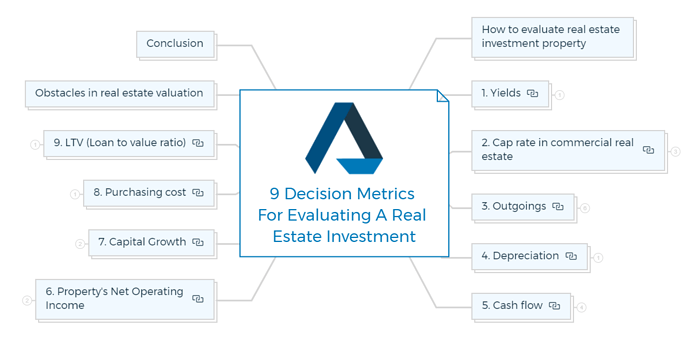

9 Must-have numbers for evaluating a real estate investment

When it comes to investing, evaluating a real estate investment is often one of the first things people think of. After all, it’s a tangible asset that has been around for centuries. But how do you know if a particular piece of real estate is a good investment?

And once you’ve found an investment property, how do you go about real estate estimated value? Here are nine decision metrics that will help you answer those questions and make smart investment choices.

Key Takeaways

- Real estate valuation is the process of determining a property’s economic value.

- Key metrics may be generated for any property, allowing investors to make accurate estimates and comparisons.

- The capitalization rate is an important metric that assesses the link between a property’s current value and potential income stream.

- Consider rental income, operating expenses, and mortgage or loan payments while evaluating real estate investments.

How to evaluate real estate investment property

The current market value of commercial real estate depends on many factors, including the property’s location, size, and condition. But how do you know if a property is worth the asking price?

There are a few key metrics that can help you evaluate a commercial investment property:

- Yields

- Cap Rate

- Outgoings

- Depreciation

- Cash Flow

- Net Operating Income

- Capital Growth

- The purchasing cost

- LTV Ratio

1. Yields

The first metric in calculating the real estate market value is Yield.

A commercial property yield is the annual rental revenue received by the owner from the tenant or tenants as a percentage of the purchase price.

Commercial property yields are usually expressed as net yields, whereas residential yields as gross yields. In other words, you can calculate commercial real estate yields using the net revenue of the property rather than the gross income.

CAUTION

Gross Income:

Gross income is the entire property income. If paid by the renter, it includes rent and any extras like energy, water, rates, property management, and other outgoings.

Net Income:

Gross rental revenue less all expenses like the council, water, insurance, maintenance, and property management. The owner’s net profit after all expenses, excluding mortgage repayments.

How to calculate real estate yields

To calculate the yield in commercial property, you’ll require two things:

- The purchase cost of the property

- The net annual rental income.

Commercial real estate yield formula-

IMPORTANT

Yield = (Net annual rental income / Purchase price) x 100

For example, if a property costs you $1000000 and the net annual rental income is $123,000, the yield would be 12.3%.

Commercial Yield = (123000/1000000) X 100

= 12.3%

You can reverse this calculation to get an initial purchase price that will give you the desired yield:

The calculation for purchase cost -

Desired Yield - 12.3%

Net Annual Rental Income - $123000

Purchase Price = 123000/12.3% = $1,000,000

Learn More

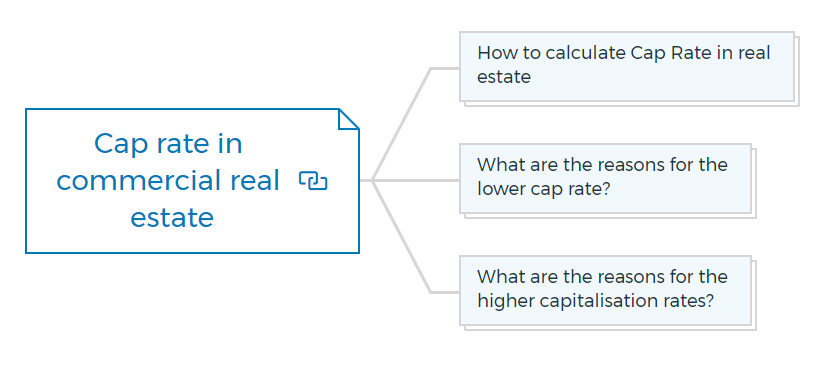

2. Cap rate in commercial real estate

The capitalisation rate or cap rate in real estate valuation is the ratio between the net operating income produced by a property and its market value (the original price paid to buy the property).

Understanding the cap rate in real estate is important to estimate the investor’s potential return on investments and determine the property market value.

A higher cap rate means a higher expected return.

How to calculate cap rate in real estate

Real Estate Cap Rate Formula -

IMPORTANT

Cap Rate = Net Operating Income / Property Value

Cap rate example -

If the property’s net operating income is $80,000 and the market value of real estate property is $1,000,000, then the cap rate would be 8%.

Cap Rate = 80000/1000000

= 8%

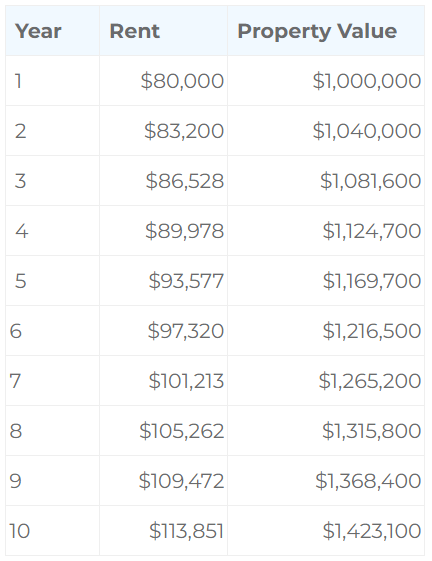

You may calculate an approximate new market value for your property using rental growth and a fixed cap rate.

Consider the following scenario:

You purchase a home for $1 million with an 8% cap rate and 4% annual rental increases:

- The purchasing price of the property is $1,000,000.

- The capitalisation rate is 8%.

- The increase in Rental Rates is 4%

If the cap rate in a certain location remains unchanged, you can see how rental increases alone will enhance the property’s worth significantly:

In ten years, the market value of real estate investment property is increased by over $400,000.

The cap rate in real estate varies by commercial asset class and region.

What are the reasons for the lower cap rate?

Comparable properties with good tenants, significant foot traffic, capital cities, or low vacancy rates have lower cap rates, as these are considered a lower risk or better capital-growth places.

Learn More

What are the reasons for the higher capitalization rates?

Higher cap rate properties may be in a quiet neighborhood or regional town, have little foot traffic, high vacancy, a short lease term, poor tenant quality.

These properties have higher risk involved or have lower capital growth. Lower capital growth and longer vacancy periods make higher cap rates seem advantageous, but their total result is frequently less.

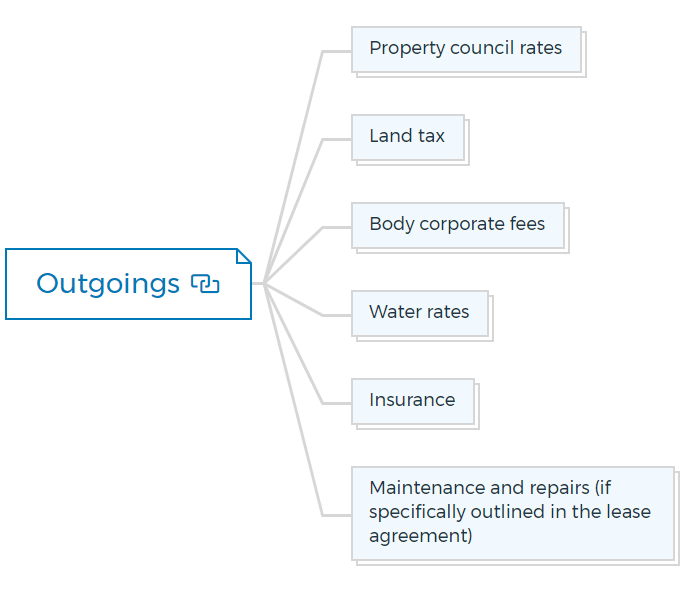

3. Outgoings

The term ‘outgoings’ describes the expenses that a tenant is responsible for under their lease agreement.

In some cases, the landlord may be responsible for paying outgoings on the property, but this will typically be outlined in the lease agreement.

These can include:

Property council rates

Council rates are a type of property tax used to fund public services such as road construction and maintenance, park and garden maintenance, library maintenance, community activities and advertising, etc.

Local councils use property values to determine how much each owner pays in rates.

Council rates are due quarterly. Check whether your council offers any discount rate on early payment.

Land tax

Land tax is a state government tax that depends on the property asset value.

The amount of land tax you pay depends on the state or territory in which the property is located and the current market [value of your land](Raw land development – What you need to know? [Part 1].

If the property is leased, the tenant is generally responsible for paying the land tax unless it is specifically stated in the lease agreement that the landlord is responsible.

Body corporate fees

Body corporate fees are paid by the unit owner in a strata scheme to cover the costs of maintaining common areas, such as hallways, gardens, foyers, swimming pools, and lifts.

The fee amount depends on unit size and the number of people living in the strata scheme.

Water rates

You will pay the water rates to the water and sewerage body that services your property.

Insurance

Landlords should ensure they have adequate insurance in place for their properties.

Types of insurance that may be relevant include:

- Property insurance

- Liability insurance

- Content insurance

- Public and product liability insurance

Tenants should also ensure good content and public liability insurance in place.

Maintenance and repairs

All properties require general upkeep. The owner or the body corporate will be responsible for the complex’s maintenance.

Many real estate salespeople ignore maintenance fees since they are one-time activities like painting the building.

Normally, tenants are obligated to maintain and repair the property but not replace significant capital items like air conditioners.

The lease should state the tenant’s responsibility for upkeep so that if they fail to do so, you can pass the expenses of replacement to them.

It’s important to be aware of your obligations regarding outgoings, as failure to pay these charges can result in late payment fees or even termination of your lease agreement.

You are missing out if you haven’t yet subscribed to our YouTube channel.

4. Depreciation

Property depreciation is a method of recovering the cost of certain real estate assets over the life of those assets.

It includes the cost of fixtures and fittings in a property, such as ovens, air conditioners, carpets, and light fittings. The Australian Taxation Office (ATO) allows you to claim depreciation on these items when you purchase them.

Landlords and tenants can both claim depreciation on assets in a property.

The landlord can claim depreciation on any items purchased for the property. In contrast, the tenant can claim depreciation on any items installed on the property (such as carpets, light fittings, and air conditioners).

How to calculate depreciation deductions

Depreciation has two categories: capital works and equipment.

- Capital Works

It includes the building’s construction and any structural improvements.

You can claim capital works deduction for:

- Building additions, modifications, or improvements

- Shop fit-outs and leasehold improvements

- Sealed driveways, fences, and retaining walls

- Environmental protection earthworks like embankments

A quantity surveyor or other trained individual can provide an estimate if real construction costs cannot be determined. You can deduct the whole estimate in the year it was incurred..

Deduction rates range from 2.5% to 4% based on the start date, nature, and usage of capital works .

However, a real estate investor who buys commercial buildings established before the cutoff dates can typically claim capital works deductions on improvements.

- Equipment

Plant and equipment are assets that are easily removable or mechanical, according to the ATO. Air conditioners, refrigerators, ovens, fans, carpets, etc.

The ATO evaluates the depreciation of assets within a building each year and is referred to as an asset’s “effective life.”

Most investors in commercial real estate property can deduct their assets, but not those installed by tenants as part of their fit-out.

If the asset is worth less than $300, you can deduct it immediately. If not, you can compute annual depreciation in two ways:

- The decreasing value strategy provides you with higher claims in the early years and lower claims later on.

