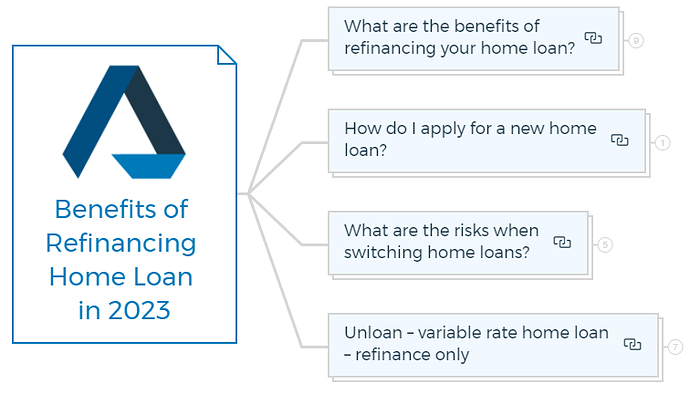

A home loan is a significant financial commitment that can take many years to pay off. Given the current state of the economy, it is wise to review your existing mortgage and assess whether refinancing is a viable option.

Refinancing your home loan can provide many benefits, including lower interest rates, reduced monthly loan repayments, the ability to buy another property, and equity release to finance your needs.

Explore the major benefits and risks associated when you refinance your home loan.

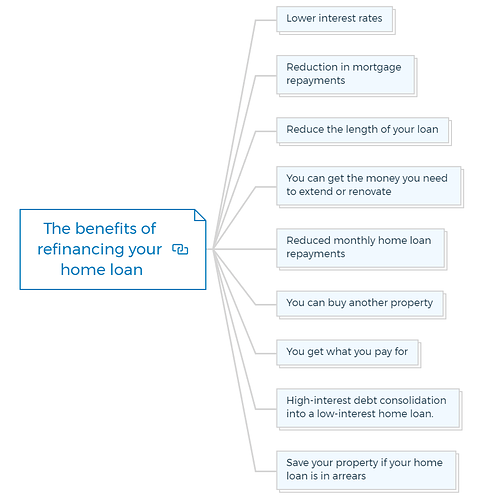

What are the benefits of refinancing your home loan?

Here are some pros to refinance your home loan in Melbourne, Australia, in 2023.

Lower interest rates

You can get cheaper interest rates by refinancing your house loan. Over your mortgage, this can save you a lot. Low rates can save you money throughout the life of your loan.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Reduction in mortgage repayments

Refinancing might lower your mortgage payments if you’re having trouble paying them. You can cut your monthly mortgage repayments by refinancing to a loan with a lower interest rate.

Reduce the length of your loan

Refinancing also shortens your mortgage loan term further. Refinancing to a shorter-term loan can assist you in paying off your mortgage faster and saving on interest.

You can get the money you need to extend or renovate

Refinancing your home loan might also give you money for home improvements. Refinancing to a loan with a greater loan-to-value ratio unlocks home equity for repairs or extensions.

Reduced monthly home loan repayments

Refinancing might lower your monthly mortgage payments. Refinancing to a lower interest rate or more extended repayment period can drastically lessen your monthly home loan payments.

You can buy another property

Refinancing might provide you with equity to buy another house or investment property elsewhere. You can leverage the equity in your house to buy another property by refinancing to a greater loan-to-value ratio.

You get what you pay for

It’s More Than Just Interest Rates when considering refinancing your home loan; it’s important to remember that the lowest interest rate may not always be the best option.

When selecting a new lender, you should also consider other factors, such as loan features, fees, and customer service.

High-interest debt consolidation into a low-interest home loan.

Refinancing your home loan can also allow you to consolidate high-interest debts, such as credit card debt, into a low-interest home loan. By consolidating your debts, you can reduce your monthly repayments and save money on interest payments.

Save your property if your home loan is in arrears

If you are struggling to keep up with your mortgage interest repayments, refinancing can allow you to save your property.

Refinancing a loan with a cheaper interest rate or longer repayment periods can reduce your monthly repayments and avoid defaulting on your loan.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How do I apply for a new home loan?

Applying for a new home loan in Melbourne, Australia, is simple. Discuss refinancing options with your current lender or new lender. You will need to provide documentation to support your application, including proof of income, a copy of your credit report, and details of your existing loan.

Learn More

Take advantage of new loan features

New loan features help you manage your current mortgage if you refinance. Offset accounts, redraw capabilities, and penalty-free additional repayments are examples. These features may include the following -

- Offset accounts

- Redraw facilities

- The ability to make extra repayments without penalty.

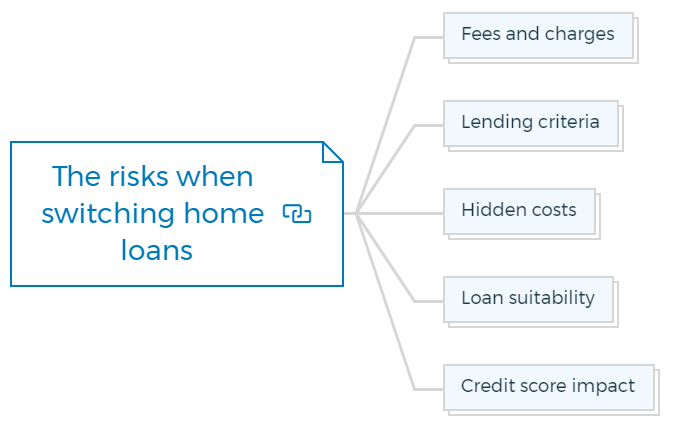

What are the risks when switching home loans?

Switching home loans may provide reduced interest rates, more flexible repayment choices, or superior features. Borrowers should consider the risks before applying.

Fees and charges

Some lenders may impose application, discharge, and valuation fees for breaking and establishing a new loan. Borrowers must compare the savings from a new loan against these charges, which can mount up rapidly.

Lending criteria

Switching loans may involve new lending requirements or eligibility criteria that debtors may not match. Loan acceptance depends on income, job, credit, and property value.

Hidden costs

Borrowers may miss fees, increased rates of interest after an introductory period, and early repayment penalties. To avoid unpleasant surprises, read and understand the loan terms.

Loan suitability

Switching loans isn’t for everyone. Borrowers need to consider their financial circumstances, such as their financial situation, long-term financial goals, the amount of the loan, and their ability to make repayments.

Credit score impact

Lenders analyse credit scores when approving new loans. Borrowers should avoid asking for multiple loans because it might hurt their credit scores.

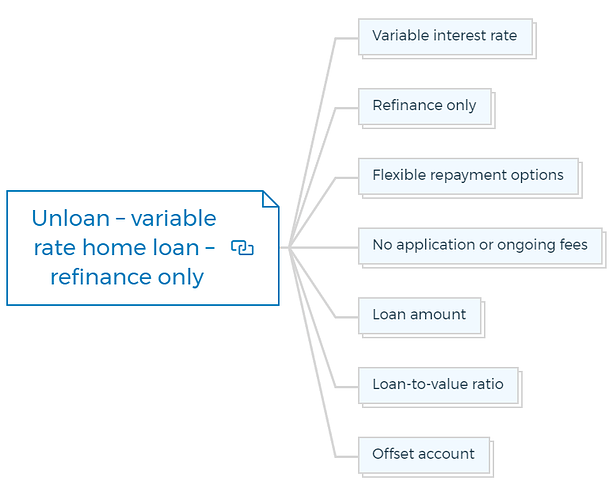

Unloan – variable rate home loan – refinance only

Unloan is a variable-rate home loan product offered by some lenders in Australia, specifically designed for borrowers looking to refinance their existing home loans.

The main features of the Unloan product include:

Variable interest rate

Unloan is a variable-rate home loan product, which means the interest rate can fluctuate over the life of the loan in response to changes in the official cash rate or other economic factors.

Learn More

Refinance only

Unloan is only available for borrowers who are refinancing an existing home loan. It is not available for new purchases or construction loans.

Flexible repayment options

Unloan offers flexible repayment options, including the ability to make extra repayments without penalty and to redraw any extra funds if needed.

No application or ongoing fees

Some lenders offer the Unloan product with no application or ongoing fees, which can save borrowers money over the life of the loan.

Loan amount

The minimum and maximum loan amounts for Unloan can vary between lenders but are generally in the range of $100,000 to $2,000,000.

Loan-to-value ratio

The maximum loan-to-value ratio (LVR) for Unloan can vary between lenders but is generally in the range of 60% to 80%. This means borrowers will need to have a minimum amount of equity in their property to be eligible for the loan.

Offset account

Some lenders offer an offset account with the Unloan product, which can help borrowers reduce the interest they pay on their loans.

Refinancing your home loan in 2023 can offer various benefits, including lower interest rates, reduced monthly repayments, equity release for renovations, the option to purchase another property, and debt consolidation. However, when considering refinancing, it’s essential to weigh the risks as well.

Switching home loans may result in additional fees and charges, new lending requirements, hidden costs, loan suitability, and impacts on your credit score. Additionally, before refinancing, it’s important to consider the loan features, fees, and customer service of your new lender. By weighing the pros and cons of refinancing, you can determine whether it’s a viable option to achieve your financial goals.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber