Present value (PV) is used in finance to estimate the value of a future sum of money. A dollar today is worth more than a dollar tomorrow. Present value accounts for the time value of money to help people and businesses make financial decisions.

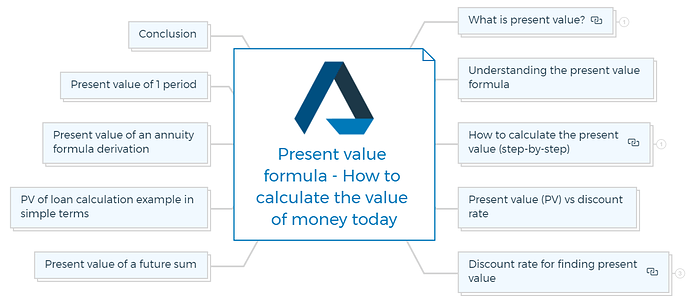

What is present value?

Present value accounts for the time value of money, which makes money today worth more than money in the future.

Present value shows how much money we need today to reach a future goal. It helps people and businesses make smart spending, saving, and investing decisions.

Present value formula and calculator

The present value formula can be represented as follows:

PV = P/ (1+R)^n

Where PV is the present value, P is the future payment or cash flow, r is the discount rate, and n is the number of periods.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Understanding the present value formula

The present value formula uses the discount rate and the number of periods to compute the current worth of a future payment or cash flow. The formula assumes the discount rate is the expected return on investment with the same risk over the same number of periods.

Inflation, risk, and the time value of money affect the discount rate, representing the opportunity cost of investing the money elsewhere. A greater discount rate means a higher opportunity cost and a lower present value, while a lower rate means the opposite.

The number of periods (n) is the time until the future payment or cash flow is received. The discount rate has more time to affect the future payment or cash flow, lowering the present value.

How to calculate the present value (step-by-step)

Present value explains what happens when you pay a lender or save money today to reach a future balance. Based on the interest rate and time, the present value of 1 is the amount needed today to obtain a future total.

Steps for calculating the present value

There are four main components in the present value calculation for future value or cash flow. These are - future payment or cash flow amount, the discount rate, the number of periods until the cash flow is received, and the present value formula.

Step 1: Calculate future payments or cash flow (P).

Step 2: Find r the discount rate.

Step 3: Calculate the period until the future payment or cash flow (n).

Step 4: Calculate PV using the present value formula.

Learn more - How to use discounted cash flow for real estate valuation?

Say you expect a $10,000 payment in five years at a 5% discount. Present value calculation:

PV = $10,000 / (1 + 0.05)^5 PV = $7,835.73

Thus, a $10,000 payment in five years at a 5% discount is $7,835.73.

Calculating mortgage payments requires understanding this calculation. Use this calculation to save money for the future.

Present value (PV) vs discount rate

The discount rate, which represents investment opportunity cost, determines present value. The discount rate is the return an investor could get on an alternative investment with equivalent risk.

Higher discount rates lower present values, while lower rates raise them. Present value calculations require a suitable discount rate.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

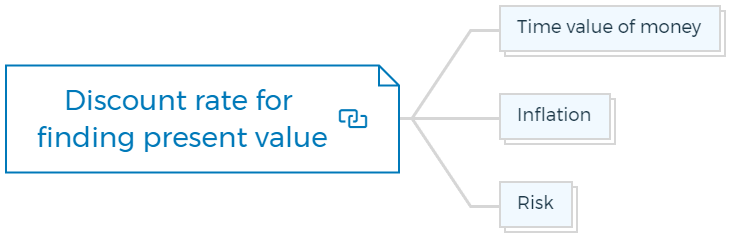

Discount rate for finding present value

We can determine the discount rate using the following factors -

Time value of money

The discount rate should reflect that money is worth more today than in the future.

Inflation

The discount rate should account for inflation, which lowers money’s value.

Risk

The discount rate should reflect investment risk. Lower-risk investments have lower discount rates than higher-risk ones.

Learn More

Present value of a future sum

The present value of a future sum of money is the amount invested today to attain a given future value at a specified interest rate. Present value of a future sum formula:

PV = FV/(1 + r)^n

PV is the present value, FV is the future value, r is the discount rate, and n is the years.

PV of loan calculation example in simple terms

Let’s say you need to borrow $10,000 at 5% interest over two years. Present value formula:

PV = $10,000 / (1 + 0.05)^2 PV = $9,512.62

The loan is worth $9,512.62. If you had $9,512.62 today and invested it at 5%, you could return the $10,000 loan in two years.

Present value of an annuity formula derivation

An annuity is a series of regular, equal payments over time. The present value of an annuity is the current value of a stream of future payments made at regular intervals. The formula to calculate the present value of an annuity is derived from the present value formula as follows:

PV = C x [1 - (1 / (1 + r)^n)] / r

Where PV is the present value, C is the periodic payment, r is the discount rate, and n is the number of periods.

Present value of 1 period

Calculating the present value of one period lets real estate investors compare investment options with different timelines and predicted returns. It helps calculate the present value of short-term commitments and obligations like one-time payments or loan installments.

For instance, an individual considering a loan can use the present value of 1 period to assess the current worth of a single payment due one year from now.

The formula for present value per period, using the formula you provided, is:

[1 - 1/(1 + R)^n] / R = W

R is the periodic interest rate, n is the number of periods, and W is the present value per period.

To calculate the present value per period using this formula, follow these steps:

Step 1: Determine the periodic interest rate (R).

Step 2: Determine the number of periods (n).

Step 3: Plug in the values of R and n into the formula.

Step 4: Solve for W.

For example, let’s say you want to calculate the present value per period for an investment with a periodic interest rate of 5% over 10 periods. Using the formula, the calculation would be:

[1 - 1/(1 + 0.05)^10] / 0.05 = W

Simplifying the equation, we get:

W = [1 - 1.628895691] / 0.05

W = 15.42205218

Therefore, the present value per period for an investment with a periodic interest rate of 5% over 10 periods is $15.42.

This means that if you were to invest this amount at the beginning of each period for 10 periods and earn a periodic interest rate of 5%, you would have a total value of $154.22 at the end of the 10th period.

Learn More

Conclusion

In conclusion, present value is a crucial financial concept that helps individuals and businesses value future payments or cash flows.

The discount rate, future payment amount, and number of periods are used to calculate the present value. Mortgage, loan, and annuity calculations use the present value formula.

The present value method helps people and corporations consider inflation, the time value of money, and investment risk when investing or borrowing.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber