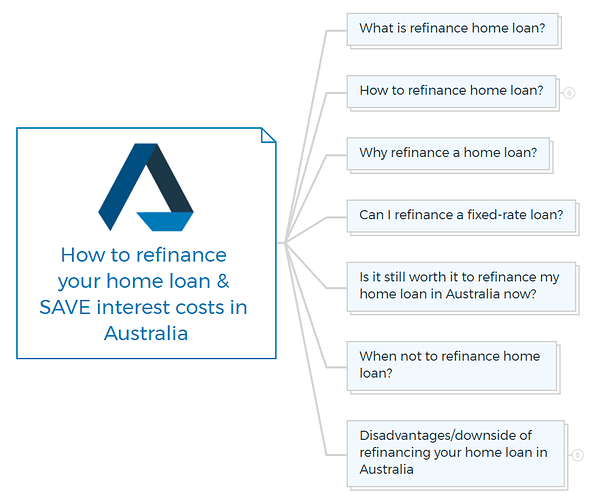

What is refinance home loan?

Refinancing a home loan means replacing your current mortgage with a new one with attractive features and different interest rates.

You will pay off your current mortgage with the new loan. The main goal of refinancing home loans is to save money on monthly instalments and reduce the overall debt.

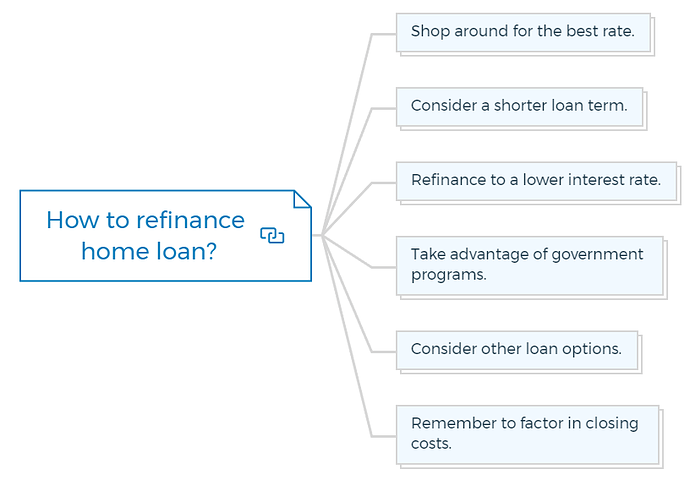

How to refinance home loan?

Here are some ways to refinance your home loan and save interest costs in Australia:

Shop around for the best rate.

Compare interest rates and fees from different lenders to find the best deal. Look for lenders offering special deals or discounted rates for refinancing.

Learn More

Consider a shorter loan term.

Opting for a shorter loan term can lower the overall interest cost, but it may also increase your monthly payments.

Refinance to a lower interest rate.

If interest rates have decreased since you took out your original loan, you can refinance to a lower rate and save money on interest payments.

Take advantage of government programs.

Some government programs, such as the First Home Loan Deposit Scheme, the First Home Owner Grant, or the HomeBuilder scheme, can help eligible first-home buyers with their deposit or grant for new homes.

Consider other loan options.

Look into other loan options, such as variable-rate mortgages, which are typically lower than fixed-rate mortgages or split loans, which allow having a portion of the loan on a fixed rate and the other on a variable rate.

Remember to factor in closing costs.

While refinancing can save you money in the long run, remember that there are typical closing costs associated with refinancing, so it’s essential to factor these costs into your decision.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Why refinance a home loan?

There are various reasons to consider refinancing a home loan -

- The most common reason people refinance home loans is lower interest costs. You can save interest costs by shopping around for a better rate.

- All home loans offer different features and flexibility. For example, a redraw facility, an offset account, or flexible repayments. You can refinance over a different loan type if the current home loan does not provide new features.

- If you are worried about the rising interest rate, you can refinance your home loan and lock your mortgage into a fixed interest rate.

- Many homeowners use the lower mortgage interest rate to simplify their finances. Consolidate high-interest credit cards and personal and car loans into your mortgage. You can minimise your monthly repayments, free up cash flow, and simplify your budget by only having one repayment each month instead of numerous.

- If your monthly budget is tight, refinancing your home loan may assist. Consolidating high-interest debt, switching loans, and changing terms might lower monthly payments. You’ll have more money to spend if your monthly debt payments are lower.

- Most homeowners realise their mortgage balance has decreased over time. Their home value has also been appreciated. The difference between these two amounts in equity. Refinancing helps you use home equity for other things.

Can I refinance a fixed-rate loan?

Yes, you can refinance a fixed-rate loan.

When you refinance a fixed-rate loan, you can keep the same loan and interest rates or choose a different loan and interest rates.

If interest rates have decreased since you took out your original loan, you can refinance to a lower rate, which can lower your monthly payments and save you money on interest over the life of the loan.

It’s essential to consider refinancing costs, such as closing costs. You should also consider how long you plan to stay in the property, as refinancing can be more beneficial if you stay in the property for a longer period.

Is it still worth it to refinance my home loan in Australia now?

Whether or not it is worth it to refinance your home loan in Australia depends on your specific circumstances and goals.

Currently, interest rates in Australia are at a record high; this can make it an excellent time to refinance if you can find a lower interest rate than your current loan.

Another thing to consider is that if you have built equity in your property, you can access some of that equity through a cash-out refinance, which you can use to fund home improvements, pay off high-interest debt, or invest in other properties.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

When not to refinance home loan?

Refinancing has numerous benefits, but a home loan health check with your broker may reveal that now is not the right time to refinance your home loan. Several considerations may assist you and your broker in deciding. It includes -

- High refinancing costs

- Low equity

- Home loans are available at a low rate but need more flexibility and features.

Learn More

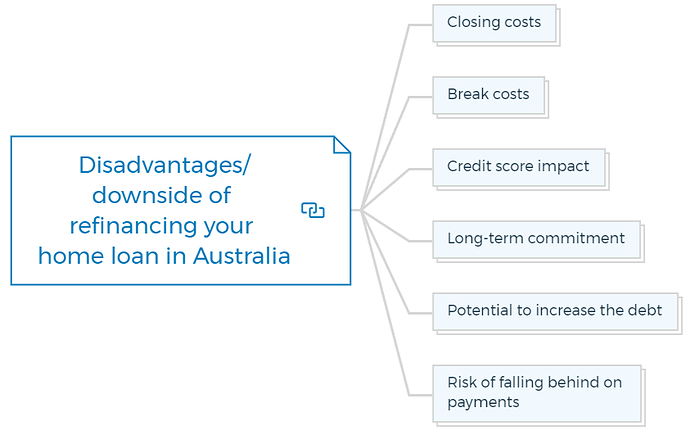

Disadvantages/downside of refinancing your home loan in Australia

Closing costs

Refinancing a home loan in Australia involves closing costs, including legal fees, lender’s mortgage insurance, and title transfer fees. These costs can add up and may offset any potential savings from refinancing.

Break costs

If you are switching from a fixed-rate loan to a variable-rate loan or breaking the fixed-rate period of your loan, you may be liable to pay break costs, which can be quite significant.

Credit score impact

Applying for a new loan can impact your credit score; it’s essential to be aware of this before applying.

Long-term commitment

Refinancing a home loan locks you into a new loan term, and you may be committed to this loan for a more extended period than you intended.

Potential to increase the debt

If you choose to refinance to a loan with a higher balance, you may owe more than before.

Risk of falling behind on payments

If you can’t make the payments on your new loan, you could risk losing your property, which will affect your credit score negatively.

Learn More

It’s essential to carefully weigh the potential benefits and drawbacks before deciding to refinance your home loan and consult with a mortgage expert or financial advisor to ensure that refinancing is the right decision for your specific circumstances.