Continued from…

The Ultimate Guide To Property Investment Finance [Part 1-4]

Understand asset allocation strategies

You should have a strategy in place before making long-term financial commitments. Advisers talk about asset allocation or diversification while discussing financial planning.

Anything you’ve put in various types of investments, such as stocks and real estate (growth assets), or lending vehicles like bonds, cash, or term deposits (safety assets), is reflected in this allocation (income assets).

The asset allocation formula considers your age (but not your capacity to handle risk).

Subtract your age from 100. If you are 40 years old, you need to invest 60% of your assets in growth assets, i.e. property & shares.

If you wish to be more aggressive, you can add any percentage to 60% and increase that percentage so that your investment portfolio is weighted >60% towards growth investments and not other investments.

After you have bought an investment property

Safeguard yourself and your assets with insurance.

If you’re planning real estate investment for building wealth, you’ll need to be sure that you’ve got adequate insurance in place for yourself and your most valuable assets, including the following:

Home and content insurance

Don’t worry about this insurance because your lender will ensure you have one. It safeguards you against financial loss in the event of a fire or other disaster that damages your house and covers your legal obligations in the event of damage.

Excess liability insurance

For your house, investment property, and automobile at a comparatively low cost, and it provides additional liability protection in the event of a large-claims lawsuit.

Income-protection insurance

The capacity to make a living in the future is the most valuable asset for most individuals in the workforce. If you’re unable to work for a long period due to incapacitating sickness or injury, income-protection insurance pays a portion of your wages.

Life insurance offers a lump-sum payment in the event of death, can help replace your income if you pass away.

Types of lenders

There are a few primary sources of finance when it comes to property investments.

Banks

Banks are deposit-taking institutions; they offer different types of loans to customers, including home loans, business loans, and personal loans. They also give credit products like credit cards and lines of credit.

Banks typically offer lower interest rates for investment property finance than other lenders because they perceive the risks to be lower due to the property’s security and the fact that it is an established market.

Non-bank lenders

These institutions don’t take deposits but rather borrow money from investors to lend it out. Non-bank lenders typically have higher interest rates than banks, offering more flexibility with their products.

It includes features like interest-only repayments and no early repayment penalties.

Private investors

Another source of finance for property investments is through private investors. These investors can be family and friends, or it can be through a crowdfunding platform.

Crowdfunding platforms are online platforms that connect borrowers with many small lenders. It can be a great option if you have trouble qualifying for a loan from a bank.

Peer-to-peer lenders

Peer-to-peer (P2P) lending is a form of financing where investors loan money to businesses or individuals through an online platform. P2P lenders typically have higher interest rates than both banks and non-bank lenders.

Building societies and credit unions

These are similar to banks, but they are mutual organisations owned by their members.

They offer a range of products, including home loans, personal loans, and credit cards. Building societies and credit unions tend to have lower interest rates than banks because they don’t need to profit.

Non-conforming lenders

Non-conforming lenders are banks or other institutions that don’t conform to the rules set out by APRA (the Australian Prudential Regulation Authority). This means they can offer other forms of loans not available at mainstream lenders.

One example of this is a portfolio loan, an investment loan designed for borrowers with two or more investment properties.

Quick Tip

As far as possible, choose mainstream lenders. Other lenders include solicitors’ funds, payday lenders, and private individuals, but their interest rates make profitable property investing difficult.

Are mortgage brokers worth it?

Investing in property requires building a team around you, and mortgage brokers for home loans can be a great resource when you’re looking for home loans. They have access to various lenders and know about the products available.

The broker can compare the borrowing capacity using home loan calculators of various lenders and their rules while calculating acceptable income.

For example, some of the following sources of income are not acceptable to every lender, or the lender may decide to use only a percentage of the applicable income to make the deal work:

- commissions

- shift work

- casual income

- second job

- part-time work

- short-term contract

- overtime

- salary sacrifice

- salary packaging

- bonuses

- rental income

- negative gearing (if any)

- maternity leave

- pensions (like carers’ pension, disability pension)

- Centrelink (support like Family Tax Benefit Part A and B)

- child maintenance payments

- fringe benefits (like a car allowance & taxed car allowance)

- franked dividends

- deductible interest

- self-employed add-backs (including depreciation)

- TAC

- work cover

- study allowance

- trust distributions

- Annuity

The broker can aid the borrower by selling the proposal to the lender and persuading them to lend the borrower money. Some debtors require extra aid.

Giving the lender a lot of statements and expecting a loan isn’t enough. Good brokers work hard behind the scenes to outline the loan’s strengths and construct a picture for the lender. They pursue the deal and have the proper contacts. A lousy broker does none of the above.

When choosing a mortgage broker for a home loan, choose an accredited broker with a good reputation. You should also check the comparison rate before choosing one.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Types of loans & mortgages

Investing in the property must be aligned with your financial goals. Before choosing a loan, seek expert advice on the best package for you. There are different types of loans for investors; first, home buyers and a home lending specialist can help you understand different products for various investment properties.

Remember that your needs may change over time. Below are different types of property loans that you should know -

Standard variable rate loan

The interest rate on this loan will go up or down, depending on the market. This can make budgeting difficult as your repayments may increase.

Fixed-rate loan

The interest rate on this loan is fixed for some time, usually between one and five years. It can make budgeting more accessible as you know what your repayments will be during that time.

Split loan

It is when the loan is split into two or more loans. Each part can be on a fixed or variable rate. Some lenders will let different applicants be on each loan split without putting the other borrower’s loan split at risk. It can help you to manage your repayments if the interest rates rise.

Line of credit

A line of credit is essentially a loan with a variable interest rate. Because it is secured against a property, it usually has a greater limit than a credit card. If monies are parked in the LOC, there is no need to make repayments on that amount.

Only the amount of the lending facility that has been utilised (drawn down) would be subject to interest. It can be helpful if you want several properties investment over time.

100% offset account

An offset account is a second standalone account connected to the loan account. The primary objective is to reduce loan interest repayments and allow fast access to any accrued savings.

It offsets the loan balance by the amount in the account at any given moment. Interest is computed on the loan’s principal amount, less any funds parked in the offset account, known as the loan’s balance.

It is a powerful instrument that many borrowers overlook; depending on the amount in the account and the size of the loan, it may save hundreds or thousands of dollars every year.

Partial offset account

This account is also mortgage-linked, but only part of the money offsets your loan’s interest. It can be helpful if you don’t have enough money saved to cover your entire mortgage repayment.

Other types of loans include investment loans, construction loans, and refinancing.

- Investment loans are for people who want to purchase an investment property.

- Construction loans are for people who are building a property.

- Refinancing is when you get a new loan to pay off an existing loan, usually from a different lender. How does an investment loan help real estate investors?

An investment loan is a specialised mortgage type designed for real estate investors. These loans offer several benefits, including:

- Low-interest rates – Investment loans typically have lower interest rates than traditional mortgages. It can help you save money on your overall investment.

- Flexible terms – Investment loans are often more flexible than traditional mortgages regarding terms and conditions. It can give you the ability to tailor your loan to your specific needs and goals.

- Tax benefits – The interest you pay on an investment loan may be tax-deductible. It can help you claim tax deductions and save money on your yearly taxes.

Investment loans can be a great way to finance your real estate investment goals. If you are thinking about taking out an investment loan, shop around and compare offers from multiple lenders. It will help you get the best deal possible.

How does a construction loan help real estate investors?

A construction loan helps investors build or renovate a property. You can also use a construction loan to purchase an investment property already under construction.

- This type of loan allows you to draw down the money you need when you need it, rather than borrowing the entire amount upfront.

- Construction loans are typically interest-only loans, which means you only need to pay interest on the amount you’ve drawn down. It can help keep your monthly repayments low.

- The interest rate on a construction loan is also usually variable. It can make budgeting difficult, allowing you to save money if interest rates fall.

After completing construction, you will need to switch to another type of mortgage (usually a standard variable rate loan). It might not be easy, so choosing the right lender and mortgage product is essential.

Make sure you understand all the costs associated with a construction loan. There may be early repayment penalties if you pay off the loan before it’s finished or administrative fees if you switch to another type of mortgage.

For example, if you’re building a duplex, you may need to take out two construction loans, one for each property.

Construction loans can be a great way to finance an investment property. Just make sure you understand all the costs and risks involved before applying.

What are the significant sources of financing in real estate?

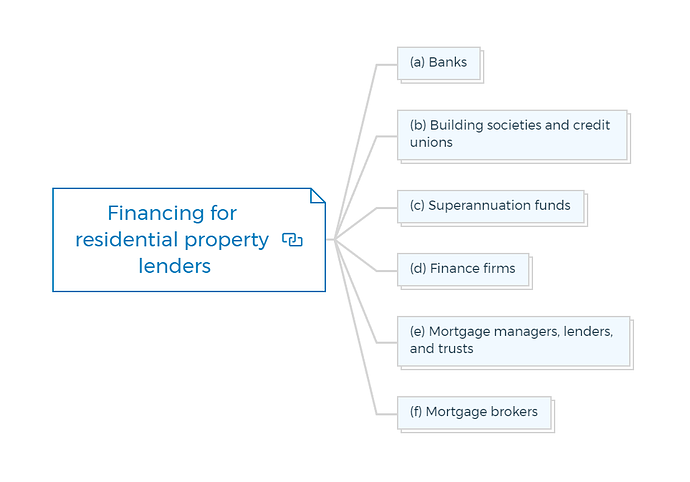

1. Financing for residential property lenders

(a) Banks

Retail (or “trading”) banks have long dominated the residential real estate lending market. Historically, they have used customer deposits and more recently, they have “securitized” some loans.

They are eager to take advantage of their large customer base with bank accounts and strive to offset their disadvantage of having staffed banking facilities’ high overhead costs.

Other financial companies provide loans with banking licenses, such as those using online banking and some investment (or merchant) banks.

Learn More

(b) Building societies and credit unions

Although these businesses aim to employ deposited savings for personal and home loans, many also provide loans to investors in residential real estate.

The Authorized Deposit-taking Institutions comprise banks, banking societies, and credit unions.

(c) Superannuation funds

A few superannuation funds offer loans; however, they might only be available to their members and owner-occupiers. A small component of the portfolios of several of these investment firms is made up of investment property lending.

(d) Finance firms

Retail banks now own the majority of finance companies in Australia. Some still provide residential real estate loans, although they focus more on lending for residential construction.

They frequently consider lending to investors who might not match the bank’s lending requirements, approving “low-doc” and non-conforming mortgages.

They frequently issue debentures or other medium-term interest-paying instruments to finance their loans.

(e) Mortgage managers, lenders, and trusts

Mortgage managers, sometimes known as “mortgage originators,” act as middlemen between investors and borrowers who want to profit from a pool of residential mortgage-backed securities (RMBS).

Due to the mortgage manager’s administration of the loans, which includes collecting loan payments and sending out loan statements, the borrowers are likely unaware that their mortgages are included in a pool of securitized loans.

(f) Mortgage Brokers

Mortgage brokers are available to help customers get the best deal for their unique situations. As brokers, they look for financing options rather than approving loans.

Although borrowers are typically not charged a price for this service, they should know that the lenders compensate the brokers through commissions.

This compensation structure has raised questions about whether some brokers’ recommendations may influence their connections to lenders.

2. Financing for commercial property lenders

Commercial finance in real estate financing is the process of providing funding for commercial real estate projects. You can use this type of financing for various purposes, including purchasing property, developing new projects, or refinancing existing projects.

Banks and other financial institutions typically provide commercial finance, but several private lenders provide this type of financing.

Many mortgage originators and brokers focus on loaning investors and developers for non-residential properties. There is no easy-to-find, comprehensive database of lenders willing to finance non-residential assets.

Some lenders only lend money to certain types of homes or regions of Australia. Some cultivate specific clientele and build connections with investors, particularly those with property holdings.

The process of commercial finance in real estate financing typically involves several different steps.

- The first step is to identify the property that will be purchased or developed.

- Determine the required amount of financing. You can do this by estimating the project’s total cost and then subtracting any funds that are already available.

- Submit a loan application to the bank or other lender.

- Wait for a decision on the loan application.

- The last step is to close on the property if the loan is approved.

Commercial finance in real estate financing can be a great way to fund your next real estate project.

How to refinance an investment property?

When you refinance an investment property, you take out a new loan to pay off your old loan. This new loan may have a different interest rate and term than your old loan.

- You can use a refinance to access more money for investing in other properties or reduce the interest you’re currently paying on your investment property.

- You can also use a refinance to consolidate your debt into one loan, making it easier to manage your repayments.

- When you refinance an investment property, you must pay stamp duty and other associated costs.

- Just make sure the loan meets your goals. Ensure the lender offers you a better rate repayment figure and meets your goals.

- Keep all papers well-organised to make refinancing or obtaining finance accessible.

- Consider refinancing fees. Paying off a fixed-rate mortgage early may result in penalties, whereas paying off a ‘variable rate’ mortgage usually results in a few hundred dollars in administrative expenses.

The main benefits of refinancing are saving you money on interest payments, giving you access to more money for buying an investment property, and making your repayments more manageable.

Calculating loan repayments in real estate

There are 2 ways to calculate loan repayment in property development.

1. Interest-only loans calculation

Calculating interest-only payments involves calculating the home loan amount by the annual interest rate and dividing the result by the number of payments made each year.

For example, $2,636.67 would be due each month for a loan of $452,000 with monthly installments of 7% annually:

$452,000 x 0.07/12 = $2,636.67

The final payment would cover the loan balance of $452,000, totaling $454,636.67 as the last monthly installment.

2. Amortizing loans (Annually)

The investment property loan amount, the interest rate, loan term, the frequency of installments, and the method of repayment all affect how much must be repaid.

Most loans that amortize have equal loan payments made each period, including interest on the loan balance and some of the original loan’s principal repayment.

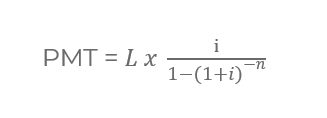

You can use the following formula to determine the equal payments that will result in no principal remaining after the last payment:

- PMT denotes the monthly (or, in this case, annual) loan payment.

- L stands for the investment loan sum.

- I is the annual interest rate on a loan.

- N is number of loan periods.

For instance, a $452,000 loan amortized over 15 years at an annual interest rate of 7% would demand $49,627.17 in payments at the end of each year.

Creating an annual amortization schedule for such loans is relatively simple (especially if this is prepared on a computer spreadsheet).

The annual interest rate equals 7% of the loan balance at the beginning of the year. The excess of the repayment over the interest is the principal repaid for the year.

The initial balance less the principal repaid over the year represents the loan balance at the year’s end.

It is possible to determine the payments for a partially amortizing loan with a balloon payment at the end of the loan as interest-only payments on the balloon and amortizing payments on the remaining portion of the loan.

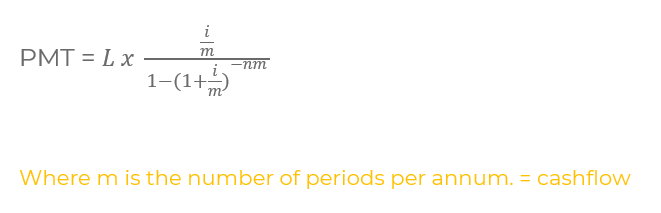

Monthly amortizing loan payments

If the mortgage repayments are made at the end of each month, you can use the below calculation to determine the number of payments necessary to fully amortize a loan with compounding and more frequent payments than once per year.

It is customary to divide annual interest rates by the number of periods to convert them to shorter ones.

If there are m periods per year, the number of periods is determined by multiplying the number of years of the loan by m, and the interest rate per period is determined by dividing the annual loan interest rate by m.

The yearly interest rate in this situation is referred to as the “nominal” annual rate.

If this periodic rate accrues compound interest, the “effective” yearly rate would be higher. The nominal conversion-based periodic rates are marginally higher than the effective conversion-based periodic rates.

Below, a nominal conversion is utilized, with monthly “rests” or recalculations of the outstanding principal.

Typically, the payments are calculated based on payments made at the end of each period.

For instance, a $452,000 loan amortizing over 15 years at an annual interest rate of 7% would call for monthly payments of $4,062.70.

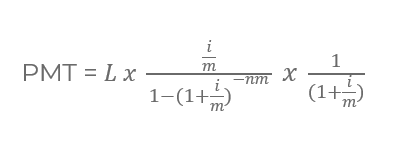

A very little difference in the payment is produced by using an interest rate of 0.6667 percent each month. If the payments are due at the beginning of each month (also known as an “annuity due”), change the calculation formula -

Each payment would be $4039.14 if it were due at the beginning of each month for the same loan.

Payments in advance are a little lower than in arrears because each payment is paid earlier, resulting in less interest accrued.

When to expect loan payments

Loan payments are generally made monthly but occasionally more often. It is typical to assume that you need to make the required payments at the end of each month, the compounding frequency will be monthly, and the interest rate will compound at nominal annual rates.

Most Australian lenders for residential properties use a complicated combination of daily interest charged to the borrower and monthly amortizing payments on an agreed date in the middle of the month.

Payments for non-residential loans must typically be made at the beginning of each month.

If the investor has a choice, the most convenient payment schedule is one where loan payments occur roughly a week after the significant tenant(s)’ due dates for rent.

Learn More

How can I get a 100 percent loan for an investment property?

The most common way to get a 100 percent loan for an investment property is to use a combination of debt and equity financing. You can also get the investor guarantor loan to get approval for a 100% investment property loan.

What is a guarantor loan?

A guarantor loan is an unsecured loan where a family member or friend agrees to cover the repayments if you can’t. It means that even if you have a bad credit history, you may still be able to get a loan.

Guarantor

If a creditor refuses to offer a loan to an individual, they may ask for a guarantee. You are the ‘guarantor’ of a loan if you sign one for a friend or family member.

You do not own the property or items bought with the loan. You have no rights, but you are entirely liable.

Co-borrower

A co-borrower is someone who signs a loan with someone else. In most cases, both co-borrowers are personally accountable for the whole loan.

If the co-borrower cannot pay their share of the loan, the other is usually responsible for both.

One lender will assign a share of obligation to each borrower, but this may not prevent repossession if one of the borrowers defaults.

Considerations before guaranteeing anything

You should just agree to be a guarantor if:

- You’re in a good financial position and can easily make the repayments yourself if needed

- You trust the borrower to make the repayments on time

- You’re comfortable with the risks involved

- You understand what you agree to.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

Principal and interest vs interest-only loans

When you take out a loan, you will need to decide whether to repay the principal and interest (the actual amount you borrowed) or just the interest.

If you choose to repay the principal and interest, your monthly repayments will be higher, but you will own the property at the end of the loan term.

If you choose to repay just the interest, your monthly repayments will be lower, but you will still owe the principal at the end of the loan term. You can also choose to roll over the principal into a new loan, which means you’ll continue to pay just the interest on it.

What is an interest-only loan?

An interest-only loan is where you only pay the interest on the amount you borrow each month. You can’t repay the principal (the amount you borrowed initially) until the end of the loan term.

This type of loan can be helpful if you want to invest in property but don’t have enough money saved up to cover your entire mortgage repayment.

- The borrower only pays the interest on the mortgage and does not have to pay back any of the money borrowed.

- It can help first-time homebuyers manage their cash flow by reducing their repayment commitment and reducing the cost of furniture and moving.

- It may be easier for would-be investors to afford negatively geared properties.

- I/O loans can be very useful in calculating the borrowing capacity on serviceability calculators.

Disadvantages of interest-only loans

- The monthly repayments do not reduce the loan principal. If property prices fall, the borrower may find it challenging to sell the property or refinance the loan.

- If the borrower does not make regular extra repayments, they may end up with a larger loan principal at the end of the interest-only period than when they started.

- Interest-only loans can be very useful in calculating someone’s borrowing capacity on serviceability calculators. The downside of Interest-only loans is that many borrowers may be caught off guard if they have too many interest-only loans.

When their interest-only period runs out, the monthly repayments for some borrowers could jump up to two or three times the amount of their current repayment.

Above all, pay off the mortgage and consider not having an interest-only loan. If you have a home loan debt, consider making an investment loan interest-only, but consider reducing your investment debt if you paid your home loan debt.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

Continued at…

The Ultimate Guide To Property Investment Finance [Part 3-4]

The Ultimate Guide To Property Investment Finance [Part 4-4]