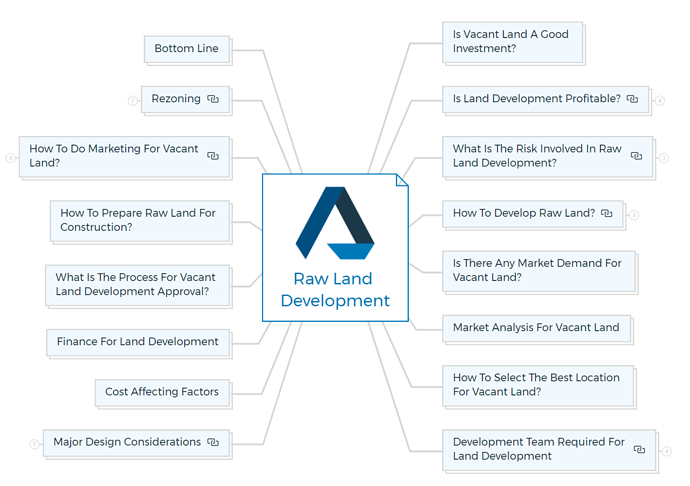

Vacant land development: Benefits of raw land

Are you an aspiring property investor or developer looking to get into raw land development? If so, there are a few things you should know before you take the plunge.

Vacant land development refers to the process of turning undeveloped land into something valuable and habitable by building on it. This can be achieved in many different ways, depending on your needs and the type of land you’re working with, but all land development projects share some common elements and steps.

Here are some of the basics of raw land development, from buying parcels of land to marketing and selling your finished product.

Is vacant land a good investment?

We can’t replicate land; thus, it can be a precious asset depending on its location and site circumstances. Areas near a river or coastline, or places with exceptional vistas, have witnessed a significant increase in value, indicating a demand for good quality land.

The advantage of holding raw land is the possibility to increase its value. Vacant land can be subdivided or rezoned, with the resulting portion(s) of land being sold for more than the initial purchase price, including subdivision or rezoning fees.

When undeveloped land is not providing money, the owner often loses the tax benefits of developed property. If an investor or developer wants to keep raw land, they’ll need a lot of cash to cover repayments, service fees, and other expenses.

Investing in raw land can be considered from two different angles:

- Land speculation

- Redevelopment and resale.

Regarding land speculation, the investor expects to keep the property until a change in land use occurs or demand is developed due to urban expansion.

On the other hand, the land developer intends to engage in entrepreneurial activities on the property, such as applying for a rezoning of land use and subdivision, installing infrastructures such as roads, water, sewerage, gas, and electricity, and then profitably selling the various subdivided portions.

You are missing out if you haven’t yet subscribed to our YouTube channel.

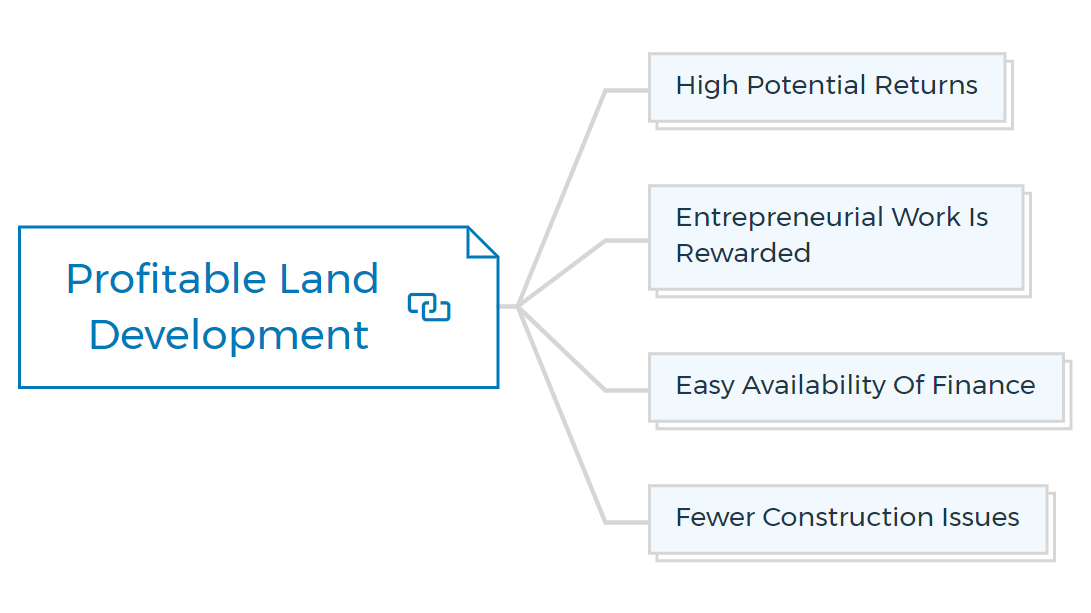

Is land development profitable?

The profitability of land development depends on two factors: location and timing. To maximise your chance of making money from developing raw land, look for areas with high population growth, high-income growth and proximity to employment centres.

Following are some reasons why land development is beneficial.

High potential returns

As previously said, a well-located property can become a valuable asset, mainly when natural forces such as population growth and migration create a desire for new zonings.

When rural land is rezoned to urban, the value of the land purchased at rural land prices is revalued at a much higher rate per square metre.

Learn More

Entrepreneurial work is rewarded

Visionary developers are often rewarded for their entrepreneurial efforts. For example, some developers have made billionaires overnight by analysing a city’s growth patterns and purchasing vast tracts of unused government property, rezoning it, and selling the subdivision as residential and commercial building lots.

Easy availability of finance

Most funders will be willing to lend money for vacant land if the timing, location, and feasibility studies show a good return. This funding is sometimes contingent on the property being rezoned.

Fewer construction issues

Dealing with a natural resource that only requires roads and essential utilities to make it usable entails fewer headaches and financial commitments than dealing with new construction.

Furthermore, compared to a new building, where the developer will only receive payment after the structure is completed, land can be sold much sooner, lowering the holding cost or interest charges.

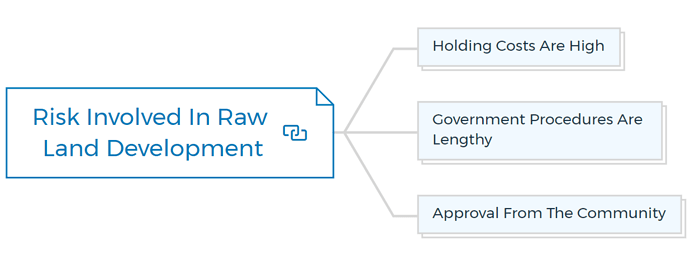

Risks with undeveloped land

The risks associated with raw land development are primarily determined by the timing factor, along with the following points.

Holding costs are high

Long-term speculative land purchases might have substantial holding costs, especially if the land cannot be rented for a specific purpose or sold beforehand. Delays in rezoning or subdivision approvals can be costly to a developer because they will be paying interest, land taxes, and professional fees without any cash flow or return from the land.

Government procedures are lengthy

Any rezoning or subdivision of land triggers a slew of government processes, including municipal and state agencies.

Some government procedures may mandate the developer to do particular studies, such as an environmental impact assessment, a traffic effect analysis, and a social impact study, depending on the size and location of the site.

Approval from the community

There may be several local active communities and action groups who voice concerns about the rezoning’s influence on the residents and environment, in addition to the usual government approvals. If these concerns are not addressed, it may slow down the property development process.

In the world of property development, risk management is critical. Follow Risks In Property Development – Industry Insiders Guide for tips and tricks for succeeding with a practical approach to all types of risk in this industry.

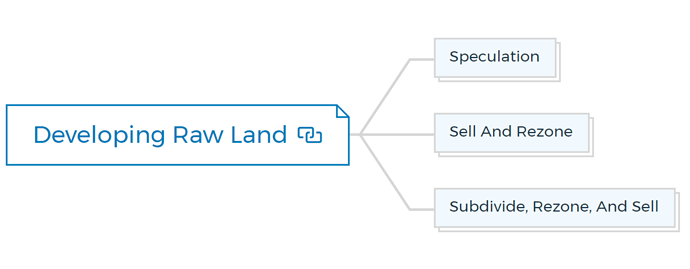

How to develop raw land?

To be successful in land development, you must be continually aware of any changes in government planning policies and maintain track of urban expansion. You can do so by going to your state’s planning authority and getting the most up-to-date planning material on current and future policies.

Now that you have this information, you have the following alternatives for approaching your development.

Speculation

Long-term and short-term speculation are both possible. The long-term premise involves buying a big piece of rural land, waiting for urban sprawl to approach, and then selling.

Short-term speculating requires being informed of any impending planning adjustments, purchasing land that will be affected by the changes and then selling at a higher price.

Sell and rezone

Rezoning and selling entail purchasing the land outright or based on a conditional option. It will take time and effort to ensure that the rezoning is effective and then sell the land to another developer willing to build the structures.

Subdivide, rezone, and sell

Rezoning, subdividing, and selling is used to rezone, subdivide, and sell residential or large industrial land plots. The developer creates an overall township plan following government planning policy and long-term structure plans.

Before being sold as individual lots, the application will go through standard government procedures.

Assessing market demand for vacant land

Land development follows the same rules as other markets and is subject to market pressures.

Because successful land development is dependent on the land’s eventual use, you should examine the variables associated with specific real estate uses while analysing market demand.

The following is a list of the main variables to be investigated:

- Population variation

- The economy’s transformation

- Effect of government policies

- Alterations in the economic structure of the community

- Availability of land

- Social services

Market analysis for vacant land

Conduct market research in the following areas to identify potential purchasers for the subdivided lots:

- Consumer demographics and profile

- Proof of previous sales

- Infrastructure that has been carefully planned

- Competitors

- Forecasting sales

- Future profits

The research can be assisted by real estate brokers, property valuers, or expert market researchers.

Learn More

Select the best location for vacant land

You will need to spend time researching land acquisition and staying up-to-date with the state planning authorities’ future planning rules to locate the best location for land development.

Your investigation should also consider the long-term planning of road and rail transportation infrastructure and the movement of people closer to job possibilities. Avoid environmentally sensitive locations, which may cause rezoning and subdivision applications to be delayed.

Avoid natural wetlands and low-lying ground and waste sites such as former garbage dumps, regions with high overhead power lines, and land near airports or heavy industrial zones.

When looking for the perfect location, consider all of the land’s future uses, which could include residential, office, retail, or industrial.

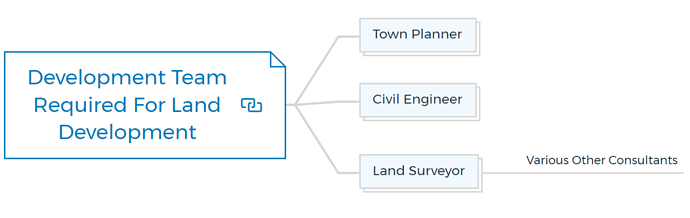

Development team for raw land development

The number of consultants on the team will vary depending on the scale of the project. Still, in addition to the developer or project manager, the town planner, civil engineer, and land surveyor are three other consultants who play an essential role in rezoning and subdivision.

The following is a list of their respective services:

Town planner

Depending on the project’s scope, you may use the services of a town planner from the beginning to the finish. The planner’s skills are most needed in the early stages when he will perform a variety of studies and consultations with various authorities to offer a conceptual layout sketch with a planned subdivision and zoning. The planner will prepare a thorough structural plan with the help of other consultants, which will serve as the framework for the various subdivisions and will be submitted to various authorities for approval. A municipal planner will draft the application and motivation documents for council approval if the rezoning is required.

Civil engineer

In the early stages, you will need a civil engineer to evaluate service opportunities and limits with the appropriate authorities. Water, electricity, and gas authorities, the local control for road and stormwater management development standards, telecommunication service providers, and the government’s transportation and environmental protection departments are among them.

The engineer will inspect the land and look into the soil and vegetation types, groundwater, existing services, terrain, and other factors affecting the town planner’s raw land development costs and planning.

The engineer will develop precise drawings and specifications in cooperation with the other team members, issued for tendering to civil contractors. It is critical to retain the services of an engineer to oversee the construction process.

Land surveyor

You will need a land surveyor at two stages of the project’s development: at the start and the end. The surveyor will prepare a complete survey of the land to be developed at the beginning of the project, covering all existing elements such as trees, water features, services, and so on. The surveyor will formalise the subdivision by drawing diagrams and pegging out the subdivided land so that titles may be issued after the subdivision is completed and approved by relevant authorities.

Various other consultants

You will also need some other consultants, but they will likely play a minor role:

- Structural engineer

- Environmental scientist

- Geotechnical engineer

- Anthropologist

- Architect

- Landscape architect

- Property Valuer

- Real estate agent

- Advertising and marketing professional

- Lawyer

Learn More

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

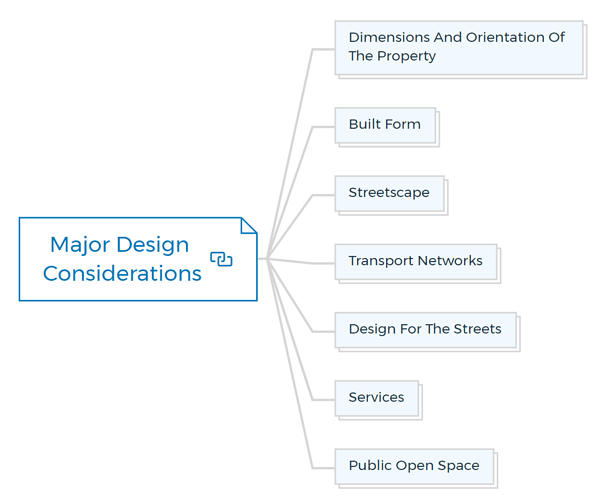

Major design considerations

Consider the following design elements -

Dimensions and orientation of the property

There is a lot of variation in the size and orientation of lots across your country’s states. For instance, in Australia’s states, the average lot size used to be roughly 500 to 800 square meters for detached dwellings.

Many local governments are now encouraging a range of lot sizes ranging from 400 to 450 square meters to achieve cost efficiency. Australian households are shrinking, and people’s lifestyles are shifting to include more time spent on leisure activities outside the home.

As a result, homeowners don’t have as much time to manage a large garden as they once did. When developing for smaller lots, the planning team should consider the following factors, where appropriate:

- The land’s natural curves and orientation, as well as the conditions of the soil

- The requirement to preserve unique features such as trees and views

- The cost-effectiveness of new and existing services

- The necessity of avoiding unnecessarily repetitive actions

- The ability to aid energy conservation by ensuring proper solar orientation

Built form

Although the final design and planning of residences on each lot is not part of a land developer’s financial feasibility, considering the following design considerations will help with the marketing strategy:

- The homes’ scale, height, and density

- A general housing theme or personality

- Privacy, natural light, and energy conservation.

- Various setbacks and building lines

- Provision of a private outdoor area

- Parking

Streetscape

In a vacant residential land subdivision, the design and character of the streetscape are essential in determining the value and image of the properties. It also has a significant impact on neighbourhood identity.

The following elements contribute to the streetscape’s value.

- The formal and informal landscaping’s quality

- Natural greenery and existing trees are preserved

- The utilisation of terrain and natural features

- Widths of the verge (the area between the lot boundary and the roadway) and street paving design

- Street furniture, such as poles and signs, is controlled and designed.

- Architectural styles under supervision

- Fence height and material are created and maintained.

Transport networks

The design team should start with the most sensitive elements of transportation, which are the needs of pedestrians and cyclists when preparing the overall conceptual site layout.

The primary highways should have gentle grades and connect residential areas to schools, parks, and community activity centres. One needs to eventually consider the design of possible bus routes and the expansion of the roadway network.

For safety, traffic effect, and noise, residential streets should have low traffic volumes and speeds.

Design for the streets

Aside from the public transportation network, the design team should pay special attention to the detail and design of the street layout, taking into account such like:

- The breadth of the street reserve (the area set aside for future road widening) and the width of the pavement

- Distances and sightlines (clean vision lines for vehicles approaching intersections)

- Design and markings for streets and pavements

- Spinning rounds to make room for garbage trucks and fire trucks

- Public transportation provisions

- Street illumination, as well as street furniture

- Pedestrians and bikes will be accommodated.

The provision of pedestrians and bicycles must be a vital component of the overall transportation network design. Residents should be able to walk or ride their bikes to community facilities.

It’s especially crucial to design for the safety of children, the disabled, and the elderly, especially when they have to cross a busy street.

Services

Water supply, sewerage, electricity, gas, telephone, and stormwater are typically provided through a series of underground ducts within the road reserve or at the back of a lot in residential subdivision developments.

Independent authorities oversee these utilities, and no attempt has been made in the past to integrate installation, except a single agreed-upon location for each service.

Recently, there have been attempts to share trenches, which has the following benefits:

- Cost-effectiveness with fewer trenches and minor construction

- The precise location of maintenance and repair services

- Reduced verge width

- Reinstatement and earlier settlement.

Public open space

Local governments usually specify the minimum amount of open space required to ensure a sufficient amount is planned at the design stage. The continuous maintenance of these spaces has recently become a concern for local governments.

Therefore, when developing areas for open space, it’s necessary to strike a balance between current and future use and ongoing maintenance requirements.

Cost factors

While the initial cost of land subdivision development may be comparable to other developments, the construction cost breakdown will differ because no buildings are involved.

The expenses that one needs to consider when conducting a feasibility study for a land subdivision development are listed below:

- Land value when purchased

- Rezoning

- Subdivision

- Services in bulk

- Expense of building

- Cost of holding

- Escalation costs

- Fees for development managers

- Consulting fees for professionals

- Insurance

- Transportation and other statutory levies

- Road widening

Learn More

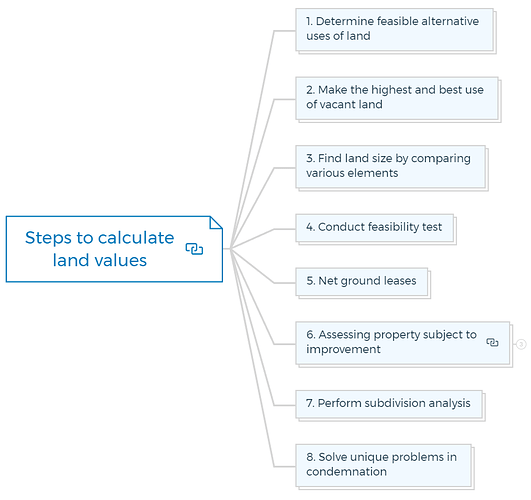

How to calculate land value?

When you are looking to invest in raw land, one of the most important things you need to figure out is what the property is worth. Determining the vacant land value can be tricky- there are a number of ways to do it, and not all of them will give you an accurate estimate. Here are 8 steps for estimating the value of vacant land.

1. Determine feasible alternative uses of land

The majority of collected residential properties and commercial properties have potential other financially viable uses. Future preservation will be influenced by identifying practical alternative applications because the value of development rights determines the donor’s eligibility for tax credits.

Collectible lands can generate money from mining, oil and gas, wood, and other natural resources, even for the more mainstream investor. Lands may be leased for various uses, temporarily or permanently.

You can achieve an outstanding value split by holding a remaining stake in the land while leasing it to a commercial user. The commercial user enjoys the current practicable usage and pays rent by it, while the landowner keeps the capital gains.

Learn More

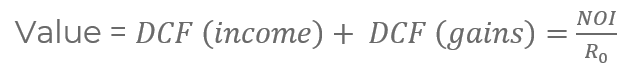

Conceptually, the discounted present value of expected income and the DCF of anticipated capital gains determine an asset’s worth:

Of course, things become interesting because the present “revenue” can come from either rents or investments. Practically speaking, the value of any income-producing asset depends on its potential annual income and any potential capital gains upon selling.

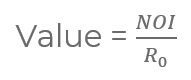

Take a look at the direct capitalisation land valuation formula:

Direct capitalisation land valuation process

The capitalisation of current income (NOI) is accounted for in this formula, but the capitalisation of the eventual resale is not.

The NOI capitalisation itself buried the eventual selling. The capitalisation of future cash flows at the moment of sale would be the only factor in determining value.

If we don’t count things like selling costs, paying off loans, etc., we could say that the value of a project with constant NOI and an expected sale in a year is:

Value with constant NOI

Even though it may all seem blatantly obvious, it highlights a crucial fact regarding pricing in general and the valuation of land holdings in particular.

The valuation technique is immaterial, assuming a constant cap rate, R0, and the same discount factor for current income and future gains.

For one, the cap rate is merely a comparison between the predicted, steady NOI and the price existing real estate investors are willing to pay for that unending supply of NOI.

As real estate performance impacts and modifies investor expectations, expected NOI and R0 fluctuate frequently and quickly.

Second, even in a dream world where NOI and property investor expectations don’t change, the cap rate for highly speculative future gains will differ from the cap rate for much less speculative current income.

Therefore, the investor’s future plans for the property type may have a significant impact on the projected present value.

Continued at…

Raw Land Development – What you need to know? [Part 2]