Continued from…

Industrial real estate – The risks, the benefits [Part 1-2]

Learn More

Team for industrial development

The development team performs most efficiently in large-scale industrial development projects when members continuously coordinate their functions.

For industrial real estate development, you will need the following team members.

- Architect

- Development Manager

- Quantity Surveyor

- Structural Engineer

- Civil Engineer

- Electrical Engineer

- Mechanical Engineer

Learn More

Specific areas of the development may require specialist involvement and the primary members of the team. Industrial consultants, fire consultants, public relations consultants, geotechnical engineers, environmental scientists, and traffic engineers are examples of such specialists.

You are missing out if you haven’t yet subscribed to our YouTube channel.

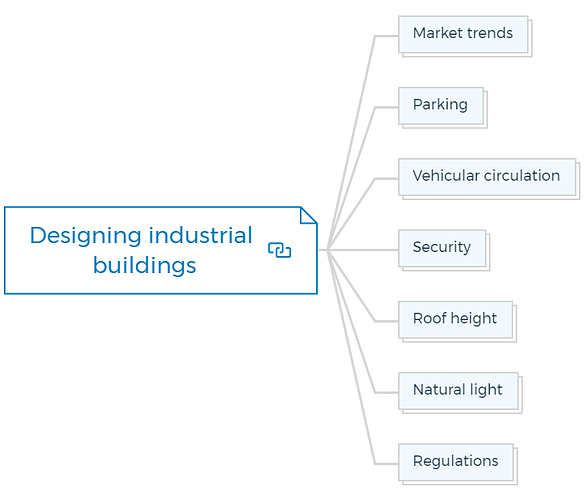

Designing industrial buildings

The design of industrial buildings or structures will vary and be influenced by several factors. The operator’s specific requirements, site conditions, and, in the case of strata units, the intended market are examples of these conditions.

Structural engineers design most industrial buildings because the structure aims to give big open spaces. Because most industrial buildings store enormous pieces of machinery or the tenant requires the building’s layout to be changed to fit into the area, vast open spaces with fewer structural columns are ideal because they allow flexibility and ease of movement.

You may consult an architect or building designer for aesthetic reasons and when more intricate planning is necessary.

In any case, you should consider the following design factors:

Market trends

Before drafting the plan, assess current trends and technology.

Parking

Offer enough space for heavy trucks and vehicles to move around.

Vehicular circulation

Offer enough space for heavy trucks and vehicles to move around.

Security

Add fences and gates to provide utmost security.

Roof height

Should be generous (gantries may be required to move heavy equipment or material overhead).

Natural light

Ideally from the south (there is less sunlight and glare from the south than the north, east or west, so windows facing south provide more consistent lighting)

Regulations

Check all statutes and building codes before proceeding.

Factors affecting the cost of development?

The development cost estimate is a critical component of a project’s feasibility. The physical character of the site, the lot size compared to the area, and the location and availability of municipal facilities are all factors that influence industrial development costs.

The following items are usually included in the total costs:

- Land cost: Ensure that the residual factors are considered.

- Bulk services: Ensure that the bulk services are adequate.

- Connection fees for services and utilities

- The price of building

- Costs for development and building plans

- Fees for project management

- Short building time and early occupation mean less interest loss and lower holding costs.

- Cost of escalation: Depending on the size of the project, try to negotiate a fixed contract.

- Fees for professionals

- Insurance policies

- Levies: Transportation and other statutory levies.

- External development costs, such as road widening

- Exchange of information

- Bank fees

Check out the property development feasibility suite for becoming a geek in this process.

Which marketing strategy you should follow?

The marketing strategy for industrial developments should be the same for office and other commercial buildings: get significant tenants. It makes the project an attractive investment and the project secure in the eyes of institutional funders.

Construction on a single-operator industrial facility should not begin until a tenant has been found and all lease obligations met. The risks are too significant, and if the tenant fails to meet specific promises and conditions, the developer could be left with an unfinished structure.

You can take a certain level of risk in a minor stratum development. Still, it should be conditional on the developer conducting all essential market research and being satisfied that the marketing programme will acquire the necessary tenants or buyers.

The marketing programme or strategy needs to be aligned with the developer’s aims and the findings of the marketing analysis.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

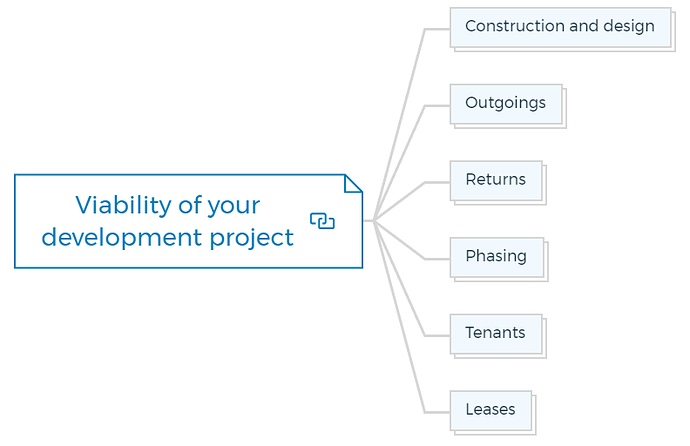

Viability of your development project

A feasibility assessment, as well as a sensitivity analysis, should be conducted for all developments. Keep the following criteria in mind.

Construction and design

Consultation with a specialized industrial designer is essential. Such an expert should have a thorough understanding of advanced construction processes, resulting in the most floor area for the lowest total construction cost, increasing the development’s feasibility.

Outgoings

Even if they are passed on to the tenant, you should consider all expenses. Some tenants agree to a lease where the landlord pays a portion of the operational costs.

Returns

Examine the acceptable returns on such developments in the area you plan to build. If you are providing space for a single, stable national tenant, you may be willing to accept a lower initial return if you consider the long-term benefit.

Phasing

It makes good sense to consider phasing in proportion to demand depending on the scale of the development. For example, if your proposed development can handle 10,000 square metres of the building, but the current demand is only for 5,000 square metres, you may construct the 5,000 square metres in Phase One and the balance in Phase Two as demand grows.

Tenants

The advantage of investing in industrial property is that it will likely require fewer tenants to fill it, resulting in fewer issues for the landlord. Any investor who is successful in securing a well-known national tenant can be assured that their cash flow will be constant for the duration of the lease, which is an ideal circumstance.

When an industrial building is custom-built to a tenant’s specifications, it’s critical to gather some background information on the tenant from other people in the same field and inquire about their position and reputation.

Leases

Industrial property leases, like commercial and office leases, come into two categories: the first is where the tenant is a small business, the lease is landlord-oriented, and the second is where larger companies negotiate the lease in their favour.

Learn More

How to do industrial property management?

A property manager may be necessary depending on the size and complexity of the development. If you choose a property manager, make sure they have experience with industrial buildings in terms of management abilities and their network within the industrial community to guarantee they have access to potential tenants.

Bottom line

Industrial real estate development is among the simplest development projects available. Of course, it is reliable on the size of the operation and the associated capital costs.

In most cases, you’ll be dealing with fewer tenants and consultants, which will free up more of your time. These renters will also sign a long-term lease, making the package appealing to most investors.

If you’re interested in learning more about property development, strategies, and facts, immediately enrol for the best structural property development courses.

FAQs

What are examples of industrial real estate?

Industrial real estate is a real estate that is utilized for industrial purposes.

Industrial multi-purpose property, factory-warehouse multi-purpose property, industrial manufacturing buildings, industrial parks, light manufacturing structures, and r&d parks are all examples of industrial property.

What drives demand for industrial real estate?

Utilization, trade, supply chain configuration, and e-commerce are all significant drivers of industrial real estate requirements, and they’re all on the rise. Industrial real estate attracts investors because of its consistent cash flow and stable prices.