- The prime cost technique allows you equal annual tax deductions across an asset’s effective life. Also known as “straight line” depreciation.

It’s best to get a tax depreciation schedule (TDS) as soon as following settlement when buying a house.

In this way, the surveyor will be able to determine the property’s depreciation accurately. If you perform major improvements, you must examine and amend your depreciation schedule.

This schedule will detail the depreciation percentages for each item in your home.

While evaluating properties, ask the selling agent for the prior owner’s depreciation plan. It will show you the additional cash flow from depreciation. Notably, you should never buy a property just for the tax advantages - the acquisition must be sound!

Learn More

5. Cash flow

Cash Flow in real estate is one of the crucial considerations for all real estate investors in evaluating commercial property investment. Commercial real estate cash flow is the money coming in and out of a property monthly or annual.

It includes rent, outgoings, and other expenses like property management fees. In other words, cash flow is the property’s net income after calculating and deducting all the expenses.

There are pre-tax and post-tax cash flows depending on depreciation and tax benefits.

How to calculate cash flow in real estate

Cash flow from a property is essentially rent minus all the associated costs.

Cash Flow calculation Formula -

IMPORTANT

Cash Flow = Gross Rent - Total Operating Expenses

It includes the mortgage repayments, rates, insurance, and other expenses.

CAUTION

Operating Expenses -

Any money spent on a property that does not increase its income potential is an operating expense. If you spend $10,000 on a new roof for 10 years, it is an operating expense.

The main outgoings you’ll need to consider are:

- Mortgage repayments

- Rates

- Insurance

- Property management fees

- Repairs and maintenance

- Legal and accounting fees

- Capital works deductions

These costs can be monthly, yearly, or one-time payments.

For pre-tax cash flow, we need to consider the depreciation deductions on the building and equipment.

It gives us the annual net operating income (NOI).

Post-tax cash flow deducts income tax payable on the NOI.

Let’s understand the calculation with an example, assuming a property generates $10,000 per month in rent and has the following outgoings:

-

Mortgage: $3,000

-

Rates: $500

-

Insurance: $200

-

Property management fees: $500

-

Repairs and maintenance: $300

The pre-tax cash flow for this property would be $2,800 per month -

IMPORTANT

(($10,000 - $3,000) - ($500 + $200 + $500)).

The post-tax cash flow would be $2,200 per month -

IMPORTANT

(($10,000 - $3,000) - ($1,500 + $300)).

You should also remember that the cash flow calculation doesn’t consider the time value of money [add link] . It means that a dollar received today is worth more than a dollar received tomorrow.

Therefore, you should use the net present value (NPV) calculation to compare different cash flows.

CAUTION

Pre-Tax Cash Flow:

Pre-Tax Cash Flow is the cash flow a property generates each year before considering any depreciation deductions.

Post-Tax Cash Flow:

Post-Tax Cash Flow is the cash flow a property generates each year after considering any depreciation deductions and income tax payable.

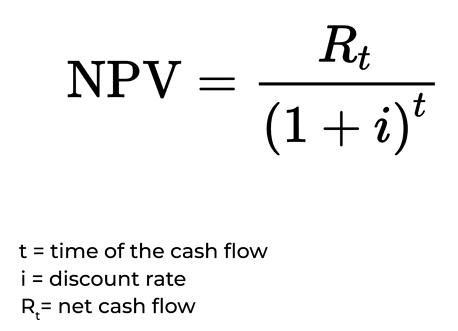

Net Present Value (NPV):

Net Present Value (NPV) is a calculation that considers the time value of money. It allows you to compare different investments with different cash flows and periods of return.

The formula for NPV calculation is

Net Present Value = the present value of all cash flows, discounted by a rate per period.

Cash Flow 1 = the first cash flow in the series

Cash Flow 2 = the second cash flow in the series

NPV calculation example

Imagine you have two potential investments. Investment A will give you a cash flow of $1,000 per year for the next five years, while Investment B will give you a cash flow of $2,000 per year for the next two years.

Which investment opportunity should you choose?

To answer this question, you need to calculate the NPV of both investments. It will tell you which investment is worth more money in the present.

The NPV calculation considers the time value of money, so it’s a more accurate way of comparing different investments.

For Investment A:

NPV = 1,000 ÷ (1 + 0.05)5

= $471.43

For Investment B:

NPV = 2,000 ÷ (1 + 0.10)2

= $667.78

As you can see, Investment B is the better investment because it has a higher NPV than Investment A.

Investment B is worth more money today than Investment A. Check Proven Strategies to Invest In Different Types of Commercial Properties

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

6. Property’s Net Operating Income

A property’s net operating income (NOI) is one of the most important metrics to measure property investment success. You can calculate it by subtracting all operating expenses from gross annual income.

This key metric indicates how much cash flow a property generates after paying debt service, taxes, and other operating costs.

- A high NOI is desirable for real estate investors as it means the property is generating a lot of cash flow. You can use this to cover total expenses, pay down debt, and provide a healthy return on investment.

- Conversely, a low NOI may indicate that the property is not performing as expected and may need improvements or refinancing .

How to calculate Net Operating Income

NOI Calculation Formula -

IMPORTANT

Gross Income - Operating Expenses = Net Operating Income

Operating expenses typically include property taxes, insurance, repairs, and management fees. It’s important to note that not all operating expenses are included in this calculation.

Debt service payments, for example, are not included because they are not considered an expense of the property.

Example Of NOI

You own a property with a yearly Gross Income of $140,000 and an operating expense of $40,000.

It gives the NOI of $100,000 ($140,000 - $40,000)

Gross Income = $140,000

Operating expenses = $40,000

Net Operating Income = $100,000

When the sum is negative, meaning operating expenses exceed revenues, it is a net operating loss (NOL).

7. Capital growth

Capital growth in property investment is the increase in the current market value of an asset. This usually refers to increasing the property’s market value over time in real estate.

It can be due to several factors, such as inflation, population growth, or increasing demand for potential properties in a specific area. The capital growth rate is an important consideration for investors, as it can affect the overall return on investment.

One of the main benefits of property investment is the potential for capital growth. Over time, property values tend to increase at a rate that exceeds inflation.

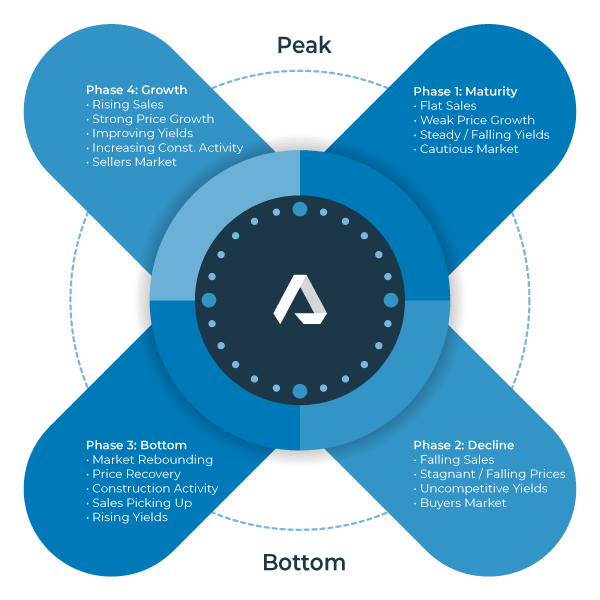

This means that investors who hold onto their property over a long period can see significant increases in their investment’s value. Within the entire property market cycle, the capital growth of various commercial properties can vary greatly depending on the demand for the property and its type, purpose, and location.

In any situation, because of the significant entry and exit costs, it’s best to buy commercial property with a long-term perspective. You can reduce most market fluctuation risks and gain profit in the long run if you complete your due diligence properly.

Here’s a diagram depicting the commercial property market clock’s cycle, which includes maturity, decline, bottom, and growth phases:

Check the detailed explanation of the property market clock - What Does The Property Clock Say?

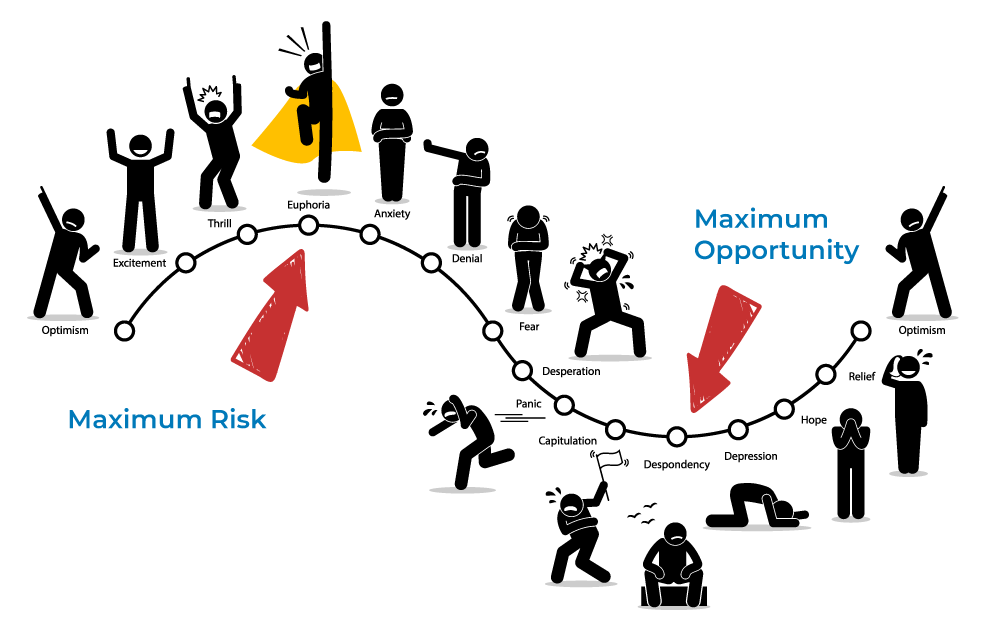

Cycle of market emotions

The commercial property market goes through an emotional cycle consistent with the stock market. The diagram below shows this emotional cycle and how it impacts the purchasing and selling of commercial real estate:

It’s important to be aware of these emotions and their effects on the market, as they can influence your investment decision making when buying or selling commercial property.

How to calculate capital growth

Property details -

IMPORTANT

Purchase price: $1,000,000

Annual rent: $100,000

Cap rate: 5%

Let’s understand the impact of rent increases and capitalization rates on capital growth with the following example:

If the annual rent increased to $120,000, the calculation for capital growth would be -

IMPORTANT

Capital Growth Calculation Formula:

((Ending value - Beginning value) / Beginning value) x 100

= (($1,200,000 - $1,000,000) / $1,000,000) x 100

= 20%

If the cap rate increased to 6%, the calculation for capital growth would be:

IMPORTANT

((Ending value - Beginning value) / Beginning value) x 100

= (($1,320,000 - $1,000,000) / $1,000,000) x 100

= 32%

As you can see, even a small change in the annual rent or cap rate can significantly impact capital growth.

8. Purchasing cost

When buying commercial real estate properties, the purchasing cost is crucial for knowing the property’s current market value.

This is the amount of money you need to invest upfront to buy the property.

The commercial property costs the same as residential property, with a few extras.

After speaking with a business broker or lender, you can determine your buying price budget.

Calculating purchasing cost

Divide your available deposit by the lender’s deposit requirements, then add 5% to cover legal fees, inspections, appraisals, and taxes.

Your available deposit should not include your savings buffer.

For example, say you have $200,000 to spend, and the lender wants 25% down.

Allow 5% for purchasing charges, bringing the total to 30%. If 30% of the total is $160,190, the maximum purchase cost is $533,966. So hunt for houses under $530,000.

Some of the most important considerations when it comes to the purchasing cost of a property include the following:

- The location of the property

- The size and condition of the property

- The type of property (e.g. residential, commercial, etc.)

- The current market conditions

- Offered money for the property

In addition to these factors, it is also important to remember that purchasing costs can include several different expenses, such as

- Legal fees

- Mortgage broker fees

- Stamp duty

- Property inspection fees

- Goods and services tax

- Valuation cost

- Survey cost

9. LTV (Loan To Value Ratio)

Also known as LTC (Loan to Cost Ratio), LVR (Loan to Value Ratio) etc.

When evaluating a real estate investment, it’s important to consider the loan to value ratio. It measures the percentage of the property’s value financed by a loan.

A high LTV ratio means more risk of losing money if the property is foreclosed on. It’s generally good to invest in properties with an LTV ratio of 50% or less.

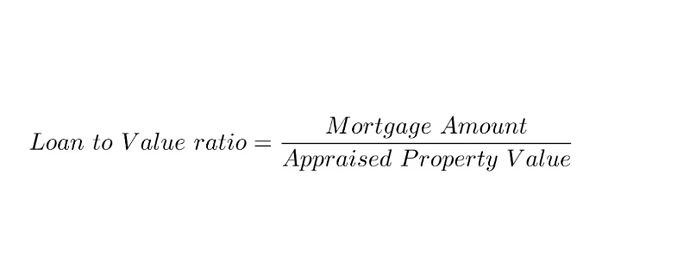

How to calculate the LTV Ratio

LTV ratio formula

IMPORTANT

LTV ratio = (mortgage amount) / (property value)

For example, if you have a mortgage of $100,000 on a property that’s worth $200,000, your LTV ratio would be 50%.

There are a few ways to lower your LTV ratio:

- Pay down your mortgage: This will reduce the amount of the mortgage, which will decrease the LTV ratio.

- Get a smaller mortgage: If you can’t pay down your mortgage, you may be able to get a smaller mortgage. It will also decrease the LTV ratio.

- Invest in higher-quality property: A higher-quality property will have a lower LTV ratio because the lender is more confident that they will be able to sell the property if they need to.

- Invest in a shorter mortgage: A shorter mortgage has a lower LTV ratio because you’ll pay off the mortgage sooner.

Keep these things in mind when looking at comparable investment opportunities, and you’ll be able to make sound decisions that won’t put your money at risk.

Learn More

Obstacles in real estate valuation

There are some obstacles to evaluating real estate investment value.

- The first and most important is the availability of good data. It isn’t easy to decide whether a property is worth investing in without accurate data. That’s why you should check 10 Data Collection Tips For Real Estate Investors

- Another challenge is assessing the potential for future growth in the area. If the market is in decline, no amount of analysis will reveal a profitable investment.

- Finally, it can be difficult to predict changes in the interest rate and other economic factors that can affect the return on a real estate investment.

It would help if you considered all of these factors when determining the value of a property. By taking all of these into account, investors can make more informed decisions about where to place their money.

Conclusion

So, while there can be some obstacles in evaluating a real estate investment, if you take the time to understand what goes into these calculations and how they impact your bottom line, you’ll make more informed investment decisions.

Have questions about any of these terms or want help crunching the numbers? You can sign up for Property Development Starter Pack.

FAQs

What is potential gross income in real estate?

The potential gross income in real estate refers to the maximum amount of rent that a property can generate. It is typically calculated by taking the property’s square footage and multiplying it by a standard rental rate per square foot.

For example, if a property is 1,000 square feet and the average rental rate per square foot is $1.50, then the potential gross income for that property would be $1,500 per month.

Of course, actual rents will vary depending on the property’s location, amenities, and condition. But this provides a good baseline for estimating what a property could theoretically bring in each month.

And knowing your potential gross income is an important part of making sound investment decisions in real estate.

How do you evaluate investments in real estate?

You can evaluate investments in real estate with these 9 numbers -

Yields

Cap Rate

Capital Growth

Outgoings

Depreciation

The purchasing cost

Cash Flow

Net Operating Income

LTV Ratio