Continued from…

The Ultimate Guide To Property Investment Finance [Part 1-4]

The Ultimate Guide To Property Investment Finance [Part 2-4]

The Ultimate Guide To Property Investment Finance [Part 3-4]

Self-managed super fund (SMSF) loans

If you’re looking to finance a property using your SMSF, there are a few things you need to know.

- You can only borrow for investment purposes, not for personal use.

- The loan must be secured by an eligible asset, such as commercial or residential property.

- The asset must be held in trust for the benefit of the SMSF.

- You can only borrow up to 80% of the property’s value.

- You must pay the loan within a maximum term of 30 years.

- You will need to pay interest on the loan and fees.

SMSF loans are a great way to invest in property, but make sure you understand the rules and regulations before taking out a loan.

Security restrictions for SMSF loans

- Owner-occupied property, construction, second mortgage, over 5 hectares, and vacant land are unacceptable scenarios for lenders.

- Interest rates are high, roughly 1.6-2% above a standard variable home loan rate.

Debt service/borrowing capacity for SMSF loans

A key consideration when determining whether to use SMSF borrowed funds to invest in property is the debt service obligations and borrowing capacity of the SMSF.

Several factors will determine the capacity of the SMSF to service the loan, including:

- The income and expenditure of the SMSF

- The interest rate on the loan

- The term of the loan

- The repayment structure of the loan (e.g. interest only or principal and interest)

- Any other investments held by the SMSF

It is important to seek professional financial advice to determine whether your SMSF can service a loan before proceeding with any investment.

Lenders use two basic methods to assess a borrower’s borrowing ability.

Net surplus ratio (NSR)

The net surplus ratio (NSR) measures the SMSF’s ability to service the loan from its current income.

To calculate the NSR, the lender will take into account:

- The projected after-tax earnings of the SMSF from all sources (e.g. salary, investment income, pension income)

- The projected after-tax expenses of the SMSF (e.g. loan repayments, running costs, insurance premiums)

- The NSR is generally expressed as a percentage and will usually be calculated annually.

For example, if the SMSF’s projected after-tax earnings are $50,000 and its projected after-tax expenses are $40,000, the NSR would be 50% (50,000/40,000).

The SMSF has enough income to cover its expenses and still has $10,000 leftover (the surplus).

The higher the NSR, the more comfortable the SMSF is servicing a loan.

Debt service ratio (DSR)

The debt service ratio (DSR) measures the SMSF’s ability to repay the loan over the term of the loan.

To calculate the DSR, the lender will take into account:

- The projected principal and interest payments of the SMSF over the term of the loan

- The projected assets and liabilities of the SMSF at the end of the loan term

The DSR is generally expressed as a percentage and will usually be calculated every month.

For example, if the SMSF’s projected principal and interest payments are $2,000 per month and its projected assets and liabilities are $100,000 at the loan term, the DSR would be 2% (2,000/100,000).

It means that the SMSF’s monthly repayments will eat up 2% of its total assets over the life of the loan.

The lower the DSR, the more comfortable the SMSF is servicing a loan.

As a general rule, the SMSF’s NSR should be greater than its DSR.

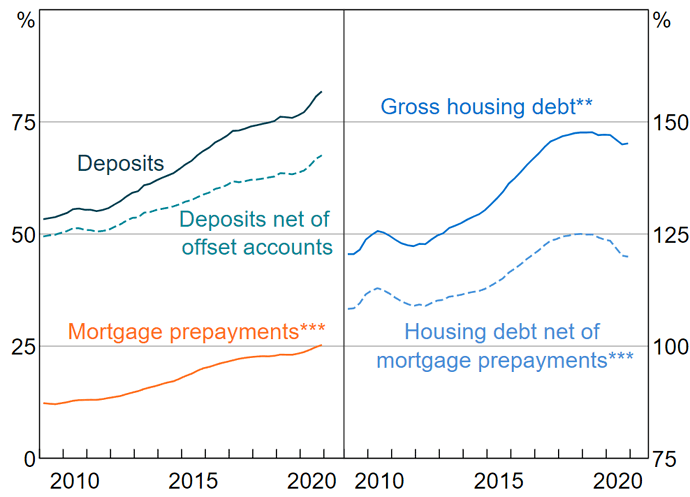

Share of household disposable income

If there is a little surplus, always ask how much you should borrow instead of how much you can borrow. As a buffer, add 2% to 7.25% to the debt cost.

Anyone who has borrowed money recently might consider basing the out-of-pocket cost of any property loan on a 7.2 per cent rate (the average interest rate over the last 20 years). Don’t let debt consume more than 40% of your household’s income.

Who can lend to SMSF?

Most major lenders, plus a few specialist lenders, are now offering SMSF loans.

Regular Lenders - Any lender can fund an LRBA. Most major banks currently lend to SMSFs. Using a major lender has advantages such as sourcing funds, drafting loan agreements, and performing most legal checks.

The disadvantages include higher interest rates than you would get if you borrowed in your name.

You, as a lender - You can become the lender of the borrowed fund to your SMSF.

If you have excess funds in your name and your super fund cannot afford the home, you may consider this. Another reason could be that you can’t find a typical lender ready to lend against the property you want to buy.

- Expert guidance is highly suggested when lending money to an SMSF.

- The amount of money loaned to an SMSF is not capped.

- If an individual is willing to lend the SMSF the whole purchase price plus legal fees, they may do so.

What are family pledge loans?

A family pledge loan is when a family member uses their property to secure your loan. It can be a great way to get into the property market if you don’t have enough money for a deposit. Normally, principal and interest are repaid. LVR can go up to 110%.

In many cases, the pledge provider is legally responsible for their portion of the obligation. There are some risks involved, so make sure you understand the pros and cons before taking out a loan.

Pros of family pledge loans

- You can often get a lower interest rate than a standard loan.

- Your family member’s property is used as security, so the lender has less risk.

Cons of family pledge loans

- If you default on the loan, your family member’s property could be at risk.

- You may not be able to get the loan if your family member’s property is not suitable as security.

What is a split contract?

A split contract is an agreement between a property investor and a builder to complete part of constructing a new property.

- The investor provides finance for the builder to start work and then agrees to buy the finished product from the builder after its completion.

- This type of arrangement can be helpful for investors who want to get involved in property development but don’t have the funds to finance a project from start to finish.

- You can also use this contract to purchase an investment property already under construction.

- Understand the builder’s track record and get a fixed price for the finished product.

Be aware that there may be some risk involved, as the builder may not complete the project on time or to a high standard. Make sure you have a solid contract in place that protects your interests.

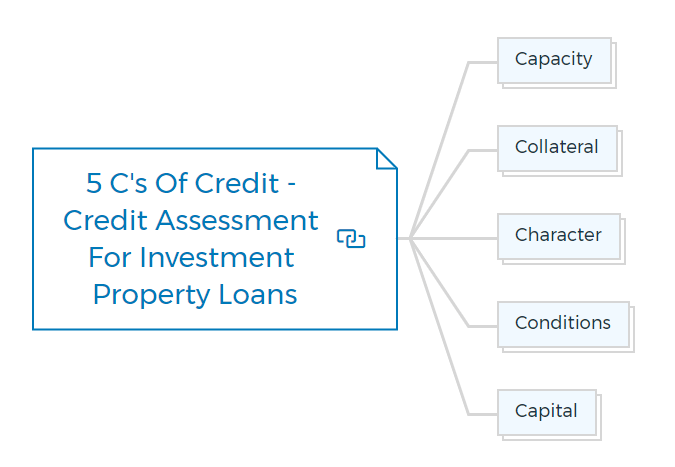

5 c’s of credit - credit assessment for investment property loans

When applying for an investment property loan, the lender will assess your creditworthiness using the Five Cs of Credit.

Quick Tip

The Five Cs of Credit are:

- Capacity: Can you afford the loan repayments?

- Collateral: What asset are you using as security for the loan?

- Character: Are you a good borrower?

- Conditions: What are the economic conditions like?

- Capital: How much equity do you have in the property?

Lenders will look at all of these factors when assessing your loan application. It’s important to understand each one to put your best foot forward.

Capacity

Capacity refers to your ability to make the loan repayments. The lender will assess your income and expenses to see if you can afford the loan.

They may also consider whether you have other debts that could affect your ability to repay the loan.

Collateral

Collateral is the asset you’re using as security for the loan. The lender will assess the asset’s value and whether it can be sold to repay the loan if you default.

Character refers to your history as a borrower. The lender will look at your credit report to see if you’ve made late payments or defaulted on loans in the past. They may also consider your employment history and financial stability.

Conditions

Conditions refer to economic conditions, such as interest rates and inflation. The lender will assess how these factors could affect your ability to repay the loan.

Capital

Capital refers to the equity you have in the property. The lender will look at how much money you’ve put towards the property’s purchase price and whether you can increase your equity if the property value decreases.

Does a property investor need to register for GST?

You must register for GST if you are carrying on an enterprise and your GST turnover is above the registration threshold. If you purchase property as part of your enterprise, you will need to pay GST on the property finance.

When owning the property, as a property borrower, you should be GST registered to avoid paying taxes on the interest earned from your investment. GST registration also allows you to claim tax deductions, which can offset the cost of your loan repayments.

If you are not GST registered, you may find that the interest you earn on your investment is subject to GST. It can significantly increase the cost of your loan repayments.

What is arrears payment?

Arrears payment is a type of payment made when the amount owed is more than what is currently being paid. It can result from missed payments, interest charges, or other fees.

When making an arrears payment, it is important to ensure that all of the correct information is included so that the payment can be processed correctly. It may include the account number, the amount being paid, and the payment date.

Arrears payments can be made in various ways, including by check, online, or over the phone. You can also make these payments through a debt consolidation program. It can help lower the monthly payments and make it easier to catch up on the outstanding balance.

Arrears payments can significantly impact your credit score, so it is important to make them on time and in full. If you are struggling to make arrears payments, contact your lender or creditor as soon as possible to discuss your options.

Learn More

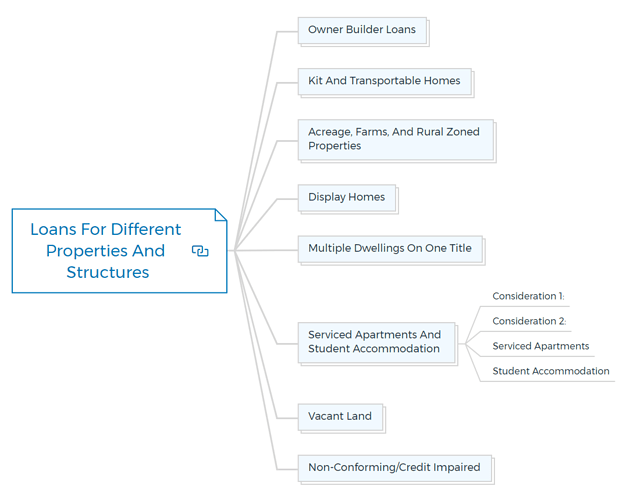

Loans for different properties and structures

There are a variety of loans available for different types of property and structures. Whether you’re buying a house, a commercial property, or a development project, there’s likely to be a loan that fits your needs.

Some of the most common types of loans for property purchases include:

Owner builder loans

Owner builder loans are a type of construction finance that allows you to finance the construction of your new home as an owner-builder.

It can be a great option for those who want to build their own home but don’t have the funds to do so outright.

There are a few things to consider before taking out an owner builder loan, such as -

- Whether you have the necessary experience and skills to build your own home.

- You’ll also need to factor in the cost of materials and labor and any permits or inspections that may be required.

Kit and transportable homes

A kit or transportable home is a prefabricated home that can be transported to your property and assembled on site.

These homes are usually less expensive than traditional stick-built homes and can be a great option for those on a budget.

There are a few things to keep in mind when considering a kit or transportable home, such as

- The cost of transport and assembly

- Permits or approvals that may be required.

Acreage, farms, and rural zoned properties

Some lenders consider this a residential loan. Obtaining a commercial loan is often preferable, especially if the property generates or has the potential to generate income.

In the event of a repossession, the lender would take the borrower’s property and the location from where the income is made.

Acreage, farms, and rural zoned properties present a unique set of challenges regarding financing. There are several different loans available for these types of properties, including:

- Rural development loans

- Farm loans

- Agricultural loans

Each of these loans has its requirements and conditions, so it’s important to do your research before choosing one.

Display homes

A display home is a property that a developer or builder builds specifically to display their work.

These homes are often used as model homes or show homes and are usually located in new developments or subdivisions.

Display homes can be a great option for those looking to invest in a property, as they often come with several features and amenities that aren’t typically found in other homes.

There are a few things to keep in mind when considering a display home, such as

- The cost of the property

- Whether the property is furnished or not

- The terms of the lease, if applicable.

Multiple dwellings on one title

You will see multiple dwellings commonly on the Australian Landscape. Multiple dwellings on one title refer to any property with more than one dwelling unit on a single piece of land. It can include duplexes, triplexes, and quadplexes.

Financing for multiple dwellings can be more complicated than for single-family homes, as there are a few different options to consider. Some of the most common loans for multiple dwellings include:

- Secured loans

- Unsecured loans

- Development finance

Serviced apartments and student accommodation

Investing strategies abound. Some tactics yield good cash flow or capital growth, while others waste time and damage an investor’s property goals.

Many consider student housing and serviced apartments to be bad investments.

Consideration 1:

Banks rarely lend more than 60% of either type of property value. It is one of the riskiest residential investment property decisions an investor can make, and lenders do not want to take that risk.

Consideration 2:

Because lenders normally only consider 60 per cent LVR (loan-to-value ratio), an investor must contribute 40% plus fees.

It is a waste of money. These funds may have gone to alternative investment properties with higher capital growth potential, up to 95% LVR.

The resale market is far smaller than the usual property market, which is terrible enough for the investor.

There would be many fewer consumers willing to chip in 40%. Like the initial investor, they would have difficulty obtaining financing, as only a few lenders will lend on such security.

So the vendor can’t demand the price they desire. It would always be a buyer’s market (i.e. sellers would not be in a strong position to negotiate).

Few investors want to put 30-40% of their funds, and many won’t have that much. So don’t think about whether you can afford it; think about how many people can afford it - the answer is not many.

Serviced apartments

The capital growth potential of serviced apartments is linked to the property’s rental increase. Some serviced apartment contracts include rent hikes over time.

- Leasing increases capital growth. The increase represents a capital gain.

- Be aware that the value may not rise at the same rate as a regular unit.

Services apartments present additional risks such as management service quality, use of the flat, and whether it can be owner-occupied. Lenders dislike them because they are burdensome, restrictive, controlling, and costly.

Learn More

Student accommodation

Student accommodation can be profitable, although it is usually significantly smaller (under 50 square meters) and riskier.

Depending on location, student housing contracts may be less demanding. Some investors rent out rooms in a house, but it is still a suburban home.

This is preferable to designated student housing since it permits standard debt amounts to be borrowed if the property is valued before locks are installed on each bedroom door.

Lenders regard it as a house and are unaware that they may purchase the property to rent to students.

Vacant land

When there is no construction contract on land smaller than 5 acres, many lenders will only finance up to 90% plus LMI. Later on, a loan increase of up to 95 per cent LVR may be possible, allowing for construction.

Lenders frequently require that water and electricity be connected to the land to make it more marketable.

Non-conforming/credit impaired

Many lenders finance property investment for people with non-standard credit. Loans may be available up to 95% LVR and often do not require any deposit.

Credit impaired or “non-conforming” finance is a type of lending typically used by people who have had some financial difficulties in the past. This can include things like defaults, bankruptcies, and other credit problems.

Non-conforming finance is often more expensive than traditional finance because lenders see it as a higher risk. However, it can still be a good option for people who might not be able to get approved for a regular loan.

Suppose you’re thinking about applying for non-conforming finance. In that case, it’s important to compare different lenders and make sure you understand the terms and conditions of the loan before you sign anything.

- Credit Hits

Your credit file is hit by:

- An enquiry every time you apply for finance;

- If a lender does a “hard” credit check (this is more common with loans over $500,000);

- If you are declined for finance

- If you default on a loan or credit card

Each credit hit decreases your credit score, so it’s important to minimise the number of times you’re knocked back.

- Credit score

It is a three-digit number that lenders use to measure how risky it is to lend money to you.

Your credit score is based on your credit history, so anything that lowers your credit score will make it harder for you to get approved for finance.

If you’re struggling with your credit score, you can do a few things to improve it.

- Get a copy of your credit file and check for errors.

- Make sure you’re paying your bills on time.

- Don’t apply for too many loans at once

- Try to keep your credit utilization ratio low (this is the amount of money you owe compared to the total amount of credit you have available)

- Talk to a financial counsellor if you need help managing your debts.

- Consider using a credit repair service.

Lenders use your credit score to decide how risky it is to lend money to you. The higher your score, the better your chances of getting approved for a loan.

A good credit score is important, but it’s not the only thing lenders look at when considering a loan application. They will also consider your income, debts, and other factors.

If you have a low credit score, you can do a few things to improve your chances of getting approved for a loan.

- Get a copy of your credit file and check for errors

- Make sure you’re paying your bills on time

- Don’t apply for too many loans at once

- Try to keep your credit utilization ratio low

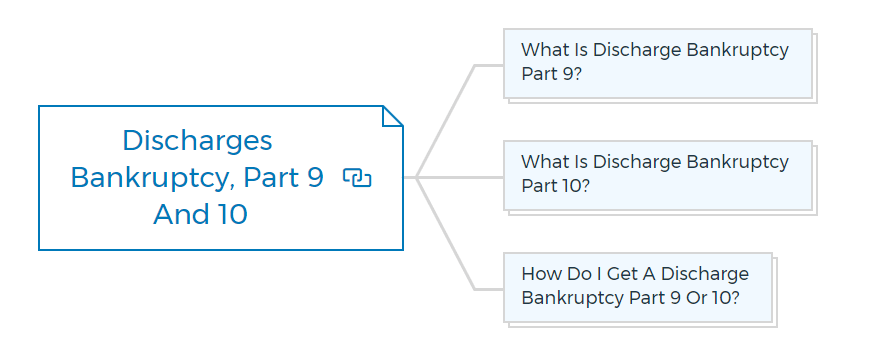

Discharges bankruptcy, part 9 and 10

If you have been discharged from bankruptcy, part 9 or 10, it is still possible to get property investment finance.

Many lenders will finance property investments up to 80% LVR for people who have had a discharge in the past. You may need to provide additional documentation to prove that you are now financially stable.

What is discharge bankruptcy part 9?

A discharge bankruptcy Part 9 is when a court declares that you are no longer bankrupt. This usually happens after you have completed all of your required repayments, and it can happen even if you still have debts outstanding.

What is discharge bankruptcy part 10?

A discharge bankruptcy Part 10 is when a court declares that you are no longer bankrupt but still have some outstanding debts. It usually happens if you have arranged with your creditors to repay your debts over time.

How do I get a discharge bankruptcy part 9 or 10?

You will need to apply to the court for a discharged bankruptcy. The court will consider your application and decide whether to grant you a discharge.

You will need to show that you have complied with the terms of your bankruptcy and that you have made a reasonable effort to repay your debts.

Tax debts

Many people owe the ATO money (usually self-employed rather than PAYE). For example, a self-employed individual earned money from their firm.

Still, they either mismanaged their cash flow or used it to stay afloat, leading to irresponsibility and not saving the tax they knew they would have to pay. They spent ATO-allocated revenue.

Banks rarely lend to these folks. Non-banks can accept clients who owe the ATO, but they usually ask that the ATO debt be paid at settlement, even if on a payment plan.

Some lenders can let you keep your debt if you agree to a payment plan with the ATO. Naturally, rates are higher. LVRs are up to 95% for purchases and 90% for refinances.

Finance strategies to invest in properties for first-time homebuyers

- Borrow less than 80%

If you have a deposit of 20% or more, you can avoid paying Lenders Mortgage Insurance (LMI). Borrowing less than 80% will also give you access to lower interest rates. - Get a family guarantor

A family guarantor is someone who uses their property as security for your property investment finance. This can help you borrow more money and get a lower interest rate. - Choose a longer-term loan

A longer-term loan will have lower monthly repayments but will cost more over the life of the loan. This may be a good option to keep your repayments low. - Fix your interest rate

A fixed interest rate means that your repayments will stay the same for a set period, even if interest rates increase. This can help you budget for your repayments. - Make extra repayments

Making extra repayments on your property investment finance can help you pay off your loan sooner and save on interest. - Get property investment insurance

Property investment insurance can help you protect your property investment from fire, theft, and storm damage. This can give you peace of mind that your property is protected.

Finance strategies for buying multiple investment properties

- Borrow more money:

If you have a good credit history, you may be able to borrow more money to invest in property. This will give you more options when it comes to buying property. - Use equity to invest in property:

Equity is the difference between the value of your property and the amount of money you owe on it. You can use this equity to invest in property. - Borrow against your home:

If you have equity in your home, you may be able to borrow against it to finance your property investment. This can be a good option if you have a low-interest rate on your home loan. - Involve LMI:

LMI is a type of insurance that protects the lender if you cannot repay your property investment finance. This can be a good option if you cannot put down a large deposit. - Property Development:

The Ferrari of all property investment strategies.

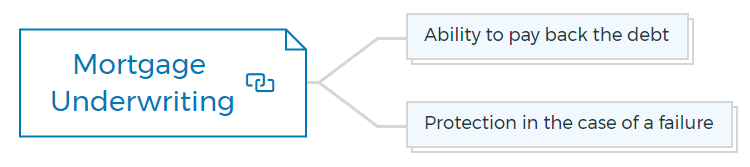

Mortgage underwriting

The lender’s decision to offer a loan and its terms is mortgage underwriting.

Each lender’s underwriting guidelines strike a compromise between the need to

(i) generate a profit from lending

(ii) maintain an acceptable level of default risk.

Each lender establishes its standards based on its business objectives and the present state of the capital market.

The suitability of the borrower and the property is considered while underwriting mortgages. Before approving a loan, the lender must be convinced there is a low danger that the debt payments won’t be made.

In the absence of this, the lender must have faith that there will be enough assets to cover the existing loan.

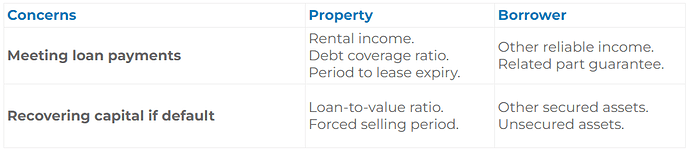

The below table depicts the underwriting criteria as a fundamental matrix with the two primary lender concerns in the rows and ways the property and borrower can fulfill them in the columns.

Underwriting criteria

Putting together lending structure and finance strategy

When looking for property investment finance, it is important to put together a lending structure and finance strategy. This will help you get the best deal possible on your property investment finance.

Your lending structure should include:

- The amount of money that you want to borrow

- The type of property that you want to buy

- The loan term that you are looking for

- The interest rate that you are willing to pay

- The repayment schedule that you are looking for

- Any other features that you want in your property investment finance.

Your finance strategy should include:

- How much money do you have available to put towards a deposit

- How much you are willing to pay in interest

- How much you are willing to pay in monthly repayments

- The type of property that you want to buy

- The loan term that you are looking for.

Conclusion

So, there you have it, a complete guide to property investment finance. Whether you’re looking to buy an off-the-plan property, invest in an SMSF, or take out a family pledge loan, you must understand the risks and benefits involved.

Do your research and speak to a financial advisor before taking out any loans.

If you’re looking to get into property development, a split contract can be a great way without spending a lot of money. Just make sure you understand the risks involved before you sign up.

And always remember the Five Cs of Credit when applying for an investment property loan.

When considering your loan application, the capacity, collateral, character, conditions, and capital are important factors lenders will assess. Make sure you put your best foot forward by researching and understanding each of these factors.

Happy investing!

Whether you are starting your property development journey or have experienced it, knowing your numbers is always crucial. So here is a property development suite that helps you to flip, develop, and control ant property for profit.

FAQs

How to buy an investment property?

There are a few key things to consider when buying an investment property:

- Location: The best investment properties are in desirable neighborhoods and have good rental potential.

- Size: Make sure the property is big enough to accommodate tenants comfortably.

- Age: opt for newer properties, as they will likely require less maintenance and have a longer lifespan.

- Budget: be realistic about how much you can afford to spend on an investment property.

- Financing: Consider this ultimate guide to property investment finance or work with a lender who specializes in investment properties to get the best financing options available to you.

What are the different types of property investment finance?

When it comes to buying an investment property, there are a few different types of finance that you can consider. The first is a standard mortgage, usually for around 80% of the purchase price.

This means that you’ll need to put down a deposit of at least 20%. Another option is an interest-only loan, which can help to keep your monthly repayments down.

However, this type of loan does come with the risk of owing more than the original purchase price if property prices fall. There are also several specialized investment loans available from some lenders.

These can often offer lower interest rates and more flexible repayment terms. Whichever type of finance you choose, it’s important to compare different deals to ensure you’re getting the best possible rate.

What is the minimum mortgage loan amount in Australia?

Minimum mortgage loan amounts in Australia can vary depending on the type of property you’re looking to invest in. For instance, if you want to buy a house as an investment property, the minimum loan amount is typically $100,000.

However, if you’re looking at an apartment or unit, the minimum loan amount is usually around $250,000. Of course, these are just general guidelines and your actual eligibility will be determined by your lender based on a number of factors including your income and employment history.

Can you get a mortgage to buy a second investment property?

It depends on a lot of things, like your credit score, the amount of equity you have in your property, and how much money you’re borrowing. But generally speaking, you can get a mortgage to buy a second investment property.

Some lenders may be more willing to give you a loan if the purpose of the purchase is to rent out the property instead of living in it yourself.

And if you already have a mortgage on your primary residence, that could help make you eligible for a loan on another property. So it definitely pays to do some research and talk to different lenders to see what’s available.