Steps to real estate market analysis

What is real estate market analysis?

Real estate market analysis, also known as comparative market analysis, is the process of evaluating and forecasting real estate markets to make sound investment decisions.

It is a key component of real estate investing, and there are a variety of methods that can be used to conduct a real estate market analysis.

The most important part of any comparative market analysis is data collection, so ensure you have accurate and up-to-date information on all aspects of the real estate market.

It includes site-specific and local factors, as well as current and emerging competition.

In simple words, you will be evaluating the current market value of properties that are similar to the one you are considering purchasing or selling.

You are missing out if you haven’t yet subscribed to our YouTube channel.

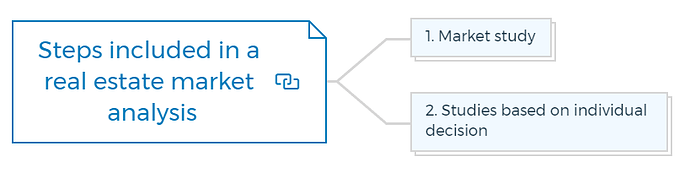

What is included in a real estate market analysis?

1. Market study

- Local economies analysis - Examines the fundamental factors determining the demand for real estate in a specific market.

- Real Estate Market analysis - Examines the demand and supply of a specific property type in the market.

- Marketability analysis - Examines a specific development or property to determine its market competitiveness.

2. Studies based on individual decision

- Feasibility Study Analysis - Assesses whether a particular project is likely to be financially viable and appropriately implemented if pursued under a proposed programme. It’s related to develop-ability, financial feasibility and investment analysis.

- Real Estate Investment Analysis - Also known as real estate proforma, which analyses a property to determine if it is a good investment. It includes modelling various timelines and or financing options to determine the best financial outcome under various assumptions.

Quick Tip

Your real estate market Analysis should answer three key questions:

- Is there a demand for the type of product you are developing?

- What rent/price can you charge for your project, and how quickly will the market accept the project?

- How can the project be planned and marketed to increase its marketability?

Learn More

How to do real estate market analysis like a pro?

Step 1 - Choose an investment property

Start with location

The first step of your real estate market analysis should be finding a location of a particular property, whether residential, commercial or industrial, which will determine its value.

Location analysis is performed based on improvements, zoning and competition. It also considers the availability of similar properties.

Determining the property’s market value

There are many theories and methods available. Some use inaccurate statistical bases; others use local trends or regional trends.

It is impossible to determine the market value of real estate purely based on visual inspections and other non-fundamental indicators. These selections should be made after a thorough comparative analysis of all real estate markets.

Quick Tip

The following questions pose challenges for real estate investors performing market analysis:

- What are the factors that determine a fair market value of a property?

- What is the best way to compare properties of similar types?

- How much does an investment property cost?

Analyse the collective economic, demographic, and local factors that affect real estate values.

Step 2 - Collect decision making data

The data collection should be viewed as competitive intelligence. For all sorts of data, the analyst must consider bias.

Raw data, also known as primary, is unanalysed and collected by the analyst. This could include reading classified ads, new development announcements, legal notices and census data. Secondary data is data analysed by someone else, who then tells the analyst to conclude.

On the demand side, the analyst should consider the following factors:

- Population

- Household size

- Demographic features

- Purchasing power

- Income

- Affordability

- Purchasing power

- Employment statistics

- Migration

- Commuting patterns

The following items are included in determining the supply side.

- Available space inventories.

- Vacancy rates and the existing property inventory’s character.

- Recent space absorption, including the sorts of tenants or buyers.

- Projects that are now being built or are in the pipeline.

- The differences in market rents/sale prices by location and quality.

- Existing and projected projects’ features, functions, and benefits.

- Concessions and terms.

The number of information sources available is also not limited. Newspapers, census and private databases, tax rolls, advertisements, and maps, etc. Any source that discloses something of interest—may be used by analysts.

The real estate market analyst may interview brokers, owners, planners, and local officials. The purpose of the interview is to gather as much information as possible about the market.

Step 3 - Understand local government requirements

The analyst must be familiar with the local government. The government is your largest partner in the real estate business.

If you want to conduct a project, you must first grasp how the political structure supports or inhibits your project.

This includes understanding zoning laws, building codes, and other regulations that may impact the real estate market.

Almost everyone in the real estate industry conducts market research:

Analysis from private sources

- Appraisers / Property Valuers

- Real Estate and Financial Brokers

- Real Estate Developers

- Real Estate Investors

- Lenders and asset managers.

Analysis from public sources

- Urban & town planners

- Consultants in economic development

- Governmental organisations.

Market analysis is utilised in the private sector to increase profitability (and reduce losses by reducing market risks). On the other hand, the public sectors often include a framework of repercussions beyond economics or feasibility, such as density, traffic, or design.

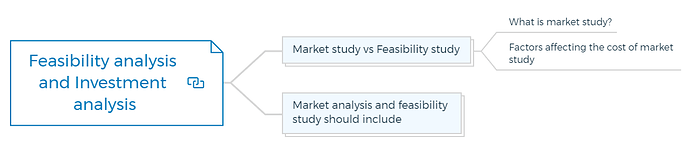

Step 4 - Feasibility analysis and investment analysis

Feasibility study will help you determine if the investment property is a good fit for your investment goals. The feasibility study should include a detailed analysis of the costs and benefits of the investment.

The feasibility analysis process is designed to see if the numbers add up given current perceptions of how a project should go, how much it will cost, and who will buy or rent the property.

Investment analysis is a related technique that looks at the same financial questions from the investor’s perspective.

Feasibility - often linked with developers and project management—is a component of market analysis for developers, whereas investment analysis explores the same concerns with a different set of options.

A developer may compare various projects, sites, and real estate markets; similarly, an investor may compare potential real estate investments against non real estate alternatives.

Funding factors will, of course, be reviewed by the investor as part of the research; nevertheless, financing is not limited to investors.

Lenders and potential lenders will conduct various investment analyses to assess risk and choose the best type of property development financing.

Market analysis is essential for a real estate project’s first feasibility assessment, but it doesn’t end there. Throughout the project’s development and management phases, market research plays a significant role in creating the project.

Market experts are frequently contacted for repositioning measures after a project is up and going and the developer finds that absorption does not meet predictions.

There are as many different types of market analysis as there are different sorts of development initiatives, stages of development, and interests served.

Learn More

Market analysis includes:

- Determining the timing for demand.

- Analysing the direct relationship between demand and supply (which should consider the role of competition).

- Calculating investment rates of return

Market study vs Feasibility study

What is market study?

Market study focuses on three main areas of evaluation: the location, the demand for the product, and the supply of comparable items. Answering specific issues posed by lenders, equity partners, or investors should always be the crucial step in any market study.

Factors affecting the cost of market study

- Complexity of real estate market

- Data availability

- Methodology used

- Number of properties studied

- Size of real estate market

- Time frame of study

- Type of real estate market analysis

The difficulties of location and supply and demand analyses lead to a series of essential questions:

1. Is there sufficient demand for the existing or projected upgrades to ensure that vacancies are kept to a minimum? This should include demographic analysis, as well as income, employment, and growth projections.

Price segmentation and coordination with marketability may be additional market components beyond supply and demand analysis.

2. Is there a market for such advances, and if so, how easily can the development be sold? What effect would the proposed development have on present supply in the nearby area (local market) and the broader market (regional market)?

3. How will the development be funded, and where will the money come from?

Tenants, real estate acquisition/sale, and financing are three types of supply and demand that I recognise.

A real estate market analysis will also include the following questions, which are more concerned with marketability than with market conditions:

4. What are the current competitive developments, and how should this project be conceived, planned, and marketed to compete effectively? To put it another way, what is the unique development concept in terms of the site plan, architecture, design, and the target market (tenant, shopper, or user)?

5. What essential elements influence your market analysis?

The market study revolves around these five points, which include supply and demand issues.

A feasibility study concentrates on the financial implications of a proposed development or acquisition. Property Development Feasibility is based on three things:

- A location looking for a use

- Employ in site search

- An investor looking for a way to become involved.

Market analysis and feasibility study Should Include…

While the study paper has no defined format, a typical real estate market analysis will include the following items:

Cover page: It includes the type of study, property address, and team members.

Letter of transmittal: Major findings and conclusions.

Table of contents: A listing of all sections.

Nature of the project: Description of the project, techniques, strategies, approaches used, and the extent of services provided.

Learn More

Economic context: Defines the market framework; first examines the more significant market areas (i.e., regions or cities) before moving on to the smaller market areas (i.e. neighbourhoods).

Analysts must consider all factors, including sociological, economic, governmental and political.

Property description and proposed development: It includes a separate description of the site and its improvements. This section outlines the proposed site’s physical and economic strategy.

Competitive developments: While the economic backdrop part will give market statistics on the competitive supply, this section should include facts on the development’s most significant competitors.

It should include rental rates and selling prices, vacancy rates, project sizes, and other data.

Market potential: In this section, the analyst determines how well the planned development will capture demand in light of the economic backdrop and comparison to competing developments.

This is where you may calculate the development’s demand. Where does the demand for the suggested plan come from? What makes your plan unique or similar to the competition?

The conclusion of the marketability: This report should not include any new information. This section is devoted to pure analysis. So far in the report, everything has been considered regarding how the projected development would compete.

Addendum: Any supporting papers, such as site plans, maps, and information that supports other portions of the report, are placed in this section.

Exhibits: Include valuable additional items, such as a map identifying the location of the subject, competitive developments, and the market area.

It also includes photographs of the subject property, its block front, the block facing it, and competition schedules in specific sections or as an appendix.

The differences between the two types of research show a wide variety of needs for thorough real estate market analysis.

A key distinction to keep in mind is that a market study may remain most relevant for a long time. In contrast, a feasibility study is more likely to adapt as financial realities change, such as employment, building and land costs, and other economic data.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

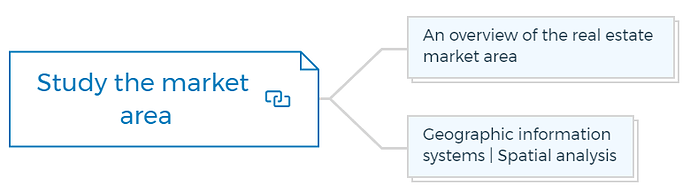

Step 5 - Study the market area

Many real estate investors overlook the significance of market research and site evaluation. The most critical aspect of considering a real estate investment is to study the market area.

An overview of the real estate market area

A thorough real estate market analysis usually leads to market research, but what format does this report take?

An organised market study prepared logically is beneficial to the reader (whether approval-granting authorities, equity partners, or lenders). This way, the information gives a clear image of the market in all of its meanings, and one can discover meaningful information to make judgments quickly.

Your market area study report should emphasise and explain four critical areas of evaluation:

- The overall market area

- Location-specific factors

- Demand factors

- Supply of comparable properties

These four sections of the market study are meant to prompt crucial questions.

For example, if you can show that the market region, location, demand, and supply factors all favor advancing, it will make sense to others. Equally essential, if you can’t build a convincing argument for the idea during the market analysis, why would anyone else want to go ahead with it?

Geographic information systems | Spatial analysis

A study of the market area is the starting point. It is the area where supply and demand are active.

Traditionally, market areas have been assessed by physically inspecting the land. New technology, on the other hand, has broadened the possibility of a market area analysis.

The emerging geographic information systems (GIS) technology, or electronic mapping, empowers real estate decision-makers from relying on arbitrary boundaries.

This new technology allows the analyst to examine geographic data from a genuinely global perspective. In many cases, artificial barriers do hide the actual market region.

A retail shopping mall, for example, would be constructed to service a specified population and geographical market region, allowing fair predictions about traffic volume and potential sales to be made.

However, a thorough examination of the market region may reveal that the outcomes are not always as evident as they appear at first glance.

Learn More

Continued at…

Real Estate Market Analysis In 13 Easy Steps [Part 2-2]