How to get a home loan in Australia?

Looking to secure a home loan but unsure what the lender will be looking for? Here is a breakdown of some critical factors lenders evaluate when assessing your application.

Ensure you’re informed and on top of your mortgage game before applying - it could make all the difference!

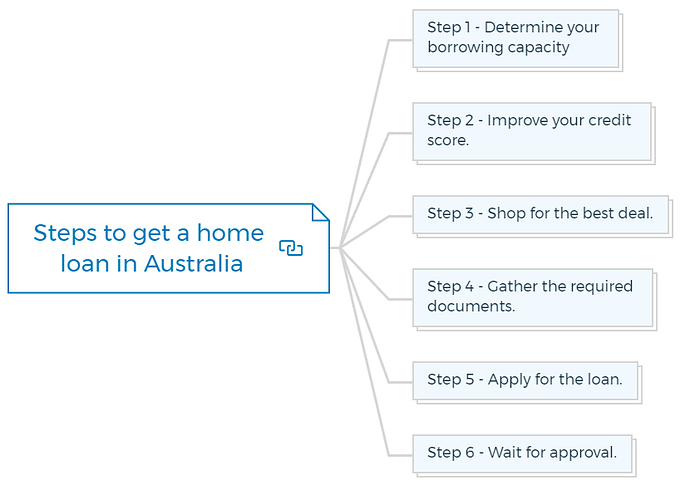

Steps to get a home loan in Australia

There are several steps to getting a home loan in Australia.

Step 1 - Determine your borrowing capacity

Before you start looking for a home loan, you must figure out how much you can afford. You can do this by using an online home loan calculator or speaking with a mortgage broker.

To determine your borrowing capacity, you need to consider certain factors, including -

- Annual income

- Monthly expenses

- Deposit

- Dependants

- Loan term

- Interest rate

- Outstanding debts

Depending on income, expenditure, and debt, banks lend 3–5 times your annual income.

Step 2 - Improve your credit score.

A good credit score can help you qualify for a better interest rate on your home loan. You can improve your credit score by paying your bills on time, keeping your credit card balances low, and not applying for too much credit at once.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Step 3 - Shop for the best deal.

Compare home loans from different lenders to find the one best suits your needs. Comparing interest rates, fees, and features of different home loans can help you get the best home loan in Australia.

Check the features of every loan product. You may plan to use -

- Offset account

- Split loan facility

- Repayment holiday

- Redraw facility

Try to limit these to a few “must-haves”—features you’ll use—to avoid overpaying.

Always remember that fixed-rate loans have fewer features than variable-rate loans. For instance, some fixed-rate loans allow extra repayments, but they may limit the amount you can pay each year.

Step 4 - Gather the required documents.

Lenders will typically require certain documents from you, including

- Proof of income

- Tax returns

- Assets and liabilities

- ID verification

- Credit score

- Debt to income ratio

Your mortgage lender must lend money in a good way. Your financial situation must show that you can repay the loan.

They need a lot of income and expense data to make that call. Ensure you gather all the required documents before applying for the loan.

Step 5 - Apply for the loan.

Once you’ve found a home loan that you’re interested in, you’ll need to fill out an application form.

Be prepared to provide detailed information about your income, assets, and liabilities.

You will need to submit a strong loan proposal to get your loan approved by the lender.

Step 6 - Wait for approval.

After submitting your application, the lender will review it and let you know whether or not you’ve been approved for the loan.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How much loan will you get?

The amount you wish to borrow will also be a crucial consideration for the lender. The lender will often consider the ratio between the amount you need to borrow and the home’s worth.

This affects the loan-to-value ratio (LVR), whether you may be required to pay lenders mortgage insurance (LMI), and your ability to repay your mortgage.

Let’s look at a quick example. Say you want to borrow $600,000 on a home that costs $800,000. You put down $200,000, and your LVR is 75%.

You can avoid paying LMI because your down payment is over 20% of the home’s purchase price. Your lower credit risk may make you a more attractive borrower.

The lender will determine if the loan is right for you based on your finances, property, and other qualifying conditions.

It’s essential to remember that getting a home loan in Australia can be complex and time-consuming, so it’s important to work with a mortgage broker or a loan officer from the bank who can guide you through the process and help you find the best deal.