

Australia’s population is on the rise, but when investing you need to look at what’s happening on a local level. Indeed, population growth is one of the indicators investors look for when determining whether an area is the next ‘hotspot’.

House Price Index

House price index is a broad measure of the price changes in residential housing.

In Australia there are several sources of the house price index and they can vary widely along with the methodologies they use for gathering and analyzing the data.

There’s no doubt, however, that property prices are rising in Australia and historically, have continued to rise across the board.

There are seasonal changes, however, with demand – and hence price growth – stronger at certain times of the year and there can be wide variations between the many individual markets situated within the larger Australian market.

Per the growth in property market cycle there will always be some capital cities growing while others experience a slowdown, and eventually those that are flat lining will have their turn.

If you drill down even further this will be the same on a local level, with different growth drivers (or lack of) leading to varying levels of price growth.

The latest figures from CoreLogic show dwelling values across the combined capitals have risen by 7.5% over the past year.

In the long-run growth is expected to continue at a rate of 1% to 3% per year until 2050, which means there are huge capital gains to come.

Rather than looking at the broad house price index, property investors need to drill down into local markets and property types to get an accurate reflection of what is happening in the area they’re looking to buy and develop in.

Demand and supply will be a big factor in determining growth, but there are many other things to consider.

Example: Australian Dollar

What’s The Relationship Between The Australian Dollar And Property Prices?

The Aussie dollar and property prices are two major indicators of how well the Australian economy is functioning.

The Aussie dollar has a varying impact on property market cycle around Australia. Broad fluctuations in the dollar don’t seem to have a direct impact on prices.

However, historically Australia has noticed a correlation between the dollar fluctuations and consistent growth across the property market.

In a nutshell, although not as apparent, there clearly is a correlation between property prices and the Australian dollar, and it can mainly be seen on a local level.

The same goes for industries; every time dollar goes up or down some industries l0ose and some industries win. It doesn’t have a complete black or white effect on all industries.

For instance, when the dollar is strong exports are more expensive resulting in less overseas demand for commodities, which means towns reliant on this, such as mining towns, could be negatively impacted with lower demand leading to job losses and people moving away.

The reverse is also true – when the price of exports falls as the dollar falls, there could be more demand in these areas, pushing up property prices.

A strong Australian dollar also means imports are cheaper and that leads to a loss of local jobs in manufacturing and retail sectors, which can also impact upon the property market.

On the other hand, when the Aussie dollar is low, imports are generally more expensive, so the local economy and jobs are boosted within Australia as people choose to buy locally instead.

It also has a significant beneficial impact on tourist centres, as it encourages more domestic travel, boosting those areas as more people visit.

It’s also more attractive for foreigners to buy property in Australia and to study in Australia, which increases demand for homes, putting upward pressure on prices.

The Australian dollar is currently sitting at around USD$0.75 and is considered to be one of the most volatile globally, being very difficult to predict which way it will go next, although it’s likely to stay low or even go lower, which again will boost Australia export of education and services, resulting in higher property prices eventually.

When considering the impact of the Australian dollar on property prices, it must always be looked at in conjunction with the cash rate, as this can offset higher costs.

The Role Of Supply & Demand In Property Market Cycle

Another crucial part of property economics for developers is understanding where demand comes from. The bulk of Australia’s property market is driven by Chinese money, with these foreign investors representing the greatest buyer demand.

Despite the introduction of stricter foreign investment rules to curb buying, demand from Chinese investors reportedly hasn’t yet waned, and is in fact set to continue for some time.

China took out the title of biggest foreign investor in real estate in 2015 spending $24.3 billion on Aussie property and a report from Investorist earlier this year found 149 of 150 China-based agencies believed Chinese spending on foreign real estate would jump to levels beyond that experienced in 2015.

Australia was the top international market, favored by 60 per cent of the surveyed agencies, beating out other popular countries including the US, UK and Canada.

Devaluation of the Chinese yuan against the US dollar had reduced buying power in the US and UK, increasing the popularity of countries like Australia.

According to Credit Suisse Estimates, Wealthy Chinese buyers have purchased $24 billion of Australia housing in the past seven years, and over the next seven years an additional $44 billion is expected to be spent on Australian Property.

Chinese investors have strong motivations for investing abroad, with one of the biggest being that Australia seen as a safe-haven for their money.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

Which Property Market Cycle Is Best To Invest In Property?

Best Time To Invest In Property

The Australian property market will continue to perform, largely due to buyer demand, much of which is coming from Chinese buyers. It’s always the right time to invest and develop if your circumstances allow.

There’s no way to pick the optimum time in the market. However, for property developers it doesn’t matter what stage the property market cycles is at, as long as their research and due diligence is stringent enough to pick the right areas to develop.

You as an investor, need to research the market, take into consideration each of the above 7 factors, and invest in the right areas – that is, areas where new infrastructure is planned and demand – along with population growth and employment – is growing.

The key is to do your homework – conduct thorough due diligence and make sure your numbers for the project stack up properly. At the end of the day if it stacks up, it stacks up.

A deal is a deal, no matter where it is, but developers need to put in the time and the effort to complete thorough research into any property purchase to ensure it will perform well in the future.

Investigate comparable sale results and the sales history of the property, review intangible aspects such as locational attributes, street appeal, floor plan, orientation, outlook, future surrounding development, town plans and zoning precincts etc.

In other words, finding the right deal and making sure your due diligence is rock solid is paramount in property development.

A word of warning – it’s crucial to exercise caution when dealing in new property and investor-driven markets that are overly influenced by foreign buyers.

Buy properties that appeal to both owner-occupiers and investors, and that satisfy lifestyle criteria such as featuring a sunny northerly aspect in the backyard, alfresco outdoor areas and open-plan living areas.

How to time the real estate property market cycle?

What Location is to retail business, Timing (Property Market Cycle) is to property development.

Most developments that have failed in the past have done so, because the developers introduced their products in the market at a time of over supply, when the demand had waned, causing a drop in prices.

What developers need to understand is that the property market is always somewhere in the market cycle and they need to time their developments, so that they don’t end up in the market when the demand has already waned.

Market cycles are not a function of how many years have passed, but a combination of influencing factors, such as the state of the economy & the demand and supply in the market. I have always liked property and I like it better than share market, as the trends in the property market are more predictable than share market.

1. Stay one step ahead

Astute developers are aware of the considerations above and typically act months or years ahead of the cycle. They are most active during the cycle’s growth and maturity stages when they buy properties at the bottom of the downturn and sell or rent them for top dollar at the apex of the boom.

The inexperienced developer must keep a close eye on the industry and economic trends to follow in their footsteps.

2. Purchase the property at the right time

Although it is generally recommended that you acquire near the bottom of the market, there is no one-size-fits-all approach to purchasing a property to develop. This largely depends on the talks and terms you proposed to buy the house.

Suppose you are aware of potential changes in the town planning of a specific area. In that case, you may decide to make an offer to purchase the property conditional on rezoning.

This will allow you to begin planning your future development. Furthermore, if you delay the settlement, you will not be responsible for the holding costs. The optimum moment to buy a particular property depends on the type of construction; for example, a residential building will have different goals than a commercial structure (such as increasing zoning density) (which may rely on a new road layout).

You can buy land to develop later if you have the financial resources, and the best time to acquire is when there are discounts available. High-interest rates contribute to this predicament by causing an overstock and a decline in demand.

Developers should plan for the next recession during the good times, as buying during a downturn provides the finest opportunities to locate a deal. They should be selling and cashing in to be picky and negotiate from a position of strength .

3. Listen for signals

The decline in vacancy rates in rental accommodation in both residential and commercial buildings is one of the first signs of a property price increase. You can obtain these types of statistics from a variety of property sector groups and research firms, including the following:

- The Property Council of your state

- The Real Estate Institute of State

- The Housing Industry Association (HIA)

- The Master Builders Associations

Several real estate companies, websites, and financial institutions offer free online newsletters that provide the current real estate market and trends.

A property developer’s ears ring with the sound of higher rental returns and robust demand for new housing. The developer knows that homebuyers and investors will flock to the market with low-interest rates. Investors aim to catch the price rise early to profit, while new homeowners feel a feeling of urgency to buy before prices soar beyond their reach.

The following are further evidence that the property market is improving:

- A steady rise in costs and a rise in building permit approvals

- A decrease in unemployment

- Corporate expansion

- A boost in investor and company confidence

- Media reports regarding the increase of cost of products and services

4. Recognize the signs of a declining market

One of the first signals that the property market is about to fall is interest rates have been steadily rising. As the rate of inquiry for rental housing begins to diminish, property management agents can recognize the early indicators of deterioration.

Increased unemployment and firms defaulting and taking longer to pay their payments are further symptoms of decline.

To avoid being trapped with unsold properties or vacant accommodation, developers who recognize these indicators should take safeguards and stop developing new plans or commencing new buildings.

Furthermore, building materials are in low supply during this time, and subcontractors demand higher charges for their services.

It is not a good idea to design any new developments right now because you may have sold houses at a set price that will cost you more to build later.

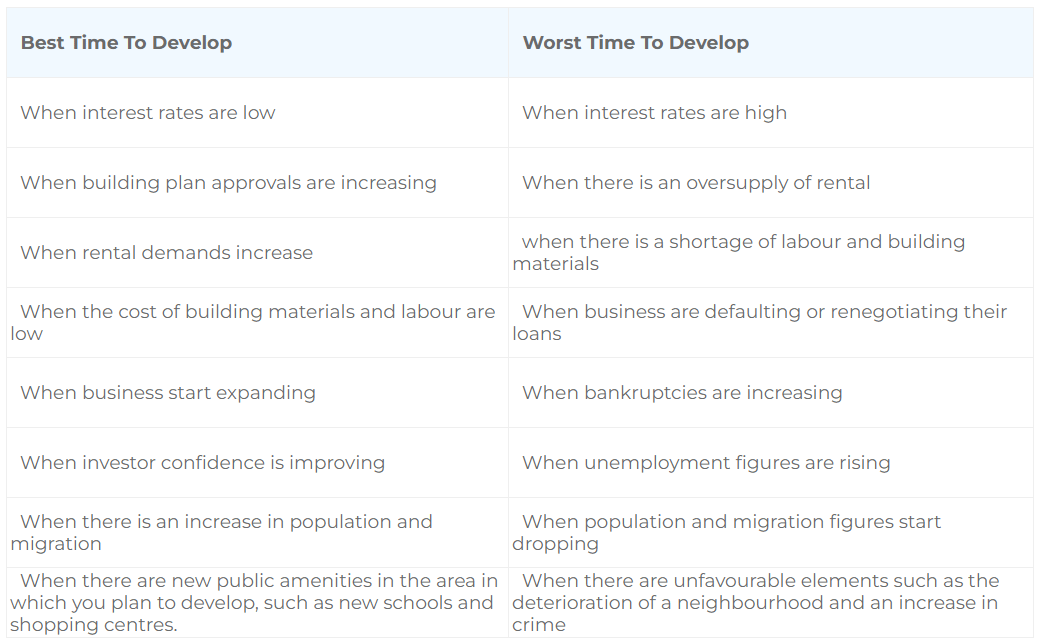

5. Pick the best time to develop

We’d all like a crystal ball to tell us when the best time is to develop our properties. Of course, if that were the case, we’d all be billionaires in real estate!

The best we can do is rely on reliable information and skilled advice. Take a look at the below image, and you will be able to identify the best and worst times to develop the property.

Best And Worst Times To Develop:

Learn More

6. Prepare for your survival

The key to surviving a property downturn if you haven’t timed the cycle well is to be in a position where you don’t have to sell, even if selling was initially part of your development strategy.

- Development becomes riskier when the developer loans more than 60% of development costs.

- At the pinnacle of the boom, unsophisticated small to medium investors buy the property and begin developing it.

- Investor developers own unoccupied properties and have inexperienced tenants.

To stay afloat in the property development business, you’ll need the financial resources to cover debt and other expenses until the real estate market improves. For your survival, carefully consider the following crucial variables.

Leveraging

As I always say, borrowing money should be done with caution. Significant gearing entails a high level of danger. Financial leverage is a good idea, but it only works if you maintain the gearing ratio during bad times.

Good Tenants

If you intend to keep your development as an investment, search for high-quality tenants with the solid financial backing and the ability to weather a downturn.

Contingent

Having a cash contingency reserve to survive a downturn makes brilliant business sense. This could come in the shape of extra credit or, better yet, personal cash reserves.

Continued at…

Property Market Cycle – Get In Or Get Out? [Part 2-2]