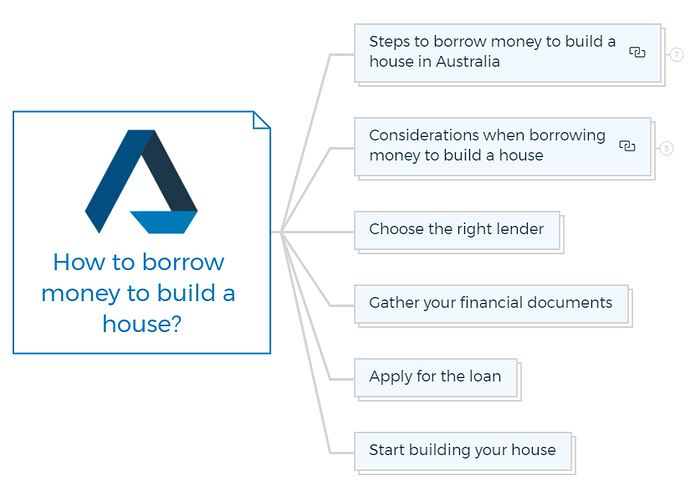

How to borrow money to build a house?

Building a house in Australia is complicated and expensive, but there are numerous ways to borrow money for the endeavour.

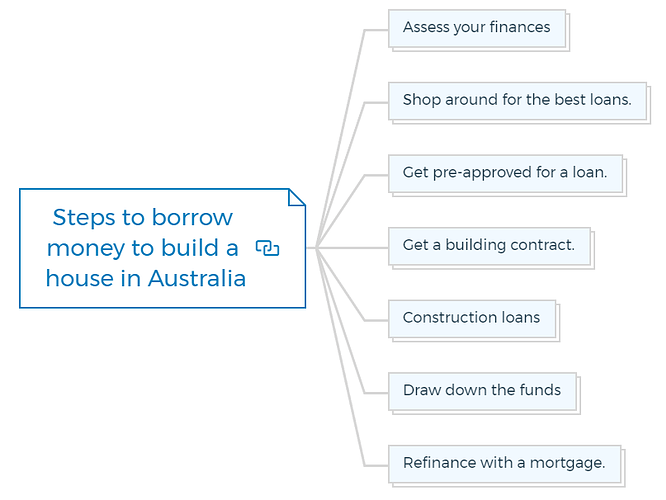

Steps to borrow money to build a house in Australia

Here are certain steps you should take while borrowing money to build a house -

Assess your finances

Assess your finances and establish how much you can borrow before applying for a loan. This will help you budget your project and prevent debt.

Shop around for the best loans.

Compare bank and non-bank loan interest rates, fees, and periods. Consult a mortgage broker to find the right financing.

Get pre-approved for a loan.

Apply for pre-approval after finding a loan. This can help you plan your project and estimate how much you can borrow.

Get a building contract.

Before building, you need a contract. This legal document specifies the task, materials, and timeline.

Construction loans

Apply for a construction loan after signing a building contract. Construction loans are typically short-term loans used to finance the cost of building a new property.

Draw down the funds

As the building develops, you can draw down your construction loan. Typically the funds are disbursed in stages, such as upon completion of certain milestones in the construction process.

Refinance with a mortgage.

After construction, refinance with a mortgage. You’ll pay the principal and interest on this long-term loan to pay off the construction loan.

You are missing out if you haven’t yet subscribed to our YouTube channel.

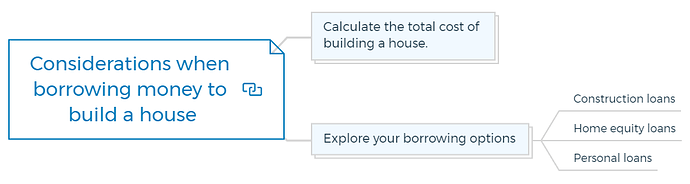

Considerations when borrowing money to build a house

Consider various factors before borrowing money to build a house. Here are the most crucial aspects of building a house -

Calculate the total cost of building a house.

Calculate the house’s overall cost first. This includes land, materials, labour, and other house-building costs. After estimating the cost, consider looking at loan possibilities.

Explore your borrowing options

Building a house requires numerous types of loans:

These are the short-term financing for house construction. These loans typically have higher interest rates and require a larger down payment than traditional home loans.

If you own a home, you can utilise it to build a house. Home equity loans feature lower interest rates than construction loans, but you may need to use your property as collateral.

Personal loans can be utilised to build a property. Personal loans, however, offer higher interest rates and shorter payback durations.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Choose the right lender.

After choosing a loan type, pick a lender. Find a construction loan with low rates and flexible terms.

Learn More

Gather your financial documents.

You’ll need to provide your lender with certain financial papers to get a house-building loan:

- Proof of income

Pay stubs, tax returns, etc.

- Credit score

Your credit score affects loan eligibility and interest rates.

- Debt-to-income ratio

Compares monthly debt payments to monthly income.

Apply for the loan

After gathering your financial documentation, apply for the loan. Prepare to discuss the house’s overall cost, your down payment, and your loan repayment arrangements.

Start building your house.

After getting finance, build your residence. To keep your project on schedule and budget, use reliable contractors and monitor the building process.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber