Golden Rules of Commercial Real Estate Investment

Commercial real estate investing - The ultimate guide

Investing in real estate, whether residential or commercial, offers ample opportunities to investors. They can build wealth, save for retirement, achieve financial freedom and what not.

Among several options, CRE, or Commercial Real Estate Investment, is the finest real estate investment choice for people wishing to earn passive income with the potential for significant long-term returns.

It is a high-risk, high-reward asset class that includes a variety of property types you’ve probably never considered investing in before.

What is commercial real estate (CRE)?

In simple words, Commercial real estate is a property where people do business.

You can also think of commercial real estate as a property having at least five or more units utilized only for commercial or income-generating purposes.

It includes retail premises, workplaces, assembly plants, warehouses, hotels, motels, theme parks, quarries, hospitals, and airports.

The tenants for commercial properties are businesses and corporations. Commercial properties may be subject to more complicated zoning rules than residential ones, depending on their location.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Why invest in commercial real estate?

There are many reasons why you might want to invest in CRE. Some of the most common reasons include:

- To generate passive income - Commercial property markets can be a great way to produce steady monthly or annual income through rents or leases.

- To hedge against inflation - As prices for goods and services increase over time, buying commercial properties can help protect your portfolio from inflationary pressures.

- To diversify your investment portfolio - Diversification is basically when an investor is spreading wealth across various markets. CRE offers 4 ways to diversify your portfolio - asset class, location, property type, and transaction sponsor.

Here’s a quick-start property development course that you should not miss (especially when it is FREE![]() ). This Free online course helps you to get started with property development and steps to achieve success in it.

). This Free online course helps you to get started with property development and steps to achieve success in it.

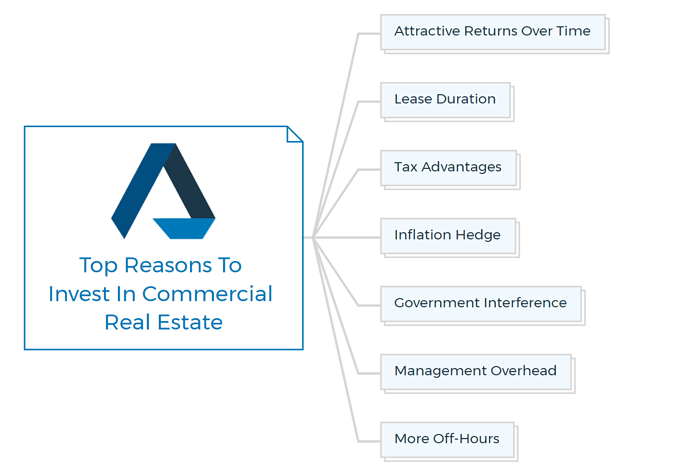

Reasons for investing in CRE

Attractive returns over time

Most investors recognize that it is best to hold an asset for an extended period rather than trade in and out in search of profits. Commercial Real Estate can deliver substantial, predictable returns in this regard.

Commercial real estate investors frequently enjoy consistent cash flow from their investments, with income paid out annually, quarterly, or even monthly.

This is because high occupancies and predictable rents often provide the consistent cash flow that most investors seek.

Quick Tip

Annual returns range from 6% to 12%, compared to 1% to 4% for residential properties.

Lease Duration

Commercial real estate leases are typically much longer than residential leases, which gives investors the potential for stability and predictability in their income stream.

Longer lease terms also give commercial tenants more flexibility to make changes to their space to suit their business needs, without worrying about potentially having to move if their landlord decides not to renew their lease.

Tax Advantages

Commercial real estate is subject to tax credits that can cut the tax burden on the property significantly.

There are several options for reducing or eliminating capital gains. If you buy properties in good locations, they should increase in value over time. However, you can depreciate the value of the structures over time for tax reasons, lowering your annual taxable income.

You can also avoid capital gains taxes when you eventually sell your property, thanks to 1031 exchanges. You’ll need to “swap” those gains for another property or item when doing so.

Deductions for mortgage interest, depreciation, and non-mortgage expenses, including upkeep, repairs, and association fees, are all possible when investing in commercial real estate.

Not good in math? Are you concerned about your tax and financial calculations? Get the property development feasibility software and calculate your numbers in no time.

Inflation Hedge

Commercial real estate has the advantage of being able to offset the long-term impact of inflation. The fact that property rentals can be adjusted with inflation, which is frequently the outcome of robust economic growth, is a crucial influence.

This is different from assets such as stocks and bonds, which might experience decreased returns due to inflation.

Government Interference

There is not much interference by the government in CRE as compared to residential real estate.

If a commercial tenant fails to pay his rent, the landlord has the same recourse ability as a car leasing firm dealing with non-payment. This is one of the main reasons why many property developers opt for commercial real estate investment.

Management Overhead

When compared to residential real estate, the management overhead of commercial real estate is negligible. To be sure, commercial real estate ownership necessitates some management. Keep track of when leases are up for renewal and when rent reviews are due.

You’ll need mechanisms in place to keep the properties in good repair, deal with unforeseen events, verify rentals are paid and pay your own costs, such as property taxes.

More Off-Hours

Don’t get confused with my words - Commercial Real Estate requires a lot of work. By more off-hours refers to the number of hours spent talking to tenants.

In comparison to residential real estate, these hours are minimal in commercial real estate.

In commercial real estate, most of your tenants will be following the typical 9-5 schedule. It usually entails extra “time off,” this way; you will be away from your phone and enjoy more personal time.

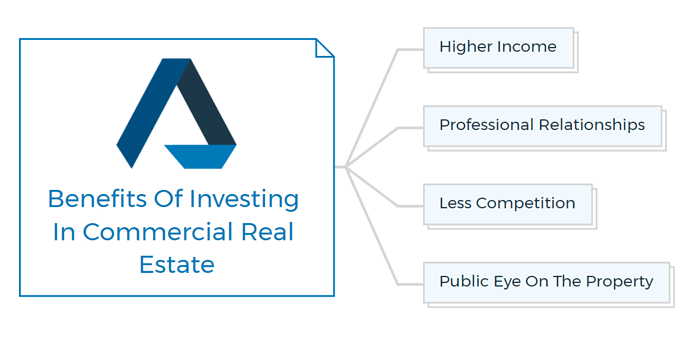

Benefits of investing in commercial real estate

As you saw, there are many good reasons to invest in commercial real estate. Commercial real estate investing can be both personally and financially rewarding.

Many people engage in commercial real estate for future prosperity and stability, while others do so for tax benefits and to diversify their investment portfolios.

Commercial developers can also benefit from the following advantages:

Higher Income

The primary benefit of investing in commercial real estate is the higher potential income. In general, CRE can provide better ROI, on an average of 6-12%.

Second, because properties tend to have more units, commercial real estate has a more negligible vacancy risk.

Also, as explained above, Commercial leases are often lengthier than those seen in residential real estate. This means that commercial property owners will experience significantly less tenant turnover.

Professional Relationships

Many small business owners are proud of their businesses and want to protect their livelihood.

Commercial property owners are usually limited liability companies (LLCs) or special purpose vehicles like discretionary and unit trusts that manage the property as a company.

This allows landlords and renters to have more business-to-business connections, which helps in maintaining professional and friendly contacts.

Less Competition

Another benefit of commercial real estate is that there is less competition. The business space is less saturated with other investors due to the perceived difficulties of commercial investing.

Public Eye On The Property

The general public is watching the property. Retail tenants have a vested interest in keeping their store and storefront in good repair because it will harm their business if they don’t.

As a result, the interests of commercial tenants and property owners are aligned, allowing the owner to maintain and increase the property’s quality, and hence the value of their investment.

Learn More

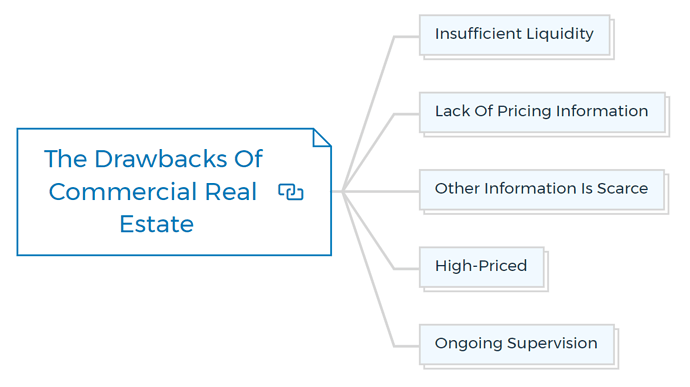

The drawbacks of commercial real estate

Commercial property is not for everyone, and no investment is risk-free. The following are some potential drawbacks in this industry:

Insufficient Liquidity

Property trust shares are widely available for purchase and sale. It is not the case with most other commercial real estate transactions.

Property syndicates are usually for at least five years, and to sell a holding is difficult unless you can locate a buyer yourself.

One can sell a direct property investment, but it will take several months and incur the usual selling charges, much like a home.

It could be a problem if there is a severe economic crisis, and you need to sell a specific commercial property.

When it comes to stocks, you may sell at a loss. However, in the case of commercial property, it may entail months of work or even no purchasers at all.

Lack Of Pricing Information

Your newspaper publishes stock prices every day. Prices for managed funds are also readily available. You will often find each suburb’s average property prices in the newspapers’ real estate sections.

However, aside from sales announced in the daily newspapers, there is little cost information available for commercial real estate developers.

So, unless you own a property trust, you have no data of a particular property in the market and the increase in its value.

For this reason, the Property Council of Australia created its commercial property investment performance index, which measures income, capital gain, sale, and total return. Based on billions worth of property, it has become a benchmark for several investors.

Other Information Is Scarce

Take an interest in the stock markets; you will find an abundance of investor information—far more than you can consume.

Magazines, books, newspaper supplements, seminars, training courses, websites, stockbroking newsletters and reports, and so on are only a few examples.

Even the residential real estate sector is well-covered, with books, at least one magazine, and regular media appearances.

However, except for a few articles and breaking reports on listed property trusts, there is little guidance for commercial property investors.

Several real estate agencies strive to educate potential investors with books and websites.

The fact is that, as a newcomer to the commercial property market, you will have a difficult time finding enough published data to help you distinguish between a good and wrong investment property.

High-Price

If you merely have a few thousand dollars to invest in commercial property, listed property trusts are likely to be your best option.

Property syndicates generally require a minimum investment amount, usually at least $10,000.

You won’t be able to get into direct property investment with less than $100,000, and you’ll almost certainly need much more.

In contrast, you can start little (about $500) with the stock market and progressively increase your investment.

Ongoing Supervision

Direct property investment may necessitate your continued participation in the property. You’ll have to maintain the property yourself unless you hire professional commercial property management.

Market trends must be kept in mind. For example, if you own an office building, the owners of adjoining workplaces may be rewiring their buildings with high-speed telecommunications cabling. If the tenant leaves, your property may become less appealing until you follow the same.

Furthermore, even while lease arrangements provide significant security, they cannot prevent a tenant from falling insolvent. That’s when the tenant’s bank guarantee (or bond) comes in handy.

Overall, if you’re just getting started in commercial real estate, it can appear to be pretty tricky. And many of the market’s professionals are content for it to remain a secret to all except the most privileged few.

As a result, this article aims to assist in ‘lifting the veil’ on these commercial real estate insider secrets. Enroll on one of my structured property development courses and achieve ultimate success in property development.

Advanced Property Development Books Bundle

Looking for an edge in the property development game?

This Advanced Property Development Books Bundle is for you. 572+ pages chock-full of insights on residential + commercial property development and investment, this bundle spans 18 ebooks. Whether you’re a beginner or a seasoned pro, these books will take your development game to the next level.

Get The Advanced Property Development Books Bundle

Includes 18 x advanced detailed eBooks

✓ 7 Real Estate Negotiation Tactics That Win More Deals - 25 pages

✓ 7 Easy Steps To Market Your New Development Project - 30 pages

✓ Improve Your Development Game With Development Economics - 40 pages

✓ How To Get Development Approval FAST? - 49 pages

✓ Advanced Real Estate Market Analysis In 13 Easy Steps - 34 pages

✓ Invest In Commercial Property To Achieve Your Investment Goals - 22 pages

✓ 10 Finance Options For Your Next Property Development Project - 29 pages

✓ 13 Golden Rules Of Investing In Commercial Real Estate - 28 pages

✓ 6 Ways To Invest In Commercial Real Estate – The Complete Guide

✓ Commercial Development 101: Become an Expert - 34 pages

✓ Definitive Guide To Commercial Property Investment - 24 pages

✓ A Beginner’s Guide To Apartment Development (Tips & Principles) - 33 pages

✓ How To Build Townhouses And Develop Villas Successfully? - 41 pages

✓ How To Sell A Commercial Property In Record Time? - 25 pages

✓ Raw Land Development - What you need to know - 34 pages

✓ Single Family Homes: Learn Property Development Without Financial Risk - 33 pages

✓ What Exactly Is Equity Finance And How Does It Work? - 42 pages

✓ Real Estate Market – 6 Tips for Timing The Market - 19 pagesWas

$297Now $37 [Limited Time Only]

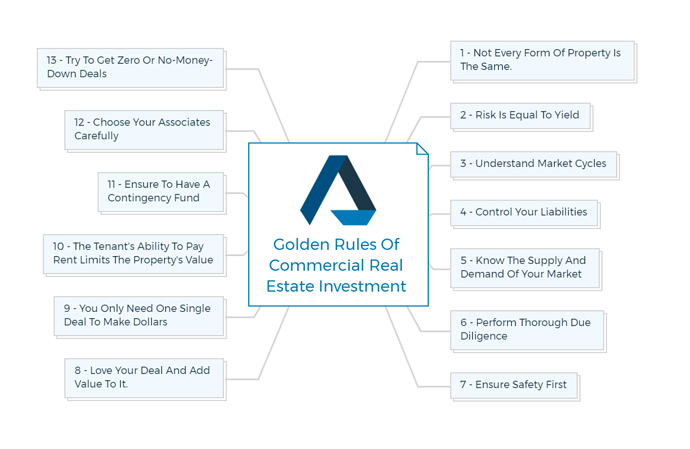

13 golden rules of commercial real estate investment

Rule 1 - Not Every Form Of Property Is The Same

There are several different asset kinds in commercial real estate. While commercial real estate is traditionally divided into five categories: industrial, office, retail, multifamily, and particular purpose, there are numerous other property types to consider, including self-storage, medical, elder care, land, and hotels.

Each sector’s market forces, return, and net profits are all different. Based on availability and demand in the asset’s specific area, some properties do better than others.

Even on a macro level, though, some industries outperform others. In today’s environment, it’s critical to understand how to pick the asset types that are most profitable or offer the best potential.

No matter which asset type you are selecting, get yourself acquainted with property developer FAQs if you want to achieve ultimate success in each of your real estate projects. You will find answers to all your questions.

As per the current trend, we can say that industrial CRE asset is one of the best performing classes while retail space is the lowest-performing commercial real estate asset.

With the rise of online shopping, retail stores find it difficult to compete, resulting in lower returns and slower growth.

Keep in mind that some commercial real estate sectors have more vacancy rates since they may only have one tenant, such as an industrial warehouse or a single office space.

To reduce the potential risk, some property developers and real estate investors choose properties that contain multiple tenants.

Rule 2 - Risk Is Equal To Yield

Quick Tip

You might have heard this before - the higher the risk, the better the reward. Similar to this, we can’t deny that the lower the cap rate, the lesser the risk.

In other words, the market capitalizes on rental revenue with a low cap rate for a low-risk investment (i.e., a large factor). A high cap rate (small factor) would be applied to the income from a risky property.

As a result, the goal isn’t necessarily to find the property with the highest return, but rather the property that offers a good balance of risk and rewards appropriate (and lucrative) for your situation.

If you find a property that has a low risk (low market cap rates) yet a high return, you’ve found the deal of the century.

Rule 3 - Understand Market Cycles

The profitability of commercial real estate is directly related to the economy’s health, unemployment rate, and GDP.

All these are the parts of the commercial market cycle which you should know. Understanding what precisely the market cycle is and how it works is highly beneficial for you.

This commercial real estate investment rule will assist you to avoid purchasing at a high price and having to sell at a low price.

Furthermore, understanding sure market cycle signs can aid in determining what possibilities are available right now and making more informed investing selections.

Learn More

Rule 4 - Control Your Liabilities

Liabilities are just assets in hiding.

While it has been seen that people have huge control over their assets and not on liabilities, but the Golden Rule of Commercial Real Estate Investment says that property developers or real estate investors must have some control over their liabilities.

In some places of the World, it is nearly impossible to fix the mortgage interest rate for more than a few years. Ensure to fix your interest rate if you find any such opportunity.

One of the significant advantages of the US real estate market over many other nations is securing fixed-rate mortgages, even 30-year mortgages.

You are just a click away from living the life of your dreams. Check this ultimate guide to get started with real estate development.

In my career in property development, I have met a lot of property investors who choose not to fix the rate. For saving a minimal amount (0.5% lower interest rate), they get fooled by the interest rates touching roofs in the future.

It’s a blunder perpetrated not only by legions of typically rational investors but also by armies of mortgage brokers who, no doubt, make more money on loans that turn out to be more profitable for the banks.

Learn More

I advise all my students to avoid providing personal guarantees on any real estate loan. There are two reasons behind avoiding personal guarantees in the loan.

First and foremost, a real estate investment should be self-sufficient. The risk of having a personal guarantee is that it could be called up, forcing you to repay the principal on loan taken out by a limited-liability company.

Of course, signing a personal guarantee dismantles this liability barrier.

The second reason is that banks will frequently ask for a list of your contingent liabilities or liabilities that may fall on your shoulders when applying for future loans. The longer this list becomes, the more reluctant a bank will be to offer you money.

Rule 5 - Know The Supply And Demand Of Your Market

One of the most crucial things to keep in mind when investing in commercial real estate is that each market is unique. You’re putting money into a specific geographic area with its supply and demand dynamics when you invest.

Certain property kinds may be doing well on a macro level, yet you may find an oversupply in your city or vice versa. Investors frequently fail to undertake sufficient market research to identify whether there is a risk of market saturation.

Researching the market supply in your surrounding area is a great place to start, considering both the present rentable square footage and any new square footage that will add due to current activity and planned developments.

If you’ve found an undersupplied property type in your market, you can undertake a feasibility study to determine the sector’s future growth potential and the chance of success.

My structured property development courses will provide you with all of the knowledge you’ll need to succeed in the property investment and development process.

Not only you will reveal my secret success strategies, but you’ll also get a taste of real estate’s practicality with these courses.

Rule 6 - Perform Thorough Due Diligence

A prospective buyer’s due diligence period is when he or she can perform extensive research on an investment possibility.

This can entail looking over the former owner’s financials, records, tax returns, profit and loss statements, and doing surveys, property inspections, a feasibility study, or any other research required.

Don’t forget to look over the 26-question Property Development Due Diligence Checklist, which will help you lower your risk. Many of my students request this checklist to ensure a smooth and error-free property development project.

You can trust and make this checklist part of your own due diligence process as they are mine too.

It is quite common for new real estate investors to become so enthralled by the prospect of purchasing their first commercial property that they overlook something important during their due diligence.

You will minimize potentially costly mistakes if you have a strong awareness of what needs to be studied, properly examined, and inspected before you buy.

Rule 7 - Ensure Safety First

The Safe Way Is The Only Way!

Mind my words here. Whether you’re new to property development or have a lot of expertise, making sure your projects are safe should always be your top focus.

Return on capital or return of capital: which is more important? What good is a 25 percent annual return if the investment fails after two and a half years? Make sure your money is secure.

It includes obtaining adequate property insurance to ensure that your assets are protected in the event of an earthquake, fire, or another natural disaster.

Developing and investing in real estate entails several hazards. As a real estate developer, you should know various real estate development risks and ways to manage them.

Continued at…

13 Golden Rules Of Investing In Commercial Real Estate [Part 2-2]