Industrial Real Estate – The Risks, The Benefits

Everything you need to know about industrial real estate

If you’re a property investor or developer, industrial real estate is a market you should definitely be keeping an eye on. Industrial properties can be more difficult to find and assess than traditional commercial and residential properties, but they can also offer much higher returns. Here’s everything you need to know about the industrial real estate market, including what to look for in an industrial property and how to estimate its potential return on investment.

What is industrial real estate?

Industrial real estate is a type of property that is used for manufacturing and storage purposes. The properties are typically large in size and have open spaces to accommodate machinery and products. They also usually have loading docks and other features that are necessary for shipping and receiving goods.

The industrial real estate market has been growing rapidly in recent years as more businesses have been moving their operations out of the city center. This is due to a number of factors, including high rents, increased traffic congestion, and the need for more space. The demand for industrial space is likely to continue to grow in the years ahead as the economy continues to recover.

Types of industrial buildings

Industrial developments are classified as “commercial,” but their role demand less sophistication than retail real estate such as malls, offices, etc. They may follow different development principles at times.

Industrial property is made up mostly of various-sized factories and warehouses, and it is divided into the following categories:

- Only one occupant/operation

- Factories/warehouses with strata titles

- Industrial parks

The zoning of industrial structures is divided into two categories:

Industrial 1

Includes work with dangerous materials, manufacturing, and specific applications.

Industrial 2

Warehouses and light manufacturing.

Most industrial structures are simple in design and are not architectural wonders. Large expanses are required, and the building is repetitious and as simple as possible for cost reasons.

Industrial property investments yield a greater rental return, although it depends on the business’s health and the building’s location. Tenants tend to be more stable and, as a result, take out longer leases due to the significant capital cost and investment required by most tenants to build up an internal plant in industries.

You are missing out if you haven’t yet subscribed to our YouTube channel.

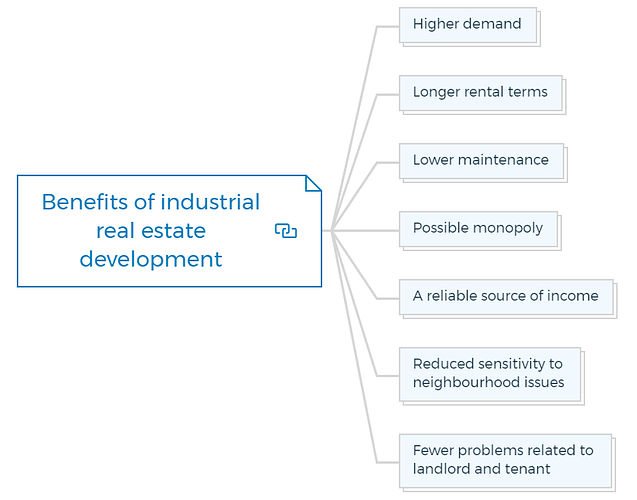

Benefits of industrial real estate development

Industrial real estate development can be profitable from an investment standpoint for the following reasons.

Higher demand

As institutional investors, government bodies, wholesalers and so on diversify their portfolios and increase exposure to the industrial sector, demand for industrial development is growing.

Longer rental terms

Industrial leases generally last three to ten years, although they can go up to 25 years, whereas residential leases last a year. As a result, these properties are more likely to provide consistent revenue over time.

Learn More

Lower maintenance

Industrial properties do not require as much maintenance as other types of properties. Most leases are triple net, which means the renter is responsible for all upkeep.

On the other hand, more extended lease periods mean that an industrial property owner won’t have to renovate as often because tenant turnover is lower.

Possible monopoly

Industrial land is often designed and zoned inside a specific location. If no more land is available for industrial growth, it usually results in a pricing monopoly.

A reliable source of income

Suppose development is designed, built, and rented to suit a prime tenant. In that case, it is done mainly on the assumption that a long-term lease would be signed, providing the investor with a reliable source of revenue for a reasonable period.

Reduced sensitivity to neighbourhood issues

Industrial land is typically allocated early in the planning process as a more effective urban structure plan. When establishing these zones, city planners frequently examine whether or not future adjacent neighbours may cause problems.

Fewer problems related to landlord and tenant

Compared to other real estate types, most industrial enterprises take good care in their operations and have fewer problems with their tenants.

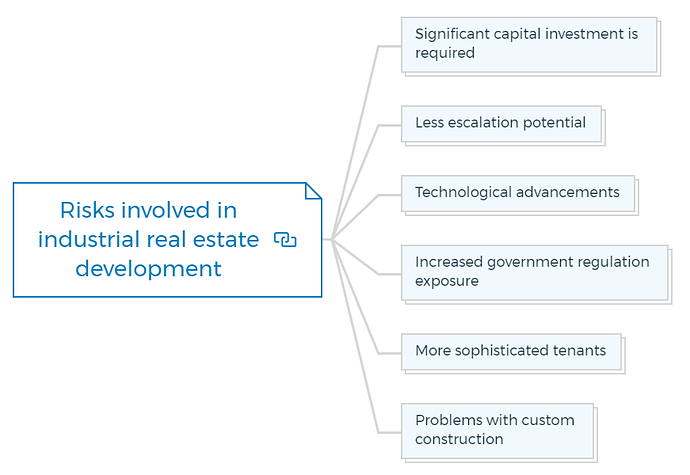

Risks involved in industrial real estate Development

The following are the risks of developing and investing in industrial development.

Significant capital investment is required

Even though industrial properties cost less per square meter to build than other buildings, they are much bigger on the inside and have long roof spans, so they require more capital.

Less escalation potential

Because most leases are long-term, the escalation terms are often fixed and not based on the CPI, so they do not allow for escalation to be adjusted if inflation rises.

Technological advancements

Industrial buildings are at risk of becoming obsolete as manufacturing and assembly technology evolves at a rapid pace to increase production.

Increased government regulation exposure

Because of the large number of people who live in industrial buildings (mainly if they are utilized as processing plants), the construction of these structures may be subject to a lot of government restrictions and inspections.

More sophisticated tenants

Tenants in these buildings are typically well-established firms with lots of lease negotiation experience.

Problems with custom construction

In some cases, a developer has to build a property to meet the specific needs of a tenant, only to find out when the lease is up that it doesn’t fit the general market.

Strategy for industrial development

The plan for an industrial project, like other advancements, should be devised to maximize market potential while minimizing development costs. This is true whether the developer plans to sell the finished project or keep it as a long-term investment.

Many developers, especially those who have secured a long-term lease with a reputable corporate tenant, would fall into the latter category. A developer may offer smaller industrial units to owner-operators and investors if the intended project is a group of smaller industrial units aimed at the small business sector.

Alternatively, the developer could sell a percentage of the units to improve their equity and leverage position while keeping the rest as a long-term investment.

Demand for industrial development

Employment patterns mainly determine industrial building demand in the most likely industries to use such structures. It will also be influenced by the individual space requirements of those industries’ employees.

Employment trends

Various variables influence business success, including national and local economics and demographics. However, these factors do not always have the same impact on employment in the industrial sector.

Work in the shipping and cargo industry, for example, is less affected by demographic shifts than employment in the manufacturing and retail sectors.

As a result, a detailed analysis of jobs in a particular industry in a specific area determines the demand for industrial space.

Specific space requirements

Specific space needs differ depending on the industry. The area required per employee in the apparel business, for example, is smaller than that needed in industrial sectors. It is because a clothes manufacturer requires a lot of labour, whereas building products require more machinery and less work.

A precise assessment of individual staff space demands is necessary to assess the market.

Location preferences

Services, transportation, raw material availability, and favourable labour conditions all play a role in determining where certain enterprises will locate.

For example, resource businesses like coal must be located near mining areas, yet the motor manufacturing industry must be near skilled labour and complementing component makers.

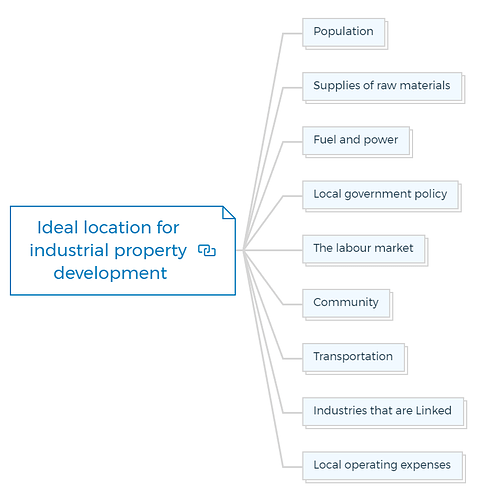

Ideal location for industrial property development

When choosing a location, industrial developers consider labour, materials, power, transportation, local government policy, and local operating costs. However, industrial hubs are generally market-driven; therefore, location decisions may be influenced by transport, prestige, and possibilities for related industries.

You should consider the following elements while determining the best location for developing industrial structures.

Population

Preference should be given to an area with one million or more population and the potential for significant population and economic growth in this development category.

However, some industrial ventures can succeed in locations with a smaller population, especially if the area possesses the qualities indicated below.

Supplies of raw materials

The availability of raw materials or additional value-added services for an industrial manufacturer could be a crucial deciding factor in establishing their business.

Fuel and power

A manufacturer sees local government or firms’ rates and possible concessions for bulk electrical power or fuel as a significant benefit.

Local government policy

Determine the local government’s policies regarding tax breaks and economic incentives.

The labour market

Developers should thoroughly examine the local labour market, including the availability of trained labour and costs such as wages—review labour legislation, union dominance, and productivity output.

Community

The local community in some locations may protest the presence of industry and exert pressure against it.

Transportation

Ensure that the site is served by an existing (or projected) highway. Examine the distance to airports, ports, and railway stations as well.

Industries that are linked

Determine the industries that may be relocating to the area and those already there and have plans to expand.

Local operating expenses

Compare and contrast the water, sewerage, waste disposal, energy, transportation, and other related expenses in different areas.

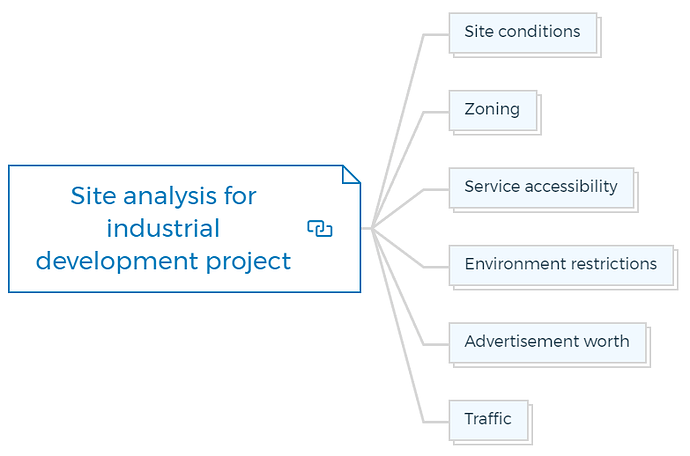

Site analysis for industrial development project

Along with the development’s location, you should thoroughly examine the following site criteria -

Site conditions

Examine soil samples to determine the soil-bearing capacity. You might find an old landfill or ex-refuse site on certain industrial-zoned land.

Examine the land’s shape, terrain, and contours; industrial structures necessitate broad, flat areas, which decreases or eliminates the cost of any land excavation or filling, as well as the necessity for retaining walls.

Zoning

Ascertain that the proposed industrial building’s planned or intended use complies with the local structure plan, zoning, easements, and any other title constraints.

Service accessibility

Check where the nearest service connections are located. Long distances to water, power, and sewerage could significantly increase the construction budget. Examine whether the current services can meet the user’s needs.

Environment restrictions

For manufacturing or processing plants, ensure that the structures and their use comply with strict environmental regulations enforced by local, state, and federal agencies.

Advertisement worth

If the site gives advertising exposure that can be seen from a major highway or arterial road, it is a plus for the developer.

Traffic

Examine if the current road system can comfortably accommodate the movement of huge vehicles and future traffic loads.

By understanding a thorough site acquisition process, you can identify how risky or safe a project is.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

Market profile

Individuals or businesses in need of industrial facilities fit the following market profiles:

- Industrial facilities are typically planned and created for national manufacturing enterprises or significant corporations for their unique use. The corporation either builds the facilities or leases them for an extended period.

- National distributors, such as substantial supermarket chains or department shops, require many warehouse and office spaces strategically positioned near sound transportation systems and possibly market visibility.

- Private and institutional investors are the two types of investors. Institutional investors will seek more significant buildings with critical and stable tenants, while smaller private investors will be looking for smaller strata-type developments.

- Small business owners require smaller industrial units for manufacturing or storage. These companies would search for a strata complex to purchase or rent.

Market analysis for industrial space

To analyze the market, one must first comprehend the market need for industrial space, which may be divided into two categories: ‘generated demand’ and ‘replacement demand.’

New companies intending to locate in a new area or existing companies wishing to expand their operations develop generated demand, which accounts for most of the market.

Established businesses want to replace obsolete facilities with better operational planning, such as better architectural design, better parking, more excellent trucking manoeuvrability, and reduced operating expenses.

Consider the below factors while conducting a market analysis.

Competition

A competitive analysis should provide crucial foundations for the marketing strategy, such as competitive sale and leasing policies, the range of items on the market, and the level of supplementary services supplied to prospective tenants.

Employment

An employment study can influence the demand for industrial growth by determining what changes in employment have occurred in the last 10 years and the predicted trends for the next ten.

Economic foundation

An economic basis analysis is essential for assessing the local community’s economic base regarding current economic trends, possibilities, and shortcomings. This data will aid in identifying the types of industrial customers who will be the most likely suppliers of industrial space demand.

Continued at…

Industrial real estate – The risks, the benefits [Part 2-2]