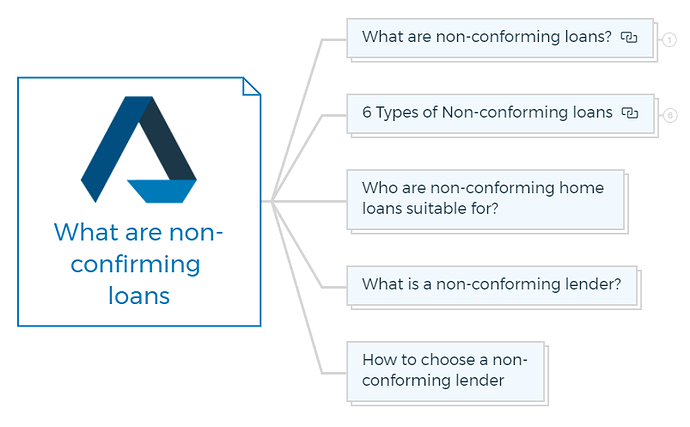

What are non-confirming loans?

Not able to get conventional loans? Have unusual financial needs? Get your dreams financed with a non-conforming loan.

What are non-conforming loans?

A non-conforming home loan is given to people who don’t meet the usual lending requirements set by banks and other financial lenders.

Non-conforming loan example -

A borrower may consider a non-conforming loan if they are looking to borrow more than traditional lenders will allow or have an income that is too high to qualify for a traditional loan.

For example, a borrower may be looking to purchase a home that is priced above the standard lending limit, or have an income that is too high for traditional prime mortgages, so a non-conforming loan may be the only option.

You are missing out if you haven’t yet subscribed to our YouTube channel.

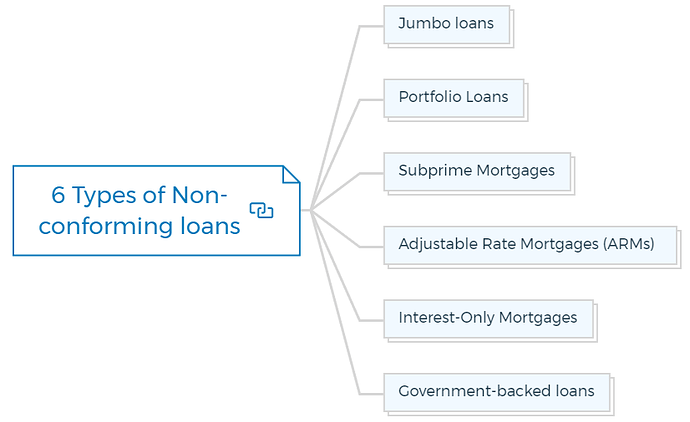

6 Types of Non-conforming loans

Non-conforming home loans come in many different varieties. Some of the most common types are:

Jumbo loans

These loans offer higher loan limits than traditional mortgages, allowing borrowers to borrow more money for larger purchases.

Portfolio Loans

These are private mortgages offered by a lender and held on their books rather than being sold to investors.

Subprime Mortgages

These are loans offered to borrowers with a lower credit score or debt-to-income ratio than is typically required for prime mortgages. They usually come with higher interest rates and more stringent repayment terms.

Adjustable Rate Mortgages (ARMs)

These loans offer a lower rate for the first few years of the loan, then adjust to a higher rate based on market conditions.

Interest-Only Mortgages

Interest-only mortgages let borrowers make payments only on the interest portion for a certain period, allowing them to reduce their monthly payments.

Government-backed loans

These mortgages are backed by the Federal Housing Administration (FHA) or other government agencies and typically come with less stringent requirements.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

Who are non-conforming home loans suitable for?

Non-conforming home loans are suitable for the following groups:

- People with an income higher than the standard lending limits of a particular lender.

- Individuals who don’t meet specific credit requirements set by lenders.

- Self-employed individuals or small business owners who may not be able to prove their source of income.

- Those with unusual financial circumstances, such as being in debt, having a history of bankruptcy, or having multiple properties.

- First-time buyers who need larger loan amounts but can’t provide enough collateral to obtain a conventional loan from traditional lenders.

- Borrowers whose property does not meet the criteria for conforming mortgages due to its size or location (e.g., condominiums).

What is a non-conforming lender?

Non-conforming lenders offer loans that don’t fit the traditional lending rules.

Simply put, they give loans to people who don’t meet the standard lending requirements of banks and other mainstream lenders. These loan companies are not subject to APRA supervision because they are not approved deposit-taking institutions.

How to choose a non-conforming lender

The rules for selecting a non-conforming mortgage lender are simple. You should check -

- The fees and best interest rates available.

- An individual lender or a group of lenders having sufficient experience and are willing to negotiate rates.

- If there are any rules or costs for paying off the loan early or refinancing it to a lower rate.

- Recommendations from satisfied previous borrowers

If you apply for a non-conforming home loan, be honest about your finances so the lender can find a loan that meets your needs. Consider carefully whether you can afford a house loan’s monthly payments.

No money? You can still become a property developer. Get started with my No-Money Down Property Development Course.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber