How to measure risks in real estate? Invest your money wisely

When it comes to real estate investment, risk is always a factor that needs to be considered. How can you be sure that the property you’re investing in is a safe bet? With these 5 ways, you can quickly measure the risks in real estate investment.

These real estate investment risk measuring techniques use simple measures to determine the risk sources and their impact on project return.

This will help you in identifying whether the return is prone to adjustments in rents, operating costs, loan interest rates, or tax regulations. You can also analyze the risk by examining prospective changes in cash flow or forecast the worst-case scenario for the property.

You can do this by changing one critical aspect at a time to see how it affects the return or by considering how an adverse scenario may impact the bottom line.

Investors in real estate cannot avoid taking risks. Still, successful real estate investors have figured out how to identify, manage, avoid & avert risks and events that occur.

What is risk in real estate investment?

Quick Tip

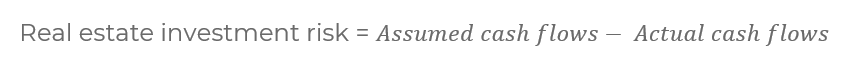

All real estate risks come from the fact that we can’t accurately predict how property investments will turn out. Buying real estate is like buying a set of assumptions that forecast cash flows. Therefore, the formula for real estate investment risk is…

However, most property investors consider the risk to be the unfavorable effects of uncertainty.

The risk is more in the form of ignorance or uncertainty about the cash flows if you purchase an investment property without thorough due-diligence.

It is sometimes necessary to distinguish between risk, which you can measure, and uncertainty, which cannot, but in reality, the two notions are difficult to separate.

Risk is the chance that the ownership goals won’t be met, so each investor’s idea of what is risk is depends on what their goals are.

For instance, if the annual cash flow is unpredictable, real estate investments that provide regular retirement income are considered risky.

In contrast, properties bought for capital gains are sensitive to market slowdowns or accelerated obsolescence, which could result in a decline in property value.

Real estate investments that are made with the intention of hedging against inflation run the risk of not generating the “real” rate of return. Properties bought to lower the risk of a portfolio might work for one investor, but their volatility might not be good for others who don’t have diversified portfolios.

The multiple definitions of risk, based on unforeseen or unfavorable events, are shown in the diagram below.

Why are property investors risk-averse?

Property investors are typically thought to be risk-averse. Risk aversion means that you’re only willing to take more risks for a higher return.

On the other hand, despite the negative projected return, many people are willing to risk small amounts of money. Investors have varied risk aversion from “risk-tolerant” to “extremely risk averse”.

Investors who are more risk tolerant than those who are risk averse will take on more risk for a given return increment. In other words, how willing an investor is to take risks depends on how much is at stake.

Most investors gradually become less willing to take on risks in exchange for a given increase in real estate return.

For instance, superannuation funds are risk averse as compared to property development corporations that will take on more risk in exchange for a higher return.

Depending on their willingness to accept risks, managed funds are categorised as “conservative,” “balanced,” or “aggressive,” which affects the mix and types of investments they hold.

Investors with different degrees of risk tolerance compete for the same properties in the real estate market.

Real estate investors who are risk-averse and who perform thorough due diligence and financial feasibility study at the start of a project have the best chance of obtaining a huge profit.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How to identify property investment risks?

You should be aware of real estate market risk, financial risk, and property risk in investment. Many risk factors are interconnected and may simultaneously impact the return, cash flow, and the sale of the asset.

When evaluating property look for the main risks that are most likely to happen and would prevent you from achieving your financial goals.

Learn More

To quickly and easily determine risks originating from cash flows, investigate the cash flow assumptions and determe the most uncertain components.

Long-term changes that are hard to see, like a neighborhood becoming unpopular overtime or a building becoming obsolete, have less obvious effects on cash flow.

Other risks are “all-or-nothing outcomes,” such as, a tenant default or a building plant failure.

Quick Tip

An essential part of risk analysis is testing, first, how delays in resale affect return and solvency and, second, what happens if the expected price at resale is not achieved.

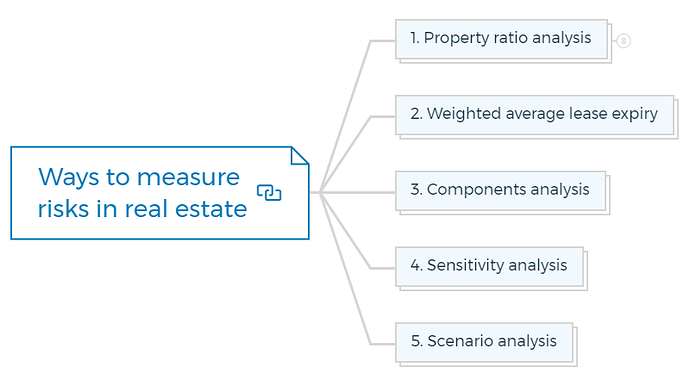

Ways to measure risks in real estate

You can easily measure risks by comparing returns on your investments. Sometimes, a quick comparison is a good start for finding potential risk factors.

For instance, a comparison of initial return and internal rate of return (IRR) shows how much the return depends on growth in rent and capital value.

In general, growth is riskier than getting the initial rental income.

In the same way, you can figure out the effects of debt financing and tax breaks on the return by calculating the return on the property and the equity before and after taxes.

These comparisons show return sources that you can use to check if returns are coming from high risk components. Here are 5 ways to measure real estate investment risks.

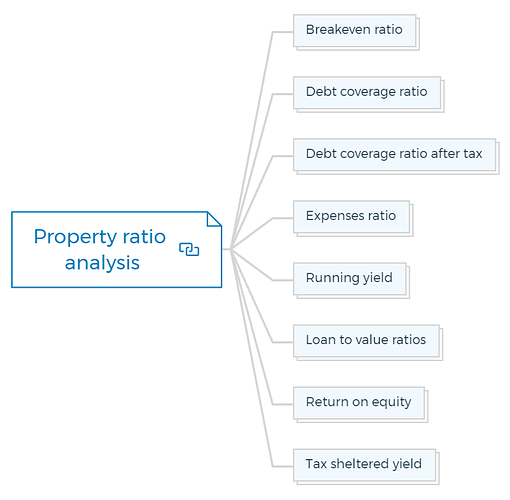

1. Property ratio analysis

Property ratio lets you compare one property to others or the same property in different years.

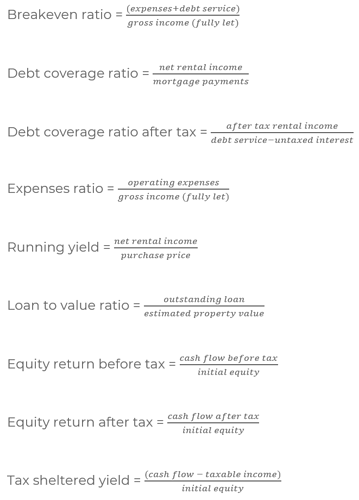

You can estimate property ratios for different aspects of income-producing properties. These ratios are used for a business to determine whether it is exposed to excessive insolvency risks and is making good use of its assets.

Property ratios

The first three ratios show whether a decrease in expected cash flow impacts the investment’s viability.

Breakeven ratio

- If the breakeven ratio is less than 1, the predicted income is enough to cover the commitments such as operational costs and loan repayments. The higher this ratio is, or the longer it remains over 1, the greater the chance that the property will drain the investor’s other resources.

Debt coverage ratio

- The debt coverage ratio focuses on the property’s net income’s capacity to support loan repayments. The amount by which the ratio is greater than 1 shows how much the net income is more than the loan payments. The range of safe debt coverage ratios vary from 1.2 to 2.

Debt coverage ratio after tax

- The debt coverage ratio after tax determines if there is enough rental revenue after taxes to satisfy loan repayments while allowing for the tax deductibility of interest.

Expenses ratio

- The expenses ratio shows how much of the gross income is taken up by taxes and the building operating costs.

Running yield

- The running yield reflects how quickly net income is predicted to grow (or decline). It’s important for properties with above-market rents…

Loan to value ratios

- Loan-to-value ratios (LVRs) are often expressed as percentages. It will decrease as the property’s value rises and the loan is paid off throughout the holding period. A decreasing loan-to-value ratio indicates less financial risk and the potential for refinancing.

Return on equity

- The return on equity (before and after tax) is computed as a percentage of the initial equity value.

Quick Tip

You can compare the return on equity with the running yield as they both indicate various measures of the current income as a percentage of the initial investment. As the running yield rises, the equity return before taxes also rises. If it doesn’t, the acquisition’s finance needs to be reevaluated.

Tax sheltered yield

- Tax-sheltered yield is the percentage of the tax-sheltered equity return. It is the difference between the equity cash flow and the taxable income, expressed as a percentage of the initial equity.

- If this percentage is near to, or even larger than, the return on equity, it indicates a heavy reliance on tax benefits, which is considered risky in property investment.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

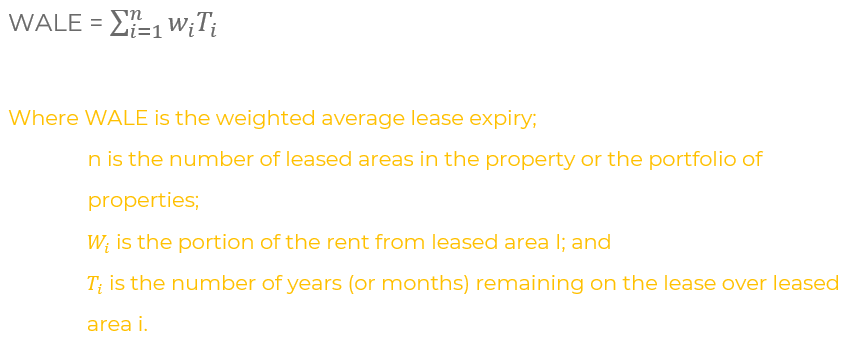

2. Weighted average lease expiry

The WALE, highlights the risks related to lease expirations and is frequently quoted for buildings with numerous tenants and property investment portfolios.

When the tenants do not renew their leases, it creates a major risk for most leased properties. This could result in lost revenue from vacancies, the need to provide lease incentives to attract new tenants, and lower rent than what is already being charged.

The longer the leases are already in place, the fewer investors worry about what might happen when the leases expire. The weighted average lease expiry (WALE) is an indicator of this risk for a multi-tenanted property or a portfolio of properties.

It represents the total number of years (or months) left on each lease, weighted by the percentage of the total rental income that each lease contributes. Vacant spaces are weighted as per the potential rental revenue.

The rental revenue is more secure the longer the WALE. A WALE of roughly three years would be average for retail properties, which are frequently leased for five years.

WALE of investment property portfolios are frequently five years or longer since major tenants in shopping malls and office buildings frequently sign longer leases that account for most of the rental income.

Learn More

3. Components analysis

Component analysis is used to distinguish between the present value of the rent under current leases, the potential rental income from currently vacant spaces, or the anticipated revenue from the spaces that will be leased once the current leases expire.

By dividing the return into its various components, you can identify the return sources from an income-producing property. Select the components to highlight those aspects of the cash flow that have varying degrees of risk.

For instance, you may isolate the return that can be attributed to rental growth, favourable leverage, or the tax shelter provided for the income and gain.

Component analysis can be used to separate the present value of rental income from tenants in one industry from those in another, to separate the present value of rental income under current leases, or to separate other parts of the return that have different risks.

- The first step is to calculate the IRR of the investment’s cash flow.

- The second step is to use IRR to discount cash flow components to their present values.

- In the final step, present values are expressed as a percentage of the initial outlay.

The goal is to identify the primary sources of return so that you can reject an investment if too much of the return comes from risky sources. An investor can change the method and parts of the return based on the analysis and his specific concerns.

This strategy aids in separating the risks attributed to the tenant. It may, for instance, draw attention to the risk of purchasing a property that has been leased back to major businesses for a set amount of time and will likely have no other occupier when the lease expires.

It is essential to be aware of three restrictions on how to interpret these components.

- First, even though component analysis is used to separate cash flow components with varying degrees of risk, the same discount rate is applied to every component.

- Second, when comparing investments of different lengths, component analysis can be misleading since a larger share of the present value is invariably a return on the initial investment as the holding period is shortened.

- Third, separating the components makes it hard to see or hide the connections between them.

4. Sensitivity analysis

In this, the analyst finds one unknown factor that influences the property return. Then, this factor is changed to observe how it affects the return or cash flows.

The rental growth rate and variations in loan interest rates are two critical factors for many real estate transactions.

You can use the elasticity of the return to compare the sensitivity of the critical variables.

Quick Tip

Elasticity is the ratio of the return’s rate of change to any other variable’s rate of change, such as the rate of increase in rent or the rate of change in interest rates.

You can calculate the elasticity by -

- Measuring the effect of a uniform change in any variable on the return.

- Or by partially differentiating the return with respect to the variable.

A huge change in return for a uniform change in any variable is indicated by higher elasticity. However, before successfully comparing elasticities, you must evaluate the probability of the uniform change in each variable.

Learn More

5. Scenario analysis

Scenario analysis is used to test potential outcomes by considering several circumstances or scenarios for a real estate investment.

With scenarios you can examine particular circumstances such as construction of several competing development projects, the closure of a significant employer, or early redemption demands from unit holders in an unlisted property trust.

The worst economic conditions that may be conceivably imagined could be an alternative scenario. The goal is to determine how a real estate investment might perform under other circumstances from those anticipated.

Even though the analysis of different possible scenarios isn’t a complete way to measure the risks of an investment, it is fairly flexible and easy to explain to anyone who wants to buy or sell real estate.

Only a few scenarios can be used to figure out what will happen, so the others are ignored. The chance of each scenario is not considered in scenario analysis.

For example, most investors would rather buy a property if the return is likely to be close to the predicted level of return than if it could fall anywhere between the expected and worst outcomes.

Summary

Risk is always a factor to consider when investing in real estate. However, by understanding and measuring risk, you can make more informed decisions about where and how to invest your money.

There are several ways to measure risk in real estate investment. By understanding the above methods, you’ll be better equipped to make safe and profitable investments.

Use one or more of the above-discussed methods and be sure that you are making the best possible decision for your real estate investment portfolio.

Get the insider’s knowledge and mastermind your next development project with the Property Mastermind Course.

FAQs

How often should risk assessments be conducted in real estate?

Some people might say that risk assessments should be conducted on a monthly or even weekly basis, while others may advocate for conducting them only once every few months or even once a year.

It really depends on the specific real estate property and the risks associated with it. For instance, if the property is located in a high-crime area, then it may be advisable to conduct risk assessments more frequently.

On the other hand, if the property is located in a relatively safe neighborhood, then less frequent assessments may be sufficient.

What is real estate financial analysis?

Real estate financial analysis is the process of evaluating a real estate investment in order to determine whether or not it is a sound investment. This evaluation is typically done by analyzing the property’s cash flow and valuation.

Cash flow is the stream of income and expenses associated with owning and operating a property. Valuation is the process of estimating the worth of a property based on its potential earnings and risks.

By analyzing both the cash flow and valuation of a property, you can get a good idea of whether or not it is a sound investment.

What are some of the components of the investment risk factor?

There are a few key components that go into investment risk:

- Liquidity risk - The risk that you will not be able to sell an investment when you want to

- Credit risk - The risk that the company or institution you’ve invested in will go bankrupt and be unable to repay your investment

- Market risk - The risk that the market will go down and your investment will lose value

- Inflation risk - The risk that the price of goods and services will increase faster than the rate of return on your investment, resulting in a loss of purchasing power over time.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber